Art Wager/E+ via Getty Images

Warren Buffett loves to talk about “never betting against America”. We agree. Since Russia invaded Ukraine almost 2 months ago, a feat the Biden Administration gave substantial heads up for, and led to European intelligence chiefs in denial to be fired, the energy support apparatus in Europe from Russia has collapsed.

As we’ll see throughout this article, that represents a unique opportunity for U.S. energy companies to generate substantial shareholder rewards.

Europe Energy Supply

Europe has some natural sources of natural gas and oil, particularly with Norway and the United Kingdom; however, overall it has a volatile energy supply.

Natural Gas

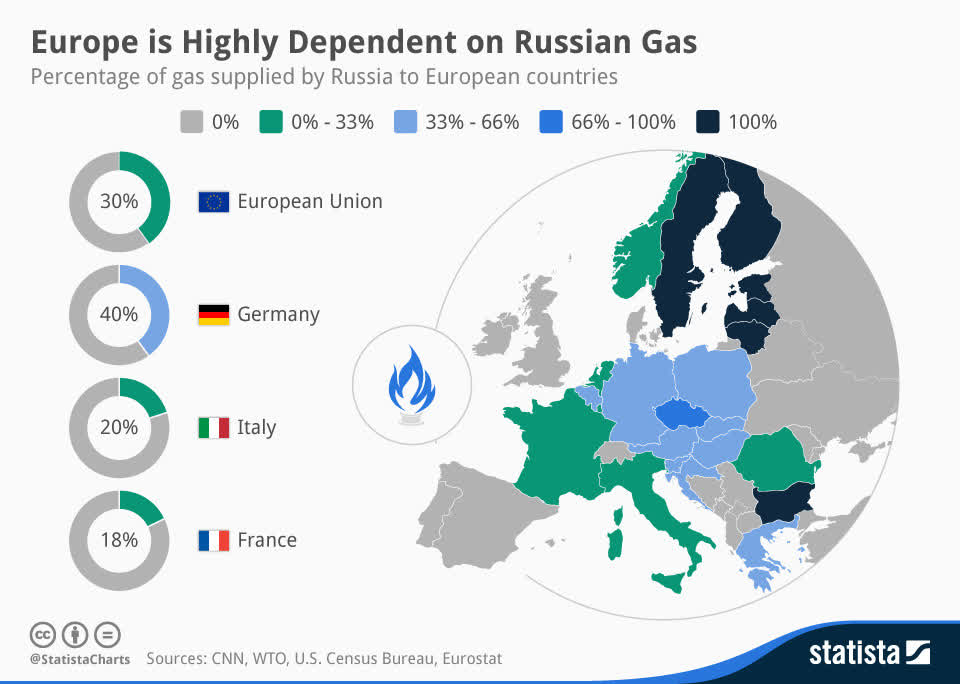

Europe’s natural gas sources vary drastically by location. However, from the middle towards Eastern Europe, demand for Russian natural gas is significant. In many countries demand is 50+%. That high dependence might seem less significant overall; however, it’s worth noting that the market and demand tend to be very inelastic.

This supply is now at threat given Russia’s strong reaction over sanctions for its invasion of Ukraine.

U.S. Export Growth

At the same time, as a result, U.S. exports have been growing rapidly.

LNG Growth

U.S. LNG natural gas exports have been growing dramatically. Despite a short-term downturn due to COVID-19, capacity has been steadily increasing. The U.S. has substantial natural gas reserves and supplies that can work to continue supplying that LNG for the long run at low costs. Multiple new projects are already under development.

The U.S. and Europe have already signed a deal to provide 15 billion additional cubic meters of natural gas to Europe in 2022. That’s 10% of what Europe gets from Russia but it’s definitely an impressive start. Germany is continuing to build up infrastructure, such as LNG re-gas terminals, that will support long-term consumption of U.S. natural gas.

Tellurian LNG (TELL) has started on their Driftwood LNG project, which will provide 15 billion cubic meters / year from Phase 1 alone growing towards a peak of almost 40 billion cubic meters from LNG. There’s demand for numerous additional projects.

Two Great Investments

In our view, there’s two great opportunities to take advantage of these changes in the market.

Tellurian LNG is one of our favorites.

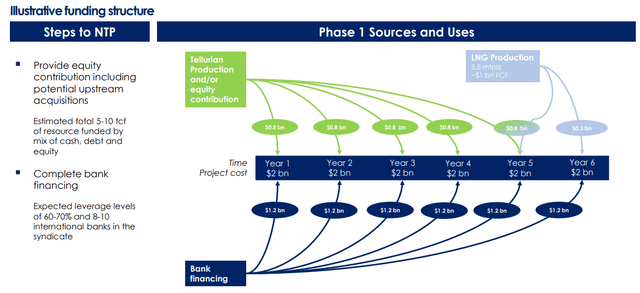

Tellurian LNG is building a massive project in relation to its $3 billion market capitalization. The company is planning to use a combination of its own upstream natural gas production, bank financing, and production in order to generate the total $12 billion project. The company’s total cost is estimated to be $7.2 billion from bank financing.

