JHVEPhoto

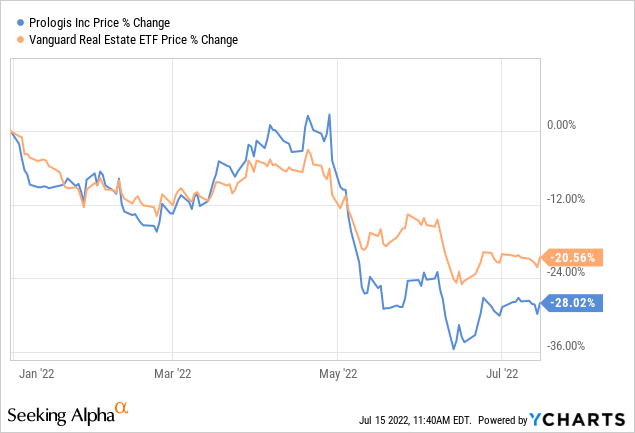

So far 2022 has been a tough year for shares of Prologis (NYSE:PLD), down by almost a third. Investors should not get overly concerned in our opinion, given that most of the drop can be explained by general weakness in the real estate sectors, as evidenced by the sharp drop in the Vanguard Real Estate ETF (VNQ). Of course, it did not help that Prologis got a little ahead of itself in terms of valuation, and that it paid top dollar for Duke Realty (DRE). In any case we believe shares are now a lot more attractive, and we’ll analyze the valuation and the fundamentals of the company.

DukeRealty Acquisition

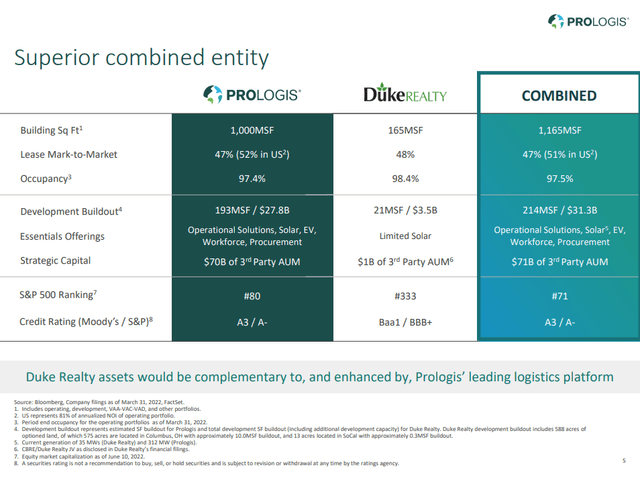

Was the DukeRealty acquisition a disaster? We do not think so. In our opinion Prologis bought good assets at a full-price, not really generating much value despite the fact that the combined entity should benefit from Prologis’ lower cost of capital, thanks to its superior credit rating, and that there are some G&A savings and operating leverage benefits.

Prologis Investor Presentation

Financials

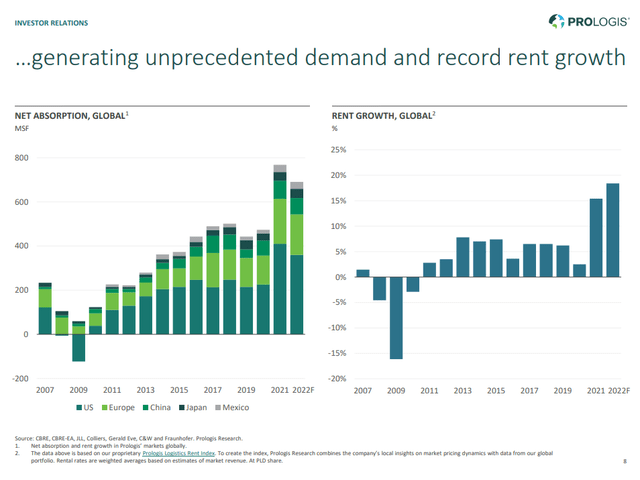

One reason why we do not think Prologis investors should get too concerned about the share price drop is that fundamentals remain very solid. Net absorption in Prologis’ markets remains very high, resulting in impressive rent growth. Such levels of rent growth bode well for NOI growth and occupancy levels.

Prologis Investor Presentation

In fact demand is so strong that at the current absorption rate, available space in the U.S. would dry up in 16 months.

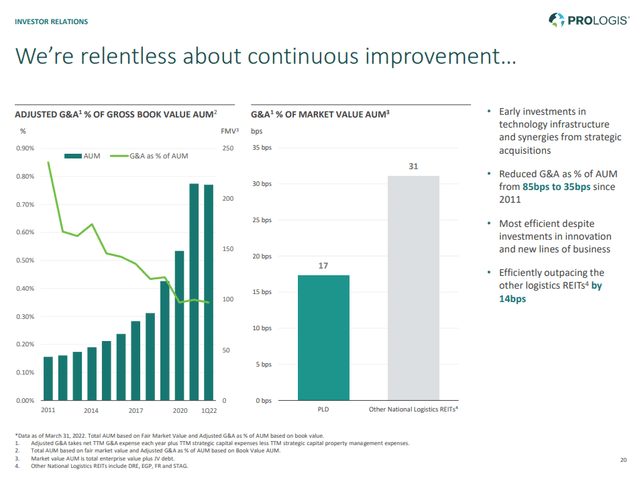

At the same time, Prologis continues to find ways to improve its efficiency, driving G&A as a percentage of assets under management to record lows. Prologis is almost 2x as efficient as its average peer.

Prologis Investor Presentation

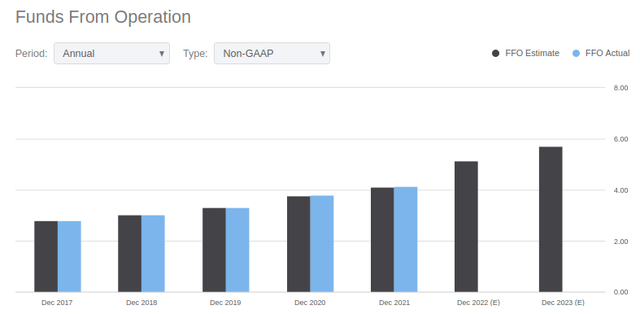

Growth

Growth in funds from operation per share has been impressive, growing almost 50% in the last four years. That is a CAGR of ~10%, which explains why Prologis has delivered such outstanding returns to its shareholders over the last few years. For 2022 Prologis is expected to deliver another big jump in FFO per share to ~$5.15.

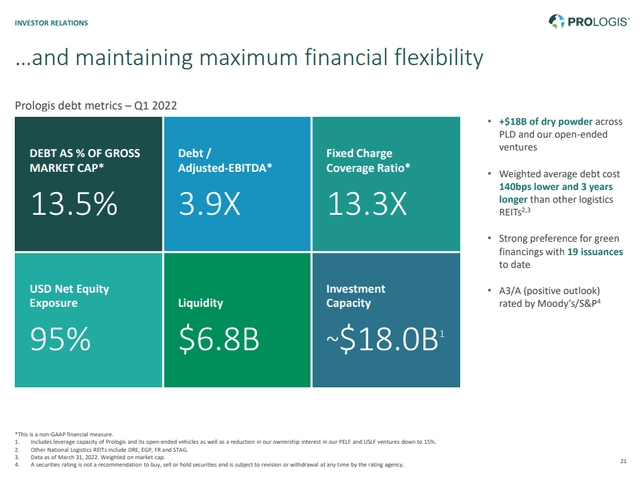

Balance Sheet

Thanks to its strong credit rating of A3/A- (positive outlook) and strong ESG practices that allow the company to access green financings, Prologis has a much lower weighted average debt cost than most of its other logistics competitors. Its balance sheet metrics are quite strong, for example debt/EBITDA remains relatively low at 3.9x, Fixed Charge Coverage Ratio is quite high at 13.3x, and liquidity is a healthy $6.8 billion.

Prologis Investor Presentation

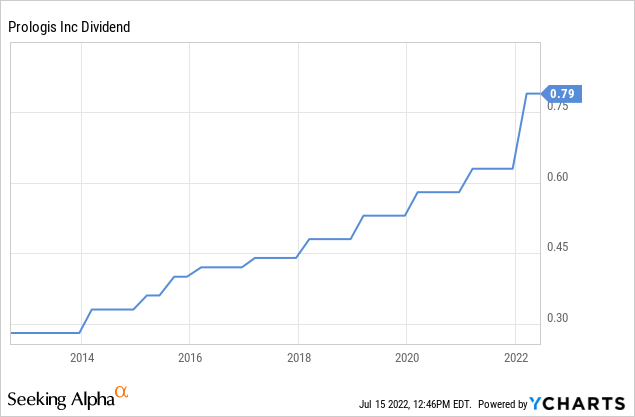

Capital Returns

Reflecting the strong fundamentals, Prologis recently made a big increase to its quarterly dividend to $0.79 per share. At current prices of ~$120 this means a yield of ~2.6%. This is not even close to the highest dividend an investor can currently get in a solid REIT, but it is important to remember that Prologis has been raising its dividend by ~10% CAGR. If it can continue to do so for many more years, investors could be looking at attractive total returns.

Valuation

We estimate a net present value per share of $115, using a 10% discount rate, average analyst earnings estimates for the next three years, and an 11% earnings growth thereafter until 2032, after which we use a terminal growth rate of 3%. Our estimated fair value is very close to the current share price. This leads us to believe that shares are currently fairly valued, and priced to deliver total returns for shareholders in the high single digits to low double digits.

| EPS | Discounted @ 10% | |

| FY 22E | 5.15 | 4.68 |

| FY 23E | 5.73 | 4.74 |

| FY 24E | 6.07 | 4.56 |

| FY 25E | 6.74 | 4.60 |

| FY 26E | 7.48 | 4.64 |

| FY 27E | 8.30 | 4.69 |

| FY 28E | 9.21 | 4.73 |

| FY 29E | 10.23 | 4.77 |

| FY 30E | 11.35 | 4.81 |

| FY 31E | 12.60 | 4.86 |

| FY 32 E | 13.99 | 4.90 |

| Terminal Value @ 3% terminal growth | 199.84 | 63.67 |

| NPV | $115.66 |

Risks

The main risk we see with Prologis is that of an overbuilding of logistics facilities by the industry, if they over estimate demand that fails to materialize. Prologis has been able to grow funds from operation very quickly in part thanks to rising rents, which could reverse should the industry overbuild capacity.

Conclusion

Shares of Prologis have lost about a third of their value for a few reasons, none of which we find particularly worrisome. One is that real estate in general has gone down as evidenced by the Vanguard Real Estate ETF VNQ. Another specific reason for Prologis is that it got a little overvalued, but we now believe shares are fairly valued again. Finally, some analysts disliked the DukeRealty acquisition. We do not believe it was particularly attractive, but we do not believe that value was destroyed for Prologis shareholders either. All in all we see the price decline as a healthy correction that has now priced shares to deliver high single digits to low double digits returns, as long as the industry does not overbuild logistics capacity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment