Jean-Luc Ichard

Published on the Value Lab 11/10/22.

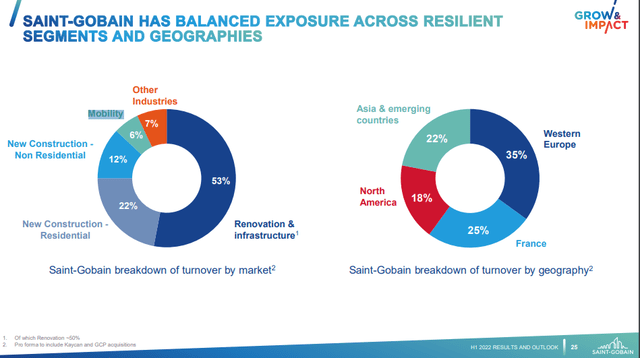

Compagnie de Saint-Gobain S.A. (OTCPK:CODGF, OTCPK:CODYY) is a building products and building chemicals company with a focus primarily on Europe. We think that it deserves to be discounted to American building products peers when it’s not, due to European exposures being unfavorable. Moreover, any current resilience and anti-cyclicality in Europe is coming from expensive tax incentives related to green construction. Gobain is well-positioned in this regard, providing insulation products but also other materials geared for sustainability, but these regimes are problematic and possibly unsustainable given the European situation.

Europe is in a recession already, a technical one for all intents and purposes, unlike the U.S., which is holding fast. This should be reflected in the expectations of this cyclical business when it’s not. Not a buy.

Q3 Review

The Q3 results have recently come out and they are worth exploring relative to U.S. players, who we’ve also begun to cover. In general, growth is not as high as with American peers, barring inorganic contributions from the Kaycan and GCP closures. What does Gobain do? A lot of plaster wall, gypsum, fiberglass products and other additives that go into concrete and cement. Some of their fiberglass things also go into cars, and they have a bit of an automotive exposure at around 6%, with some other miscellaneous industrial exposures making about 7% of total revenue. The rest is utterly in construction.

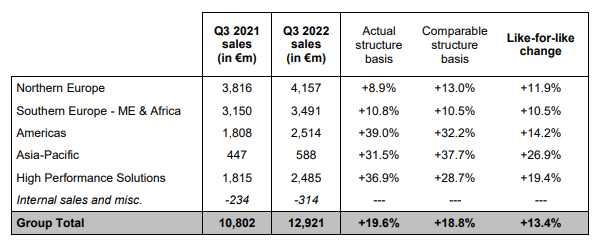

Its segment breakdown is mostly geographical and looks like this for Q3.

Segments (Q3 2022 PR)

There’s a lot of European exposure, and also Nordic plus UK exposure. Americas is meaningful but by no means dominant, and the smaller APAC segment is primarily driven by India, which is why it’s growing despite China lagging typical APAC portfolios due to their COVID-19 restrictions. American growth was really pronounced, but a lot of this is coming from their acquisition of previous publicly listed GCP Applied Technologies. About 9% of Gobain’s total revenues on a run-rate basis are going to come from this acquisition as of closure this quarter, which is a company that makes concrete admixtures and flooring materials. North American exposure is about 50% of GCP, and, therefore, 5% of Gobain’s overall revenue. About 75% of the Americas growth is coming from this acquisition. Organically it is seeing revenue growth, but it is almost all pricing-driven. Volumes are down.

Northern Europe includes the UK, which is a declining market. They are divesting a lot from there, but the pricing in the residual businesses is constructive. Resilience in the Nordics is present in the Northern Europe segment thanks to renovation exposures, and not just to newbuilds, which has saved them from declines in activity in markets like Sweden, which we’ve observed in other members of our coverage group including Nordic Waterproofing. Other more Eurozone exposures, which is Germany within the Northern Europe segment, is benefiting from the EU green push and initiatives for sustainable, energy-efficient construction. Again, renovation is staying strong because of these top-down initiatives from regulators. In line with the Germany story, Southern Europe is also performing well, still with volume decline.

Driven by India, APAC was the only growing segment by both volumes and pricing.

High performance solutions, which is where the mobility and other exposures are, and includes things like insulation, is performing well in both prices and even volumes due to the recovery in mobility as the automotive industry rebounds from the supply shortages in semiconductors.

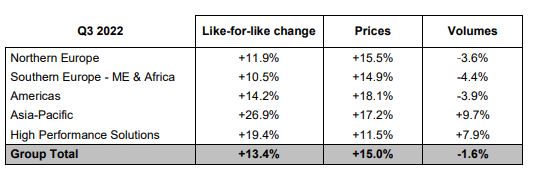

Volumes and Pricing Contribution (Q3 2022 PR)

Remarks

Much like building products peer Owens Corning (OC), volumes are seeing declines as the housing market recedes from the higher-rate environment. In particular, the matter of newbuild versus renovation becomes important for assessing the performance of companies in this market. Gobain has some renovation backstops, but the majority of its exposures are cyclical and newbuild. While regulatory support for some of the newbuild markets in Europe related to energy efficiency is keeping volumes from tanking, Europe broadly is seeing declines thanks to rampant energy inflation. The recession is firmly there, while the U.S. continues to post job growth and a shrinking current account deficit thanks to an exploding dollar and value in previously valueless commodities like gas.

Many of these initiatives that are coming top down are not necessarily very popular. In Italy, the incentive for renovation costs is 110% for tax deductions on personal income, but many are criticizing its sustainability and the effectiveness of the initiatives. Idiosyncratically, there is the issue that smaller businesses cannot handle the Kafkaesque bureaucracy that goes with it in Italy. It may not be politically or financially tenable and is indeed supposed to end this year, especially as energy requirements and energy relief go to the top of the agenda over the wealthy renovating houses.

The cycle will hit Gobain’s construction exposed industries, and the drop will be more dramatic than the pressure we are so far seeing in the U.S. macroeconomically. Where Gobain and OC both trade at the same 4.3x EV/EBITDA, we’d prefer the American pick any day.

Be the first to comment