naphtalina/iStock via Getty Images

Introduction

This article examines two ways of protecting investors – the SEC way and investor self-protection through a Do It Yourself (DIY) investor market. DIY markets are a hypothetical regulation-free alternative way of allowing investors to protect themselves. DIY markets can be designed to serve the needs of any significant user group. Retail investors, meme traders, and crypto traders are prominent examples.

Do retail investors that share financial markets with activists – hedge funds and other investors who buy shares to alter strategy of a targeted company – need SEC protection?

Gary Gensler, SEC chair, considered the question in a recent speech. Matt Levine comments in two recent articles, here and here.

The SEC’s proposed protection of other investors from activists

Investopedia defines activism thus.

“An activist investor is an individual or group that buys a significant stake in a public company in order to influence how the company is run, such as by obtaining seats on its board of directors.”

The SEC apparently intends to protect ordinary investors from activists. Levine summarizes his understanding of the SEC’s intentions below.

Can Gensler be suggesting that any activist that buys controlling shares of a corporation because of a better way to manage the firm is taking unfair advantage of the shareholders that sell to them?

Gensler wants the activist to describe their strategy before sellers acquire the stock. Then the existing stockholders will capture the value of the better strategy before they sell the stock to the activist.

This has the direct effect of denying activists the ability to capture the value of their superior strategy. Worse, it reduces the incentive to find better strategies in the first place.

A regulation-free way to protect investors

SEC protection of investors contrasts with a system where investors protect themselves. The DIY market provides investors other than activists with a low cost, safer way to trade financial instruments that will have no appeal to activists. By giving investors a choice, investors of the three basic investor types– day traders, investors, and activists – control the costs and benefits of the ways of protecting themselves from other investor types.

Importantly, any significant group of investors can form a DIY market that can govern itself through the DIY market board of governors. Thus, any interest group can form a DIY market and use it to issue financial instruments that have the investment properties the interest group wants.

The costs and benefits of a DIY market for the three types of investors

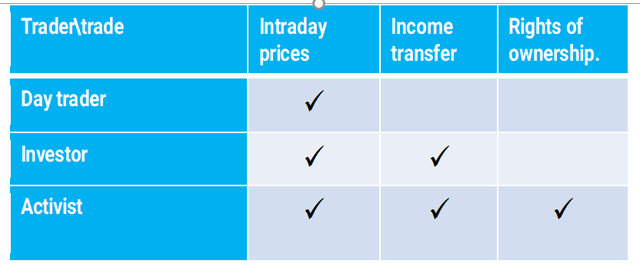

Consider the difference between the DIY market and the SEC’s national market system (NMS) for three investor types. The table below classifies Investors by their investment objectives. The table relates the gains a marketplace provides investors for each investor class.

All three investor classes want to pay and collect Intraday changes in value. Thus, every trading platform provides it.

Author

Importantly, venues like futures markets provide this capacity without SEC regulation and at a lower cost and less credit and counterparty risk than other organized markets. Futures markets also provide greater trader anonymity than do the SEC-regulated NMS securities markets. The DIY market would provide these benefits of futures markets to a market for spot investments.

Unlike day traders, both retail investors and activists want dividends and interest payments. But these income transfers come with the added cost of higher margin requirements associated with the greater risk of protecting market participants from changes in the value of the entire investment rather than only the protection from risk created by intraday changes in value that futures exchanges provide.

ETFs are a prominent example of a form of investment that separates ownership from control of the value of securities. Only activists who want to influence the decisions of managements need the most expensive cost of investing, transfer of ownership rights.

How the DIY market works

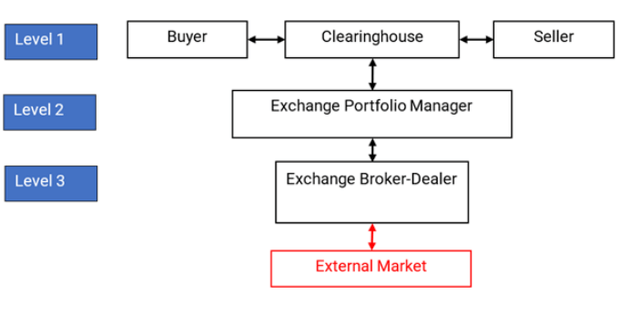

The diagram below describes a three-tiered trading platform that provides each class of investor with the form of investment they need. Compare this system of investor self-protection to the SEC’s proposal.

The graphic identifies three levels of cost and quality the DIY exchange mechanism would provide. The difference from SEC protection is that in the DIY system the investor, not the SEC, chooses a level of protection from the market’s risks.

The system permits investors with like needs to manage the market they use for themselves.

Author

Each customer selects their desired transaction level.

- A level one participant wants the least cost, minimum service status of a day trader. Each trader is marked to market daily. The exchange clearinghouse is a buyer to each seller and the reverse as with futures trading. Level one is both cheaper and safer than the other two levels. It adds the property of a central clearinghouse that serves both the day trader and the investor by hiding identity.

- A level two participant has level one privileges but also receives interest and dividend payments. These traders acquire an exchange-originated ETF-like security supported by the appropriate external securities investment.

- A level three participant, an activist who wants ownership rights is sold the external market instrument she wants. She automatically exits this system for the external NMS.

The key value of an investor-designed market is that the investor trades an instrument like NMS securities in every way except that ownership of DIY assets does not permit an investor to pursue activist objectives.

Reconciling prices in the DIY system to NMS prices

Whenever DIY securities prices differ from NMS prices, convergence of DIY prices to NMS prices occurs through intermarket arbitrage. The exchange broker dealer sees both external and internal prices in real time and fills orders at the better of the two. The two cases:

- The DIY price exceeds the NMS price. In this case, sellers are filled at the DIY price. Buyers, at the NMS price.

- The NMS price exceeds the DIY price. In this case, buyers are filled at the DIY price. Sellers, at the NMS price.

- Accounting. New sales and purchases of NMS securities and the DIY instrument are paired with the related NMS security and both instruments accounted for on a deferral basis. Deferral accounting is cheaper than mark to market accounting and assures that both purchases and sales of the DIY instrument occur at prices better than the National Best Bid and Offer (NBBO) prices.

Assembling a DIY market

The DIY market is a platypus-like creature. It has some properties of an ETF. It has some properties of futures contracts. Like SEC-regulated spot exchanges, it trades a spot price.

ETF-like. The DIY market trades a financial instrument constructed by acquiring a portfolio of NMS securities and then issuing a new financial instrument with value derived from the NMS securities that support its value. This gives DIY securities the two important ETF properties – the ability of the DIY originator to create a new instrument and the ability to trade the instrument like a common share,

Futures market-like. The DIY market assures both levels of DIY trader are separated by a clearinghouse – the most significant positive property of futures markets.

Spot market-like. The DIY market trades an instrument that mirrors the settlement properties of the associated NMS market.

Instant settlement. A key benefit of a hypothetical market is that expensive, risky, separate settlement of trades to transfer ownership rights are eliminated like current settlements in the cash market are eliminated. Settlement and transaction are the same electronic message so that clearing is instantaneous.

Conclusion

The SEC is overly important because investors are too passive. Investors don’t shoulder the responsibility of protecting themselves, leading to costly SEC rules that have undesirable side effects like inhibiting traders’ ability to collect the value of better corporate strategies. This inability to capitalize the value of activist innovations will suffocate innovation itself.

This article looks at the cost of SEC regulations that have an obvious negative impact on both the value of securities and the quality of the information prices contain. It describes how investors could protect themselves. Instead of SEC rules that limit the ability to collect the value of innovation, investor self-sufficiency encourages further innovation.

Be the first to comment