chaofann/iStock via Getty Images

Co-produced by Austin Rogers

The nature of REITs as a publicly traded way to own the relatively illiquid asset class of real estate creates some interesting situations.

Today, REITs are heavily discounted to their net asset values as well as their private real estate equivalents.

At High Yield Landlord, we are following in private equity’s footsteps by buying high-quality yet heavily discounted REITs.

Real estate investment trusts (“REITs”) are a unique, hybrid asset class combining the steady, income-heavy returns of real estate with the liquidity and daily tradability of stocks.

Most readers are well-aware of this basic fact, but it’s useful to restate it because it can be easy to overlook some of the odd situations that can arise from it.

For instance, what happens when the forward-looking and/or emotionally driven price movements characterizing the stock market meet the price stability and relative illiquidity of real estate? Unsurprisingly, we often find price discrepancies between the two.

“Price discrepancies” is just a nicer way of saying “mispricing,” which signals opportunity for the investor willing to do their due diligence. So, in this article, let’s roll up our sleeves, look at the data, and in the process perhaps even find a few attractive REIT discounts.

REITs Discounted Vs. Private Real Estate

It’s no secret that private real estate prices are far more stable than the prices of publicly-traded REITs.

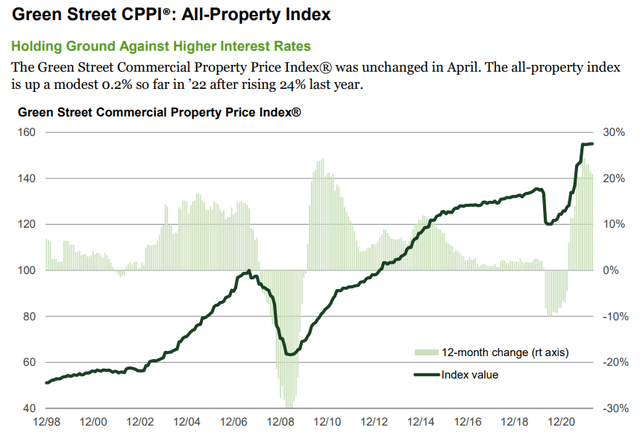

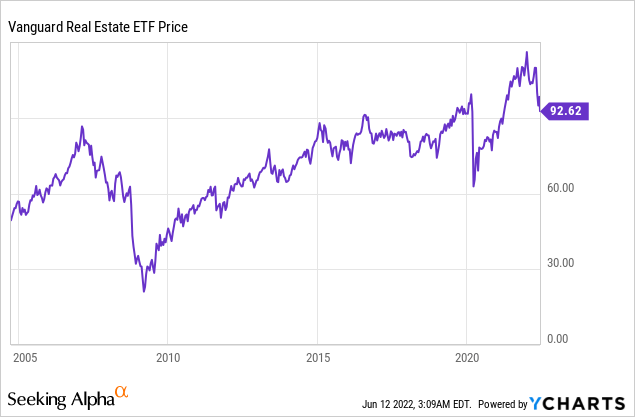

Compare, for instance, Green Street’s Commercial Property Price Index (first image below), measuring the private market valuations of all major classes of commercial real estate, to the Vanguard Real Estate ETF (VNQ) (second image below), which measures the prices of all publicly-traded REITs.

Real estate prices have risen substantially (Green Street Advisors)

As you can see, REITs generally follow private market real estate prices, but with much greater volatility.

Sometimes, REIT investors are more optimistic than the private real estate market, valuing REITs much higher than the sum of their real estate parts. In these cases, REITs typically issue substantial amounts of equity to arbitrage by buying relatively lower valued private real estate.

Other times, REITs price in much more pessimism than the private real estate market, valuing REITs significantly lower than the sum of their real estate parts. In these cases, it’s more common to see private equity giants like Blackstone (BX), Apollo Global Management (APO), KKR Inc. (KKR), and others take publicly-traded REITs private at premiums to their market prices.

