Vertigo3d

Thesis

The Trade Desk, Inc. (NASDAQ:TTD) is scheduled to report its Q2 earnings release on August 9. Ad tech investors have been on edge recently, given the macro headwinds impacting the industry. Therefore, investors are proffered a timely reminder that digital advertising is still affected by economic cycles, despite the allure of ad ((tech)).

Notwithstanding, we noted that TTD was at a bottom in our previous update in May. Despite the disappointing Q2 print from Snap (SNAP), Meta (META), and Roku (ROKU), TTD held its May lows firmly. Therefore, it has increased our conviction that TTD’s long-term bottom is likely to hold, as tech has likely bottomed.

Still, our valuation analysis suggests that TTD is at most a market-perform at its current valuation (yes, it’s still pretty expensive). Therefore, investors are urged to adjust their expectations and exposure accordingly.

However, if the company could make further inroads into connected TV (CTV) advertising, it could help re-rate TTD. Hence, we believe that’s the most critical impetus to spur potential upside surprise against our market-performance thesis. Under CEO Jeff Green’s capable leadership, the bears are advised not to bet against it.

Accordingly, we reiterate our Buy rating on TTD as we head into its Q2 earnings.

CTV Advertising Continues To Power Growth For TTD

We maintain our conviction that CTV advertising is a multi-year opportunity as more ad budgets move from Linear TV toward programmatic advertising.

The Trade Desk’s recent partnership with ad behemoth Disney (DIS) emphasized the massive opportunities that could unfold for the leading demand-side platform (DSP) of the Open Internet. Chief revenue officer Tim Sims articulated (edited):

When you have someone that’s the size and scope of Disney saying, ‘We’re making our ID interoperable with UID2 so advertisers can transact more effectively through programmatic channels in biddable environments’ — that’s a huge step forward. It really speaks to Disney’s forward thinking on the future of TV. – The Trade Desk

Moreover, Disney’s record-breaking success in this year’s upfront also highlighted the commitment toward ad-supported streaming. Disney was reported to have garnered $9B in upfront sales, with “40 percent earmarked for streaming.”

As a reminder, The Trade Desk has also been making tremendous strides to leverage the CTV ad momentum, which has driven its recent growth. CEO Jeff Green accentuated in last quarter’s earnings call (edited):

With the explosive growth of premium CTV over the last few years, especially the last year, the trend is clear. We see it clearly reflected in some of the UGC data that’s been reported in the last few weeks, and it’s also why CTV remains by far our fastest-growing channel and why premium video, in all of its forms, has become the largest segment of our business. This trend will be equally apparent internationally, where there is also a flight to premium content. (TTD FQ1’22 earnings call)

Don’t Fret The Ad Weakness – Things Will Improve Soon For The Trade Desk

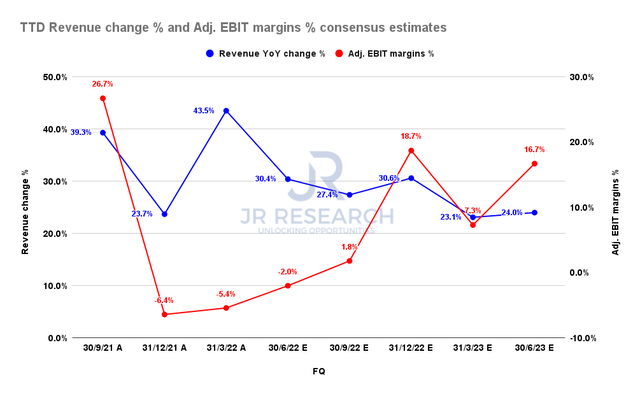

TTD revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) suggest that the moderation in The Trade Desk’s revenue growth should stabilize from Q3. Therefore, the company is still expected to navigate the macro headwinds resiliently.

