Aguus/E+ via Getty Images

The momentum investor’s sole purpose is to identify stocks that are positioning for a price breakout for either fundamental (a new product, a merger), economic (strong sector growth), or market-based (an industry that is gaining in strength with traders), reasons (or a combination of the three). The column will focus on industry fundamentals, basic financials, and charts to make its determination.

This is a high-risk strategy and should only be used by traders who can lose a substantial amount of money. This column is not specific investment advice for any individual.

Investment thesis: between a positive macroeconomic backdrop and strong RRG readings, On semi is an attractive but risky play.

ON Semiconductor (ON) is a specialized chip company (emphasis added):

ON Semiconductor Corporation, together with its subsidiaries, manufactures and sells semiconductor components for various electronic devices worldwide. The company operates in three segments: Power Solutions Group (PSG), Advanced Solutions Group (ASG), and Intelligent Sensing Group (ISG). The PSG segment offers analog, discrete, module, and integrated semiconductor products for various applications, such as power switching, power conversion, signal conditioning, circuit protection, signal amplification, and voltage regulation functions. The ASG segment designs and develops analog, mixed-signal, logic, ASSPs and ASICs, Wi-Fi, and power solutions. It also provides trusted foundry and design services for government customers; and manufacturing services. The ISG segment offers complementary metal oxide semiconductors image sensors; proximity sensors; image signal processors; single photon detectors, including SiPM and SPAD arrays; radars; and actuator drivers for autofocus and image stabilization for a range of customers in automotive, industrial, medical, aerospace/defense, communications, networking, wireless, consumer, and computing markets. The company serves original equipment manufacturers, distributors, and electronic manufacturing service providers.

They are the 16th largest semiconductor company by market capitalization.

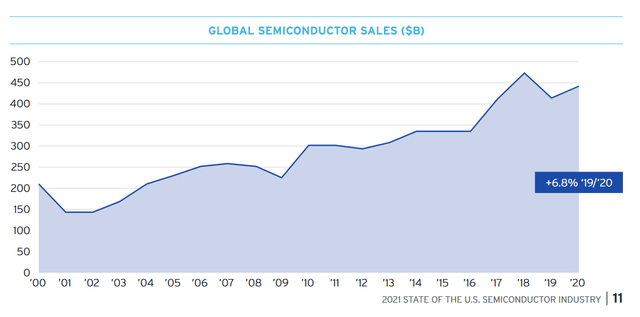

The macroeconomic backdrop for the industry couldn’t be stronger:

The shortage took hold in 2020, largely due to significant swings in demand caused by the COVID-19 pandemic as far back as Spring 2020. Some customers reduced production and chip purchases as the virus spread across the globe. In addition, a number of countries and regions went into lockdown in early 2020, which significantly interrupted semiconductor supply. Chipmakers, meanwhile, saw surging demand for semiconductors in other sectors used to enable remote healthcare, work-at-home, and virtual learning, which were needed during the pandemic. The shortage continues to affect a range of downstream sectors, including cars, consumer electronics, home appliances, industrial robotics, and many other key goods.

….. For all quarters during the shortage, the industry has run fab utilization well above the normal utilization level of 80 percent. When market demand runs high, such as in a cyclical market upturn like the one the market is in now, front-end semiconductor fabrication facilities, or fabs, will typically run above 80 percent capacity utilization, with some individual fabs running as high as between 90-100 percent

This is part of a longer-term trend: At the company level, this is entirely about momentum of earnings.

At the company level, this is entirely about momentum of earnings.

The above table (from the Seeking Alpha ON page) shows that between December 2020 and the trailing 12 months, gross revenue jumped to its highest level in the company’s history.

The above table (from the Seeking Alpha ON page) shows that between December 2020 and the trailing 12 months, gross revenue jumped to its highest level in the company’s history. The above table shows quarterly revenue data. It jumped strongly in July and again moved higher in October.

The above table shows quarterly revenue data. It jumped strongly in July and again moved higher in October.

