Torsten Asmus/iStock via Getty Images

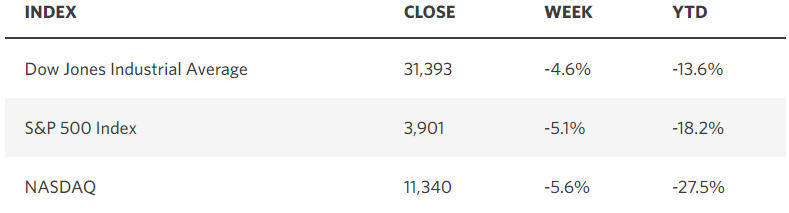

My forecast for a peak rate of inflation of 8.5% fell short last week with the 8.6% print for May, but the core rate did decline from 6.2% to 6%. Regardless, the headline number sent stocks reeling on Friday, which followed a steep sell off on Thursday, resulting in a horrible week for the major market averages. The disparity between headline and core inflation is now the widest it has been in ten years, which is entirely due to the surge in food and oil prices. The ongoing war in Ukraine continues to put upward pressure on both and its ultimate end is a very difficult thing to handicap. Despite more restrictive monetary policy having little impact on the prices of food or energy, the consensus of investors now sees a 75-basis point rate increase in July after a 50-basis point increase this week, with short-term rates climbing to 3.25% by year end. That sent 2-year Treasury yields to 3.06% and 10-year yields to 3.15%, which were both new highs and explains the pain inflicted on stock prices.

Edward Jones

Last week I discussed how my optimism for the second half of the year was grounded in expectations that the economic expansion continues, corporate profits grow high single digits, and the rate of inflation gradually comes down, which gives the Fed room to be less aggressive in tightening monetary policy near the end of this year. The fact that headline inflation rose to 8.6% instead of falling to 8.2% doesn’t change my outlook. Why should it? Nor does the retest of the May lows for the market averages, which should be expected.

Bloomberg

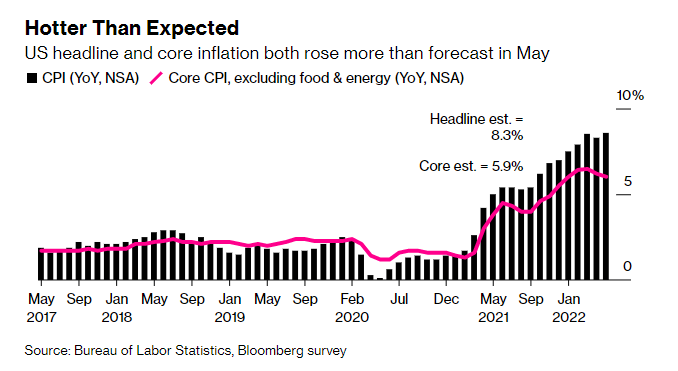

My resolve stems from rising wages, record low levels of unemployment, surplus savings, and the equity consumers have built up in their homes. All of these factors are acting like shock absorbers for the price increases on goods and services. A prime example is gasoline. Despite the average price soaring to a record $5 per gallon, current consumption measured in millions of barrels per day has risen to meet the average daily usage from a year ago. It had fallen modestly below year-ago levels in April and May. In fact, the latest week’s data show usage rising to 9.2 million barrels per day, which is 7.5% higher than a year ago. So, are consumers retrenching? Not according to this significant datapoint.