Today, REIT prices have dropped markedly along with the broader stock market, while the average of private real estate prices has ticked up quite significantly since the beginning of the pandemic. Are REITs accurately pricing in a future drop in commercial real estate prices? It is possible, especially considering the rising interest rate environment.

The portfolio managers of the Baron Real Estate Income Fund, however, believe that rising rents in this inflationary environment should cause real estate prices to hold steady, if not rise, across most property types.

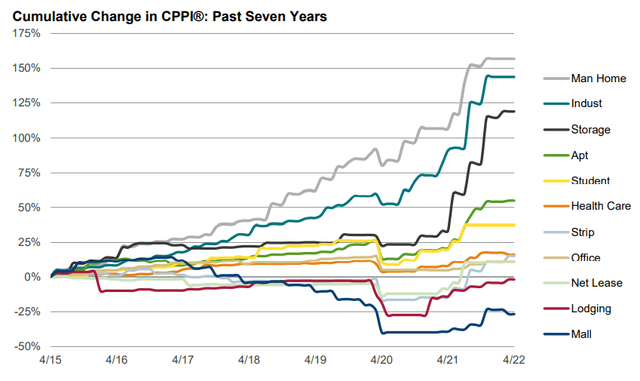

Of course, just as some property types are better suited for inflation (apartments, single-family rentals, manufactured homes, student housing, industrial, self-storage, hotels, multi-tenant retail), so also are some property types better able to handle rising interest rates.

Inflation benefits more some specific property sector (Green Street Advisors)

REITs with long lease terms and contractually limited rent escalations in the low single-digits (like net lease and some healthcare and office) will fare worse with both high inflation and rising interest rates.

But in their Q1 2022 Quarterly Letter, Baron Funds listed several examples of arbitrage opportunities between public and private real estate valuations:

Multi-Family REITs: Private market transactions in the mid-high 3% capitalization rate range vs. current public market valuations for best-in-class apartment REITs in the near a 5% capitalization rate.

Single-Family Rental REITs: Private market transactions in the mid-3% capitalization rate range vs. current public market valuations for best-in-class single-family rental REITs in the mid-4% capitalization rate range. Analysts estimated that in 2021 Blackstone purchased Home Partners of America for $6 billion or an estimated 3.5% capitalization rate vs. the Fund’s investment in Invitation Homes (INVH) which is currently valued at only a 4.5% capitalization rate.

Office REITs: Private market transactions have occurred at or below a 5% capitalization rates for high-quality properties in several markets vs. current public market valuations for best-in-class office REITs in the mid-5% to mid-7% capitalization rate range. Certain office REITs are valued in the public market on a per square foot basis at approximately 40% to 60% of the estimated replacement cost.

Shopping Centers: Private market transactions below 5% capitalization rates, vs. current public market valuations in the mid-5% to mid-7% capitalization rate range.

Self-Storage REITs: Private market transactions in the mid-3% capitalization rate range, vs. current public market valuations for REITs in the low-4% range (notwithstanding having higher-quality portfolios and more significant embedded growth).

Life Sciences Real Estate: Analysts estimated that Blackstone and Ventas (VTR) purchased life science office buildings at $1,300 to $1,500 per square foot in the private market, yet the Fund owns the public REIT with the premier life science real estate portfolio in the country, Alexandria Real Estate (ARE), which is currently valued at only $900 per square foot.

Data Center REITs: Data center REITs QTS and CoreSite were acquired last year at 25 to 27 times EBITDA yet the Fund owns the premier data center company in the world, Equinix (EQIX), and it is currently valued at only 23 times EBITDA.

Hotels: Many individual and bulk hotel transactions have traded in the private market in the 13 to 17 times cash flow range, representing large premiums to several public hotel companies. Also, several hotels have been acquired in the private market at $600,000 – $1 million per key vs. publicly traded hotel REITs valued on average at $350,000 per key.

As you can see, there is a veritable cornucopia of discounted opportunities in the REIT market right now. Below we highlight two of them.

