Jacob Ammentorp Lund/iStock via Getty Images

A little nonsense now and then, is cherished by the wisest men. ― Anonymous

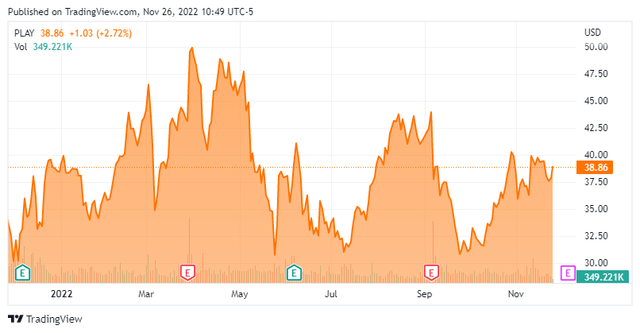

Today, we take an in-depth look at a consumer-focused play. The company is growing through a key acquisition and overseas expansion. The shares are down 40% from recent highs as rising interest rates and worries about a possible recession have pounded growth names in 2022. With the shares trading at reasonable valuations, selling near 52-week lows and seeing some recent insider buying, this name seems to set up as a solid covered call play. An analysis/recommendation follows below.

Company Overview:

Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) is a Coppell, Texas based owner-operator of venues that combine entertainment and dining for adults and families with 200 locations in 41 states, Canada, and Puerto Rico. The company increased its venue count by 52 after closing on the acquisition of Main Event in June 2022. D&B (for founders David Corriveau and James “Buster” Corley) opened its first entertainment and dining center in 1982 and initially went public in 1995. It was subsequently purchased by private equity shop Wellspring Capital Management in 2006, sold to PE firm Oak Hill Capital in 2012, and taken public again in 2014, raising net proceeds of $98.6 million at $16 per share. Its stock trades for just under $39.00 a share, translating to a market cap slightly under $1.9 billion.

The company operates on a 52- or 53-week fiscal year (FY) ending the Sunday closest to January 30th. For the avoidance of doubt, FY22 refers to the fiscal year ending Sunday, January 29, 2023.

D&B derives approximately one-third of its top line from food and beverage with the balance coming from entertainment, including bowling, arcade games, billiards, karaoke, laser tag, virtual reality, mini-golf, and sports viewing, amongst others. Most of these games are activated by play credits loaded onto cards or D&B’s mobile app from an automated kiosk. Marketing an experience of “Eat Drink Play and Watch”, the venues are popular for birthday parties and corporate events. Prior to its acquisition of Main Event, the company primarily targeted young adults 21 to 39, who accounted for ~58% of visits. Owing to its ‘eatertainment’ concept, D&B has low leverage to food costs, which represented only 7% of total revenue in FY21, translating to high gross margin of 84.3%. As such, every one of its 200 locations is profitable on an EBITDA basis. Its average store size prior to the onboarding of Main Event was ~40,000 sq. ft. with the acquiree contributing average space of ~55,000 sq. ft. That said, D&B is embarking on/experimenting with a new smaller store format, featuring venues of 15,000 to 25,000 sq. ft. With the exception of a handful of cases, the company does not own the property on which it operates.

Pandemic Impacts:

Owing to the social and non-essential natures of its offerings, D&B was severely impacted by the pandemic, as it was compelled to close (at the time) all of its 137 locations, resulting in a 68% downdraft in net revenue from $1.35 billion in FY19 to $436.5 million in FY20. Correctly seen as a loser in the lockdown scenario, its share price plummeted 90% in one month, touching an intraday low of $4.61 on March 18, 2020. In dire straits, the company raised net proceeds of $182.2 million in equity offerings that diluted then existing shareholders by ~56%. At the end of FY20 (January 31, 2021), 33 D&B locations were still closed. However, with FY21 net revenue approaching FY19 levels at $1.30 billion, shares of PLAY rallied above pre-pandemic levels to $53.53 in late-March 2022 – although below its all-time high of $73.48 (2017).