EIA

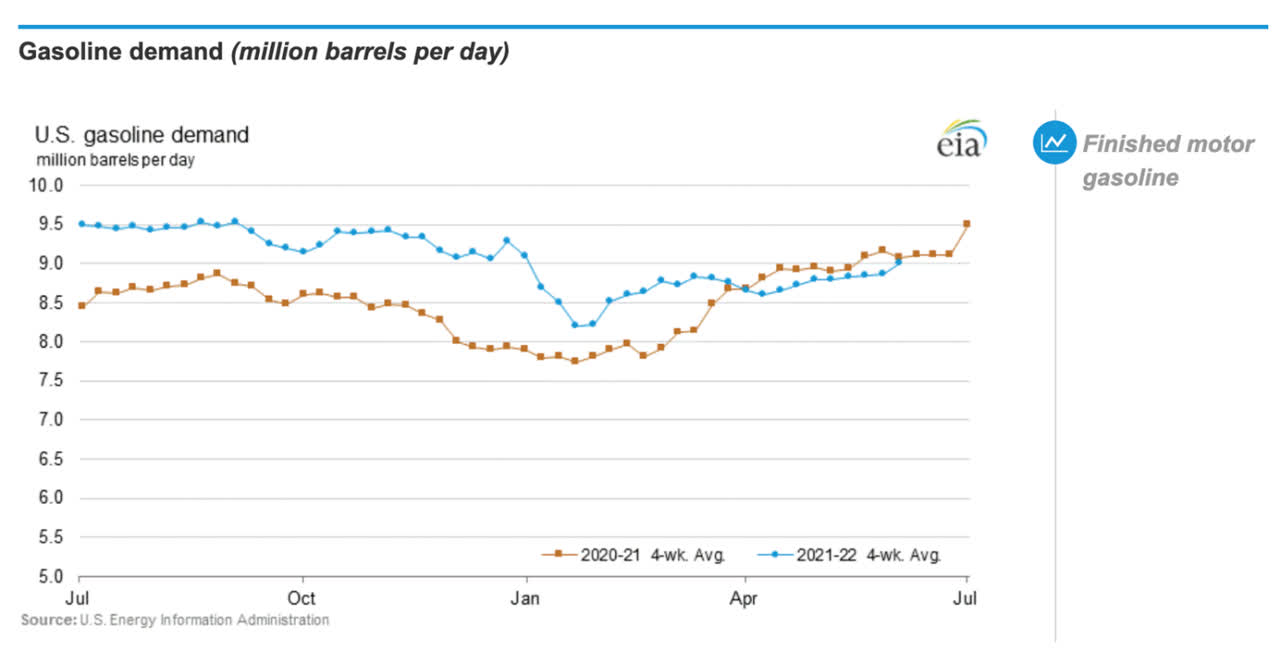

We did have a rise in weekly unemployment claims last week, which was well above expectations and the highest level since January. Yet the increase of 27,000 to a total of 229,000 claims is meaningless when the four-week moving average for continuing claims at 1.32 million is the lowest level since 1970. While the economic fundamentals look durable, the rate of growth is slowing, which is what we want to see. There has been a softening of activity in both the service and manufacturing sectors of the economy, as can be seen the gradual decline in ISM surveys.

Bloomberg

We need the rate of economic growth to slow in order to bring down prices, but not to the extent that the economy contracts. The latest ISM surveys are both at the mid-50 level, which suggest growth in the economy at trend of approximately 2%. If these surveys fall below 50, that would indicate contraction. So far, this looks like a soft landing. It does not feel that way because the main stream media on both sides of the aisle is pounding into our heads every day how much more are paying for the stuff we buy. Thanks for the news flash!

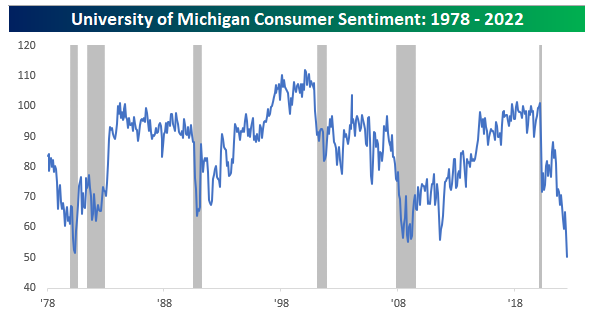

This relentless drumbeat of bad news has weighed heavily on consumer sentiment. The University of Michigan Consumer Sentiment survey fell to an all-time low last week. As I have said many times before, this is a contrarian indicator. Economic conditions and stock prices are typically at their worst coincident with the bottom in consumer sentiment. We have to be getting close with an all-time low in this survey.