1. Alexandria Real Estate Equities (ARE)

ARE is one of the REITs mentioned in Baron’s quarterly letter as being heavily discounted as of the end of the first quarter. Since then, ARE’s stock price has only dropped further, making it even more discounted.

The REIT owns and develops Class A life science laboratory/office properties used by the world’s largest pharmaceutical companies for drug research & development. The company, led by CEO and founder Joel Marcus, pioneered investment in this space and has been invested in it for over 25 years.

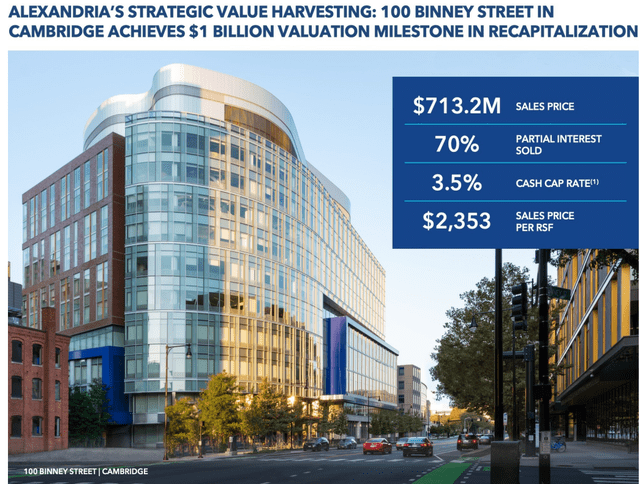

The recent sale of a 70% interest in one of ARE’s high-quality properties in the life science cluster of Cambridge, Massachusetts, demonstrates the huge gap between private market real estate and public market REIT valuations.

Life science property cap rates (Alexandria Real Estate)

The property sold for a cap rate of 3.5% and a price per square foot of $2,353, 2.6x higher than ARE’s implied valuation of $900 PSF at the time Baron Funds put out its quarterly letter.

Also compare ARE’s ~6% AFFO yield to the cap rates in this space of 3.5% to 4%.

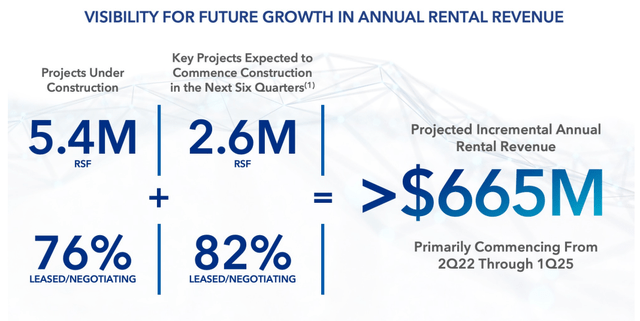

Better still, ARE has vast property development capabilities and a deep pipeline of projects currently in development.

Alexandria Real Estate Equities has a large development pipeline (Alexandria Real Estate)

These properties can be delivered at stabilized NOI yields of 5-6%, thereby giving ARE a significant competitive advantage over peers without the ability to develop properties from the ground up. In addition, ARE enjoys massive liquidity of $5.7 billion and a strong balance sheet with a weighted average debt term of 13.8 years, nearly double that of its weighted average remaining lease term of 7.3 years.

The market appears to have shunned ARE because of its triple-net leases, but 97% of its leases feature annual rent escalations of 3%. As such, if and when inflation cools down to around that level, ARE will be able to better keep up with inflation than nearly any other net lease REIT. Moreover, it is estimated that its rents are today 30-40% below market, providing a path to rapid growth as its leases expire. The management has noted that it expects up to 35% rent increases in 2022 for its expiring leases.

If private life science real estate values hold steady, ARE is discounted by 30-60%. That suggests massive upside if and when the market comes to its senses.

