Weekend Images Inc./E+ via Getty Images

The past is whatever the records and the memories agree upon.” – George Orwell

In today’s piece take an in-depth look at a mid-cap financial name that appears dirt cheap on P/E basis and also has seen some recent insider buying.

Company Overview:

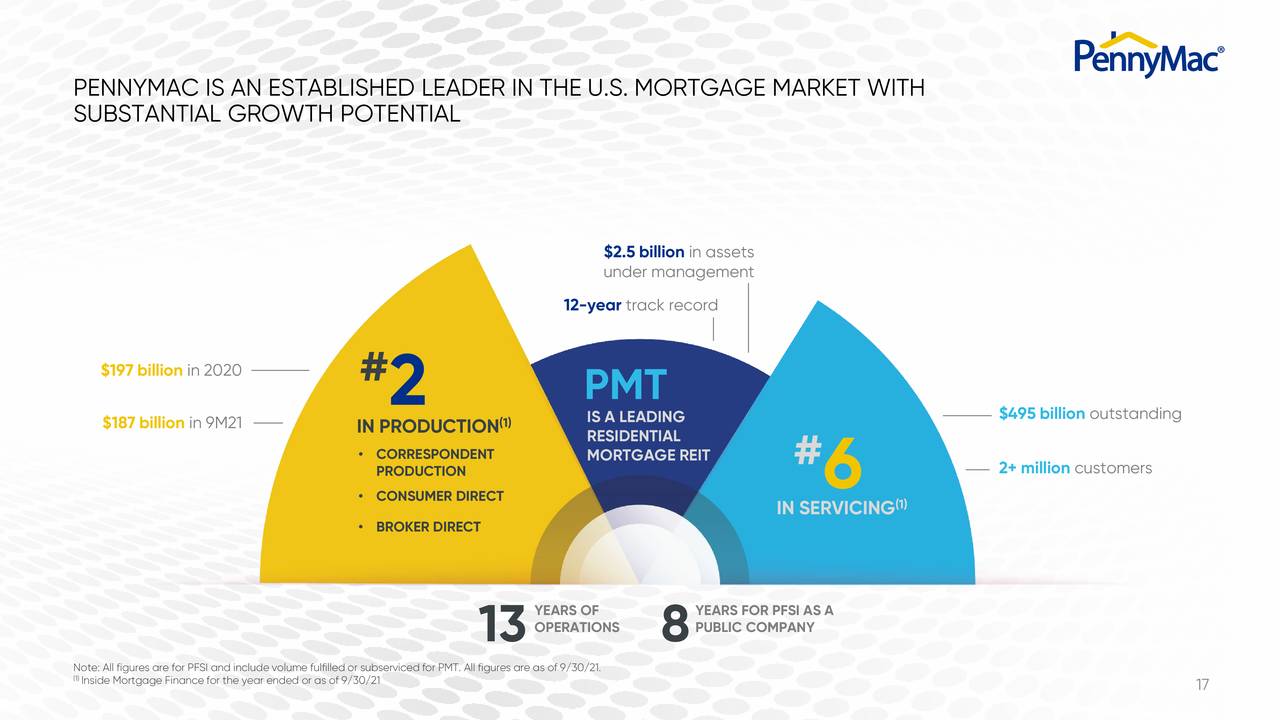

PennyMac Financial Services, Inc. (PFSI) is a Westlake Village, California based specialty non-bank financial services firm dedicated to the production, servicing, and investment management of U.S. residential mortgages. It was the number two residential lender (behind Rocket Companies (RKT)) in 2020, providing mortgages totaling $197 billion. It also ranked sixth in servicing volume. The company was formed in 2008 and went public in 2013, raising net proceeds of $216.8 million at $18 per share. PennyMac trades right at $68.00 a share, translating to a market cap of approximately $4 billion.

Source: November Company Presentation

Operating Model

Operating as a non-bank, PennyMac borrows funds from ~11 warehouse facilities providing it with $14.6 billion in capacity plus term note financing totaling another $2.6 billion. Once originated or purchased, PennyMac does not hold onto the mortgages to collect net interest income but rather sells the mortgages to investors – primarily to Ginnie Mae MBS investors in the secondary market – realizing a gain on the sale. PennyMac generates revenue from three business segments: Production, Servicing, and Investment Management.

