Justin Paget

Peloton Interactive, Inc. (NASDAQ:NASDAQ:PTON), once a darling of Wall Street, is now struggling to keep its head over the water. The fact that the news of founders leaving the company led to a 7% rise in its market value yesterday (September 12) is a testament to the company’s struggles.

Co-founder John Foley is no longer the executive chairman of the company’s board effective September 12. This comes just months after he stepped down from the CEO position last February after serving at the helm for around 10 years. Chief Legal Officer and co-founder Hisao Kushi will resign on October 3, and Chief Commercial Officer Kevin Cornilsis also leaving the company and will not be replaced. Karen Boone, who has represented the Board since 2019, has been appointed as the new Chairperson of Peloton’s Board of Directors. Tammy Albarrán, who most recently served as the Chief Deputy Counsel of Uber Technologies, Inc. (UBER), will take on the legal duties at Peloton effective October 3.

The only rational explanation behind yesterday’s positive market reaction to these changes is that investors are expecting newly appointed CEO Barry McCarthy, who brings a wealth of subscription business experience from his previous stints at Spotify Technology S.A. (SPOT) and Netflix, Inc. (NFLX), will have a stronger say on the company’s business in the absence of Peloton co-founders.

In this analysis, I am not going to speculate whether this leadership shakeup will eventually end up creating value for long-term shareholders. Rather, I will focus on Peloton’s business model to determine whether the company is going to zero or if a turnaround is still possible.

Strategic Errors and Bad Timing May Have Cost Peloton Money

To understand what Peloton is about and how it became what it is, I believe investors should reference the comments made by co-founder Foley in the prospectus filed with the SEC at the time Peloton filed for its IPO. Here’s what Mr. Foley had to say:

I founded Peloton in 2012 to solve a challenge in my own life. My wife, Jill, and I knew great fitness experiences made us feel like better versions of ourselves, but there were countless barriers to working out regularly. We loved going to boutique studio fitness classes like cycling, running, boot camp, and yoga. We were addicted to the fast-paced energy, the motivational instructors, the thoughtful programming, and the way exercising with a group pushed us harder. These classes left us feeling energized, refreshed, stronger, and ready to take on anything. However, with demanding jobs and two small children at home, just getting to the gym became harder and harder. Classes with our favorite instructors sold out quickly and were prohibitively expensive. We also had to accommodate someone else’s schedule at someone else’s location. And we were often left without time, without options, and without the feeling of “being our better selves” that we sought.

I figured that there must be a way to make these workouts more convenient, more affordable, and more accessible. There had to be a way to bring fantastic, high-energy, instructor-led group fitness into the home, to be experienced on my time, any time I wanted. And my hunch was that if I could make it possible, others would want it as well.

For those of you who lead busy lives, Foley’s remarks and mission should sound exciting, I bet. Peloton was founded with the idea of solving a problem faced by many individuals living hectic lifestyles. Proving Mr. Foley correct, consumers lined up to get their hands on expensive Peloton bikes and treadmills, and they showed no reluctance in paying a subscription fee to get access to fitness instruction videos on the screens of their Peloton exercise equipment. It seems fair to say that Peloton pioneered the growth of the interactive fitness industry.

Then came the pandemic!

As you can imagine, mobility restrictions imposed by authorities to curb the spread of the pandemic in the first year of Covid-19 were a boon to Peloton’s business, as consumers who were initially reluctant to workout at home had no option but to convert their homes into gyms. Peloton’s exercise equipment stood out from the rest as these machines enabled gym-goers to have a more immersive, interactive experience at home. Peloton’s product sales and subscriber base went through the roof, and then came the reality check.

In my opinion, there were multiple reasons behind Peloton’s fall from grace.

- Peloton overreacted to the massive demand for its equipment in the early days of the pandemic and ramped up production only to see demand waning when mobility restrictions eased.

- As Professor Robert J. Dolan points out, Peloton confused potential and existing customers in 2021 with its pricing strategy and a product line-up that made little sense. Innovating for the sake of innovation can be a reason for the downfall of any company.

- Investors were expecting too much from Peloton on the back of its massive success in 2020, and these high expectations may have played a role in the dramatic collapse of its market value.

Peloton faced backlash for safety issues as well, and this could not have come at a worse time as the company was already facing many hurdles when these safety issues came to light. In summary, I believe Peloton’s downfall was brought about by questionable strategies and bad luck.

There’s Room for Growth but the Competitive Landscape is Changing

Peloton, in my opinion, is operating in an industry that is likely to grow steadily in the coming decades. Fitness, or getting in shape, is a priority for many people across the world today regardless of their age. As consumers, you would know that the buzz around living a healthy lifestyle today is stronger than what we have seen in recent years. That being said, many people still find it difficult to stick to an exercise routine because of a few major reasons.

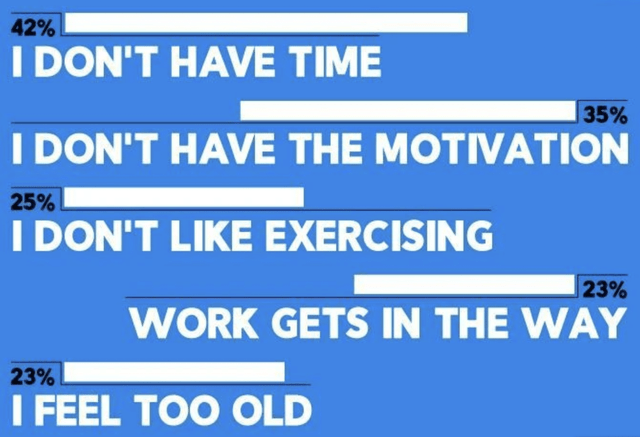

Top 5 reasons why Americans do not exercise regularly (OnePoll survey results, 2019)

Not surprisingly, not having enough time is the number one reason behind the lack of exercise hours logged in by Americans. It is the same everywhere else too. Peloton’s products could be pricey and may not be for everyone, but the company is trying to solve a problem that is faced by many people today. Peloton already has amassed a subscriber base of around 3 million and consistently reports a very low monthly churn rate of around 1%, which could be considered early indications of customer loyalty. Peloton seems to be doing something right amid all the chaos, but this alone will not be sufficient to lift the company up.

In the long run, I believe the fitness industry will move to a hybrid environment where people strike a balance between outdoor and indoor exercise. For this reason, I believe there is room for both connected fitness equipment and gyms to survive and thrive. Peloton, nonetheless, is changing its business model to focus more on subscriptions and less on hardware. This change, in my opinion, may create more challenges for the company in the short run before we see long-term results.

With inflation already eating into Americans’ wallets, subscription businesses are likely to find it difficult to grow in the coming quarters. Peloton has already delivered one price hike recently, and I believe it is just a matter of time before high inflation and these price hikes lead to cancellations of subscriptions and a slowdown in new member additions. From a hardware perspective, the company is already facing stiff competition from the likes of Bowflex, Echelon, NordicTrack, and SoulCycle. Price-based competition is already visible in this market segment, and Peloton is no longer alone in offering digital subscriptions alongside fitness equipment.

Competition is heating up at a time when Peloton is still trying to get the house in order by rightsizing the company, outsourcing product manufacturing and delivery, and making leadership changes. Peloton, in my opinion, is not fully ready to defend its market leadership in the interactive fitness industry.

Takeaway

I find Peloton’s mission attractive. I also believe Peloton has a lot to offer the global fitness industry. The strategy to focus on subscriptions may not yield the desired results in the short run because of external challenges, but the company seems to be moving in the right direction by rethinking its strategy and rightsizing business operations to achieve cash flow neutrality in the coming quarters. Although I believe Peloton will play an important role in revolutionizing the way people break a sweat, I am not confident that the company is investable just yet. Even if Peloton were to successfully come out of this difficult spot, I believe it would take many years for shareholders to enjoy investment returns.

Be the first to comment