levoncigol/iStock via Getty Images

“Control your own destiny or someone else will.” – Jack Welch

The Past

At various times during the year, I often go back in time and take a look at what the investment landscape looked like and how I was interpreting the scene. I’ve found that to be quite informative because while the players have changed the patterns often repeat.

On March 24, 2018, I penned an article with the headline:

S&P 500 Weekly Update: A “Bottoming” Process For Stocks Or A Deeper “Correction’ Looming?”

The equity market was in the midst of a corrective phase testing support in the 2500-2600 zone, and I noted:

What we are witnessing is a typical bottoming process, a process that takes time. Patience is now required.”

Fed Chair Powell had just raised rates by 25 basis points, but it was apparent the Fed posture at that time was nothing to be concerned about:

The Fed stance remains the same, the pace of rate increases will be measured and data-dependent. All of this is bullish for stocks. Interest rates at these levels, amidst the present Fed outlook, are NOT a reason to shed equity exposure.”

Ironically investors were concerned about a “war” back then as well, but it wasn’t a ‘human tragedy”, it was a potential trade war over “tariffs”. Real GDP was reported at 3.6%, inflation was running at 2.3% and the headlines just couldn’t resist showing how gas prices could hit $3 and how bad the situation might get. In line with that thought process, believe it or not, analysts/economists were running around preparing for a recession.

Most of those analysts weren’t paying attention to facts. Instead, they were pounding an agenda.

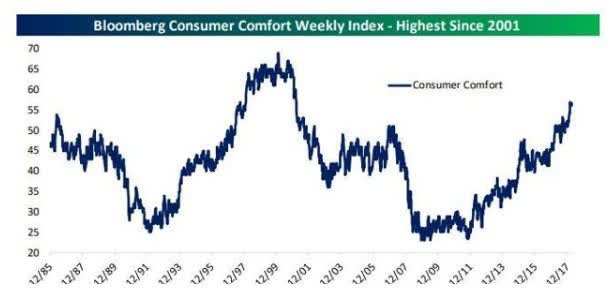

Consumer comfort is tracked using responses on three categories: the economy, the climate for spending, and their personal finances. As the graphic illustrates, the index is at its highest level since 2001.”

Consumer Comfort – 2018 (www.bespokepremium.com)

Households were in great shape and amazingly there were no stimulus checks handed out to make that happen. Consumers can be a resilient group.

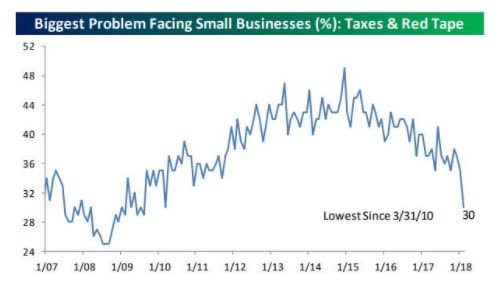

Back in October 2016, a combined 42% of small businesses cited either Taxes or Government Regulation as their biggest problem, and the two were tied for the lead as being cited by the largest percentage of businesses.

Small Business Survey – 2018 (www.bespokepremium.com)

In the March 2018 report, the combined reading of these two problems was just 30%, which was the lowest in eight years.

The job picture was strong with a 4% unemployment rate and initial jobless claims were at lows last seen in 1970.

So instead of listening to the data, it was all about the biased opinion that was keeping investors and some money managers scared. That turned out to be a wrong-footed approach based on emotion. I know that to also be FACT since the S&P rose from 2500 to the pre-Covid high of 3400.

When it came to identifying new trends in early 2018 it was my belief:

“While Technology takes a well deserved break, Energy and Materials show signs of life. Take a look at some of the energy explorers. The individual names I’m tracking in the Savvy Investor Marketplace service are up 13% since March 12th. Many are also posting new 52-week highs.”

WTI was trading at $66/barrel, and it was highlighted in a recent Dallas Fed Energy Survey that almost half of oil & gas CEOs expect a “substantial” increase in the number of rigs if crude remains between $61-64 a barrel. Quite ironic given the energy crisis the economy faces today.

