Irina Tkachuk/iStock via Getty Images

|

PERFORMANCE |

Average Annualized Total Returns as of June 30, 2022 |

||||||

|

One Month |

ǪTR |

YTD |

One Year |

Three Year |

Five Year |

Since Inception (1/12/2015) |

|

|

SVXAX A Share Class (w/ load) |

-21.48% |

-14.32% |

-7.52% |

-1.25% |

15.79% |

8.69% |

7.33% |

|

SVXAX A Share Class (w/o load) |

-16.68% |

-9.09% |

-1.88% |

4.77% |

18.10% |

9.99% |

8.19% |

|

SVXLX Investor Class |

-16.67% |

-9.05% |

-1.79% |

4.94% |

18.27% |

10.14% |

8.35% |

|

SVXCX C Share Class |

-16.70% |

-9.21% |

-2.14% |

4.19% |

17.40% |

9.35% |

7.55% |

|

SVXFX I1 Share Class |

-16.66% |

-9.05% |

-1.75% |

5.03% |

18.43% |

10.29% |

8.49% |

|

SVXYX Y Share Class |

-16.64% |

-8.99% |

-1.66% |

5.17% |

18.54% |

10.44% |

8.62% |

|

MSCI EAFE NR INDEX |

-9.28% |

-14.51% |

-19.57% |

-17.77% |

1.07% |

2.20% |

3.63% |

|

MSCI ACWI EX-US NR INDEX |

-8.60% |

-13.73% |

-18.42% |

-19.42% |

1.35% |

2.50% |

3.56% |

A Shares Gross Expense Ratio 1.42% C Shares Gross Expense Ratio 2.00% I1 Shares Gross Expense Ratio 1.15% Y Shares Gross Expense Ratio 1.00% Investor Gross Expense Ratio 1.25%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-807-4122. Performance for SVXAX (w/load) reflects maximum sales charge of 5.75%. Performance for SVXAX (w/o load) does not reflect maximum sales charge of 5.75%. If reflected, the load would reduce the performance amount quoted. SVXAX imposes a 1.00% deferred sales charge on purchases of $1,000,000 or more that are redeemed within 18 months of purchases.

Performance data does not reflect the deferred sales charge. If it had, returns would be reduced.

Smead Capital Management, Inc., The Advisor, has agreed to waive its fees and/or absorb expenses of the Fund to ensure that Total Annual Operating Expenses do not exceed 1.42% for Class A shares, 2.00% for Class C shares, 1.15% for Class I1 shares and 1.00% for Class Y shares respectively, through March 31, 2023. This operating expense limitation agreement can be terminated only by, or with the consent of, the Board of Trustees. See the prospectus for additional details.

Dear Shareholder

While the near-term decline in the Fund has been frustrating, we always love volatility and what opportunities it gives us in lower security prices.

During the 2nd quarter of 2022, the Smead International Value Fund declined 9.05% versus a decline of 14.51% in the MSCI EAFE Net Index and a 13.73% decline in the MSCI ACWI ex-US Net Index. We were pleased to see that the Fund produced better relative results but hate watching the value of our stock decline (largely in June alone). The carnage of 2022 continues to roll on.

Our holdings in Interfor (OTCPK:IFSPF), Porsche Automobil (OTCPK:POAHY) and Assicurazioni Generali (OTCPK:ARZGF) were the largest detractors in the quarter.

Cenovus Energy (CVE), Occidental Petroleum (OXY) and Frontline (FRO) were the greatest contributors to performance.

While the near-term decline in the Fund has been frustrating, we always love volatility and what opportunities it gives us in lower security prices.

The Rhythm of the Night

Corona’s 1995 classic “The Rhythm of the Night” rings in our ears as we stare at the circumstances that are likely to expose the darkness of the 2020’s. We saw the light in the 2010’s and will see the night in the 2020’s. Our aim for this letter is to give an understanding to investors of the rhythm of what we are likely to see in the road ahead.