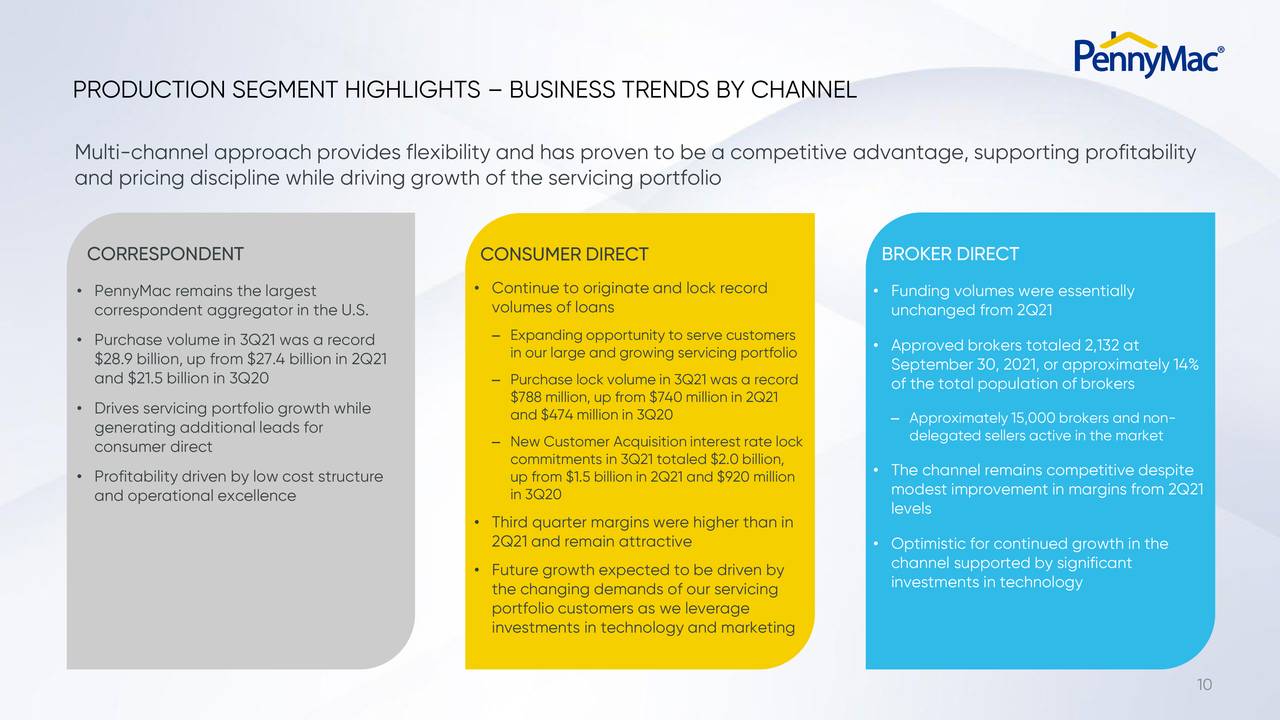

Production consists of mortgage origination, purchase, and sale, which are sourced from three channels. PennyMac’s correspondent production channel consists of mortgage aggregation from non-affiliates (over 700 credit unions, community banks, and independent mortgage originators – ‘correspondent sellers’) that have been insured or guaranteed by the Federal Housing Administration, Veterans Affairs, or USDA, which are subsequently pooled into mortgage-backed securities (MBS) guaranteed by Ginnie Mae and sold to institutional investors. It earns an origination fee from the correspondent seller, interest on the loan while it is held, and a gain or loss when it is sold to MBS investors.

Source: November Company Presentation

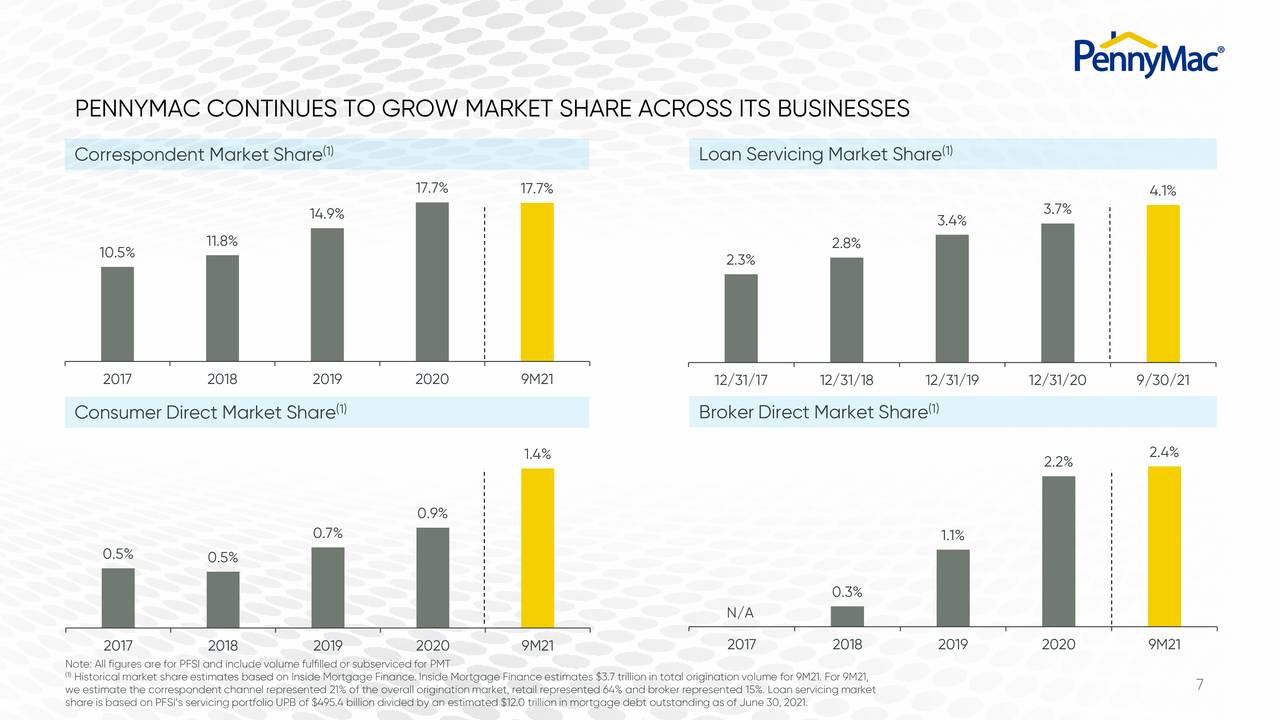

Additionally, the REIT PennyMac Mortgage Investment Trust (NYSE:PMT) – owing to the fact that it is not an approved issuer of Ginnie Mae MBS (only Fannie Mae and Freddie Mac) – sells its Ginnie Mae MBS-eligible loans purchased from correspondent sellers to PennyMac, which are then sold to MBS investors. From this arrangement, PennyMac earns a fulfillment fee. Owing to this relationship with PMT, PennyMac is the number one correspondent aggregator in the market with $160.9 billion of unpaid principal balances (UPB) at YE20, providing it with a 17.7% market share in a channel that accounts for ~21% of all mortgages.

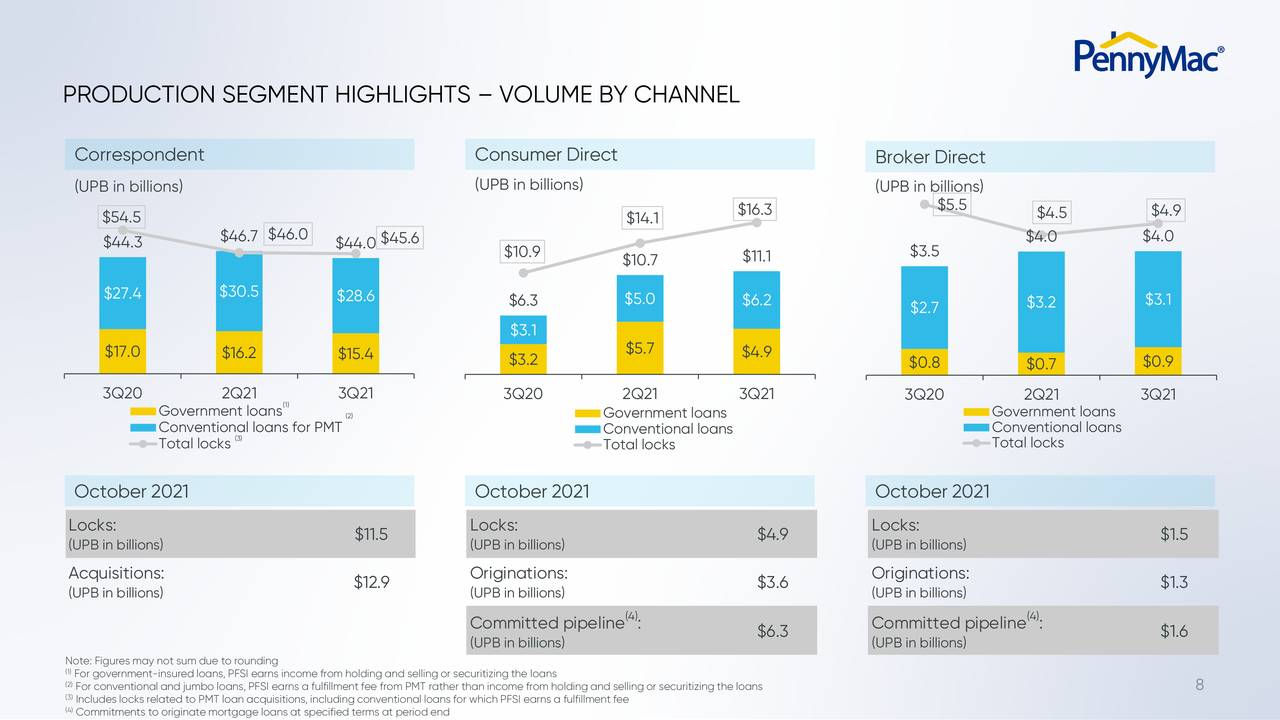

The second avenue by which PennyMac originates mortgages is its consumer direct channel. This operation exists entirely through customer acquisition via internet advertising and call centers for support with no brick-and-mortar branch locations. The mortgages originated are then sold to MBS investors or to PMT. The firm ranked 15th in the consumer direct league tables in 2020, with a 0.9% market share and UPB of $23.5 billion. This retail channel accounted for ~63% of all mortgage business in 2020, providing PennyMac with a significant under-tapped opportunity.

The firm’s third channel is broker direct, whereby a mortgage broker sends PennyMac application packages for underwriting and funding. Like its consumer direct channel, these loans are either sold to PMT or to investors. Approximately 2,100 mortgage brokers throughout the country, or 14% of total, are approved to offer PennyMac’s products. At YE20, PennyMac’s UPB through this channel was $12.2 billion, representing a 2.2% market share – good for seventh in the market at that time. The broker direct channel was responsible for ~14% of all mortgage originations industrywide in 2020.

The consumer direct channel has an outsized effect on the top line with revenue margins per UPB significantly higher (300 to 500 basis points) versus other channels (usually less than 100 bps). With that said, consumer direct has the highest expenses (~140 bps) versus, for example, the correspondent channel (~10 bps). Even with the higher costs, consumer direct has the greatest impact on the bottom line, further emphasizing the firm’s untapped opportunity. Management expects future growth in consumer direct to be driven by changing demands in its service portfolio, which it is leveraging with spends in technology and marketing.

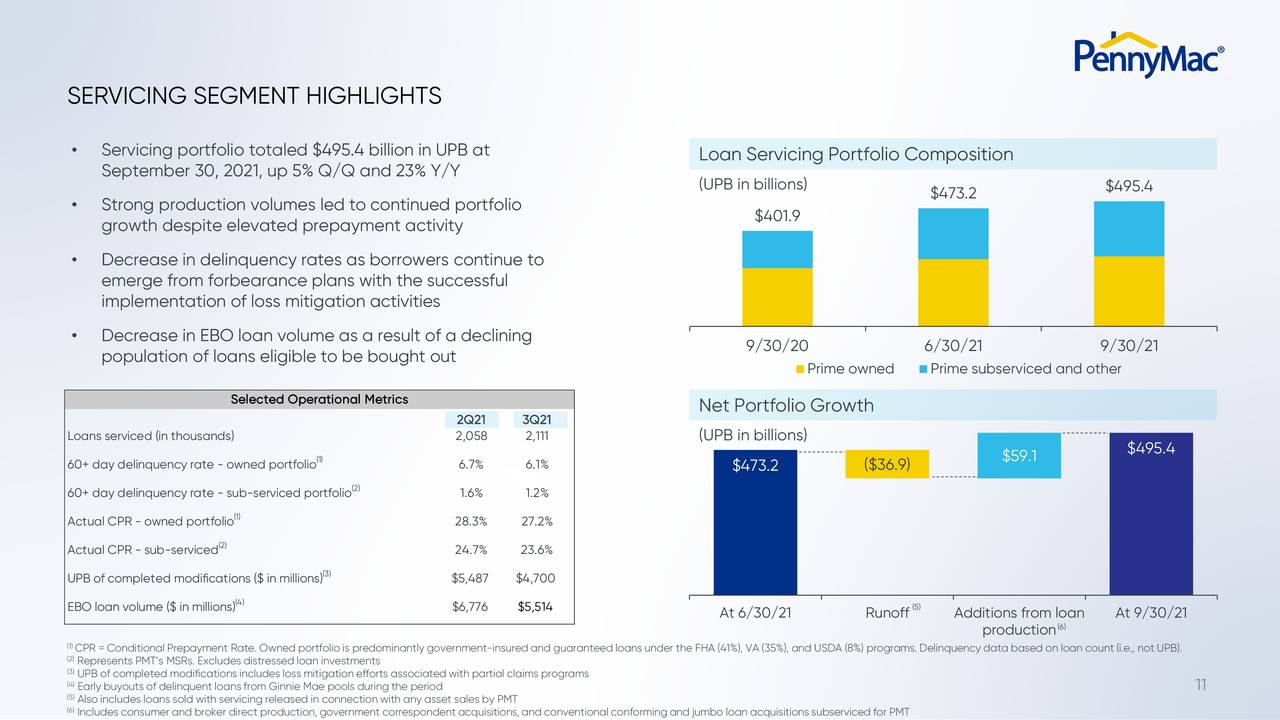

Regarding its service portfolio, PennyMac boasts a considerable one, facilitating UPB of $449 billion as of YE20, ranking it number six in this line. Servicing includes collecting loan payments, remitting principal and interest payments to investors, managing escrow funds for tax and insurance expenses, and performing loss mitigation activities on behalf of investors.

Furthermore, through its investment subsidiary PNMAC Capital Management [PCM], PennyMac manages a $2.3 billion mortgage portfolio on behalf of PMT.

Production is by far the largest contributor to PennyMac’s top line, accounting for 88% of the $3.7 billion generated in 2020.

Industry Dynamics

The rise of non-bank originators such as PennyMac had its origin in the banking crisis of 2008, which spawned regulation requiring banks to better assess a borrower’s ability to pay and – on the servicing side of the business – provide would-be defaulters the opportunity to renegotiate their mortgages before resorting to foreclosure. The additional compliance measures compelled some banks – such as Citigroup (C) – to exit the business, creating a vacuum for non-bank lenders, who are not subject to the same level of scrutiny as banks, to fill.

And with economic dislocations created by various government responses to the pandemic, a goldilocks-like environment developed for originators in the $12 trillion mortgage market: historically low interest rates – meaning more refinancings – wedded to a surge in demand for housing as former urban dwellers departed the cities en masse for the suburbs – meaning more purchase transactions. PennyMac’s experience is a case-in-point: after generating fully diluted earnings of $4.89 a share on net revenue of $1.5 billion in 2019, its performance ballooned in 2020 with fully diluted earnings of $20.92 a share on net revenue of $3.7 billion as its loan production surged 67% to UPB of $196.6 billion. Owing to this performance, the lender was able to repurchase 8.9 million shares of its stock in 2020, or 11% of the total outstanding, while its book value per share climbed 82% to $47.80.

In addition to stock buybacks, PennyMac has employed its extranormal cash flow to engage in a hiring spree in an attempt to capture even larger market share in the high-margin consumer direct and broker direct channels as well as servicing, where its stated aims are to become the number five, number three, and number three industry participant, respectively.

