gorodenkoff

Well, the stock market had a pretty bad week.

And, guess what?

Analysts attributed something other than the Federal Reserve or inflation as one of the major causes.

The cause…FedEx (FDX).

Looking forward, however, the Federal Reserve will top out the list of influences on stock prices.

FedEx Corp. came out on Thursday evening with a shocker.

The company that has a role in global commerce, so much so that some analysts claim that it is a proxy for the economy, came out with some not-so-good news.

Because of slowing revenues, the company was going to close offices around the world, freeze hiring, and keep more aircraft on the ground.

On Friday, the stock price for FedEx dropped 21 percent.

This was the wrong news, at the wrong time.

Goldman Sachs (GS) and General Electric (GE) also presented bits of information on Friday that was also not good news but didn’t get the headlines as FedEx did.

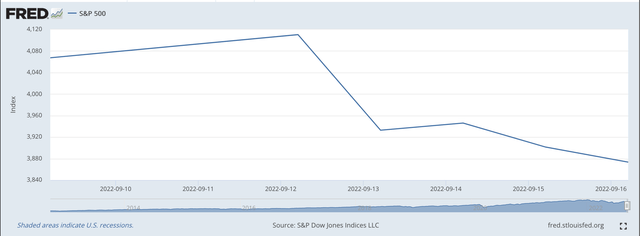

The S&P 500 Stock Index dropped 0.7 percent for the day, bringing its weekly loss to 4.8 percent.

The NASDAQ closed down 0.9 percent for the day, with its weekly loss being 5.5 percent.

And, the Dow Jones Industrial Average dropped 0.5 percent for the day, with a weekly loss coming in at 4.1 percent.

Inflation Numbers Also Hit The Market

Earlier in the week, the market was rocked by the latest inflation numbers coming in higher than analysts had expected.

The market? The S&P 500 Stock Index dropped by 177.72 points.

But, by the end of the week, the S&P 500 closed down by 237.08 points.

It was not a very good week!

S&P 500 Stock Index (Federal Reserve)

The inflation numbers reinforce the feeling that the Federal Reserve has a lot of work remaining and that what the Federal Reserve has to do is not going to be very pleasant for the economy, or, the stock market.

Inflationary forces are much stronger and much more durable than investors had been expecting.

Consequently, the monetary authorities were going to have to “stick with” a tighter monetary stance than was recently expected.

Federal Reserve Meeting

And, the Federal Reserve has a meeting of the Federal Open Market Committee this week, the group that determines what monetary policy is going to be.

The FOMC will meet on Tuesday and Wednesday, September 20 and 21.

Previous to this week’s data, the expectation was pretty well set that the Fed would move the range for its policy rate of interest by 75 basis points.

Now, however, there are more analysts betting that the Fed might even go as high as 100 basis points.

Wow!

Newly published market expectations for the effective Federal Funds indicate that by the middle of next year the Fed’s policy rate of interest might be at 4.4 percent.

Right now, the effective Federal Funds rate is 2.33 percent.

The former expectation was for the rate to hit only 4.0 percent.

So, expect a lot of attention to be focused on the Federal Reserve this week.

My feeling is that the policy range will only be raised by 75 basis points, bringing the top of the range to 3.25 percent.

This will be enough for the time being to convince the financial market that the Fed is serious enough to keep on, keepin’ on.

Market Concern

Investors still have a concern about the Fed that continues to linger.

Will the Federal Reserve really keep up the pressures as it is needed?

Jerome Powell, Federal Reserve chairman, has not exhibited, during his tenure in office, the strength of will to really come down hard on markets. If anything, Mr. Powell has always seemed to want to err on the side of monetary ease in what the Fed is doing so as to avoid “fluke” market movements that would set off something undesirable.

As a consequence, Mr. Powell’s results have always provided an excessive amount of reserves in the banking system, a situation that is a very important part of the current scenario.

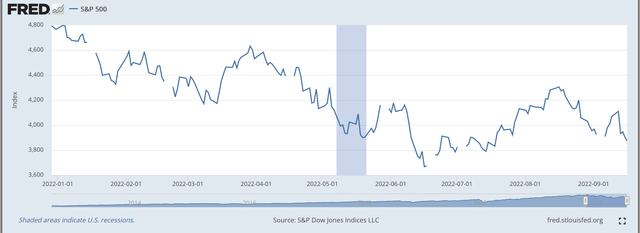

This is a major reason why the stock market has bounced around so much this year.

S&P 500 Stock Index (Federal Reserve)

The Federal Reserve attempts to exert its tightening, one way or another.

And, stock prices fall.

The investment community senses that the financial markets are not really tight, inflationary pressures are lessening, and the supply chain problems are ending, and so on.

Stock prices rise.

Then Mr. Powell gives a speech (Jackson Hole) confirming how tight the Federal Reserve means to be going forward.

Stock market prices fall.

Then stock prices rise again.

And, then the inflation report comes in too high on Tuesday and then the FedEx news comes out on Friday.

The stock market goes down.

Behind it all, the commercial banks and the financial system have lots and lots of money hanging around. For example, excess reserves in the commercial banking system still total around $3.2 trillion.

Debt continues to grow, even though many firms are now showing some financial stress.

And, articles are appearing that show that even Paul Volcker, the Fed Chair that brought inflation to its knees in the early 1980s, flinched a little. Check out this recent article by the well-known economist Frederich Mishkin. According to Mr. Mishkin, Mr. Volcker “blinked” before he succeeded.

The Future

The Federal Reserve is facing a lot of pressure going forward and obviously, a lot hangs on what decisions the leaders at the Fed make.

These leaders have been under so much pressure lately, it is my belief that, in order to prove themselves to investors, they will stay “tight”…maybe too tight.

If this is the case, then my belief is that the basic movement in the stock market in the near future is down.

The extent of the downward movement will depend upon how “soft” the economic recession that is looming on the horizon really turns out to be.

My guess is that if the recession becomes too severe, too quickly, and the stock market collapses, then the Federal Reserve will respond by, again, throwing everything it can into the banking system to prevent the downturn from becoming too severe.

Within this scenario, we must not forget what is happening in the rest of the world. Inflation seems to really be taking off in England and in Europe. The central banks are beginning to respond.

The China economy is not doing all that well.

And, then there is Russia and the situation in Ukraine.

Plenty to worry about!

Be the first to comment