iQoncept/iStock via Getty Images

Introduction

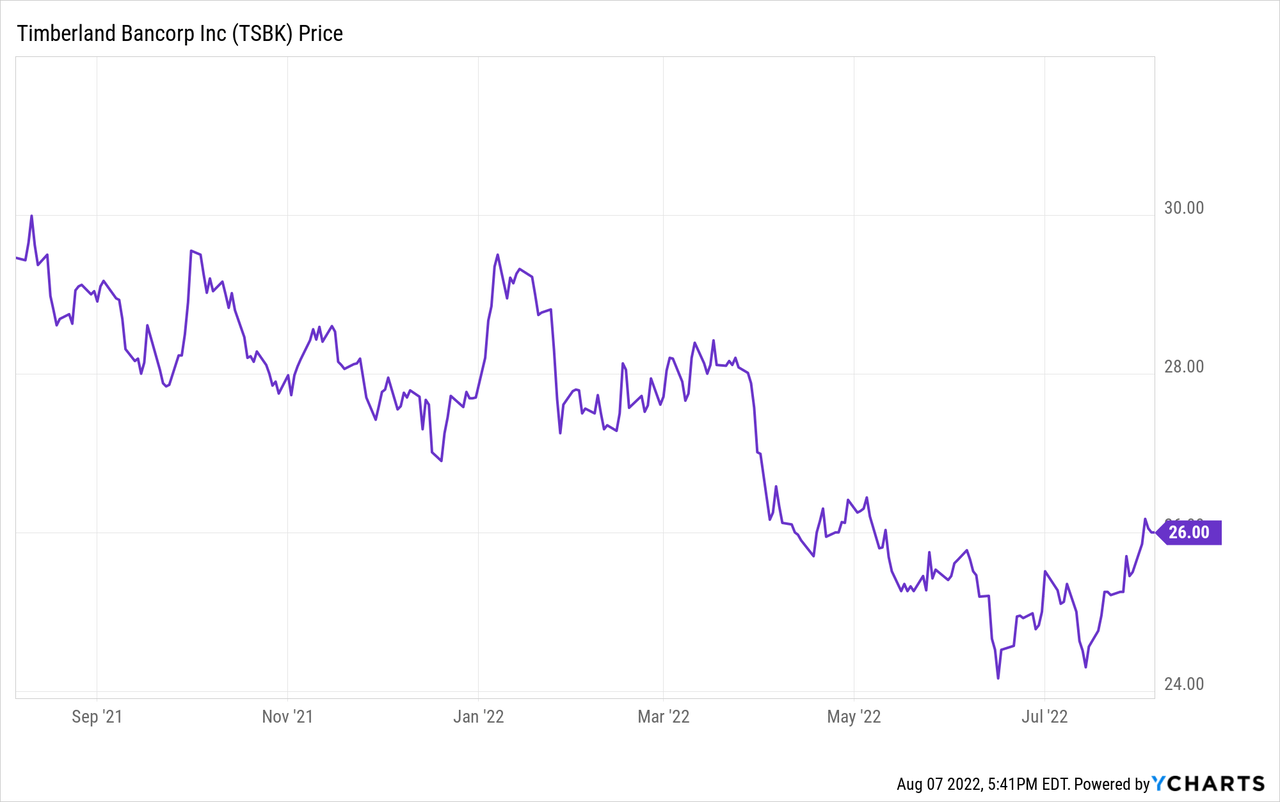

I have been following Timberland Bancorp, Inc. (NASDAQ:TSBK) since 2020 when the stock was trading at just under $20/share. The share price has performed pretty well in the past two years but has been able to keep the “damage” limited as the stock is now just 15% off its 52-week-high. I appreciated Timberland’s strong focus on asset quality and resilient financial results and now the company has reported on its 9M 2022 results, I wanted to check if my investment thesis is still valid. For a background on the bank, please revisit my previous articles.

A decent result in Q3 and 9M 2022

The bank’s financial year ends in September, so the financial results of the most recent quarter provide us a look under the hood of the third quarter results of the bank.

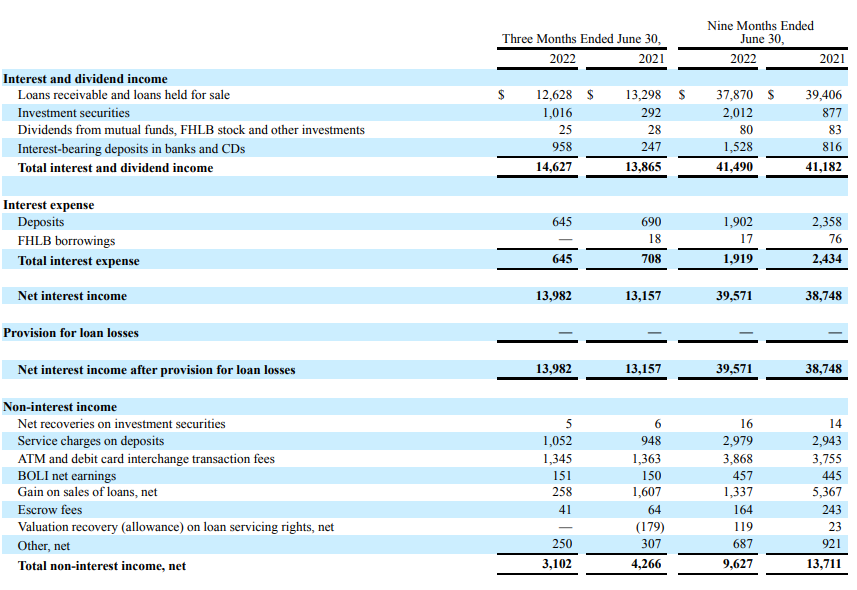

The bank aggressively reduced the cash on its balance sheet and used the funds to purchase additional investment securities, and that helps to explain the rather nice increase in the interest income: the interest income on the loan book decreased, but Timberland was able to increase the income from securities and deposits and CDs by about $1.4M and that helped to boost the total interest income to $14.6M. An increase compared to the same quarter last year. And as the interest expenses slightly decreased, the net interest income increased by approximately 6% to just short of $14M.

Timberland Bancorp Investor Relations

As expected, the bank’s pre-tax income came a bit under pressure due to the lack of gains on the sale of loans. These gains dropped to just $258,000 in the third quarter and $1.34M in the first nine months of the year, compared to $1.6M and $5.4M respectively. In fact, excluding the gains on the sale of loans, Timberland’s non-interest income actually increased slightly, as you can see in the image above.

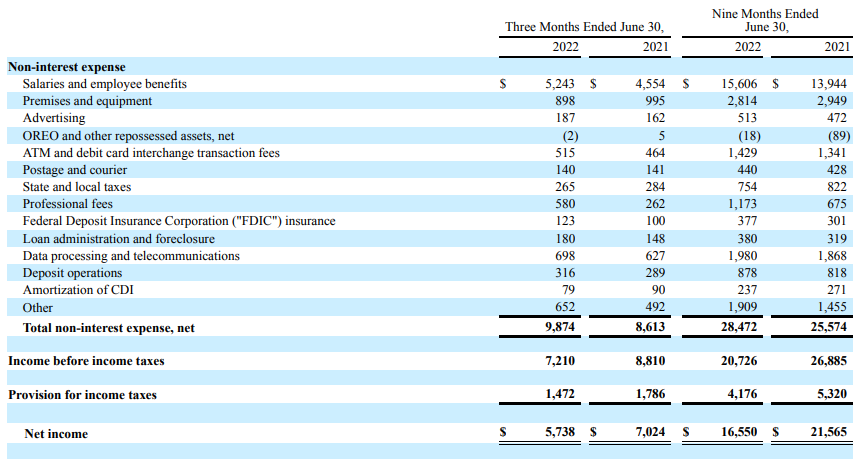

Unfortunately, the non-interest expenses also increased, mainly due to an increase in salaries (+$0.7M) and professional fees (+$0.3M). And as you can see below, the pre-tax income was hit by this. Timberland reported a pre-tax income of $7.2M (which is still better than the preceding quarters) while the net income was approximately $5.74M.

Timberland Bancorp Investor Relations

The EPS came in at $0.69 in the third quarter and $1.99 in the first nine months of the year. Keep in mind Timberland has been buying back its shares and the EPS is based on the average share count of respectively 8.28M and 8.32M shares in Q3 and 9M 2022. The current share count is just 8.25M shares, which means the EPS in 9M 2022 would increase to just over $2.00 based on the current share count.

Timberland Bancorp is currently paying a quarterly dividend of $0.22 and as you notice, that dividend is very well-covered.

The balance sheet remains strong thanks to two elements

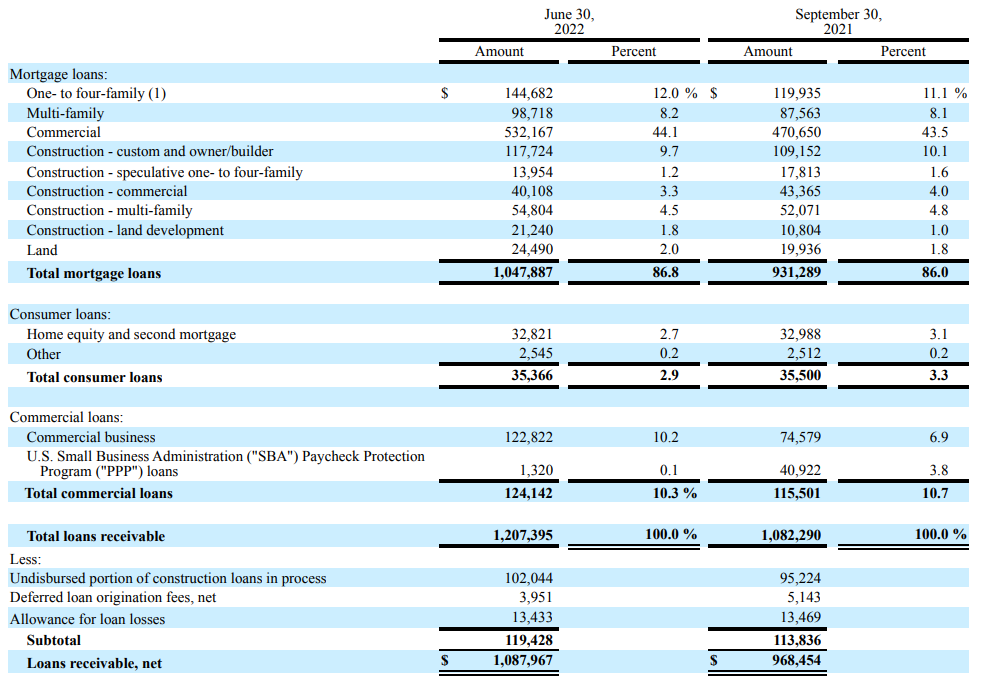

One of the main reasons why Timberland is able to post strong earnings (even when the gains on the sale of loans are relatively low) is the lack of loan loss provisions. Not because the bank is pushing the limits, but because its loan book is quite robust.

Timberland Bancorp Investor Relations

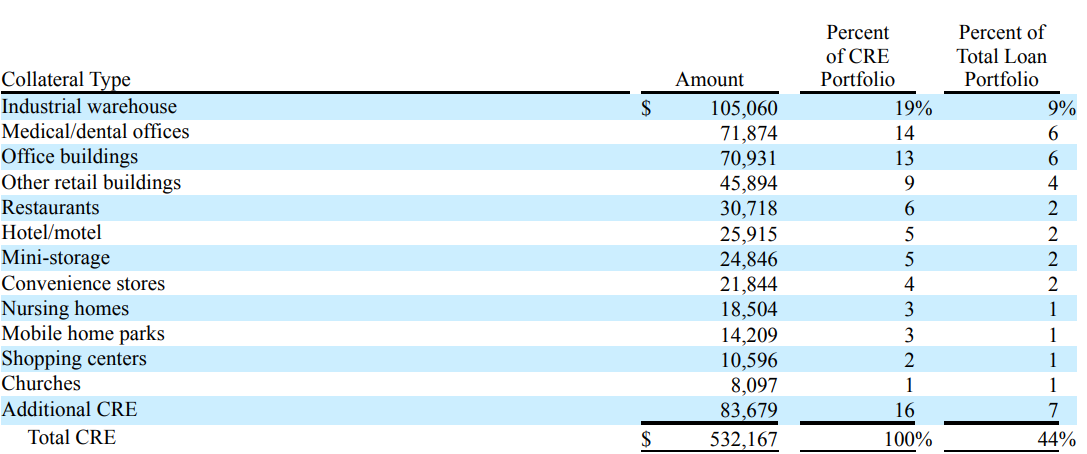

The total loan book consists of about $1.09B in loans excluding $102M in commitments and including about $13.5M in loan loss provisions.

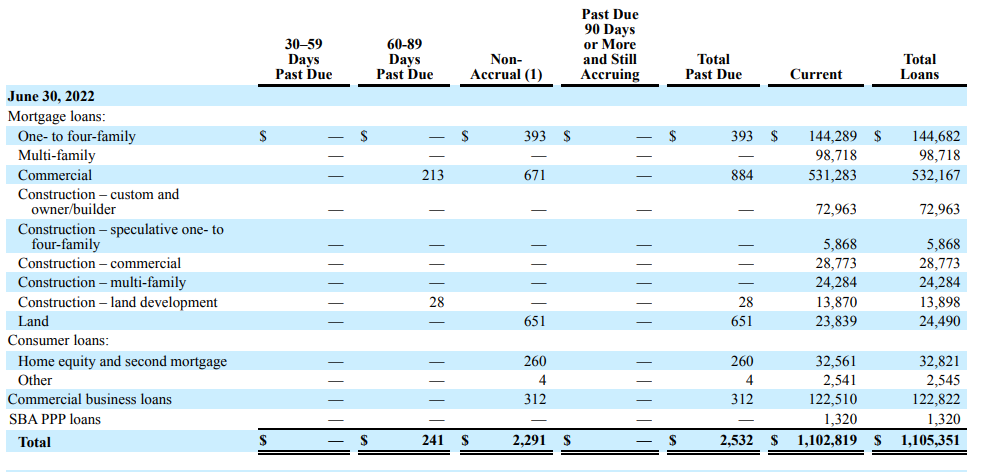

But as you can see below, the total amount of loans past due is just a small fraction of the loan book. As of the end of June, only $2.5M of the loans were classified as ‘past due’ and the majority of these loans are backed by real estate.

Timberland Bancorp Investor Relations

I’m also not too worried about the commercial real estate portfolio. Although the bank has not released detailed LTV ratios, I like the exposure to a wide range of commercial real estate, with 33% of the loan book consisting of industrial warehouses and medical or dental offices. So it’s not like the CRE loan book consists of poorly performing malls in Washington State.

Timberland Bancorp Investor Relations

The very strong loan book explains why Timberland hasn’t had to record loan loss provisions in a while, as the current provisions provide a coverage ratio of about 500% of the loans past due. And that assumes the bank won’t recover a dime from these loans.

Investment thesis

I like Timberland’s share repurchase plans, but I was hoping the bank would accelerate the plans. During the first three quarters of the year, TSBK repurchased just under 136,000 shares, which is in excess of 1.5% of the total share count. The bank spent $3.65M on these repurchases, which means it paid on average just under $26.9 per share.

The tangible book value per share is approximately $24 which means the bank is trading at a premium of less than 10% to the tangible book value. And as Timberland will generate $2.8-3/share in earnings while paying out less than a dollar per share in dividends, the TBV per share will likely reach the current share price before the end of next year.

Taking all these elements into account, I think Timberland is still interesting at the current levels. I have a small long position in Timberland Bancorp and would like to increase this position, but I’m in no rush.

Be the first to comment