jetcityimage/iStock Editorial via Getty Images

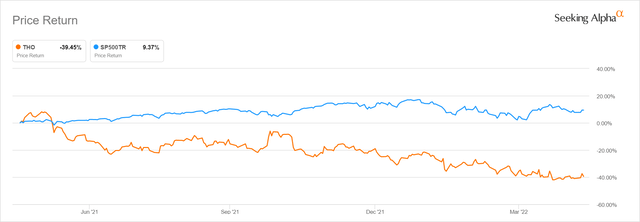

Thor Industries’ (NYSE:THO) business is booming. The recreational vehicle company’s recent second quarter report shows 42% revenue growth and a 60% increase in backlog. So why has its stock price dropped 40% in the last year, woefully underperforming the US stock market?

Thor’s share price return last year. (Seeking Alpha)

This article will discuss several possible explanations from expectations for a cyclical slowdown, COVID-related uncertainties, and pressures from cost inflation and supply chain challenges and explain why we have concluded that now is an attractive time to buy the company.

Thor’s business is booming, but challenges remain

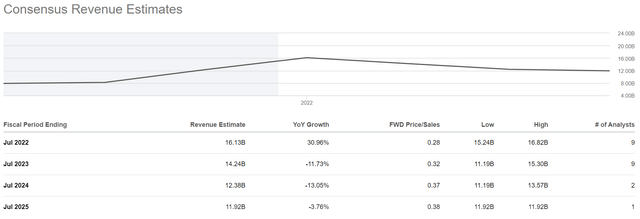

Thor Industries can barely produce recreational vehicles (RVs) fast enough to keep up with demand. It’s rare to hear a company claim that the backlog is “higher than we prefer”. With sales expected to grow over 30% in the current fiscal year ending in July, and supply chain challenges affecting essentially all industrial companies, it’s easy to see why Thor might struggle to keep up with demand. But the company is also being more prudent with production levels to help prevent an inventory glut, like the one experienced in 2018 and 2019 when demand softened at a time when inventory was plentiful. Some analysts do predict weaker demand in the years to come as seen in the consensus revenue estimates shown below, but the company’s results have yet to show signs of concern.

Thor Consensus Revenue Estimates (Seeking Alpha)

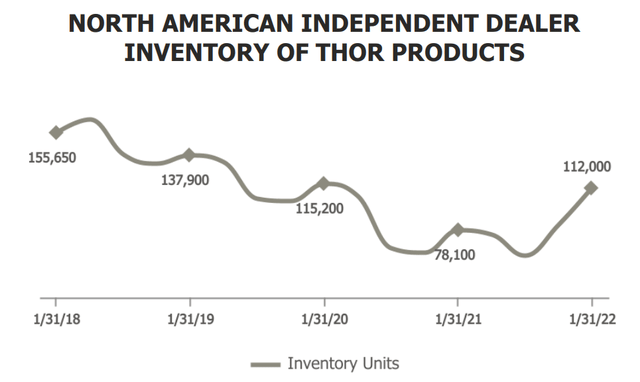

Company management certainly seems to indicate that the focus is on working down its record backlog while ensuring adequate supply to dealers rather than being concerned about an imminent collapse in demand. Management recently noted that, “We are working hard to deliver enough units to continue to reduce our order backlog and we are making progress.” While also commenting that, “North American RV independent dealer inventory of our North American RV products remain below pre-pandemic levels. Even with the inclusion of the Tiffin Group units in the current quarter, our current level of dealer inventory is still below pre-pandemic levels.”

As such, concerns about a cyclical slowdown colliding with elevated inventory levels seem overblown.

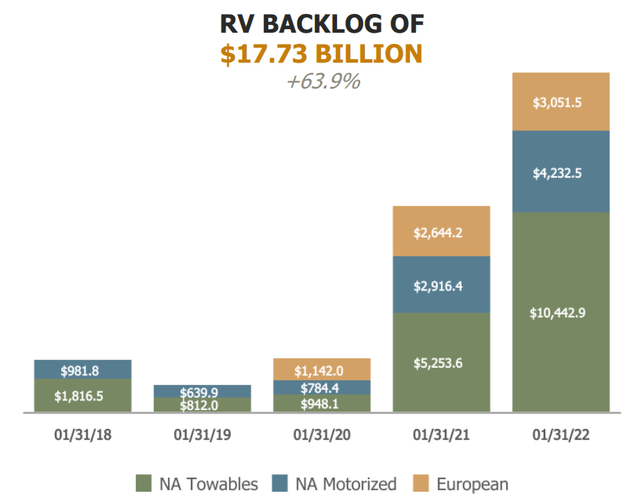

Thor Industries Second Quarter of Fiscal 2022 Financial Results Presentation (Thor Industries)

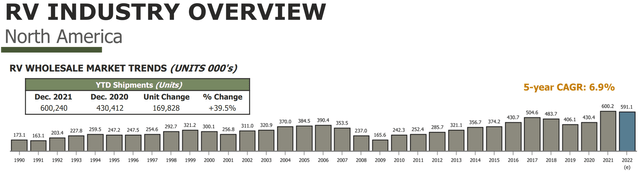

It’s understandable that investors might be concerned about a downturn in demand as the RV industry can be cyclical, as demonstrated by the chart below. One current bearish narrative points to the boom in demand during the COVID pandemic and prophesizes an inevitable drop in unit orders as reason enough to avoid Thor’s stock. But we see that narrative as incomplete, if not short-sighted.

RV Industry Overview. (Thor Industries Second Quarter of Fiscal 2022 Financial Results Presentation)

It’s important to note that while the industry might be cyclical, it is growing steadily over the long term. It may also be premature to start calling an interim peek in RV demand, or in Thor’s financial results for that matter. Thor’s management sees little sign of a material drop in demand over the coming quarters. In fact, management flags a combination of strong orders and growing interest in the RV lifestyle, as evidenced by record attendance at sales events. Addressing the question if demand remains strong after a record year for RV sales in calendar 2021, management had a clear response.

“The start of the 2022 calendar year saw strong retail demand in the RV industry in both the North American and European markets as both first-time and repeat buyers pursued the RV lifestyle. We are extremely encouraged by strong foot traffic in dealerships and attendance at the early calendar year 2022 RV shows. Several RV shows, including the January Tampa SuperShow, set attendance and unit sales records as dealers had a strong supply of inventory to showcase.”

Even if orders start to dwindle, Thor likely has strong financial results secured through the next several quarters due to its impressive backlog which currently exceeds a year’s worth of revenue.

Thor Industries Backlog (Thor Industries Second Quarter of Fiscal 2022 Financial Results Presentation)

Thor powers through cyclical downturns

Perhaps more importantly, we caution investors from applying industry cyclicality blindly to Thor Industries. Thor has long demonstrated its flexible cost model and ability to profitably navigate even the worst of cyclical downturns. We can’t phrase it better than management in their recent earnings press release.

“THOR has consistently proven that the greatest strength of our business model is that it empowers us to remain nimble despite our size. In the event that the macro pressures eventually create a downturn, we expect THOR to outperform the market as it has in every downturn since its inception in 1980. Our model has enabled us to generate a profit in every year of our 41-year existence, even during the most difficult years for our industry and the economy more broadly. In fact, each time our industry has experienced such a downturn, THOR has come out stronger than it was before.”

It’s important that Thor can maintain profitability even at the toughest of times as it allows investors to stick with the company for the long-term, rather than panic selling in a crisis. It also allows Thor to leverage its strength at the most opportune moments to pick up market share or otherwise prepare for the next upturn. In a way, Thor’s stock price is more cyclical than its underlying business. In just the last five years, Thor’s share price has exceeded $140 on multiple occasions while also falling below $50 on multiple occasions, all while achieving a negative total return. But over the past five fiscal years, Thor has grown its revenue by more than 2.5 times (not even counting the expected 30% growth in fiscal 2022) and grown earnings per share at nearly the same rate. Investors can draw confidence from the strength of Thor’s underlying business while attempting to time allocations as the gap between its fundamentals and its share price widens. Quite often, as is now happening, the share price presents ample opportunity as it seems to move ahead of company results. Thor’s share price has dropped approximately 40% in the past year while revenues and profits reach for record highs.

Thor Industries Share Price Total Return 5Y (Seeking Alpha)

Thor is also able to grow faster than the overall RV industry. Acquisitions have been a feature of Thor’s business throughout its history, and recent times have been no exception. Sizable purchases such as the Erwin Hymer acquisition in 2019 expanded the geographic scope of the company, but more recent acquisitions have served to vertically integrate Thor through the supply chain. Management sounds particularly excited about its 2021 addition of Airxcel, a leading supplier of OEM and aftermarket RV parts and accessories.

“We are pleased to report that the integration of Airxcel has gone exceedingly well, which is a testament to our integration planning and the strong team at Airxcel. Demand for their products remains very robust, and we are making investments in capacity to grow Airxcel’s presence both within THOR and across the entire industry.”

Thor’s strong financial position allows it to expand Airxcel’s capacity, and external sales to the RV industry will allow for growth beyond its own RV unit sales. Cyclical downturns may be inevitable, but Thor is more than ready to power through them.

Thor’s strong industry positioning is critical

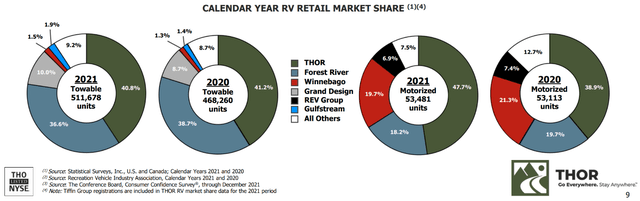

Thor’s share price may fluctuate wildly, but its industry positioning remains solid and steady. Timing share purchases is something we only do when there is a strong fundamental backdrop. We don’t want to buy anything we won’t be satisfied keeping for the long-term should volatility work against us in the short-term. Thor provides plenty of fundamental comfort through its leading position in an oligopoly as well as its consistent value creation and financial discipline. The RV industry, particularly in North America, is highly concentrated and dominated by Thor and Berkshire Hathaway’s Forest River.

RV Industry Market Share (Thor Industries Second Quarter of Fiscal 2022 Financial Results Presentation)

Investors shouldn’t underestimate the power of oligopolies. There is a reason why antitrust laws exist to prevent the over-consolidation of industries. Powerful players in an industry really can control pricing to some degree and ultimately, achieve more attractive returns. Market domination helps keep competitors out, acting as a barrier to entry, and the reduced competition leaves the remaining companies with the ability to focus more on their own bottom line.

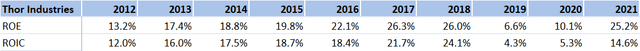

At a time when most companies are experiencing rising material costs, supply chain disruptions, and difficulties hiring workers, Thor’s pricing power afforded partially by its oligopoly position will help soften any financial headwinds. Thor’s history of strong profitability and return on investment is likely to continue as its industry position has been stable. We certainly continue to be impressed by the company’s admirable return on equity (ROE) and return on invested capital (ROIC) over time as well as recent margin progression.

Thor Industries ROE and ROIC. (Refinitiv Eikon)

The real strength of Thor’s investment case is its strong and sustainable industry positioning combined with its ability to generate superior returns on invested capital – all that’s left is finding the right price.

Thor’s valuation should comfort long-term investors

We use several valuation methods to zero-in on a fair value for Thor Industries, and essentially all of them point to significant undervaluation currently. If we look at traditional valuation metrics such as Price/Earnings multiples or Free Cash Flow Yield, we find surprisingly attractive figures for such a high-quality company. Some analysts may say that earnings will fall, bringing valuation multiples back to reality, but we have yet to see evidence of declining earnings, and even if they do fall quite significantly as consensus predicts (note the EPS % Growth estimates in the graphic below), valuation multiples still look quite attractive. Considering that Refinitiv/Datastream shows an average forward P/E multiple for Thor of about 12.5x over the last decade, today’s figures seem to indicate a substantial upside. And we rarely see an FCF yield of 22% for such a company.