There was no ‘wavering’ in the bullish stance back then. Instead, “Conviction” was HIGH.

The secular BULL market is entrenched, the positives far outweighed the negatives but the ‘skeptics’ fear was rising interest rates. Given the backdrop that was just laid out, adding in Corporate earnings growth, the probability that stocks will be higher down the road remains high. Sifting through all of the rhetoric and fear based reporting isn’t easy. Focusing on what really matters has treated savvy investors to nice rewards during this bull market. I don’t believe we need to be preparing for the end just yet.”

Many won’t agree with me on my market stance now when the two dirtiest words are now on the tip of their collective tongues, Trade War.”

Back then the advice was to follow Howard Marks’ quote:

Investors face not one, but two major risks: the risk of losing money and the risk of missing opportunities.” – Howard Marks

March 2018 was an identified ‘opportunity’.

The investment landscape has changed dramatically since then. A discernable trend emerged in mid-2021. From there it started to take root, making it a very challenging time for investors. Similar to 2018 the equity markets have experienced a corrective phase and embarked on a “bottoming” process. While there are some economic similarities that we can look to for comfort, the similarities to then and now end there. This changing scene has disrupted the situation to the point where an investor doubts their next move.

Seeds were planted last year that are now starting to show up as issues. With this “change” afoot market participants won’t have a strong footing in which they can be sure the next step won’t take them tumbling down the cliff. Going forward this won’t be your typical BULL market scene where the majority of signs were pointing in the same direction. In 2018 the issues were conjured up, exaggerated, and magnified. Today they’re all quite REAL.

The Week On Wall Street

All of the major indices entered the week looking to improve on the recent gains off of the mid-March lows. The S&P 500 started trading Monday on a streak that saw gains in 7 out of the last 9 trading days. A see-saw session was finally resolved to the upside as the rally continued on Monday and the buyers stayed in control on Tuesday extending the rally to 11 days.

The S&P’s 11% rally ended on Wednesday and by the end of the week, the index gave back 3% of that gain. It resulted in a mixed picture as the S&P, NASDAQ, and Russell 2000 posted modest weekly gains while the DJIA and Dow Transports lost ground.

The first quarter of ’22 has played out the way I expected. Hectic, volatile, and frustrating. The S&P has given investors 10+% moves in both directions. A 13% correction was followed by an 11% rebound. Indecision has set in and what is on the mind of many market participants in the direction of equities in the second quarter.

The Fed & The Yield Curve

The 10-year Treasury closed at 2.38% on Friday, and the yield curve has inverted as the 2-year closed at 2.44%.

An inverted yield curve reflects a scenario in which short-term debt instruments have higher yields than long-term instruments of the same credit risk profile.

Investors are rightfully concerned that inversions raise the probability of a recession, but recession alarm bells shouldn’t start ringing when just one part of the yield curve inverts. Instead, the odds of a recession rise as an increasing number of points in the yield curve invert. For instance, while 2s10s is inverted, the three-month vs 10-year curve is nowhere even close to inverted (185 basis point spread) and was just recently at its steepest level in five years. Historically speaking, when just a few points of the yield curve invert, the probability of a recession barely increases. It isn’t until the majority of points in the curve invert that a recession in the next two years becomes increasingly inevitable.

I’ll repeat what was said last week. Is it worth keeping an eye on? Sure. Is it worth making portfolio decisions based on it today? I don’t think so.

The Economy

Manufacturing

The seasonally adjusted S&P Global US Manufacturing Purchasing Managers’ Index posted 58.8 in March, up from 57.3 in February. The improvement in the health of the US manufacturing sector was steep overall and the sharpest since last September.

Dallas Fed manufacturing index fell 5.3 points to 8.7 in March after bouncing 12 points to 14.0 in February. The index was at 29.3 a year ago.

Chicago PMI jumped 6.6 points to 62.9 in March, better than expected, and unwinding a lot of the 8.9 point decline to 56.3 in February.

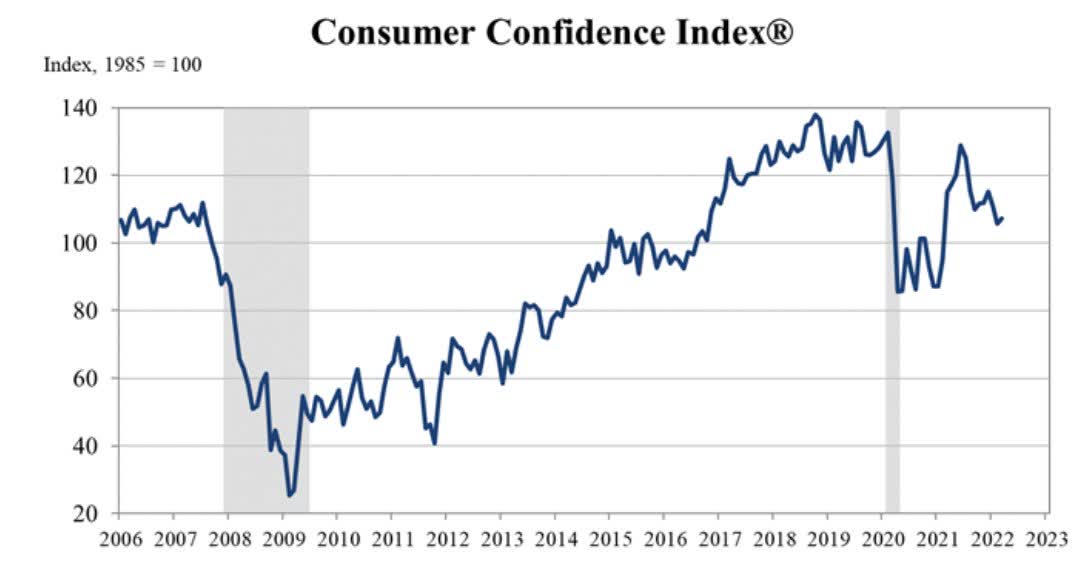

Consumer

The consumer confidence index rose for the first time this year gaining 1.5 points to 107.2 in March, after sliding -5.4 points to 105.7 in February. The index remains well off the pre-pandemic levels. The components were mixed, but expectations fell to the weakest level since February 2014.

Consumer confidence (www.conference-board.org/topics/consumer-confidence)

The other economic reports this month showed that Personal Income increased by 0.5% (in-line). Personal consumption disappointed rising 0.2% (0.4% expected).

On the inflation front, the February year-over-year PCE chain price metric rose to a 40-year high of 6.4% from a prior high of 6.0%. While the core measure rose to a 39-year high of 5.4% from a prior high of 5.2%

JOLTS: job openings dipped 17k to 11.2 million in February, about the same as we saw in January, both just under the all-time highs. The jobs are there and that suggests little need for any additional “assistance” from the government.

Non-farm payroll report was overall solid by nearly every metric. Payrolls increased 431k in March after gains of 750k in February and 504k in January. Payrolls have increased by over 400k every month since May as most employees have found their way back to the workplace they left during the pandemic.

The Global Economy

We’ve discussed the ramifications of the “war” on the European economy, which has the distinct possibility of placing the EU in a recession.

They put themselves in a “box” when they drove down the road to be dependent on Russian hydrocarbons. A total ban along with a timeline to get out from under” is now under discussion. Whatever comes out of these discussions is going to be a costly endeavor for them and it also has ramifications on the price of oil.

I continue to advise investors to tread lightly when looking at what might be “bargains” in the global markets. Similar to an investment in ANY market, your timeline is important.

One thing is for sure, the investing world is revolving around commodities these days. Commodity exporting countries are doing very well. Canada (EWC) and Mexico (EWW) have broken out to new highs, while the relative strength in Australia (EWA) and Brazil (EWZ) have improved dramatically.

The EU Presents The Greatest Risk

However, with inflation, specifically, energy costs continuing to pressure economies, under any reasonable scenario, the U.S. is better positioned for the economic risks today than Europe or Asia. In the near term, the energy crisis will cause a consumer confidence crisis. That is likely causing capital to flow from East to West, we’ve seen this already in market performance in the last month, and it likely continues.

I reiterate that it will be difficult for the EU to avoid a serious downturn in their economy. While the plans to alleviate their dependence on Russia are the first step, this interim/transition period demonstrates how their energy problems are just beginning. Germany is preparing their citizens for natural gas rationing. Natural Gas Customers in the EU pay an average of 6 to7 times more than what U.S. consumers pay.

Germany’s Producer Price Index grew 25.0 % YoY in Jan 2022, compared with a growth of 24.2 % YoY in the previous month. That is an all-time high.

Germany PPI (www.ceicdata.com/en/indicator/germany/producer-price-index-growth)

The U.S. can withstand a recession in the EU, but it will surely affect the profits of multinational companies, which eventually affect our markets. However, a dramatic slowdown in the EU does increase the probability of a global recession. China is in the best position to avoid a recession followed by the U.S. After that, no country is “safe”.

The “green climate agenda” was a failure and will continue to take a toll. The decisions that spawned this crisis are profound. However, they are dwarfed by the fact that the US has decided to follow that same path, and leave the “crisis” to “fix itself”.

China

Disappointing results on the economic scene as China’s manufacturing and services activity contracted together for the first time since the Wuhan coronavirus outbreak.

- China’s official manufacturing purchasing managers’ index fell to 49.5 in March, down from 50.2 in February.

- Official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, fell to 48.4 from 51.6 in February.

Both are now in “contraction” territory.

Final read on Manufacturing PMIs from Markit:

Eurozone – 56.5, a 14 month low

UK – 55.2, a 13 month low

China – 48.1, falls to contraction levels

Japan – 54.1, near highs, 14 months in expansion territory

ASEAN – 51.7

While Manufacturing data slowed in March, other than China, PMIs remain solidly in expansion territory.

Political Scene

“Show me your budget and I’ll tell you what you value”.

That was a quote from Joe Biden while on the 2007 campaign trail.

This week’s unveiling of the proposed budget from the administration indicates no change in policy. More taxes and more spending.

Taxing “Unrealized gains” is back on the table for some individuals and increasing the corporate tax rate to 28% is also being proposed. Taxing anyone at any level on “unrealized gains” is anti-capitalistic, anti-investment, and more than likely unconstitutional. The sheer fact that it’s being proposed “again” should send chills down the spine of every capitalist in the U.S.

In total there are 36 new taxes in the budget with 11 of them targeting the oil and gas industry. The other 25 punish “success”. Once again the message is clear. The US oil/Gas industry will have to continue to operate under an anti-business hostile environment. Bottom line; the taxes won’t incentivize oil companies to “play ball” in what is a ballpark filled with holes and rocks.

The “spending” proposals include more “defense” spending and are filled with “wish list” items that have already been proposed and failed. The good news is that it would appear that these proposals have little chance of being enacted. The bad news continues to be the mindset that continues to show an anti-business, anti-investment bias. At the end of the day, it projects a no-growth inflationary future.

While the “wealth tax” only affects a small number of people, it also has NO impact on the total tax revenue collected. It amounts to a “rounding” error. So its sole purpose is to embark on “class warfare” that reflects a convoluted childish mentality. Federal tax revenues are at record levels and are a function of a pro-business, low tax environment that is left over from the pre-pandemic era. Given the high tax receipts combined with inflation running hot and the FED embarking on a tightening cycle, raising taxes in ANY form adds a ball and chain to growth. These proposals if adopted cement the no-growth story in place. NO government has ever taxed its way to prosperity.

Consumers are showing disdain for the higher tax mindset. During the great Covid migration, a Strategas Research study found high-tax states experienced a 76% increase in “outmigration” compared to 2019, while low-tax states saw a 25% increase from domestic in-migration. Income migration was measured in aggregate dollars and as a percentage of a state’s income, with Florida the runaway winner, gaining $37 billion of new income over the last two years. At $10 billion, Arizona was a distant No. 2. California and New York were the biggest losers.

Earnings

Last earnings season the talk was about it being one of the most important since we would get clues from companies on what the economy looks like. It’s funny, but I’m reading the same storyline about the upcoming season as well. Last season was strong and guidance did not disappoint. BUT, once again the buzzwords from analysts revolve around management commentary for 2022 guidance. Many believe that will be the primary driver of equity performance in April/May.

With the global issues magnified in the EU and elsewhere, I continue to point out that investors might be more inclined to start moving more towards U.S. exposure broadly.

Food For Thought

Another mindless “out of touch with reality” proclamation in a new study that proclaims “Rich” countries must stop producing Oil and gas by 2034.

On the flip side:

Hess CEO John Hess said that government officials and investors need to be more realistic about displacing fossil fuels and learn from the current volatility that the world still relies on oil and gas.

“The focus really should be on energy security and oil and gas have a vital role to play in the global economy. Oil and gas are needed for decades to come and the key challenge to oil and gas is investment.”

Jamie Dimon and other concerned corporate executives made their case for energy independence on Monday during a closed-door White House meeting. T The “Marshall Plan” message:

“Come up with an all-the-above American energy strategy that will make America energy independent, less dependent upon energy from other places around the world. It’s a very simple fix.”

For some reason, “simple”, and “common sense” isn’t part of the US energy policy. The present policy will keep oil prices elevated at levels that will keep energy investors in profit but also can have the potential to take down the entire economy.

Sentiment

The Daily chart of the S&P 500 (SPY)

A week that started on a positive note, ended with across-the-board weakness, as the latest rally fizzled.

S&P 500 4-1 (www.FreeStockCharts.com)

The S&P 500 sits ~ 6% off of the highs, between support and overhead resistance. The “directionless” scene is adding to the indecisiveness of investors. Anyone looking for clues as to what comes next from the fundamental backdrop will also find the frustration levels high.

Investment Backdrop – The Present

- The job market remains strong, unemployment is at 3.9%, and initial jobless claims are at historic lows.

- Household balance sheets are in excellent shape

- The Fed is embarking on an interest rate cycle.

- The “war” on everyone’s mind is Russia/Ukraine and it has implications that could send the Eurozone into recession, even if it ends tomorrow.

- Consumer “comfort” and “confidence” are at multi-year lows

- Inflation is running at 7.9.

Surely a mixed bag for investors to sift thru and then make decisions. Dominant investment themes always exist. There are, however, turning points in investment cycles where many market participants have trouble recognizing the emergence of a new theme, instead find themselves mired in frustration at the exact point in time where they should be recognizing the plethora of new opportunities.

They become frustrated precisely when they should be the most inquisitive about new opportunities. The problem is that, in this phase of the investment environment, we can become too complacent pursuing the old theme rather than endorsing a new asset class.

It’s not so easy to “change” but the lesson learned from the last 6-9 months remains – when there is a MATERIAL change in the landscape, we have to change as well. I bring this up because recently I’ve written that in the kind of market environment I believe we are in, an open mind and flexibility in approach are more important than ever. An investor can’t be married to a particular narrative because other than “Energy”, the trends are fleeting in what has been a directionless market since last October.

I’ve moved on to playing smaller trends and moves, and focus less on “the market” and more on individual groups and stocks. How long that lasts remains a question mark as the “issues” dominate the scene.

The 2022 Playbook Is Open For Business

Thank you for reading this analysis. If you enjoyed this article so far, this next section provides a quick taste of what members of my marketplace service receive in DAILY updates. If you find these weekly articles useful, you may want to join a community of SAVVY Investors that have discovered “how the market works”.

March is in the books and we can call it a “rebound” month. All of the indices posted gains and that broke the two-month streak of losses for every index except the Russell 2000.

March Results

- Dow Transports +6.8%

- S&P 500 +3.7%

- NASDAQ +3.6%

- DJIA +2.4%

- Russell 2000 +1.3%

Key Market Sectors

- Energy +8.8% – The Leader for the 3rd straight month

- Commodities +8.1%

- Healthcare +5.3%

- Consumer Disc. +4.2%

- Technology +3.2%

- Financials -0.47%

- Semiconductors +0.08%

- Small-cap Value +1.4%

- Small-cap growth +1.3 %

First Quarter Results

- Transports -1%

- DJIA -4.4%

- S&P -4.7%

- Russell 2000 -7.7%

- NASDAQ -8.9%

Key Market Sectors

- Energy +37.7%

- Commodities +24.8%

- Financials -1.8%

- Healthcare -2.7%

- Technology -8.5%

- Consumer Disc. -9.5%

- Semiconductors -12.6%

- Small-cap Value +0.2%

- Small-cap growth -11.8%

It sure has been a challenging start to 2022. We’ve seen the first significant correction in over a year. For the first 3 months, it’s been Energy/Commodities and little else. March saw renewed interest in the Dow Transports making it the BEST performing index in ’22, However, that isn’t saying much as it ONLY lost 1% for the year.

BIFURCATED MARKET

Consumer Discretionary (XLY), Healthcare (XLV), Biotechs (IBB), and Real Estate (XLRE) posted gains this week. While the Energy and Commodity trade cooled off. On Friday, Semis and Transports sold off hard signaling a “growth” scare. Yet HIGH PE growth had a positive session.

Confused? Welcome to the second quarter.

SMALL CAPS

After a horrific January, the Russell 2000 has been the steadiest of all since then. The Russell was the only major index that was positive in February and as reported, the small caps added another 1.2% to their gain in March. However, the index is still down 7+% for the year.

SECTORS

ENERGY

In less than 2 weeks the Energy ETF (XLE) is right back up to resistance at $78. A level that has capped prices since 2016. This strong move is now reminiscent of the rally that took place between ’04 and ’08. In that time frame, the XLE rallied from around the $25 level before topping out at $90 right before the financial crisis. Ironically this rally has also started at $25, the 2020 March lows.

I don’t see any policies that will materially change supply, so if demand stays as is, the price of WTI should remain elevated. Energy stocks remain a BUY on ANY dip. The charts of individual companies are “pristine” pictures of a BULLISH trend. The companies that are paying a base + variable dividend are inflation busters.

FINANCIALS

Financials (XLF) are back to “neutral” as they are in the middle of the recent highs and lows. Most of the charts for many individual stocks show the same indecisive pattern. New additions should be geared to names that offer a dividend. I’m not in the accumulation mode but remain in a HOLDING pattern.

HEALTHCARE

Healthcare is inching back to the old highs and has moved back to levels seen last summer. For now, we have a well-defined range with the ETF nearer the highs. The group should be considered somewhat defensive as they shouldn’t be adversely affected by inflation or higher interest rates.

Sub-sector – Biotech

Like so many other charts I reviewed this week, I noticed that the Biotech ETFs IBB and XBI have broken a short-term downtrend. Now the question is will this move have staying power? I’ve talked about a bottoming pattern for about a month now. The long-term trend line of support drawn from the lows back in 2016 acts as an important indicator to keep an eye on. The February lows were NOT violated this month, keeping that support in place. That increases the probability of a bounce in a sector that has lagged for quite some time now.

Both IBB and XBI posted gains of 4% this week, and the fun may just be starting.

GOLD

The Gold ETF (GLD) made a run in early March, failed at resistance ($193), and remains in a sideways trading range flat for the month. My metal of choice continues to be Uranium (URA), and that ETF posted an 8.2% gain in March easily outpacing the indices. Gold may glitter but Uranium shines.

TECHNOLOGY

With economic growth here in the U.S. coming into question, one area that I want to continue to have exposure to is the sector that provided Growth. While it’s been all about Value lately, Growth did make a slight comeback in March. In a low growth environment, I’d rather have exposure to a company that is growing at 20% versus a Value name growing at 2-3%.

Sub-sector – Cybersecurity

Here is a “Theme” with tailwinds. Unlike many of the more innovative, “futuristic” investment themes, Cybersecurity has a thriving market and need right now, while also still having growth potential. Cyberwarfare has shined a spotlight on Cybersecurity recently and unfortunately, cyber attacks are only likely to become an even greater threat used by terrorists, criminals, and sovereign powers.

The Global Cybersecurity ETF (BUG) is currently slightly above ($31) where it was at the end of 2020 ($29), meaning there has been no progress for over a year now. It has shown nice relative strength recently, though, putting in a potential double bottom in January and February.

Sub-sector – Semiconductors

A 19% rally off the March lows and the sector I believed could lead the entire market back has done just that. The group has retraced some of that move after running into a stiff resistance level. A perfect sector to use a covered call writing strategy now as it looks like a short-term sideways trend with a “lean” to the downside may emerge.

That coincides with my “take what the market gives you” strategy.

ARK INNOVATION ETF (ARKK)

This HIGH PE, HIGH growth sector of the market is yet another area that has broken its downtrend. Last Tuesday was the first time since November ’21 that ARKK traded above its 50 and 200-day moving average for the entire trading day.

The ETF rallied 3.4% this week and is now up ~37% since March 14 lows. Many of the individual names in the group also have excellent short-term risk/reward setups. No one knows how long this trade continues and I don’t suggest getting married to this group unless they have a 3-5 year time horizon. For the active investors, there is a bundle of opportunities waiting for them to shake the trees and pick up the fruit.

CRYPTOCURRENCY

Crypto started the week up almost 6% to the highest levels since the start of the year. The downtrend for Bitcoin that ran from November 2021 through late January 2022 has been broken. The $44,000-$44,500 level has acted as resistance three times and with BTC rallying to 46,500 before pulling back that level may now act as support.

The associated ETFs – BITO and OTC:GBTC – posted gains for the week.

FINAL THOUGHT – The FUTURE

While I don’t profess to be able to forecast the future when the handwriting is on the chalkboard you have to read it. Inflation is HIGH, Energy costs are a big part of that problem. What is more worrisome – no permanent solutions have been proposed to resolve the “Energy Crisis”.

This in turn has caused a “Consumer confidence crisis”. Investors should not take this lightly. These sorts of structural pressures typically fade slowly, which can prompt the market to start pricing in potential stagflation.

But to have stagflation, the economy needs to be stagnating. While there are some early signs of a potential slowdown, there is also some evidence indicating the economy can stabilize and stay in a very low growth backdrop. Of course, what “forces” eventually win the tug of war remains to be seen. Along the way to an eventual conclusion, there could be many other factors that come along to change any perceived outcome. Therein lies the problem market participants face today.

However, with inflation, specifically, energy costs continuing to pressure global economies, under any reasonable scenario, the U.S. is better positioned for the economic risks today than Europe or Asia. For now, that is likely causing capital to flow from East to West. We’ve seen this already in market performance in the last month, and it likely continues. That can serve as a potential offset to the “policy crisis” here in the U.S. How much of an offset remains to be seen.

Either way, it confirms that the indecisiveness in the equity market is perfectly understandable.

“Our prayers and thoughts should be focused on the plight of the Ukrainian people who are under unimaginable stress.”

POSTSCRIPT

Please allow me to take a moment and remind all of the readers of an important issue. I provide investment advice to clients and members of my marketplace service. Each week I strive to provide an investment backdrop that helps investors make their own decisions. In these types of forums, readers bring a host of situations and variables to the table when visiting these articles. Therefore it is impossible to pinpoint what may be right for each situation.

In different circumstances, I can determine each client’s situation/requirements and discuss issues with them when needed. That is impossible with readers of these articles. Therefore I will attempt to help form an opinion without crossing the line into specific advice. Please keep that in mind when forming your investment strategy.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

Be the first to comment