Bespoke

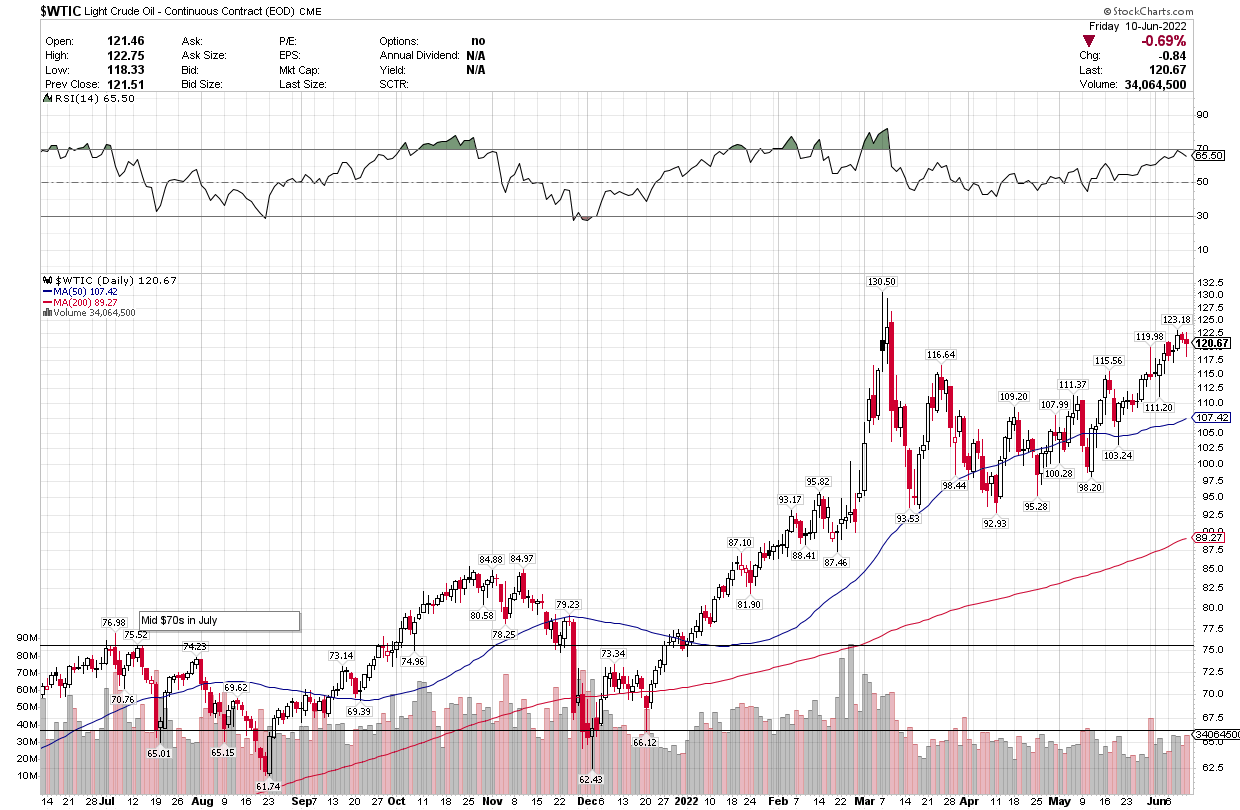

My primary concern at this point is that psychology plays as important a role in recessions as do deteriorating economic fundamentals. In other words, we can talk our way into one if we create enough fear and anxiety in the consuming public. At this point, the activities of consumers reflect a lot more confidence and optimism in their own outlooks than do their words, which look more like Armageddon. I think we have another two months for the soft landing scenario to play out. Short-term interest rates should be up to 1.75 – 2% by summer’s end in advance of the Fed’s September meeting. We need to see a continued cooling in economic activity, but the most important datapoint will be the price of oil. If oil prices start to retrace their rally over the past two months, then inflation expectations should come back down. Oil is the lynchpin for now.

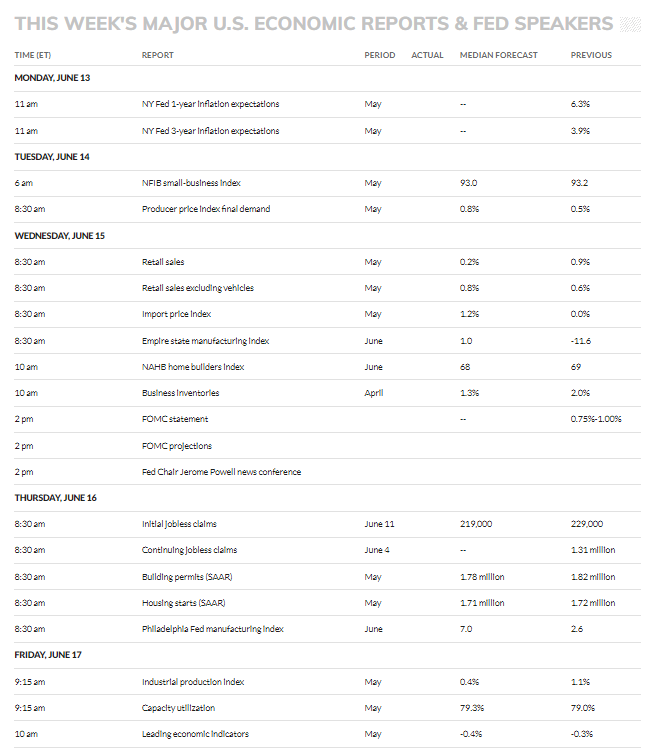

Economic Data

The Fed’s rate decision on Wednesday, followed by Chairman Powell’s press conference, will be the critical event of the week. We also have the producer price index, which is bound to tell the same story as last week’s Consumer Price Index. Tuesday’s retail sales report for May will test my thesis that consumer continue to spend, despite rising prices.

MarketWatch

Technical Picture

After pulling back from the early March high of $130 when Russia invaded Ukraine, crude oil has risen from the low $90s to approximately $120 per barrel. We need to see some stabilization here with a lower top that results in another decline. That could come from global growth concerns, an increase in supply, or any improvement in the Russia/Ukraine conflict.

Stockcharts

Be the first to comment