Khanchit Khirisutchalual/iStock via Getty Images

Co-produced with Treading Softly

It’s no big secret the market has been a real downer this year. You’d have to be living in a van down by the river, out in the mountains, and be entirely disconnected from the news.

In a bear market, it’s easy to be discouraged and frustrated with your portfolio’s performance. When the market moves in ways well outside of our individual control, it can be scary for investors. Many investors compare investing in the market to “gambling” because they can’t predict market movements and they don’t know how to manage them.

However, you don’t need to predict what the market will do tomorrow to make money. I can’t determine or decide what millions of others think is a good price to trade my shares for. They make that decision for themselves. I can, however, control how much my portfolio generates in income by placing my dollars to work in sectors and investments that generate a solid income stream.

It’s even better when the market is falling and I own holdings that are actively raising their dividends. That’s right. Various companies, funds, and securities are seeing rising payouts instead of falling ones. They aren’t setting their dividend policy based on popular opinion. They are earning profits and their distributions are based on how much they make. This allows me to get more money from the same investment, and if the price has fallen, I get an even better yield when I reinvest those dollars.

Predicting what other people will pay me tomorrow for my ownership of a particular company is impossible. Fortunately, I don’t care what they offer, I’m not planning on selling. I just focus on investing in companies that have the best chance of earning more in the future.

Let’s dive in and look at two picks that are hiking their dividends, as we predicted they would.

Pick #1: ATAX – Yield 8%

When we last talked about America First Multifamily Investors, L.P. (ATAX), we highlighted the significant CAD (Cash Available for Distribution) that ATAX was generating and that those gains would be passed along through dividends. We just didn’t know exactly how. We wrote:

We don’t know how ATAX will distribute these proceeds. They might raise the regular distribution when the next one is announced in mid-June, they could announce a “supplemental” distribution that will pay out the gains over time as many BDCs do, or they could simply store up the gains and pay a massive year-end distribution. It could even be a combination of those three.

We can be very confident that these gains will be distributed to shareholders, and at HDO, we aren’t all that particular about what the paying company wants to call them. We’ll be happy to collect!

Sure enough, when ATAX announced its dividend, it was increased 12% to $0.37/quarter. Plus, ATAX announced a “supplemental” dividend of $0.20 to distribute gains from the Vantage sale. I love when investments hike their dividend, it is usually a signal that management expects the high earnings to continue. The safest dividend is often the one that was just raised.

What I love, even more, is when a company hikes its dividend and the price comes down! ATAX announces a 12% hike, and its price fell over 6% on June 10th! Some days, I just have to shake my head and wonder if the market is allergic to cash.

All I can say is thanks! I can get a yield of 8% and a portion of that will be Federal Tax exempt!

But wait, it gets even better. ATAX already has $1.55 in CAD in the books including Q1 earnings and two asset sales. Historically, ATAX seeks to distribute approximately 100% of CAD. Excluding the asset sales, ATAX has $0.38 in CAD. In other words, ATAX’s new distribution of $0.37 is approximately their run rate for their recurring earnings. We’ll see additional supplements throughout the year as the $0.20 announced is only a portion of the excess ATAX has to distribute.

ATAX’s main investments are in MRBs (mortgage revenue bonds) which are issued by state housing agencies to encourage the construction of affordable government-subsidized housing and the development of new-build apartments that are not affordable housing.

The MRB segment is a niche investment that doesn’t get a lot of attention from large institutions. ATAX profits from the interest payments, and these are the revenues that are Federal Tax-exempt, a benefit that is passed along to investors through the partnership structure.

ATAX will sometimes provide an additional loan to the developer. The MRB loans are secured by a first-lien interest in the property and if ATAX makes a second loan that is usually a higher coupon second-lien interest. What makes ATAX unique is that it has the ability to take over and actively manage a property. Back during the Great Financial Crisis, they did have to foreclose on some properties. ATAX proved its ability to successfully manage and eventually sell those properties to get a recovery, this gives us a lot of confidence to hold ATAX even through a recession.

The “Vantage” joint venture is where ATAX provides capital to build new apartments. ATAX’s partner does the actual building and leasing up of the properties. Once the properties are at high occupancy, the properties are sold for a profit to investors. ATAX doesn’t have direct control over when the properties are sold, so this segment results in somewhat unpredictable, but large gains.

Apartment rents have been skyrocketing, and ATAX is benefiting from the apartments that were built during COVID but weren’t sold. Where a typical year will see a couple of apartments sold, ATAX has already seen two sales this year at a record high prices and there could be another 2 to 4 property sales before year-end.

This year, we expect that ATAX’s regular distribution will be covered by their recurring cash flow alone. It is looking likely that the proceeds from the Vantage properties will be distributed as a special dividend at year-end like they were last year.

The market might be running away from cash, I’m running towards it!

Note: ATAX is a partnership and issues a K-1 tax form.

Pick #2: BRSP – Yield 10.6%

BrightSpire Capital, Inc. (BRSP) is a commercial mortgage REIT that hiked its dividend by another 5% to $0.20/quarter. This is over a 40% increase from the $0.14 dividend paid the same quarter last year, having increased the dividend each quarter!

One question I am often asked when prices fall is “when will the dividend get cut?”. Investors assume that somehow dividends and share price are tied together. They aren’t. Dividends are not determined by the share price of any investment.

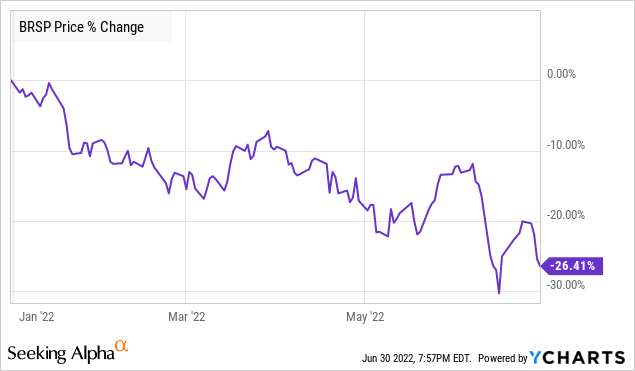

Here is BRSP year-to-date:

Did BRSP cut? No, BRSP hiked its dividend twice during this period and is paying out a dividend that is 11% higher today than it was paying on the 1st of January.

BRSP’s price has simply followed the price of the entire market as the S&P 500 is down a similar amount and the Nasdaq is down a good bit more. It is true that if a dividend stock is going down while the rest of the market is going up, the price action could be indicative of some kind of concern over the dividend. After all, the risk of a dividend cut is one reason why investors might sell a dividend-paying stock, however, it is far from the only reason investors sell.

This is why I don’t put a lot of emphasis on price. Every investor is buying or selling for their reasons. I’m going to buy or sell for my reasons. What is my reason? I want income that is going to fund my retirement.

My focus is always on what the company will earn, companies that earn more. Their earnings go straight to my pocket through the dividend, and in the long run, the market tends to come around.

What does BRSP do? They lend floating-rate mortgages – when interest rates go up, do you want to have floating-rate mortgages? Yes!

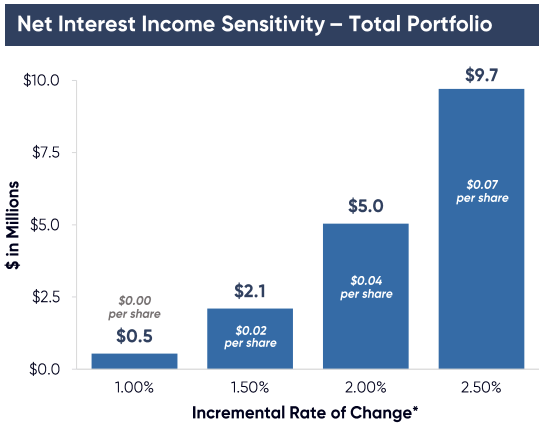

BRSP’s income is growing from two sources. First, as interest rates rise, BRSP’s net interest income goes up directly as a result.

Supplemental Financial Report

This is from the end of Q1 when the Fed’s target rate was 0.25%-0.5%. Today it is 1.5%-1.75%. Already 1.25% higher and the Fed is suggesting it will raise at least 0.5% and maybe even 0.75% next month. BRSP’s earnings are improving as a result.

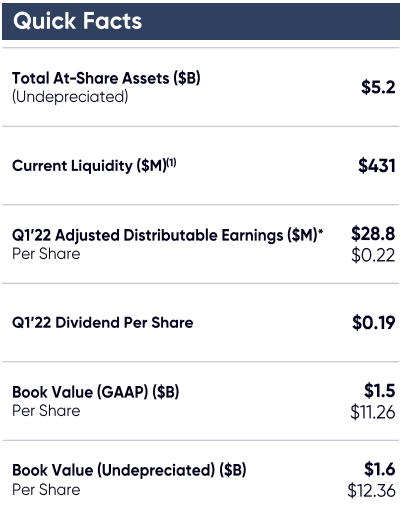

In addition to growth through rising rates, BRSP has a significant amount of liquidity, with over $431 million. BRSP’s plan coming into 2022 is to deploy that capital to increase earnings.

Investor Presentation

BRSP was earning $0.22 in Distributable Earnings in Q1, easily covering their newly raised $0.20 dividend. As BRSP’s income continues to climb, we expect more raises in the next few quarters.

BRSP’s income is climbing and in the current rate environment, we can expect it to climb more, and that’s enough for me to be buying! For those with an obsession with book value, note that BRSP is trading at a +35% discount to book value!

Dreamstime

Conclusion

With BRSP and ATAX, in many ways, we can eat our cake and have it too. The market is selling off their shares even as the companies are earning so much income they are raising their dividends. We get more dividends, for a cheaper price!

So what will you do with those dividends? That’s up to you! Receiving cash dividends provides you with the ultimate level of flexibility. You can reinvest it into the market and snag great opportunities at amazing prices. You can reinvest it into BRSP and ATAX, increasing your ownership of these two income engines. You could save the cash for a rainy day, or even splurge and get a gift for yourself or a loved one. The options are endless.

This is why I love income investing, especially with a focus on retirement. Retirement often is a time where retirees have less required work to do, but also less free spending money. You have countless hours in the day to fill with whatever you want to do. Often the “doing” comes with some sort of dollar-cost to it. So leveraging your largest asset – your retirement portfolio – to generate a large, recurring, and reliable sum of income for your coffers is an excellent means to find financial security and independence.

The market has been a real downer this year, but picks like ATAX and BRSP are allowing my income to be up. How is your income stream doing? Is it growing all on its own?

Be the first to comment