However, the company’s FCF is expected to be massive. The company expects $4-5 billion in FCF depending on whether it buys gas from the markets or whether it uses its own production. Even counting the project cost and financing, the company can rapidly payback all debt and start to generate massive shareholder returns.

The company recently announced a plan to begin construction supported by massive demand on the back of the invasion. We expect that to support the company crossing the hurdles to start the project, allowing it to grow and generate substantial cash flow.

Our other favorite investment is Exxon Mobil (XOM).

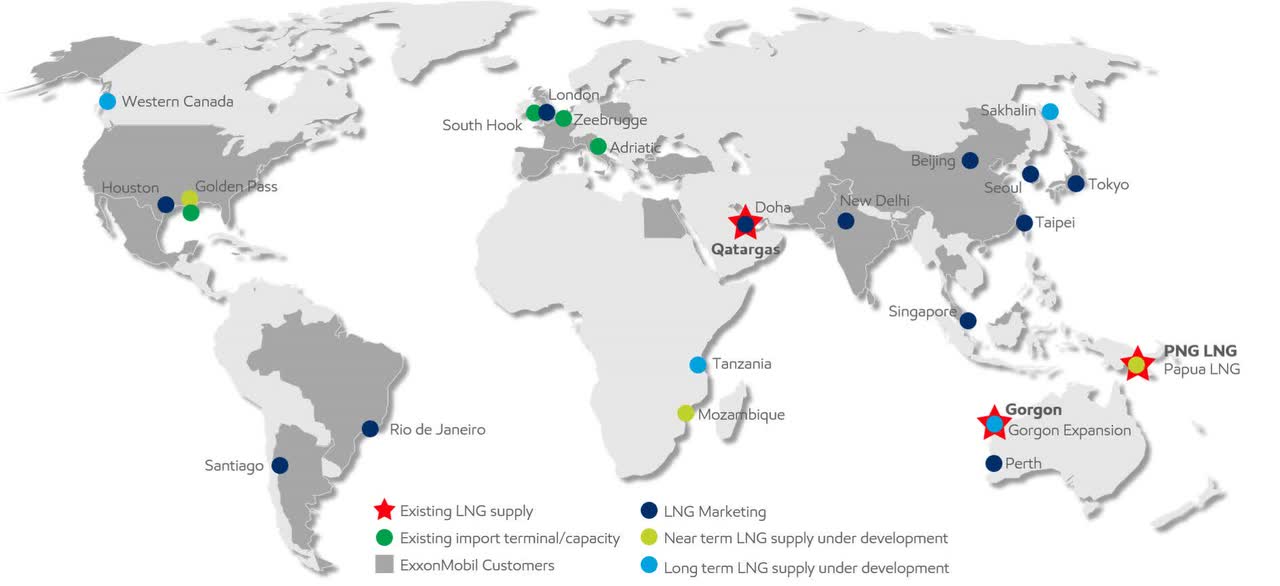

ExxonMobil Presentation

Exxon Mobil has an impressive and distinguished portfolio. The company is focused on the Gulf Coast with numerous other assets including potential assets to receive LNG in Europe. The company produces 23 million tonnes per annum of LNG and in 2024 it’s working to start the Golden Pass LNG project that could add 5+ MTPA to the company’s production.

The company could also see 10 MTPA in attributable production from its Mozambique assets. The project is halted by security concerns, however, it’s worth noting the takeaway is that Exxon Mobil has an enormous natural gas business and the ability to continue expanding it. In the US, the company is also one of the largest natural gas producers.

We expect natural gas to become an important transition fuel for the company as it replaces what can’t easily be replaced with renewables. Exxon Mobil has one of the strongest positions in the world in the industry, which’ll enable substantial shareholder rewards.

Thesis Risk

In our view, the largest risk to our thesis isn’t actually the global instability from the conflict, but rather it’s renewable energy. Technology has a tendency to move quickly, quicker than most people expect. Electric vehicles were a fad 10 years ago, now in another decade, several countries will no longer allow gas vehicle sales.

The transition towards renewables means that natural gas could be quickly replaced as a transition fuel, especially as battery technology improves. That risk is worth paying close attention to.

Conclusion

The Russia-European war means that Europe is now gathering natural gas from an unfriendly nation. Many expect that won’t end well and Russia is now committed to rapidly moving away from that situation. The U.S. is well positioned to benefit incredibly well from this situation with massive production and export infrastructure.

Tellurian and Exxon Mobil are two of our favorite opportunities to take advantage of this shift. Both are expecting to rapidly expand their infrastructure and have strong natural gas production. They are working to integrate their assets from production to export which could generate strong FCF. In our view, that makes both companies a valuable investment.

Be the first to comment