Thor Industries valuation multiples. (Refinitiv Datastream and I/B/E/S Mean valuations)

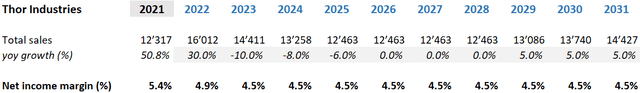

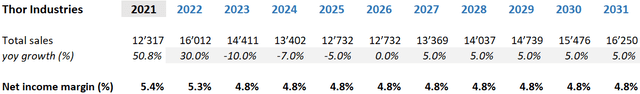

We also use various scenarios to construct discounted cash flow models, predicting cash flows into the future and then discounting them back to a present value. Even when we use a 9% cost of capital, net margins consistent with long-term averages and the conservative sales assumptions shown below (note that sales end the 10-year modeling period below predicted 2022 levels), we get nearly 40% upside from the current price near $82 per share.

Thor estimates. (Refinitiv and Oyat estimates)

Using less bearish (or perhaps more realistic) estimates for sales and net margins as shown below and an 8% cost of capital, we get closer to 100% upside. Notice that sales 10 years out still barely exceed predicted 2022 levels.

Thor estimates. (Refinitiv and Oyat estimates)

The usual pushback we get when modeling Thor’s future cash flows and calculating a fair value is that the company will likely see a drop off in results following the COVID-related bump in recent years. We do model in a drop in revenue in most cases, but we can also point out that Thor was likely worth at least its current share price before the pandemic ever happened. Even in 2018 before the sizeable Erwin Hymer acquisition or any of the other business purchases in recent years, and even while revenue was just over half of what it is predicted to be for 2022, Thor achieved $8.14 in diluted earnings per share. At Thor’s average P/E multiple of about 12.5x, that would be worth about $102 per share.

We acknowledge the myriad of risks facing Thor currently. After all, there is war in Europe, raging inflation, supply chain bottlenecks, a volatile oil price, uncertain interest rate trajectories and a lingering COVID pandemic which could all derail Thor’s current momentum. But the current valuation as we calculate it, combined with the company’s strong fundamental position, makes it a buy. We re-entered our position in the company in March at approximately $82 per share. We currently hold a modest position at about half of its potential size, ready to pounce should an even more attractive deal arise.

We think Thor is a buy, but you don’t have to take our word for it. During the company’s recent second quarter, it announced the authorization of a $250 million share repurchase program and repurchased approximately $58.3 million of common stock under that program. That’s a big statement from a company that rarely repurchases significant amounts of its own shares.

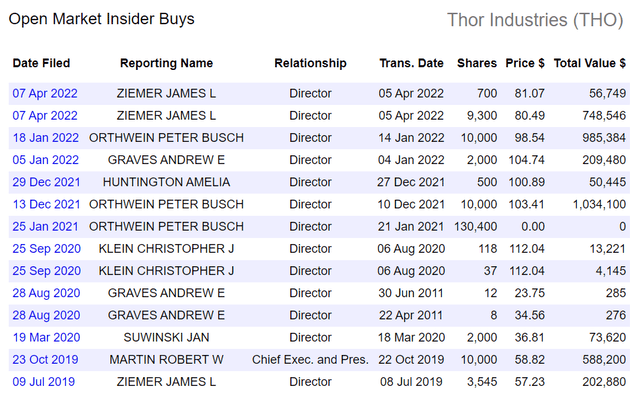

More importantly, perhaps, several insiders have recently purchased shares.

Insider buying at Thor Industries. (Dataroma)

Thor Industries: We are on the road again

We are delighted to own Thor industries once again as its business continues to boom despite predictions of a cyclical slowdown and continuing cost and supply chain headwinds. Substantial order backlog and strong profitability will protect short-term results while Thor’s leadership position in the RV oligopoly should provide long-term success. Structural growth in the RV industry combined with continued strategic acquisitions should also help Thor grow for many years to come. Thor is a high-quality company that has demonstrated the ability to navigate through the cyclicality of its end markets. Consistently high levels of ROE and ROIC and sustained profitability through even deep recessions are attractive attributes of the company’s quality and strong management. After a substantial share price drop over the last year, Thor’s valuation once again offers investors an attractive entry point in our opinion. We suggest long-term investors have a fresh look at Thor’s current value proposition and consider a meaningful allocation, albeit with room to increase the position should the negative share price trajectory continue.

Be the first to comment