Despite an unprecedented FY20 followed by a robust YTD21 – more on that shortly – shares of PFSI are trading at a microscopic price-to-TTM EPS ratio of 3.6 as investors are skeptical that interest rates can remain near historical lows in the current inflationary milieu. Higher mortgage rates translate into fewer refinancings, which comprised the majority of the lender’s 2020 business. Also, investment capital looking for a home will flood into profitable endeavors such as non-bank lending, increasing competition and thus compressing margins. Owing to these industry dynamics, investors fear that PennyMac’s bottom line will revert back to 2019 when the total mortgage origination market was $2.3 trillion.

3Q21 Results and Outlook

So far, at least for PennyMac, the forecasted normalization is occurring at a manageable pace. On November 4th, 2021, the company reported 3Q21 fully diluted earnings of $3.80 a share on revenue of $786.6 million versus $7.03 per share on revenue of $1.12 billion in the prior-year period, representing 46% and 30% declines, respectively. The top line missed Street consensus by 5% while the bottom line beat by 10%.

Source: November Company Presentation

Although down somewhat dramatically year-over-year (y-o-y), owing mostly to a lack of refinancings and narrower gain-on-sale margins, PennyMac’s headline results masked the inroads made in consumer direct mortgages, which were up 50% y-o-y to a record $16.3 billion in UPB. In fact, market share gains YTD21 versus FY20 were achieved in not only consumer direct (0.9% to 1.4%; now 13th), but also broker direct (2.2% to 2.4%; now 6th) while its industry-leading correspondent market share remained at 17.7%. Furthermore, its loan servicing market share improved from 3.7% at YE20 to 4.1% as of September 30, 2021 – still 6th. All delinquency and forbearance metrics improved in the quarter versus 2Q21. More impressive still was the return on equity, which through 3Q21YTD stood at 32% after an eye-opening 61% in 2020 and a solid 22% in 2019.

Source: November Company Presentation

And although mortgage rates have creeped higher, they still remain stubbornly low, with the 30-year still near 3%. The normalization in mortgage originations has not yet occurred, with FY21 now forecasted to be slightly higher versus a record FY20 ($4.2 trillion vs. $4.1 trillion). With that said, originations are expected to decline to $3.0 trillion in 2022, with purchase originations comprising a record $2.0 trillion of that total.

Source: November Company Presentation

Balance Sheet & Analyst Commentary:

Also impressive is PennyMac’s book value per share, which continues its steady ascent, standing at $58.00 on September 30, 2021, up from $47.80 at YE20. This performance was aided by a relentless share repurchase program – total authorization $2 billion – which has acquired 12.8 million shares over the first ten months of 2021, reducing shares outstanding by ~17%. This program comes at the expense of its dividend, which at $0.20 a share quarterly translates to a current yield of 1.2%.

The Street leans positive on PennyMac with one buy and five outperform ratings outpointing two hold ratings, with a median price target of $90 a share. Analysts expect PennyMac to earn $15.56 a share on revenue of $3.23 billion in FY21 and $12.77 per share on revenue of $2.77 billion in FY22.

Director Farhad Nanji, representing the interests of FMN Partners, continues to be very bullish, purchasing over 440,000 shares in late November in the high $63 to high $64 range, bringing his partnership’s total ownership interest to a shade under 4 million shares, or 7% of the company. It should be noted that the company’s CEO did sell nearly $1 million worth of stock on December 6th, but that is a very small part of his overall holdings.

Verdict:

If the Street consensus proves accurate, PennyMac will nearly $50.00 a share for the years 2020-2022. Most of that money – aside investments in its non-correspondent channels – appears earmarked for share buybacks, and with its stock trading at approximately five times FY22E EPS when it is generating ROEs north of 30% each of the last two years and ~20%-25% over the longer haul, it is a solid allocation of capital.

The risk, of course, is that rates explode higher and the housing and refinancing markets dry up. But with a solid multi-channel base to work from and small but growing penetration (1.4%) in its most-profitable consumer direct business, PennyMac has considerable upside if rates remain stable. And there is the rub as the Bard would say. With inflation at multi-decade highs and government debt exploding, it is hard to see rates remaining stable in 2022. Therefore, PennyMac cannot be considered for a large stake even if the shares appear very cheap. They do merit a small ‘watch item‘ position for now. We might revisit this name if the prospects for a more certain rate environment in 2022 improve.

Life can only be understood backwards; but it must be lived forwards.”― Søren Kierkegaard

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment