Mark Wilson/Getty Images News

Standard & Poor’s Stock Market Index achieved its first weekly gain in the last four weeks.

Anna Hirtenstein and Alexander Osipovich write in the Wall Street Journal:

“Stocks tumbled earlier this month on concerns that the Fed could puh the economy into a recession as it tightens monetary policy to combat inflation.”

“Market indexes bounced back this week after bargain-hunters swooped in to buy cheap stocks–i a paradoxical twist where bad news was good news–some worse-than-expected economic figures fueled investors’ hopes that the Fed might become less hawkish.”

The authors quote Luc Filip, head of investments at SYZ Private Banking: “It’s clear that economic activity is cooling, which should cool down inflation.”

“That together is rather positive.”

Whoa!

A little more than a week after the Federal Reserve raised its policy rate of interest by 75 basis points!

What is going on here?

And, Federal Reserve chairman Jerome Powell spent much of the week talking to Congress and the press, trying to confirm that the central bank is here to stay in this battle.

What Story Do You Want To Follow?

Furthermore, there were stories flashed all over the place about how firm Mr. Powell will stay.

From the first four years of Powell’s tenure as the leader of the Fed, there is not complete confidence in him concerning how tight the chairman is willing to run the place.

Mr. Powell, over the past four years, has always erred on the side of monetary ease.

He got us through the COVID-19 pandemic and the accompanying recession.

But, he pumped so much money into the banking system that bubbles were created all over the place, including in the stock market.

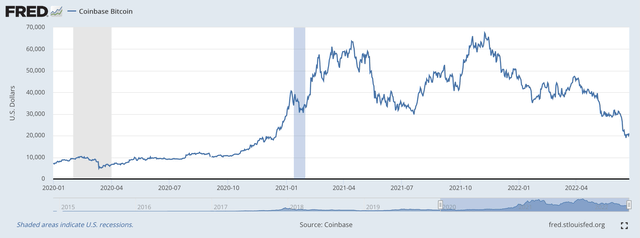

One of the bubbles that the Fed contributed to was the rise in the price of Bitcoin (BTC-USD). On December 31, 2019, one Bitcoin cost around $7,150.

Bitcoin price (Federal Reserve)

On November 9, 2021, the price had risen to more than $67,500.

Market capitalization for all crypto-currencies, which had been less than $1.0 trillion at the earlier date, was recorded to be around $3.2 trillion on the November date.

Today, the valuation is less than $1.0 trillion as bitcoin climbed up to about $21,000. Just last week the price had dropped below $18,000.

The point is, that Mr. Powell is working on a legacy that contends that he is so afraid of generating a crisis that he will do all that he can to not let that crisis happen.

As a consequence, analysts all over the world are raising questions about Mr. Powell’s ability to carry through on his promises to do what is necessary to bring inflation under control.

A Comparison

Let me just point out one such discussion, by the not insignificant author Niall Ferguson.

Mr. Ferguson writes in Bloomberg,

“Jay Powell wants us to believe he has what it takes to bring inflation under control.”

“History warns us to be skeptical.”

And, what is the comparison that Mr. Powell is put up against?

Well, of course, it is former Fed Chairman Paul Volcker.

Mr. Ferguson brags:

“I knew Paul Volcker.”

“Jay Powell is no Paul Volcker.”

And, who does Mr. Ferguson drag out of the closet to make a historical comparison… Arthur Burns.

“Note: I never met Arthur Burns–Volcker’s predecessor, but one, as Federal Reserve chairman–who preferred puffing on a pipe to cigars.”

“But I think I’ve read enough about Burns to suggest plausibly that the current Fed chair, Jay Powell, has more in common with him than with Volcker.”

“This is unfortunate, and potentially disastrous for the economy.”

Mr. Ferguson compares the history of the 1970s with the history that is now being made.

And, Mr. Ferguson concludes:

“Will the Powell Fed be more like the Burns Fed or the Volcker Fed?”

“We won’t know for sure until it confronts something much uglier than the current equity bear market.”

“All we do know is that Powell has blinked before now.”

Why should we not feel that Powell, therefore, is likely to blink again?

Mr. Ferguson certainly believes so.

Many other analysts also seem to believe that he will blink again for they are covering the air and the pages with concerns that he will come up short in his current task.

And, this certainly sets the environment for the stock market to behave as it has done this week.

This is not the way one should go into the battle against inflation, particularly at this early stage in the fight.

But, here we are. Leaders set their own stage and must then deal with it.

The “book” is still out on Mr. Powell. We hope he has what it takes and “sticks with it.”

I believe that the near future of the stock market is for prices to fall further. We are in a bear market and will remain there for the foreseeable future.

Note

I have worked with both Paul Volcker and Arthur Burns. I was a special assistant to George Romney when he was the U.S. Secretary for Housing and Urban Development. I was there on August 16, 1971, for the first meeting of the Cost of Living Council, associated with President Nixon’s Wage and Price Freeze. I served on the Committee on Interest and Dividends. I was also in on a lot of other things with the two, individually and together.

My feeling. No one comes close to Paul Volcker. Arthur Burns did not have the skills and background to be the Chairman of the Board of Governors of the Federal Reserve System.

I have not met Mr. Powell, but, unfortunately, I believe that his skills rest closer to those of Mr. Burns than they do to Mr. Volcker.

Be the first to comment