chaofann/iStock via Getty Images

In the past few months, we’ve witnessed a market sell-off that has pushed most sectors of the market into a bear.

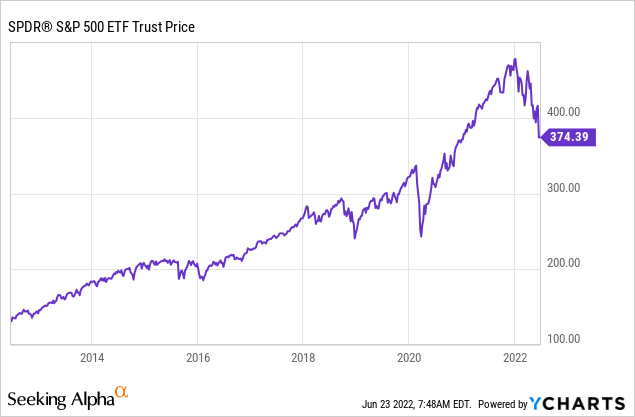

The S&P500 (SPY) is down 23%, REITs (VNQ) are down 24%, and the NASDAQ (QQQ) is down over 30% since the beginning of the year.

In this environment, it pays to take a step back to know where to invest.

While tech stocks may be down the most, they delivered massive gains over the past years. As a result, they still aren’t trading at particularly cheap valuations. They are also the most negatively impacted by the current high inflation and rising rates because they are growth stories with the lion’s share of their cash flow expected sometime far into the future.

Similarly, the S&P500 is still priced at a historically rich valuation and that’s largely due to tech stocks, which make up a large component of it:

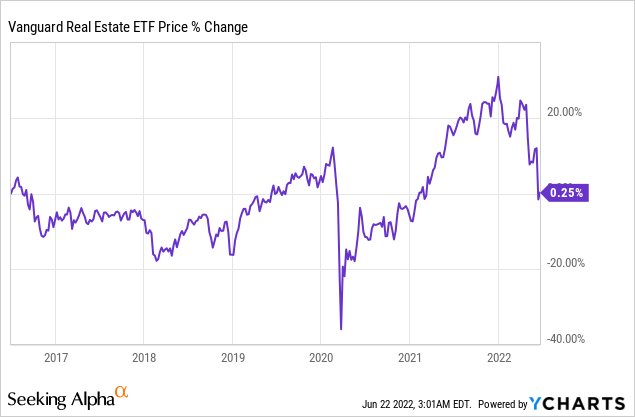

In the meantime, REITs are in just the opposite boat. Their share prices are flat over the past 6 years, and that’s despite strong fundamentals and significant real estate market appreciation since then:

REITs were such poor performers because the market favored growth investments, and then came the pandemic, which continues to negatively affect their market sentiment to this day.

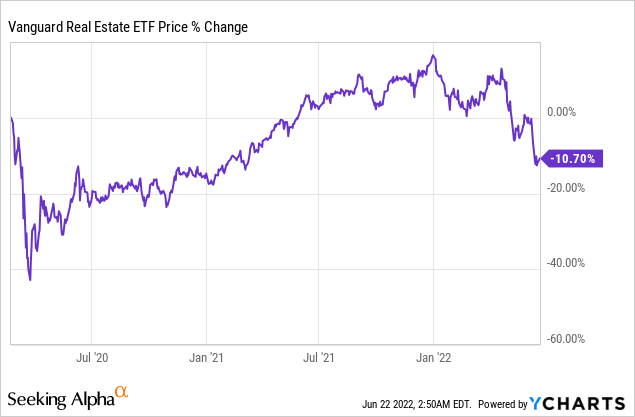

While REITs, like everything else, have risen since March 2020, they are still 10% below pre-pandemic levels:

That’s the performance of a market-cap weighted ETF, and so you can imagine that many of the smaller and lesser-known REITs are down much more than that. Some individual REITs have dropped 30%, 40%, 50%, or even more.

This is despite the fact that most REITs:

- generate record-high cash flow;

- pay higher dividends than ever before;

- have the strongest balance sheets in their history;

- enjoy strong growth prospects as rents rise with inflation;

- and own assets that experienced huge appreciation over the past years.

The market is still treating REITs as though they were significantly less valuable than prior to the pandemic when, in reality, it is the exact opposite. Therefore, we have an obvious “mispriced” situation here that’s ready to be exploited.

In this article, I’ll make the case that we are now witnessing a “once in a decade” opportunity to score big returns in REITs. Thanks to modest valuation and strong future prospects, REITs are primed to rise in the years ahead. The following are a few key reasons why.

Real Estate Will Always Be Needed

Real estate is a basic life necessity. People will always need places to live, have fun, work, store things, and do business. As long as that remains a fact –and it always will — REITs will have a sizable market to serve.

There are countless things people will always need, no matter how much human society changes. Many of these things are provided by REITs. For example:

People will always need a place to live–like an apartment offered by Essex Property Trust, Inc. (ESS):

Apartment community (Essex Property Trust)

People will always need healthcare–delivered in a hospital-like those owned by Medical Properties Trust, Inc. (MPW).

Hospital (Medical Properties Trust)

Retirees will always need living space in old age–typically in retirement communities like those owned by Welltower Inc. (WELL).

Senior housing (Welltower )

People will always need haircuts–in barbershops at strip centers like those owned by Federal Realty Investment Trust (FRT).

Shopping center (Federal Realty Trust)

People will always need industrial warehouses to store and ship goods that they order on Amazon.com, Inc. (AMZN) or elsewhere:

Warehouse (Prologis)

People will always need farmland to feed themselves:

Farmland (Gladstone Land)

I could go on and on, but you see what I’m getting at here.

REITs own properties that cater to universal human needs. While businesses come and go, the need for high-quality real estate will never go away. This means that REITs have the potential for secular growth and will never become “irrelevant.”

This stuff cannot be inflated away, and in the long run, the value of these assets is almost certain to rise as long as they are well-managed and conservatively financed.

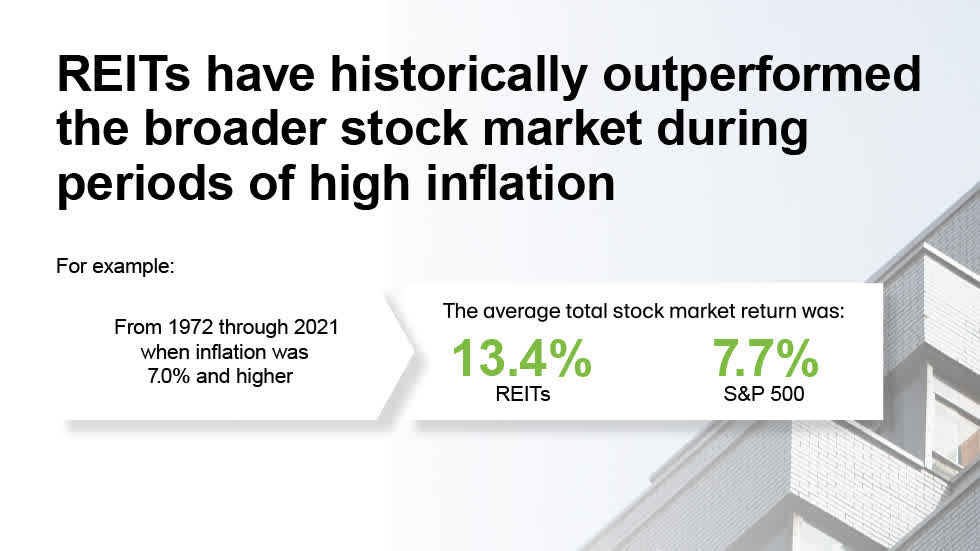

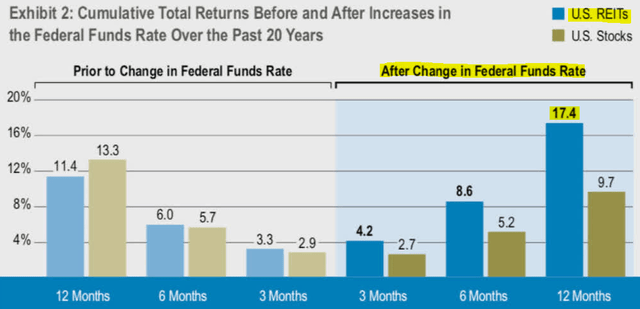

In fact, REITs tend to generate the highest returns when inflation is high and interest rates are on the rise. This makes sense, because the positive impact of inflation on rents and property values is far greater than the negative impact of rising interest rates:

REITs outperform inflation is high (NAREIT) REITs outperform during times of rising interest rates (Cohen & Steers)

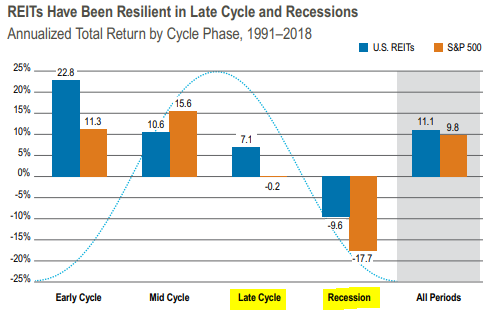

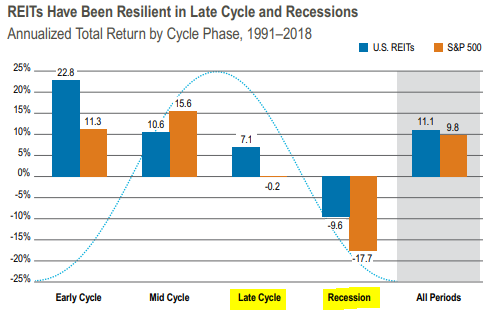

Moreover, REITs also continue to earn positive returns in late cycles and enjoy better downside protection during most recessions because they own essential assets that remain needed. Moreover, their cash flow may not even change in a recession because most REITs enjoy multi-year leases:

REITs outperform during recessions (Cohen & Steers)

So, why are REITs so cheap today?

The market appears to mistakenly think of REITs as office, mall, and hotel investments, which admittedly suffered from the pandemic, and have an uncertain future due to the rise of remote working, e-commerce, and home-sharing technologies. Zoom (ZM), Amazon, and Airbnb (ABNB) are here to stay.

But less than 10% of REITs actually invest in offices, malls, and hotels.

The vast majority of REITs today invest in defensive sectors that benefited from the pandemic. Good examples would be e-commerce warehouses, data centers, cell towers, single-family homes, manufactured housing, timberland, farmland, etc.

These property sectors are doing better than ever. Rents are rising rapidly. Property values are hitting all-time highs. And yet, the REITs that own them are currently discounted because of this false perception that REITs are basically office and mall investments.

But Valuations Won’t Always Be This Low

If you study history, you will find that REITs, like other stocks, go through cycles of fear and greed.

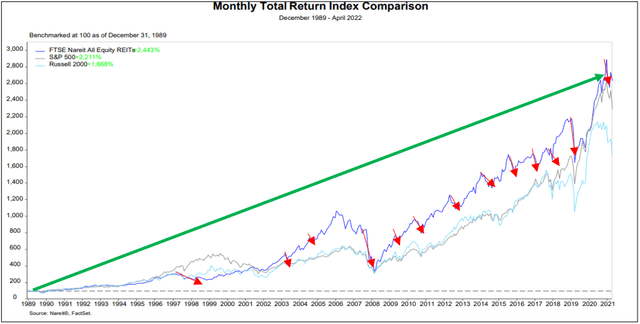

At times, they are out of favor, and then at other times, they are in high demand again. Volatility comes and goes, but based on history, REITs have a 100% chance of a recovery and will become popular again:

The key is to buy REITs when they are out of favor, which is the case today.

Eventually, the narrative will shift to something else and investors will return.

Today, they are avoiding REITs due to the pandemic, rising interest rates, and perhaps, the risk of a recession.

But as we explained earlier, these fears are mostly unwarranted. Most REITs and real estate investments benefited from the pandemic. Rising rates are the result of high inflation, which benefits REITs. And while recessions hurt all stocks, REITs are more resilient than others, and recessions are only temporary.

We actually think that, in a weird way, a recession could help REITs. Here’s why:

- It will shift the focus away from the pandemic. (This is already happening);

- It would cool off the inflationary pressures; and

- It could lead to rate cuts, or at the very least, end aggressive rate hikes.

As such, a recession could actually help REITs. They are already priced as if we were deep into a recession. Historically, they have been very rewarding to own early into the recovery when the narrative begins to change:

REITs outperform during recessions (Cohen & Steers)

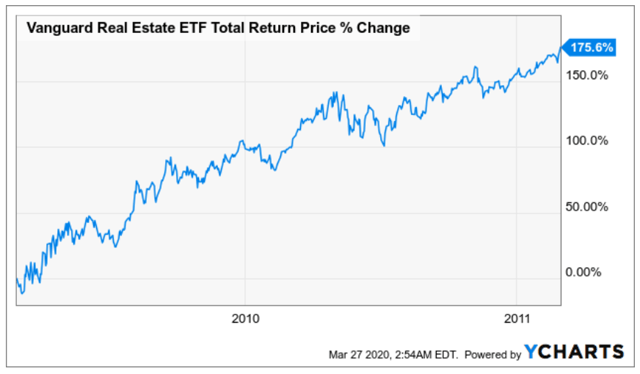

Take the early recovery of the great financial crisis as an example: REITs nearly tripled in just two years:

REITs nearly triple following the great financial crisis (YCHARTS)

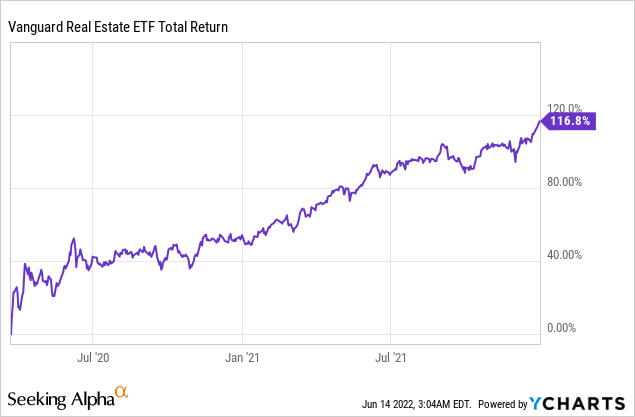

Or the recovery of the initial pandemic crash: REITs doubled in just one year:

REITs nearly double following the pandemic (YCHARTS)

Now, REITs are again priced at their lowest valuations in years.

What’s coming next?

Based on history, there is a 100% chance of a strong recovery, which would lead to significant gains for investors who buy REITs today.

If you missed REITs in early 2020 when they crashed, now is your second chance to buy them at historically low valuations. This could literally be a once-in-a-decade opportunity to build wealth in REITs.

Be the first to comment