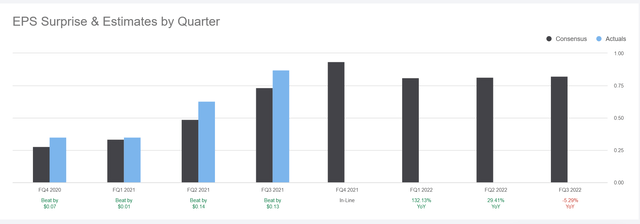

The company has been beating earnings estimates …  … for the last four quarters.

… for the last four quarters.

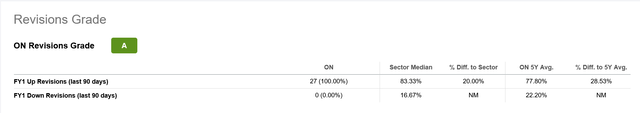

As a result …

… 27 analysts have increased their earnings estimates for the upcoming quarter.

… 27 analysts have increased their earnings estimates for the upcoming quarter.

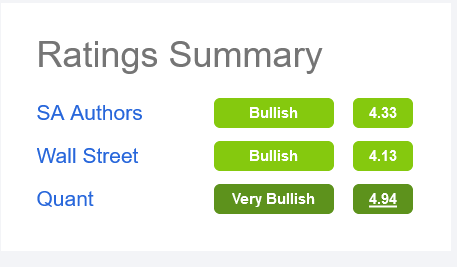

Overall, all analysts tracked by Seeking Alpha …  … are either bullish or very bullish.

… are either bullish or very bullish.

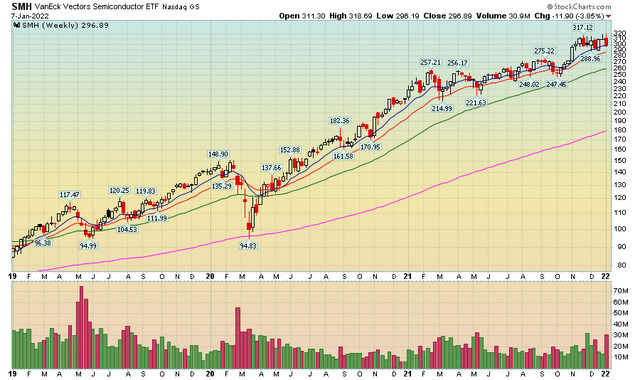

Fundamentally, the company is sound. Now, let’s turn to the industry’s technical picture, starting with a long-term chart: 3-year weekly chart of the SMH from StockCharts.

3-year weekly chart of the SMH from StockCharts.

The semi-conductor ETF has an incredibly bullish long-term chart. All the EMAs are moving higher with the shorter EMAs above the longer EMAs. Prices are using the shorter EMAs for technical support.

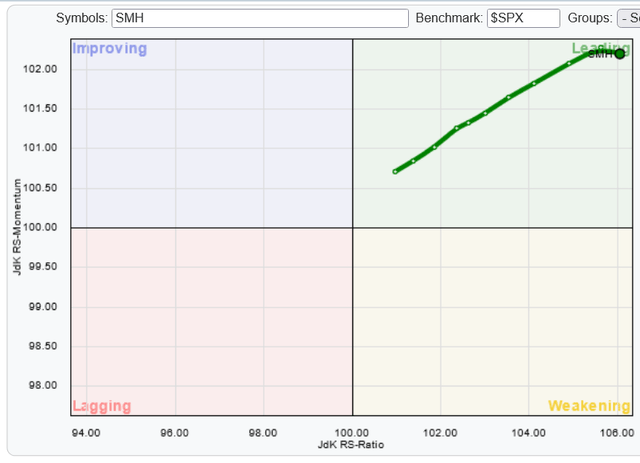

Relative Rotation Graph of the SMH relative to the SPY from Stockcharts.com

Relative Rotation Graph of the SMH relative to the SPY from Stockcharts.com

The SMH has one of the strongest RRG positions I’ve ever seen. This chart uses weekly data, so it shows a longer-term horizon.