Main Event Acquisition:

Then on April 6, 2022 D&B, announced it was acquiring Main Event from Ardent Leisure Group (OTC:ARDLF) for a cash consideration of $835 million, which was equal to nine times the latter’s trailing twelve month [TTM] Adj. EBITDA (ending December 31, 2021). Main Event’s concept is similar to D&B’s, although it primarily targets families versus young adults for the latter. Management initially expected the combination to achieve store support center and supply-chain synergies of $20 million over the first two years. The transaction was financed entirely by bank loans, upping D&B’s net debt to $1.13 billion and its net leverage to 2.3. Although the price paid for Main Event was not outrageous, with 275 basis points of recession-inducing rate hikes on the horizon – the first 25 basis point hike occurred in mid-March – the market stepped away from shares of PLAY, which have since retreated 40% from its post-pandemic high, currently trading near their 52-week low of $29.76.

International Expansion:

At the closing of the Main Event deal, D&B onboarded a new CEO and a new executive management team, including Chief International Development Officer Antonio Bautista. He did not waste much time expanding the company beyond its North American borders, with a September 14, 2022 announcement of a partnership with Abdul Mohsen Al Hokair Holding Group to develop the D&B concept in West Asian markets, including 11 sites in Saudi Arabia, the UAE, and Egypt.

2Q22 Earnings & Outlook:

A week before that news, the company posted its 2QFY22 financial results, which were mixed. D&B earned $0.59 a share (GAAP) and Adj. EBITDA of $119.6 million on revenue of $468.4 million versus $1.07 a share (GAAP) and Adj. EBITDA of $119.2 million on revenue of $377.6 million in 2QFY21. Since the quarter included one month of results from Main Event, the comparisons are not apples-to-apples. However, the bottom line badly missed Street expectations of $1.04 a share as wage and commodity inflation were blamed along with transaction costs associated with the merger. This poor outcome was despite its top line being $35.4 million better than expectations; although, that may have been the result of some analysts not updating their models to reflect Main Event.

On the positive side of the ledger, management indicated that it had already realized synergies of $11.5 million from the acquisition and upwardly revised its total synergy estimate from $20 million to $25 million. Its D&B rewards program, launched in November 2021, surpassed four million members. And maybe most encouraging was the update on the first five weeks of 3QFY22, where the company saw comps of 22.1% versus the same period in 2019, spearheaded by a 42.3% comp at Main Event (17.6% at D&B). This was a significant acceleration versus 2QFY22, which saw comps improve at 9.6% at D&B branded stores versus the same period in 2019. For the approximately one month Main Event stores were part of D&B in 2QFY22, comps improved 29.7%.

Despite the strong start to 3QFY22, the market chose to focus on comp sales versus 2QFY21 (up only 4.3%) and the cost-inflation-impacted bottom line, selling shares of PLAY down 14% in the subsequent trading session to $37.72, commencing a slide to the low 30s.

Balance Sheet & Analyst Commentary:

D&B did generate 2QFY22 operating cash flow of $84.5 million, of which $25.0 million was employed in the repurchase of 764,988 shares at an average price of $32.70. The $100 million buyback program was authorized by the board in December 2021 and represents a return to the company’s pre-pandemic policy of returning capital to shareholders. Although debt was elevated due to the Main Event deal at $1.23 billion, on a pro forma basis, D&B’s net leverage (as stated previously) stood at a manageable 2.3.

Street analysts are slightly positive on the company’s prospects, featuring one outperform and five buy ratings versus two hold ratings. Price targets proffered range from $34 to $66 a share. On average, they expect the company to earn $2.74 per share (GAAP) on revenue of $1.96 billion in FY22, followed by $3.66 per share (GAAP) on revenue of $2.34 billion in FY23.

Insiders and one beneficial owner are bullish on the company’s prospects based on their recent PLAY transactions. Collectively, the CFO and Chief Procurement Officer bought 17,154 shares while beneficial owner Hill Path Capital Partners added 300,000 shares – all in the low 30s on October 11-12, 2022.

Verdict:

Don’t pay much mind to the implied growth rates FY23E verses FY22E, as the latter only reflects seven months contribution from Main Event. However, trading at an EV/TTM Adj. EBITDA of under 6 and a PE ratio of approximately 9.5 on FY23E EPS, D&B is already appears priced for recession. As a smaller-ticket alternative to say a trip to Disney (DIS) World, it can be reason that it is better equipped to weather a bad macro environment. If D&B were to trade to the valuation for which it purchased Main Event (EV/TTM Adj. EBITDA of nine), that would translate to nearly $70 per share on a pro forma basis.

When you play, play hard; when you work, don’t play at all. ― Theodore Roosevelt

Be the first to comment