Eric Francis/Getty Images News

Only when the tide goes out do you discover who’s been swimming naked – Warren Buffett

Written by Sam Kovacs

Introduction

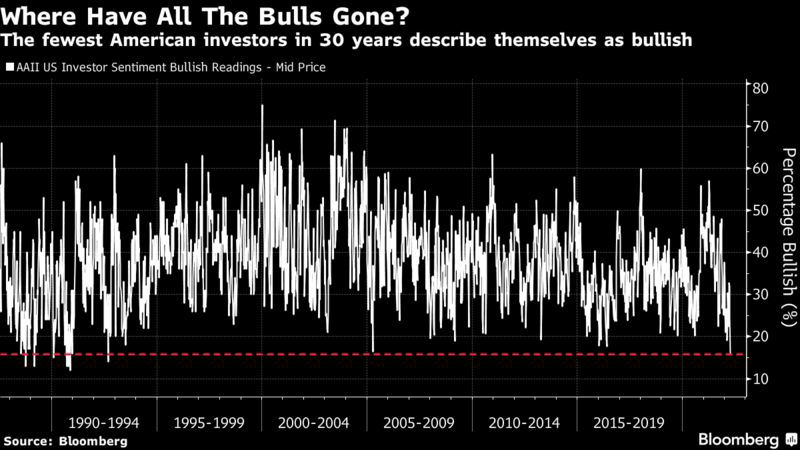

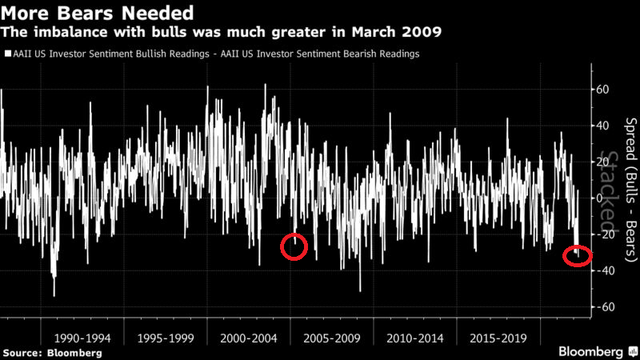

Where have the bulls gone? There are less bulls today than there were during the 2020 lockdowns. There are less bulls today than there were after the 9/11 attacks. There are less bulls today than there were during the Great Financial Crisis.

Bloomberg

This is the lowest reading from the AAII survey in the past 30 years.

This is not to say that American investors now describe themselves as bearish, as the bulls – bears graph is a lot less extreme.

What this tells you, is that Americans are undecided.

There were very few bulls in 2005, just before 2 more stellar years for the index. Similarly, bears hadn’t overtaken yet.

That is far from the only similarity with 2005.

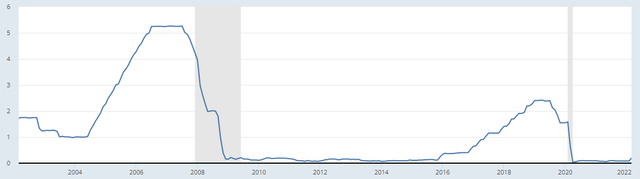

The economy was overheating. The likes of Ackman had already established positions against Real Estate (which would ultimately prove too early). The fed was amid a tightening cycle.

2005 was also 2 years after the previous trough, and conflicting views have caused investors to be unsure how to position themselves.

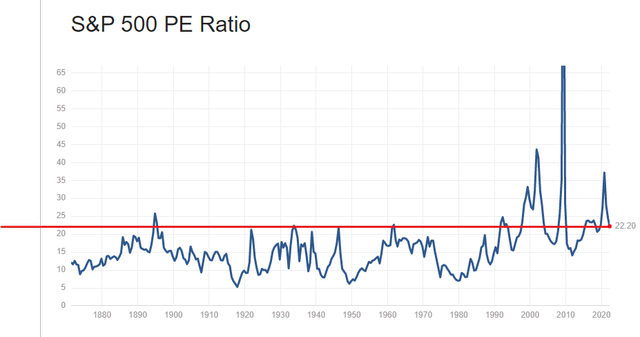

But here’s the thing. P/E ratios are not nearly as bad as they were.

And while a ratio of 22x might seem historically high when we look at the past 150 years, this would overlook the trend towards printing excess amounts of money that has developed during the past two decades.

As I’ve said before, with so much excess cash having been added into the economy during the past two years, there is no real place for it to stay in than financial assets, bloating valuations.

Is it sustainable? no. Do we need to account for it in our analysis? Yes.