Thisis the rhythm of the night

The night, oh yeah

The rhythm of the night

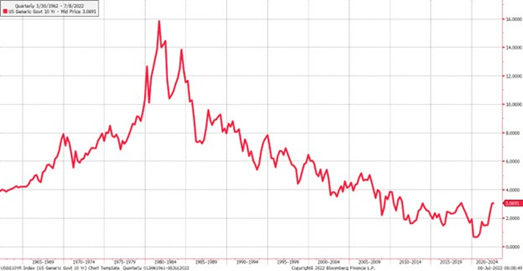

The cost of capital rising is the rhythm we must think about as investors. Below is the 10-year Treasury yield since 1962. Humans eat, sleep and extrapolate, according to Jim Grant. We extrapolated out low rates to be an end-all over the last three to five years. In reality, it was a lift-off period for the cost of money going higher. Thus, mean reversion takes the drum to get the rhythm back to where normalized levels of interest rates have been over decades. The cost of money rising hurts all assets, but for some assets, it could be a bad ending in the night.

Source: Bloomberg. Data from 3/30/1962 – 7/8/2022.

This is the rhythm of my life

My life, oh yeah

The rhythm of my life

Since we have millennials sitting on our investment team, we know the rhythm of their life has been pretty basic. Low inflation, cheap delivery, whatever goods they want and a shared economy. This was the rhythm of their life. What we now see is persistent inflation, delivery costs rising with energy and labor prices, a shortage of goods available to consumers and the value of ownership increasing by the day.

This value of ownership is increasing on tangible assets like homes or in asset heavy companies. It is tough to compete buying a home when you don’t own one already. It will be tough to compete in the car business when others already have the assets to build cars in a scalable way. Asset-intensive businesses could be winning in the stock market for the first time in “my life, oh yeah.”

You could put some joy upon my face

Oh sunshine in an empty place

Take me to turn to

And babe I’ll make you stay

What could put some joy on the investors’ face is businesses that benefit from inflation. Some have dubbed these “inflation proxies”. Below is a chart looking at an inflation proxy index (SGI) relative to the FTSE Developed Index, a composition of stocks in the developed stock markets of the world.

Source: Bloomberg. Data from 7/10/2017 – 7/8/2022.

Businesses benefiting from higher inflation have been punished in the last month of the 2nd quarter. We saw this firsthand in the businesses that we own. Banking, lumber, oil and UK homebuilding companies have all dropped swiftly in value during this same period. We are willing to ride this volatility out as investors have fewer things “to turn to.” Wealthy households are getting poorer as we write this. We don’t want to take the risks that most institutional and individual investors are taking. Instead, we want to take the type of risks that could “make you stay” wealthy.

Oh I can ease you of your pain

Feel you give me love again

Round and round we go

Each time I hear you say

Once investors finally accept inflation into their hearts and minds, its stickiness will be very problematic for central bankers. The zeitgeist this causes could trigger a large change in the companies that investors want to own to “ease you of your pain.” Asset-heavy, inflationary-oriented businesses may become the most popular parts of the stock market globally.

As an example, energy as a sector reached 11.49% of the MSCI All Country World ex-US Index on 6/30/2008 while oil prices were sprinting toward $150 barrel and the price of money was diving to the floor. At recent Brent prices of $120 and money getting more expensive from every word that central bankers utter, this same index stands at 6.11% as of May 31, 2022. This weight has backed off in the last month, but as the song says, “round and round we go.”

While some postulate that the central bankers may “ease you of your pain,” all we know is that stock market investors who under- owned these energy stocks may need to feel to give them some love again.

It seems contrary to say that a world awash in ESG and carbon fears would want these energy businesses so quickly after avoiding them at all costs. It would be strange for a world in love with asset- light businesses to want asset-heavy companies. It would be crazy to see a world that believed that we’d never see inflation again love inflation proxy stocks. These vast movements in price and psychology are shifting right under our noses. After all, “This is the rhythm of the night.”

Fear stock market failure!

Cole Smead, CFA, Lead Portfolio Manager

Bill Smead, Co-Portfolio Manager

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment