undefined undefined/iStock via Getty Images

Fed President Bullard is very hawkish:

Federal Reserve Bank of St. Louis President James Bullard said the central bank needs to move quickly to raise interest rates to around 3.5% this year with multiple half-point hikes and that it shouldn’t rule out rate increases of 75 basis points.

“More than 50 basis points is not my base case at this point,” Bullard said in a virtual presentation to the Council on Foreign Relations on Monday, adding the Fed under Alan Greenspan did such a hike in 1994 leading to a decade-long expansion. “I wouldn’t rule it out, but it is not my base case here.”

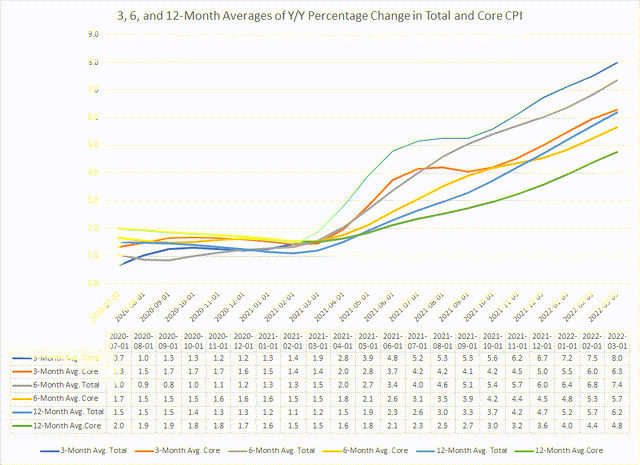

This chart (or one similar to it) is probably what’s spooking him.

3, 6, and12-month average Y/Y percentage change in total and core CPI (Data from FRED; author’s calculations)

The Fed uses averages when looking at prices, which prevents one month of data from skewing the analysis. Unfortunately, all the averages for the core and total CPI data are sharply rising at sharp rates. There are no signs of plateauing, either.

The World Bank cut its global growth forecast:

The World Bank cut its forecast for global economic expansion this year on Russia’s invasion of Ukraine and is planning to mobilize a funding package bigger than the Covid-19 response for nations to deal with various resulting and ongoing crises.

The Washington-based institution has lowered its estimate for global growth in 2022 to 3.2% from a January prediction of 4.1%, President David Malpass told reporters on a call on Monday. The decline was spurred by a cut in the outlook for Europe and central Asia, which include Russia and Ukraine, he said. The global forecast for this year compares with 5.7% expansion in 2021, he said.

The IMF followed suit earlier today:

Compared to our January forecast, we have revised our projection for global growth downwards to 3.6 percent in both 2022 and 2023. This reflects the direct impact of the war on Ukraine and sanctions on Russia, with both countries projected to experience steep contractions. This year’s growth outlook for the European Union has been revised downward by 1.1 percentage points due to the indirect effects of the war, making it the second largest contributor to the overall downward revision.

This is not a surprising development. The war in Ukraine has taught us that Ukraine is a major agricultural exporter while reminding us that Russia is a major energy player.

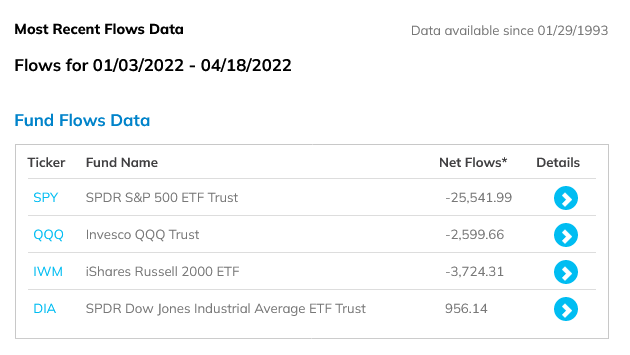

Year to date fund flows tell an important story

SPY, QQQ, DIA, and IWM fund flows (ETF.com)

Money is flowing out of the large index-tracking ETFs.

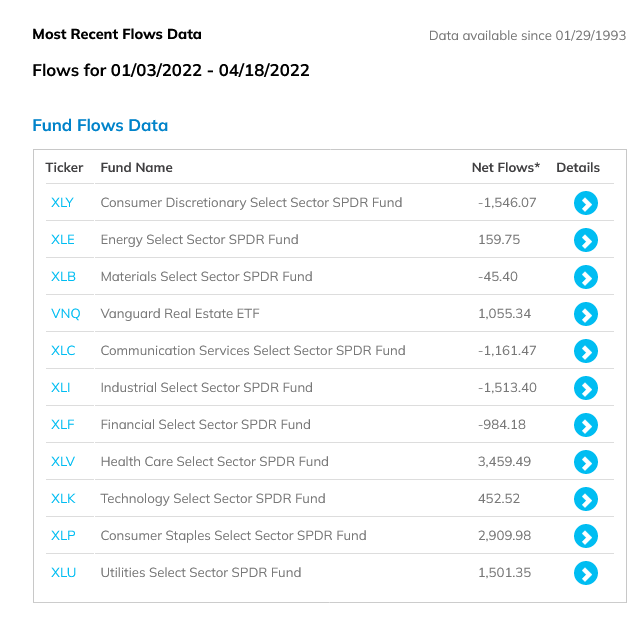

YTD Money flows for major sector ETFs (ETF.com)

Money is flowing out of more aggressive ETFs and into more conservative ETFs.

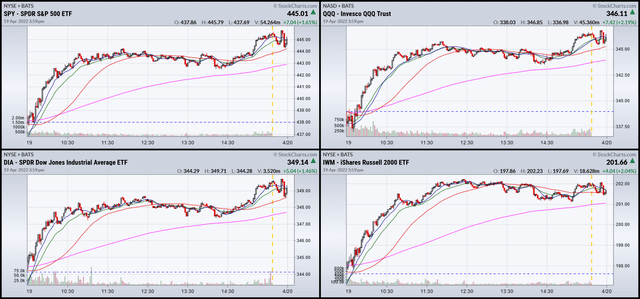

Let’s take a look at a few sets of charts

1-Day SPY, QQQ, DIA, and IWM (Stockcharts)

The markets rallied right out of the gate. Most of the gains were baked in by the late morning. The best thing about these charts is that prices didn’t drop at the close, meaning traders were comfortable holding positions overnight.

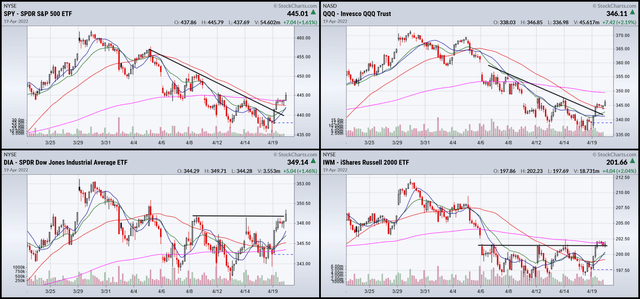

1-month SPY, QQQ, DIA, and IWM (Stockcharts)

The SPY and QQQ broke through resistance today, printing solid rallies. The DIA and IWM are right at resistance.

Today was a solid turnaround for the markets. As always — the real issue of follow-through. Let’s hope it continues tomorrow.

Be the first to comment