MediaProduction/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Both These Things Can’t Be Correct

As you know, because everyone everywhere is telling you, we are all doomed. The fissures in American capitalism have been prised open by thirteen years of near-zero interest rates and suppressed worker incomes, combining to usher in the biggest transfer of wealth from labor to capital ever known. China, strengthened by its importing of manufacturing jobs and intellectual property from the US, now considers itself the principal power-broker in the Russian invasion of Ukraine. Meanwhile the Federal Reserve is so wrong that even the normally cool, calm and collected Prof. Jeremy Siegel of Wharton Business School is popping blood vessels on Twitter. Under these conditions, the center cannot hold, and something bad is going to happen very soon.

Well, this could be true. It is true that value has been transferred from labor to capital at a rate and scale that would floor even Karl Marx. (Marx didn’t know about globalization and he didn’t know about quantitative easing, so, we can forgive him for that if nothing else). It is true that China is looking less and less like an emerging superpower and more like an actual superpower. And it is true that so many people are convinced that the American dream is over that, maybe it is over.

OK.

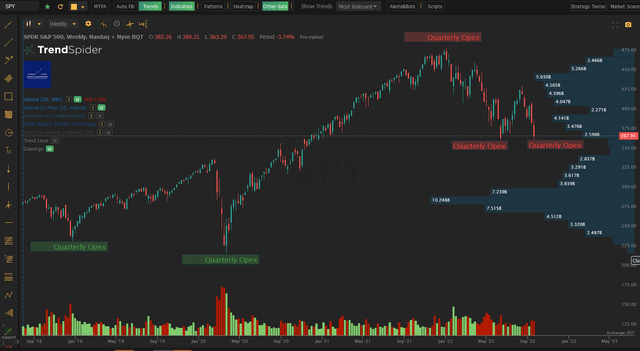

But let’s sit back a little and consider this. Let’s just look at the S&P 500, for so long the doyen of investor havens globally. Is it going to zero anytime soon? You can open a full page version of this chart, here.

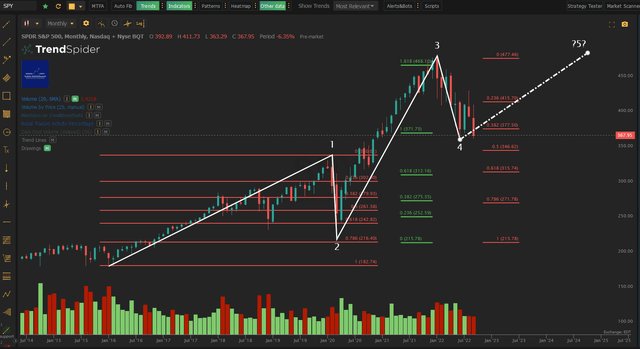

SPY Chart (TrendSpider, Cestrian Analysis)

So far, whilst the June low holds in the SPY – indeed even if the SPY falls to $341 or so – we can say that looking through the not-necessarily-voodoo lens of Elliott Waves and Fibonacci retracements and extensions, there’s still a strong argument to say that not only will the market move up, but new highs are possible within this standard pattern that crops up again and again in securities markets. Doesn’t mean it is going to happen. But it does mean that the bear argument is, as always, most deafening when retracements approach typical lows.

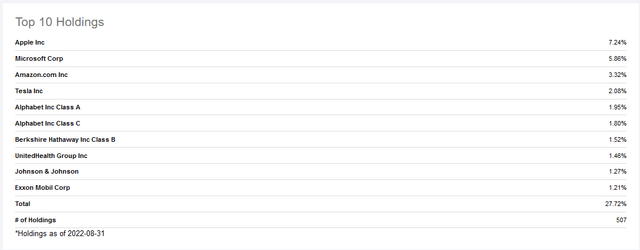

Among the many curious artifacts in markets right now is Apple stock. Apple, Inc (NASDAQ:AAPL) is the largest single component of both the S&P 500 and the Nasdaq-100 index. Here’s the ETF forms of those indices. Full page versions, here for SPY and here for QQQ.

SPY Top 10 Holdings (Seeking Alpha) QQQ Top 10 Holdings (Seeking Alpha)

7.2% of the SPY and 13.6% of the QQQ. Yikes.

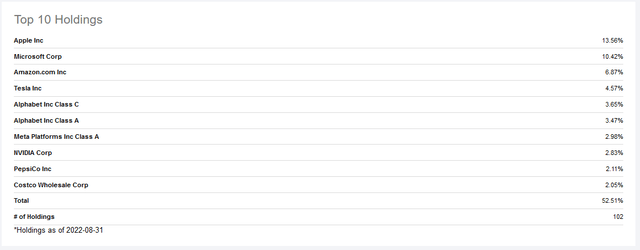

AAPL has held up incredibly well versus other big names in those indices. Let’s look at the QQQ Top 10 for instance – here’s all those names today vs. all-time highs. Only PepsiCo (PEP) has been more resilient. The normally bombproof Microsoft (MSFT) has dropped 30% vs. Apple’s 17% which is not to be expected when you think that Apple requires way more consumer spending to hold up revenue and earnings than does Microsoft, and it’s consumers right now expressing pain rather than corporate budget holders.

QQQ Top 10 – Individual Change Since ATH (YCharts.com)

Now, it may of course be that AAPL has simply been a safe holdout in which investors have parked money, on the basis that it may fall a little but when the market moves up, so too will AAPL. This removes the psychological risk associated with simply going to cash – whereupon one can easily form the view that any new rally is “not real”, unsustainable, etc, and is best avoided. This can hurt investors lulled into a false sense of bearishness by the unyielding chorus of doomsayers who can always be found at times like these. AAPL may in short be the last bastion of the bulls against an inevitable market capitulation. A recent Seeking Alpha article makes this case in a thoughtful, unemotional fashion – and is written by an author who was bullish on AAPL at the right time, so it should be considered. You can read it here.

Our own view for what it’s worth is that this market will recover or plunge pretty much according to AAPL stock. In many ways AAPL ought to be watched more closely than the indices themselves, since the games played with options around the S&P and the Nasdaq are still greater than those played with Apple stock alone. Here for instance is an indication of the importance of options flows – particularly major options expiries – on the SPY. (Full page version, here).

SPY vs Quarterly Opex (TrendSpider, Cestrian Analysis)

So whilst we watch the indices, we also know that getting a true picture of underlying sentiment can be challenging around quarter ends. Apple is hardly immune to options pressure, but our observation is that it is less of a playing field than are the indices themselves.

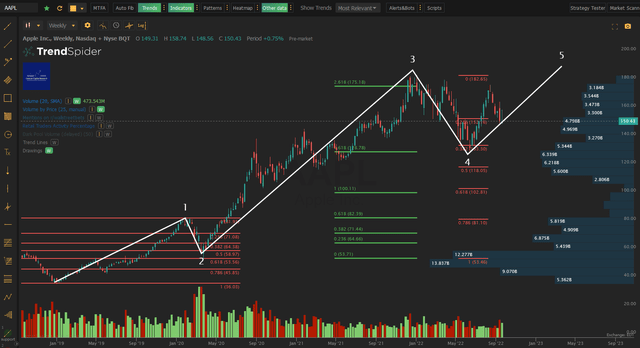

Here’s how AAPL has performed since the 2018 lows (the last time the Fed tried to normalize monetary policy!). Full page version, here.

AAPL Stock Chart (TrendSpider, Cestrian Analysis)

Now of course this could fall off a cliff tomorrow. The crazy-strong dollar could hit AAPL earnings, the buy-now-remortgage-the-house-later consumer could come over all Lutheran and stop buying stuff in order to embrace the deferred-gratification dream, anything could happen.

But in our very best estimation, this stuff won’t happen.

We think AAPL is heading to new highs. And we think that chart supports the notion. Because here’s a fairly standard and unexciting Fibonacci trend playing out since 2018.

- Wave 1 up, runs from $36 to $82, peaking right before the Covid crisis.

- Wave 2 down, drops to the 61.8% Fibonacci retracement level – to the dollar! – in March 2020

- Wave 3 up, peaks a little above the 2.618 Fibonacci extension of Wave 1 – that’s a bullish run for sure but not crazy-bullish (a similarly timed peak in TSLA was the 5.236 extension of its prior Wave 1!), right around the end of 2021.

- Wave 4 down, which so far bottomed in June at the 38.2% retrace of that Wave 3 up and has since moved up into…

- A possible Wave 5 up in progress – it sure looks like one – which right now put in a smaller degree (i) up peaking in August and dropped back to the 61.8%-ish of that move up since then for what looks like a smaller degree wave (ii) that we think will find support soon.

If this pattern plays out we would expect to see AAPL peak in the $190s, maybe low $200s. You will find plenty of people telling you that AAPL can moon from here based on that same chart – we don’t share that view. We have found in our work that Wave 5s in these names are not spectacular – they tend to move up above the Wave 3 high per theory, but rarely do they leave that Wave 3 high for dust. It does happen – TSLA and NVDA have seen this in 2020-21 for instance – but it’s the exception not the rule.

So, in conclusion – we do think the market has a way to fall but not before AAPL and others make new highs. We continue to expect the S&P and the Nasdaq to make those new highs in the next year or two, and we expect that to be a huge head-fake for many, who will breathe a sigh of relief and conclude that everything is OK. Everything is not OK, we can point to many mirrors cracked, but that doesn’t mean we think markets blow a gasket now. For now, we continue to look up.

Cestrian Capital Research, Inc – 26 September 2022.

Oh by the way, lest you think us perma bullish, we are not. We just think there’s a little more up before there’s a lot down. Because those five waves up you see from the 2018 lows? If that does complete as we think? That forms a larger-degree Wave One up which is likely to be followed by a larger degree Wave Two down, and given typical levels of Wave Two retracements – 50%, 62%, 79% of the prior Wave One up? THEN we will be buying into some bearish sentiment, and how. (Especially as if AAPL does hit new highs you can expect the kid at the bus stop to be declaring capitalism saved, SAVED I TELL YOU! – which will be right around the time we will be activating our short strategies in our subscription services).

Be the first to comment