Turning to the company, we see a similar technical picture.

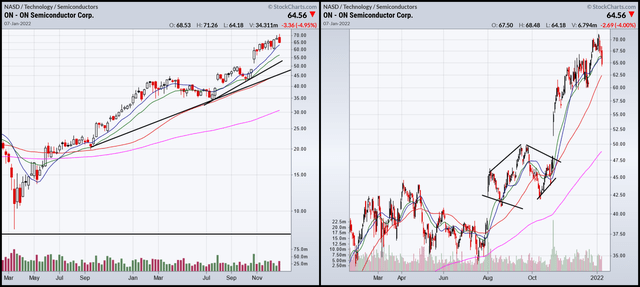

2-year weekly (left) and 1-year daily (right) charts of ON from stockcharts.com

2-year weekly (left) and 1-year daily (right) charts of ON from stockcharts.com

The stock’s weekly chart (left) couldn’t be more bullish. It has the same technical foundations as the SMH ETF (rising EMAs with the shorter above the longer, etc…). The daily chart (right) shows that the stock has gapped higher twice in the last year. At the end of last summer, it broke to new highs at the beginning of August then consolidated sideways in a diamond pattern. This is normally a topping formation. But prices again broke higher in the Fall on the company’s earnings beat.

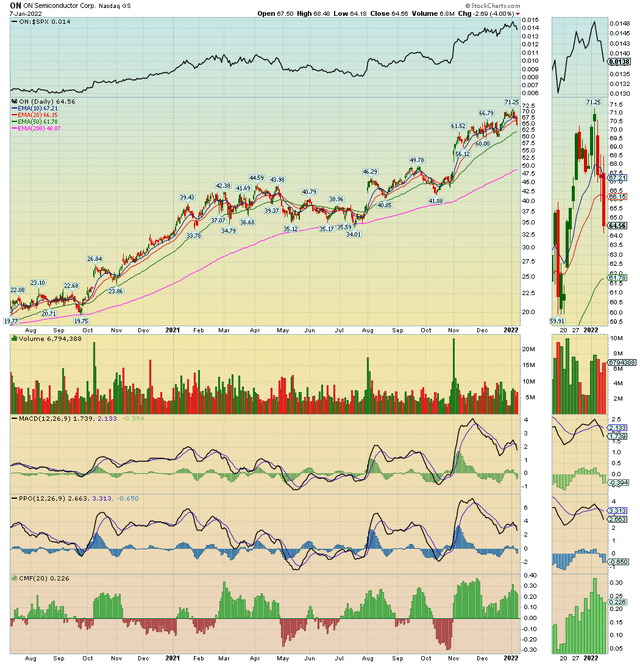

However, the company’s momentum chart profile is weak: 1 1/2-year chart of ON with the ON/SPY ratio (top panel); MACD (1st panel below price); Price Percentage Oscillator (2nd panel below price): Chaikin Money Flow (3rd panel below price). From StockCharts.

1 1/2-year chart of ON with the ON/SPY ratio (top panel); MACD (1st panel below price); Price Percentage Oscillator (2nd panel below price): Chaikin Money Flow (3rd panel below price). From StockCharts.

Momentum (the MACD and PPO) peaked in mid-November 2021 and have been declining since.

Which begs the question — why am I including this company? The answer lies in the following facts.

- The sector backdrop is as strong as it could be. Semiconductor demand is through the roof. The industry has tremendous pricing power due to global manufacturing problems. These aren’t going away anytime soon.

- The company’s revenue growth picture is incredibly strong. The last four quarters have seen earnings beats and record-levels of profits.

- The RRG chart for both the sector and company point to out-performance.

Therefore, there are two ways to play this.

- Take a position outright now, understanding that in the short-term the declining momentum indicators could mean a continued drift lower.

- Put the stock on a watch list and wait for a positive indication from the momentum indicators.

Either is valid.

Be the first to comment