2. AvalonBay Communities (AVB)

AVB is the largest multifamily REIT on the public market. Historically, AVB has focused on fast-growing, high-cost coastal cities like NYC, San Francisco, Los Angeles, and Seattle, and the REIT still has the vast majority of its portfolio located in these markets.

Class A apartment community (AvalonBay Communities)

But AVB is rapidly expanding in new markets like Colorado, Texas (Dallas/Fort Worth and Austin), South Florida, and North Carolina. The REIT has already committed over $1 billion each into the Denver and South Florida markets as well as hundreds of millions into Texas and North Carolina.

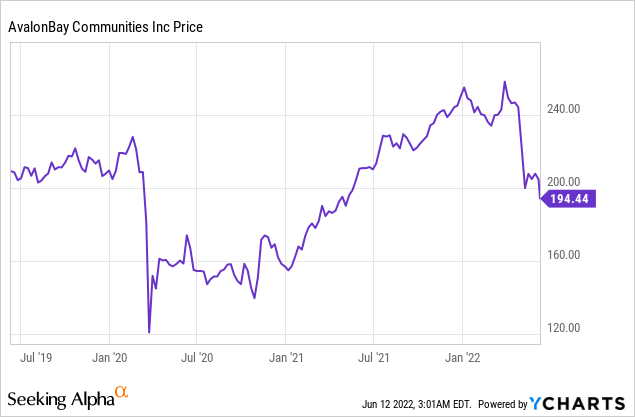

Despite rents rising by double-digits and property values soaring, AVB is now trading under its level immediately preceding COVID-19.

Despite high-quality apartment communities trading hands for cap rates around 3.5% to 4%, AVB is currently trading at an AFFO yield of ~5.2%. The company’s NOI yield (implied cap rate) is even higher.

AVB also has significant property development capabilities, which are a huge benefit in a time when cap rates are so low.

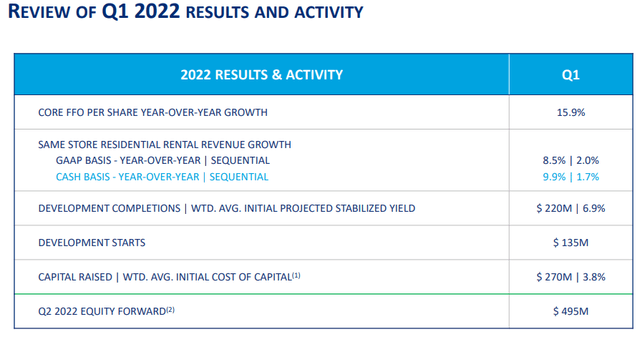

In the first quarter, AVB completed $220 million of developments at a projected stabilized NOI yield of 6.9%. This is significantly higher than the stabilized development yields of AVB’s multifamily REIT peers that also engage in developments, which average around 5.5%. Notice also that AVB began development of another $135 million of apartments during Q1.

AvalonBay Communities development pipeline (AvalonBay Communities)

As you can see from the first-quarter results, AVB is firing on all cylinders, with core FFO per share growth of 15.9% year-over-year on top of 9.9% same-property cash rent growth. In April, that bumped up to 13.7%, demonstrating continued momentum into the second quarter.

Likewise, AVB is strongly capitalized, having just secured a well-timed forward equity deal to issue $495 million of shares at a price of $247.50 per share. This should allow AVB to continue funding its investments for at least another few quarters. And if AVB’s stock price remains depressed into the second half of the year, management always has the option of pursuing accretive capital recycling by selling its highly appreciated properties at sub-4% cap rates.

For 2022, management now expects core FFO per share growth of 16% on the back of 11% NOI growth. That is slightly up from the initial guidance of 15.6% and 10%, respectively.

If rent rates continue climbing and multifamily real estate remains hot, AVB has at least 30% upside to fair value.

Bottom Line

The market downturn has created myriad opportunities among publicly-traded REITs wherein stock prices and real estate valuations have moved in opposite directions. At High Yield Landlord, we are happily taking advantage of the best and most discounted opportunities available.

Be the first to comment