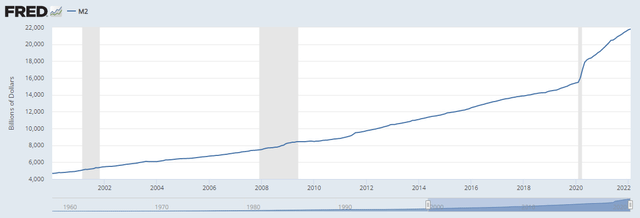

Want to hear something scary? There are 36.5% more dollars moving around today than there was in just before the pandemic. This number has never decreased, it keeps increasing, at a slope higher than pre-pandemic.

Real yields are still in deep negative territory. No cash has been withdrawn from the economy (as modern monetary theory would have suggested at this point).

Where do you want stocks to go? The only answer is up.

We need to be cognizant however, that if you’re going to be the last bull, you’re also likely taking part in the last bull of this market cycle.

When the tide goes out, you do not want to be caught naked.

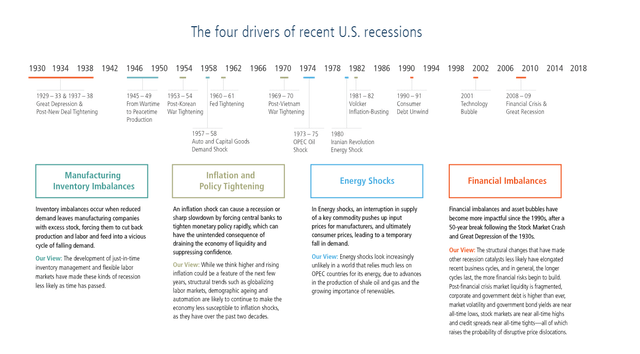

When you look back over the past 100 years or so in the US, there have been 4 key drivers of recessions: Manufacturing imbalances, inflation and policy tightening, energy shocks, and asset bubbles.

Any of these sound familiar in the current environment?

I believe ultimately the Fed will kill the market by raising rates way more than anyone is currently anticipating.

The tightening cycle will likely go on throughout the next two years or so.

Stock Pickers Should Be Picky

Therefore, it is important that we favor stocks which:

- Are well valued. Now is not the time to overpay.

- Are in a supportive macro environment.

- Have appealing dividend policies.

The last point is particularly important, and at the center of our framework at the Dividend Freedom Tribe.

While Robert and myself work hard to uncover alpha for members, as we did by being among the first to accumulate overweight energy positions at fantastic valuations post COVID, our system doesn’t rely on this.

We buy stocks when they have a mix of yield and dividend growth potential which ensures we’ll be able to retire off dividends and live happily ever after.

What this means for any individual will change based on age, assets, saving power, and lifestyle expectations in retirement.

But effectively, if you can buy high quality stocks when the dividend growth promises a stress-free retirement, so long as you don’t get it wrong on the dividend growth profile, you’ve already won.

But since doing this results in us buying high quality stocks when they’re cheap, we’ve realized that we could do a lot better by also selling them when they become overvalued.

This results in us buying low, getting paid to wait, and selling high. If we have to get paid to wait forever, we’ll still come out on top.

And that is an extremely crucial point to remember. Stock market investing isn’t an end in and of itself, it’s a means to an end. Usually that end is a happy retirement.

That is why you’ll never see us suggesting untested stocks with no dividends.

With that said, let’s show this with a few examples.

Buy Philip Morris, Avoid Coca-Cola

Let’s look at two consumer staples stocks. Staples usually do better in late cycle stages of the market, because of their defensive nature, and inflation resistant profiles.

Let’s look at two dividend investor favorites: Philip Morris (PM) and Coca Cola (KO).

Both can be frowned upon morally. The former causes cancer, the latter obesity. Both are polluting. Bad, bad, bad.

But they also generate a lot of cash, pay dividends, and have global consumers who love their products.

And at a first glance, they are quite similar.

PM has been growing its dividend at 5% per annum during the past decade.

KO has been growing its dividend at 5.6% per annum during the past decade.

PM pays out 73% of its free cashflow as a dividend.

KO pays out 76% of its free cashflow as a dividend.

Both have decades of history of paying increasing dividends.

Fundamentally, we’re looking at 2 American behemoths, who have moats so large around their businesses that they will not be displaced so simply.

But the market appreciation of these stocks is significantly different.

You see, KO yields 2.6% and trades at 29.7x earnings.

PM, however, yields 4.85% and trades at 17.7x earnings.

Maybe part of that difference is due to the perception of sin. Sugar is generally more tolerated than tobacco, despite obesity killing more than smoking.

So, there is a widespread bias which tilts PM’s yield higher. This is a structural benefit for investors.

But there is also a seasonal effect whereby PM is slightly undervalued relative to its history, whereas KO is significantly overvalued.

During the past decade, PM has yielded a median 4.68%, whereas KO has yielded a median 3.1%.

Let’s see these on the MAD Charts. (click here to find out more about how they work)

Let’s look at PM first.

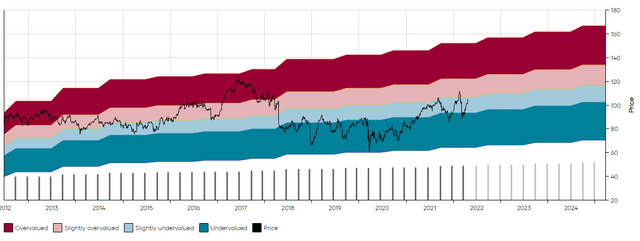

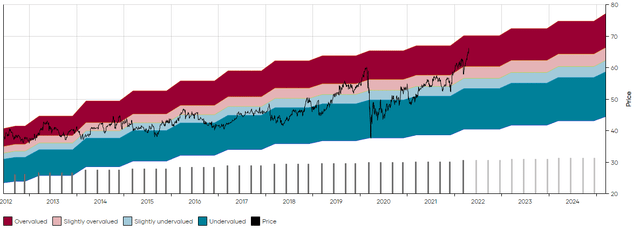

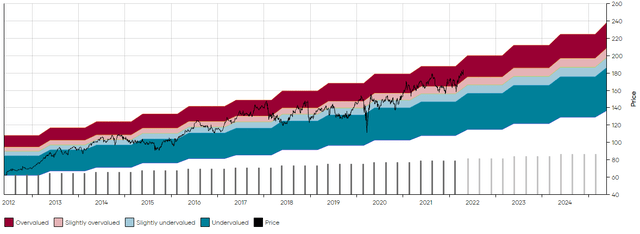

Dividend Freedom Tribe – PM MAD Chart

As you can see, it is trading quite close to its median yield. At this yield PM has very good overall potential. From all of our past analysis, we estimate that PM can grow its dividend at about a 4% rate in upcoming years.

This results in great dividend potential.

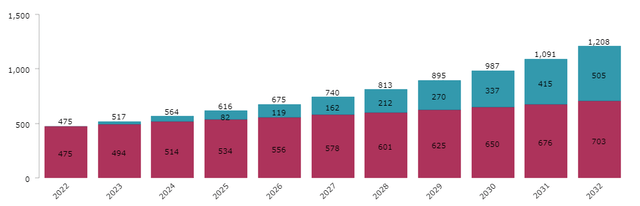

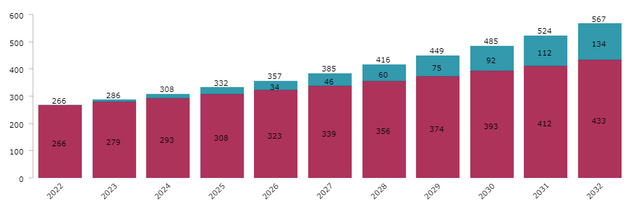

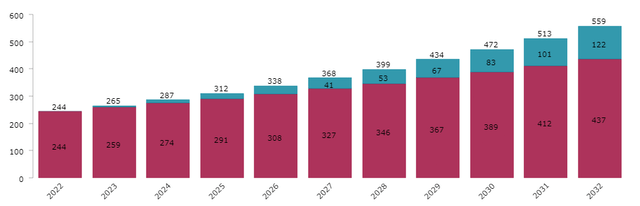

Let’s simulate the dividends received each year for the next 10 years, if you purchased PM at the current price and reinvested proceeds every year while the dividend grew at 4% per annum.

Dividend Freedom Tribe – PM Income Simulation

In year 10, you’d expect to receive $1,208 in dividends, or 12% of your original investment. This is excellent.

Let’s compare this to KO.

Dividend Freedom Tribe – KO MAD Chart

Coca Cola is trading at a valuation which is historically significantly overvalued. It has not managed to sustain these valuations in the past 10 years. This makes it unlikely that it breaches $70. If it does breach that level, then the price of KO runs into unchartered territory. Even if it climbs to $80, that is only 12% appreciation from here. PM would have to increase 60% to be similarly overvalued.

Plus, the income from a position in KO is underwhelming.

If you invest 10K today and the dividend continues to grow at 5% and you reinvest dividends, then in year 10 you’d expect to receive $567 or 5.67% of your original investment.

Dividend Freedom Tribe – KO Income Simulation

This is not satisfying. Our rule of thumb is that it should ideally be 10% in 10 years, and no less than 8%.

Therefore, by buying PM and avoiding KO you get:

- Similar fundamentals.

- Higher yield.

- More exposure to value.

- Less risk.

All things we’re looking for in the current market environment.

Buy Enbridge, Avoid Johnson & Johnson

For the second example, I want to highlight two stocks in different sectors.

Both sectors, energy and healthcare are expected to continue to do well in the late stages of the cycle.

Getting the macro alone right will not save you however when the market ultimately corrects.

You need to get the micro right, so you don’t get wrecked.

Enbridge (ENB) , is a stock which we’ve been repeatedly suggesting since it traded at just above $30.

It now trades at $47.

What I love is when a stock increases more than 50% since purchase, and it is still a buy.

This is the case for Enbridge.

The company has suffered not from a downtick in financial performance. Its earnings, revenues and dividends have increased like clockwork.

Now what has hurt ENB is a curious factor: Wokeness.

When we were recommending doubling down on Energy when everyone thought the world would run on rainbows and dandelions, we often said that investors could “go woke or get paid”.

ENB now yields 5.8%, but is on the rise and has breached its historical resistance of $40.

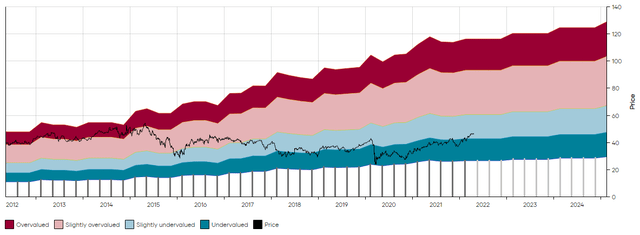

Dividend Freedom Tribe – ENB MAD Chart

Management increases distributable cashflow to increase 5% to 7% per year over upcoming years which should result in similar dividend increases. The MAD Chart looks a little funny because ENB is a Canadian stock and so the exchange rate affects the USD value of the dividend from quarter to quarter.

Nonetheless, a 5.8% on ENB is still nonsensical.

The company is the backbone of much of America’s energy transportation.

It is evergreen, operating effectively what is a toll business.

Enbridge should yield 4% to 4.5%, not 5.8%.

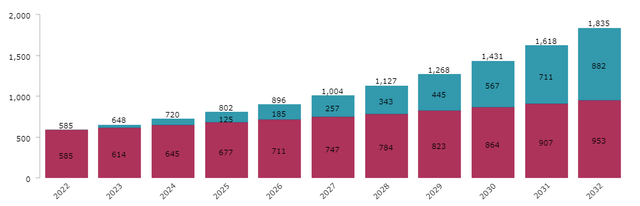

Just look at the crazy dividend potential. If ENB increases its dividend at 5% per annum, and you invest 10K, and reinvest dividends annually, then in year 10 you’d expect to receive $1,835, or 18.35% of your original investment.

Dividend Freedom Tribe – ENB MAD Chart

This is huge. It tells you one thing. The market is mispricing ENB. This will adjust. If it doesn’t, well ENB is already priced for a bear market.

Johnson & Johnson (JNJ) however, doesn’t share the same fate.

The company is as All Weather as they come. Great management. Brilliant stewards of capital. Phenomenal business. Love them.

But at the right price.

At the current price of $184, JNJ is quite overvalued historically, even with the latest dividend increase.

Dividend Freedom Tribe -JNJ MAD Chart

During the next 2 years, investors cannot expect it to increase more than to $200-$210 in extreme conditions.

The current yield of 2.45% is slightly above the tight band of 2.6% to 2.9% within which JNJ usually lives.

The 6.6% dividend growth potential doesn’t justify the current price.

Yes, I think it might ultimately be going a little higher, but am not comfortable holding at the current price because downside in a recession ($120-$130) is much more significant than the upside.

If you invest $10K in JNJ at current prices, while reinvesting dividends and the dividend continues on its long-term trend of 6% per annum, then in year 10 you can expect to receive $559 in income, or 5.59% on your original investment.

Dividend Freedom Tribe – JNJ Income simulation

Therefore, JNJ is the type of stock you’d want to avoid right now, as the music will invariably stop while you’ll still be dancing.

Conclusion

Hopefully, this article will have given you a feel for what is yet to come in this bull run. Given that you never know when, or how much things will increase or decrease, you want to protect your downside.

The best way we’ve found to do that was to invest in your future dividend income stream and shift to value.

So far, it’s worked great. Best luck in these murky waters. Survive and thrive, or perish and vanish.

Be the first to comment