Justin Sullivan/Getty Images News

This article was prepared by Eranda Kalhara, CFA in collaboration with Dilantha De Silva.

Roku, Inc. (NASDAQ:ROKU), a leading TV streaming platform provider mainly focused on the U.S. market, witnessed a sharp rise in its market value during the pandemic period as homebound consumers found solace in Roku and other streaming services/devices. The pandemic-induced revenue growth momentum has come to a halt as the world is getting back to normal. As we have previously highlighted, long-term flexibility in work hours and work-from-home concepts are increasingly going out of popularity today, with many companies expecting their workforce to report back to the office.

The high growth momentum Roku witnessed during the pandemic has proven to be short-lived and the stock has fallen over 66% YTD and more than 76% in the last 12 months. This massive decline in Roku’s market value has pushed Roku stock price to where it was at the beginning of the pandemic more than two years ago, and we believe now is a good time to reassess the prospects for the company to determine whether Roku is a good investment at these prices.

Although there are rumors of Netflix, Inc. (NFLX) bidding for Roku, we do not believe there is a high chance of such a deal. For this reason, we will only focus on Roku’s fundamentals in this analysis.

Ad-supported streaming service to gain traction while switching TV brands to hamper platform revenue

Advertisements have always been a key component of the media industry. Higher revenue from advertisements can compensate for the low growth in other segments, and Roku is a market leader in ad-supported streaming services. The company also offers ad-supported content channels which feature licensed third-party content.

Roku offers multiple mediums for advertisers to reach their target customers, including their AVOD space, the Roku Channel, and other available AVOD services on the Roku platform. Roku has struck gold with value-added services provided to advertisers including data related to behavioral information of users such as location, active time, type of content, and other specifics that help advertisers to better utilize their marketing budget. This service has not only helped to make the platform more AVOD friendly but has also attracted more users. Roku was able to grow the number of advertisers by 20% in 2021, excluding political advertisements.

The cherry on top is that the company was able to retain over 95% of advertisers who were spending over $1 million. In addition, Roku witnessed a surge in the spending of the top 10 broadcast TV advertisers in the first quarter of 2022, with nearly 80% year-over-year growth in spending on Roku while spending 7% less on legacy pay-TV. Roku’s monetized video ads nearly doubled in 2021 driven by an increase in client acquisition, retention, and spending per client.

Some investors believe that attracting or retaining more advertisers to the platform might impact the ultimate user experience. On the contrary, we believe Roku’s successful advertisement model will enable the company to offer more premium content at no cost to users (other than having to tolerate a few advertisements). A classic example is how Roku is offering Bloomberg TV at zero cost to users in the United Arab Emirates.

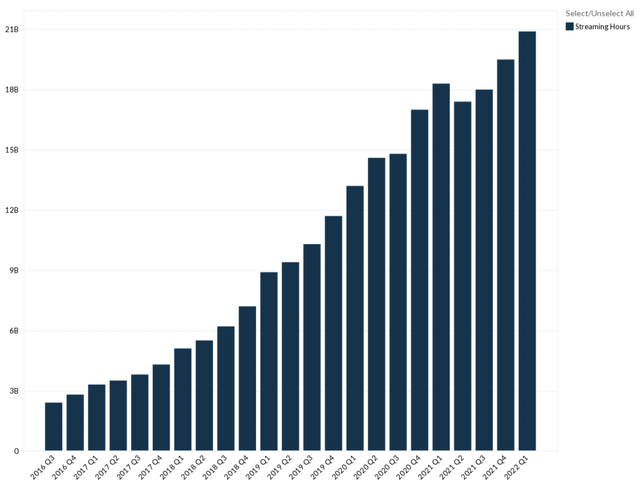

As illustrated below, the total hours streamed on Roku have been moving in the right direction despite a pullback in early 2021.

Exhibit 1: Roku streaming hours

One of the biggest risks Roku is facing today, in our opinion, is the possibility of some of its hardware partners switching to alternatives.

Roku’s OS has been licensed to other hardware partners including TCL and Hisense. The Roku OS is designed to be powered with moderate processing power which is ideal for low-price-scale TVs. Roku charges little to none on the OS and hardware partners receive little to no upside from advertising revenue either. With the high double-digit growth in android TV OS, TCL and Hisense added Android TV to their U.S. product lineups in 2020.

With the increase in sales of Android and other third-party TV OS, we believe these TV brands might attempt to claw some of the economics back from Roku, which could prove to be a massive obstacle for Roku’s growth. Many TV manufacturers are now focused on developing their own operating systems as well (ex. VIDAA U by Hisense), and this could further incentivize some of Roku’s hardware partners to move away from Roku.

Content-neutral standpoint has played well for Roku

A key contributor to the growth of Roku has been its content-neutral standpoint that helps to attract new services while retaining the older ones. Users, including myself, prefer diversity and do not usually like to be tied down to services of one streaming service. I would prefer to watch Black Mirror or Squid Game on Netflix, Peacemaker on HBO Max, and probably another show on a little-known local streaming service. The point is that consumers prefer to make choices on their own rather than having to choose what is available for them in a given Smart TV operating system.

The content-agnostic platform of Roku does not push forward any one media streaming service provider over the other. Roku players gained recognition partly for being neutral in terms of content providers as a result of the company not having any content tie-up, while its competitors such as Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOG) (GOOGL) were not forthcoming in allowing competing services on their streaming devices. This open concept of Roku has not only helped attract users but also in attracting advertisers. In addition to all this, Roku, with its user-friendly interface, is also well-supported by other services such as Google Cast, AirPlay 2 (on many models), and Spotify Connect.

According to Park Associates, Roku leads in the streaming devices and connected TV sector in the U.S. with a market share of 38% in 2021. The company leads by providing the highest percentage of available on-demand services as well, with Roku giving access to 65% of the 225+ on-demand services tracked by Park Associates, while its rivals offer access to less than 50% of these services.

Even though the open stance of Roku has worked well in general, there were instances of pushback from a few media companies leading to limited or delayed service additions such as HBO Max and Peacock. This might lead users to search for alternative platforms. Nonetheless, Roku has been gaining traction with the availability of more than 200 free channels to surf and is in the process of adding more. The must-watch content available through free Roku channels will be able to capture users with a limited spending budget on entertainment in the future, which, in our opinion, could play to the advantage of Roku amid challenging macroeconomic conditions.

The pandemic and low-cost hardware fueled user growth – no more fuel?

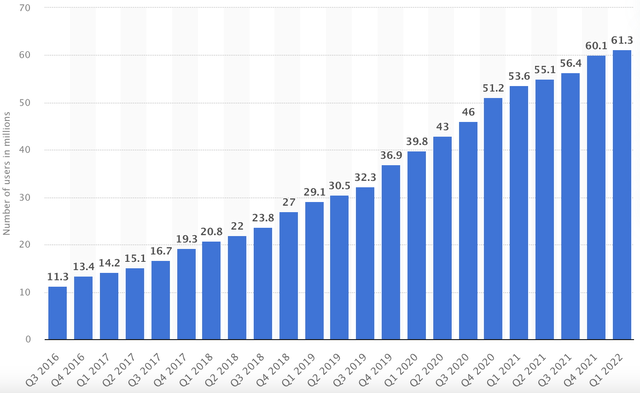

Roku has been enjoying a surge in active users since the beginning of the pandemic, which does not come as a surprise given how mobility restrictions forced consumers to rely on at-home entertainment solutions. Confirming our fears, Roku witnessed a slowdown in user growth in Q1 2022 as the company only added 1.1 million incremental active accounts, leading to 61.3 million total monthly active users.

Exhibit 2: Roku monthly active users

Total streaming hours reached 20.9 billion in the quarter, an increase of 1.4 billion from the last quarter. This growth in streaming hours enabled Roku to expand its ARPU and record an increase in subscription sales.

Roku has been continuously adding new features and channels, and this strategy has led to increased user satisfaction and user retention. The Roku Channel, which contains mostly free content, was among the top 5 channels on the Roku platform in the U.S. by reach and engagement in the last quarter. This has been a strategic core asset of Roku which has been providing users with free entertainment while offering content providers and advertisers many options to distribute and monetize content.

The recent decline in Netflix’s active users leads us to believe that users in this segment are sensitive to price changes (other factors affected Netflix’s lackluster performance, but price sensitivity played a part too), especially in a high inflationary environment. With this in mind, we believe the Roku Channel eco-system is in a good position to weather external shocks. Our projection is for Roku to see moderate user growth in the next few quarters at best, which might not lead to outsized gains in its stock price in the foreseeable future.

Roku offers four different streaming devices with retail prices ranging from $30 to $100, and this affordable price point played a massive role in the company’s growth over the last few years. Today, Roku is facing fierce competition from Amazon Fire TV and Google Android TV which are priced at similar or better rates. Any negative impact on user growth resulting from the intensifying competition in the industry could lead to a contraction in profit margins since Roku will be forced to compete with these tech giants to retain its market share.

Strategic directives and international expansions

Roku competes in a capital-intensive industry where tech giants are relying on funding their R&D programs to compete with Roku. Google, Amazon, and Apple Inc. (AAPL) have a loyal userbase that loves their respective ecosystems, and this threatens the continued growth of Roku. Roku will have to invest in technology R&D and will also be forced to increase its investment in both original and third-party programming. The streaming company confirmed that it will be expanding the original content slate with more than 50 new shows scheduled for the next two years with a target to monetize 155 million people in the U.S. who have access to a Roku device at home. The jury is still out on this new path as not all original content will gain traction. Leading streaming companies in the world including Netflix have spent years mastering their content slate but still come up with original shows that do not gain traction despite all the data that is analyzed before approving the production. Roku, arguably with limited access to consumer data compared to the likes of Netflix, is at a bigger risk of spending millions of dollars to create original content that might fail to gain traction.

Roku is already working on a big-budget bet on original content with the movie ‘Weird: The Al Yankovic Story,‘ a biopic of Weird Al starring Daniel Radcliffe. Given Roku’s limited funding ability and lack of experience compared to competitors, we are wary of investing in Roku before we see data to confirm the company can compete with larger streaming peers. In our opinion, Roku is best positioned as a media-tech company, which has been its strong suit for many years.

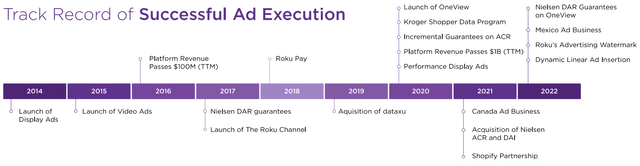

With the acquisition of demand-side platform Dataxu, Roku has positioned itself to compete fiercely for ad dollars supported by enhanced automated services provided to marketers on Roku’s advertising platform. In addition, we appreciate the management’s decision on tactical partnerships and agreements to improve the quality of content in the Roku ecosystem while maintaining successful ad execution. What attracts us to Roku is its ability to offer an ad-supported streaming platform for consumers while maintaining profitability, but the strategic focus on original content has forced us to remain on the sidelines today.

Exhibit 3: Timeline of Roku’s ad business

The long-term growth potential of the company primarily depends on international expansion, which might be challenging given the little-to-no brand recognition of Roku in many markets compared to its peers. In addition, converting users who are used to piracy sites such as torrents in frontier markets will require deep pockets.

That being said, it should be relatively easy to convince users of many international markets such as India and Brazil to sign-up for an ad-supported streaming platform that offers a wide variety of content from premium and free-to-air channels in comparison to users of many western markets that look down on ad-supported platforms. This is because users in these populous regions are already familiar and okay with ad-supported models as long as they offer quality content at zero cost.

Takeaway

There is a lot to like about Roku – from its content-neutral standpoint to the successful ad-supported business model. However, the streaming industry is going through radical changes today with even Netflix wanting to focus on ad-supported streaming while macroeconomic conditions are hampering short-term growth prospects. Roku, on the other hand, is pivoting toward original content creation, which is a very risky bet, in our opinion. Amid these challenges, we have decided to remain on the sidelines today.

Be the first to comment