Furthermore, its adjusted EBIT margins are also expected to recover remarkably through FY23, as it laps the stock-based compensation related to Green’s stock awards. Therefore, we urge investors to look forward, as The Trade Desk is well-primed to ride the CTV ad momentum further once the macro headwinds subsequently improve.

TTD’s Valuation Is More Reasonable, But Not Undervalued

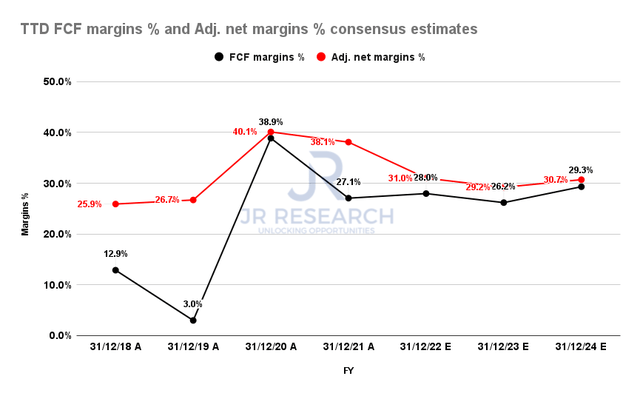

TTD FCF margins % and adjusted net margins % consensus estimates (S&P Cap IQ)

However, investors should note that The Trade Desk’s margins are expected to recover only from FY24, given the worsening macros. Nevertheless, we believe the market has factored these challenges into its valuation, coupled with FY21’s challenging comps. Consequently, even though TTD continues to trade at a discernible premium, we believe its valuations are more reasonable at the current levels.

| Stock | TTD |

| Current market cap | $24.32B |

| Hurdle rate [CAGR] | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 3% |

| Assumed TTM FCF margin in CQ4’26 | 29% |

| Implied TTM revenue by CQ4’26 | $3.99B |

TTM reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-perform hurdle rate of 11%, with a free cash flow (FCF) yield of 3%. Our analysis indicates that the market supported TTD’s May lows at an FY24 FCF yield of 3.89%. We urge investors not to be overly aggressive in their valuation parameters despite TTD’s high-quality growth. It’s always prudent to assume a reasonable margin of safety to improve the potential for outperformance.

Consequently, we require The Trade Desk to deliver a TTM revenue of $3.99B by CQ4’25, which is likely achievable based on the revised consensus estimates.

Notwithstanding, we are not convinced that TTD could outperform the market at the current levels unless it gets materially re-rated much higher (i.e., the market requires lower FCF yields).

But, if management can provide much better guidance on the revenue and profitability of its CTV growth opportunity, then it could provide investors with some pleasant upside surprises.

Is TTD Stock A Buy, Sell, Or Hold?

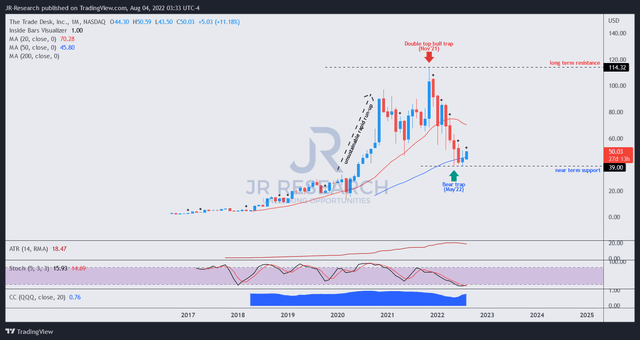

TTD price chart (monthly) (TradingView)

We reiterate our Buy rating on TTD.

We observed that TTD is at its long-term bottom, underpinned by May’s bear trap (indicating the market denied further selling downside resolutely). Coupled with tech’s likely bottom, we are confident that TTD’s May lows should hold.

Even though it’s near-term overbought, we urge investors to use potential short-term downside volatility to add exposure.

However, more cautious investors can consider adding after its earnings release. Or investors who are looking for a market-outperform hurdle rate should consider adding at levels closer to its near-term support ($39).

Be the first to comment