MicroStockHub

I adopted the DVK Quality Snapshots in 2019 after reading this article by David Van Knapp on high-quality, high-yield DG stocks. This simple yet elegant system provides a quick way to assess the quality of dividend growth [DG] stocks. It employs five widely used quality indicators from independent sources and assigns 0-5 points to each quality indicator, for a maximum of 25 points.

In this article, I deploy DVK Quality Snapshots to find the highest quality DG stocks in Dividend Radar, an automatically-generated spreadsheet of DG stocks (trading on US exchanges) with dividend increase streaks of at least five years. I’m using the same stringent screens DVK used in this June 2020 article and in my update in August 2021.

It is informative to see how the quality scores of DG stocks have changed over the past year.

Quality Scoring

In devising DVK Quality Snapshots, DVK decided to consult widely-used and trusted sources that rate or rank various factors related to quality: Value Line, Morningstar, S&P Global, and Simply Safe Dividends.

He selected the following quality indicators to determine each stock’s quality score:

- Value Line [VL] Safety Rank

- Value Line [VL] Financial Strength ratings

- Morningstar [M*] Economic Moat

- S&P Global [S&P] Credit Ratings

- Simply Safe Dividends [SSD] Dividend Safety Scores

Readers can learn more about each quality indicator by clicking on the links.

VL’s Safety Rank measures the total risk of each stock relative to approximately 1,700 other stocks covered by VL. The safest stocks receive a rank of 1, whereas the riskiest stocks receive a rank of 5.

In nine steps, VL also provides Financial Strength ratings, from A++ to C. To assign ratings, VL considers factors such as balance sheet strength, corporate performance, market capitalization, and stability of returns.

The following quality indicator is M*’s Economic Moat, a proprietary data point that reflects the strength and sustainability of a company’s competitive advantage. A wide moat company can sustain its competitive advantage for at least 20 years, whereas a narrow moat company can do so for at least 10 years.

S&P provides Credit Ratings to help investors determine investment risks. Ratings are either investment grade (AAA through BBB-) or speculative (BB+ through D).

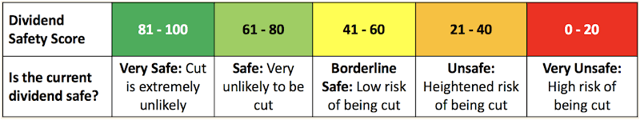

The final quality indicator is SSD’s Dividend Safety Scores, which are based on more than a dozen fundamental metrics that influence the ability of companies to continue paying dividends:

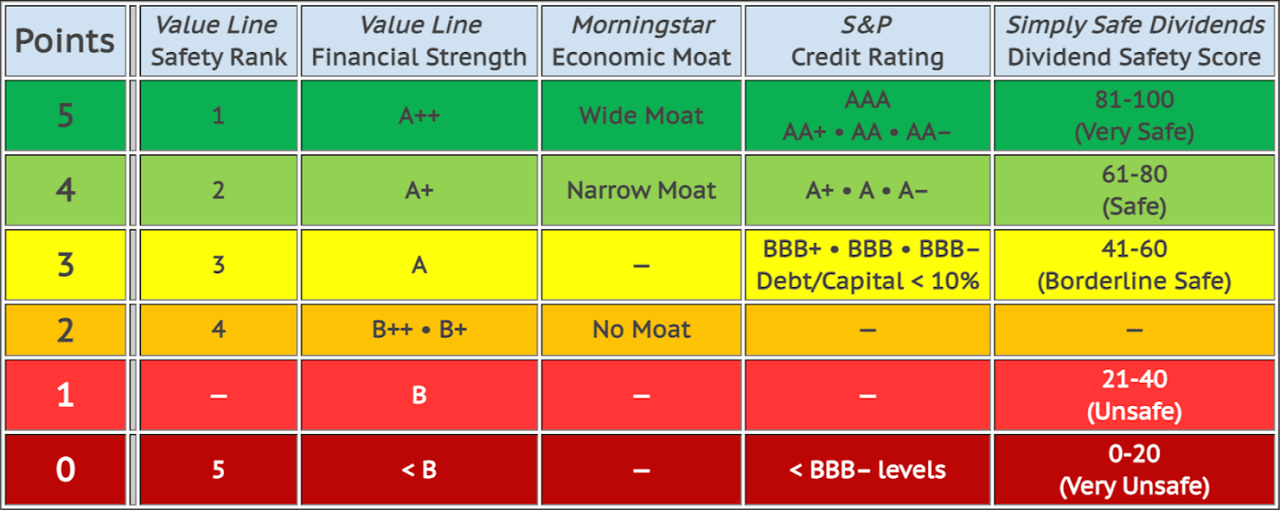

Here is the scoring system used to compile DVK Quality Snapshots:

Created by the author to explain the DVK Quality Snapshots scoring system

Generally, 5 points are assigned to the highest ranks and best ratings so that the highest quality stocks would get 5 points on every factor for a maximum score of 25 points.

For S&P credit ratings, points are only awarded for investment-grade stocks. A stock gets either 5, 4, 3, or 0 depending on its credit rating, or 0 if it doesn’t have a credit rating. Some stocks do not have credit ratings, including stocks with no or little debt. In such cases, the scoring system assigns 3 points to stocks with a Debt/Capital of less than 10%.

Highest Quality

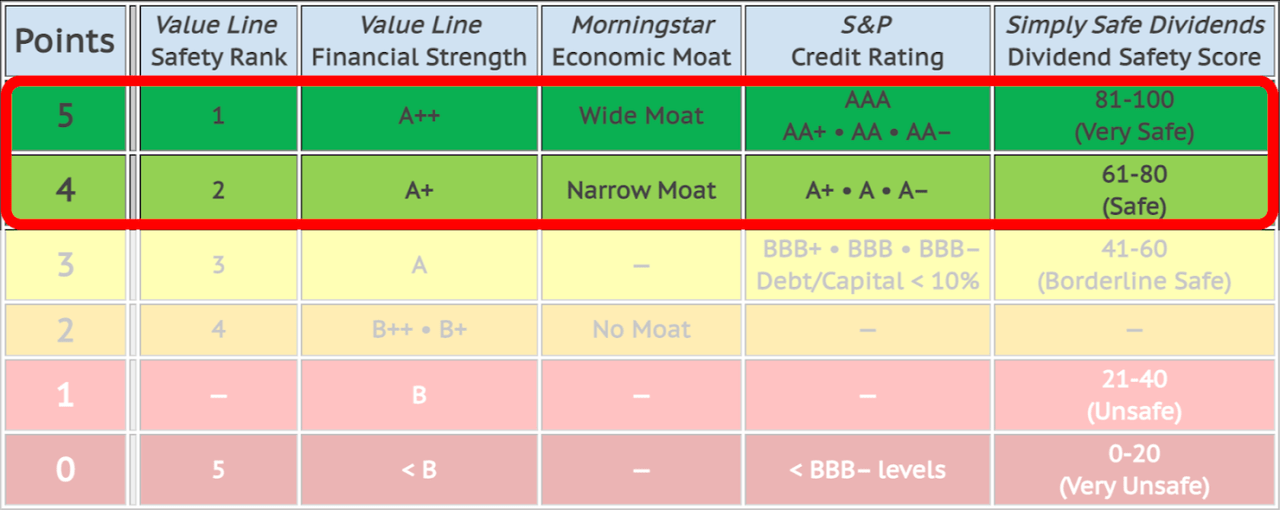

To screen for the highest quality DG stocks, I’m following DVK’s lead in considering only stocks that appear in the top two scoring categories of all five quality indicators, as illustrated in the following image:

Created by the Author, following DVK’s June 2020 article

The top-scoring stocks received 5 points for every quality indicator, for a maximum score of 25 points. The lowest qualifying stocks received 4 points for every quality indicator, for a total of 20 points.

Key Metrics and Fair Value Estimates

Below, I’m presenting tables for each qualifying score (25 points down to 20 points). Stocks are presented in rank order.

Each table presents key metrics of interest to DG investors and the DVK Quality Snapshots quality indicators.

-

Yrs: years of consecutive dividend increases

-

Adj Qual: DVK Quality Snapshots quality score

-

Fwd Yield: forward dividend yield for a recent share Price

-

5-Avg Yield: 5-year average dividend yield

-

5-DGR: 5-year compound annual growth rate of the dividend

-

5-YOC: the projected yield on cost after five years of investment

-

C#: Chowder Number, a popular metric for screening dividend growth stocks

-

5-TTR: 5-year compound trailing total returns

-

Buy Below: my risk-adjusted buy below price

-

-Disc +Prem: discount or premium of the recent share Price to my Buy Below price

-

Price: recent share price

|

Color-coding

|

I use a survey approach to estimate fair value [FV], collecting fair value estimates and price targets from several online sources such as Morningstar, Finbox, and Portfolio Insight. Additionally, I estimate fair value using each stock’s five-year average dividend yield. With up to 11 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

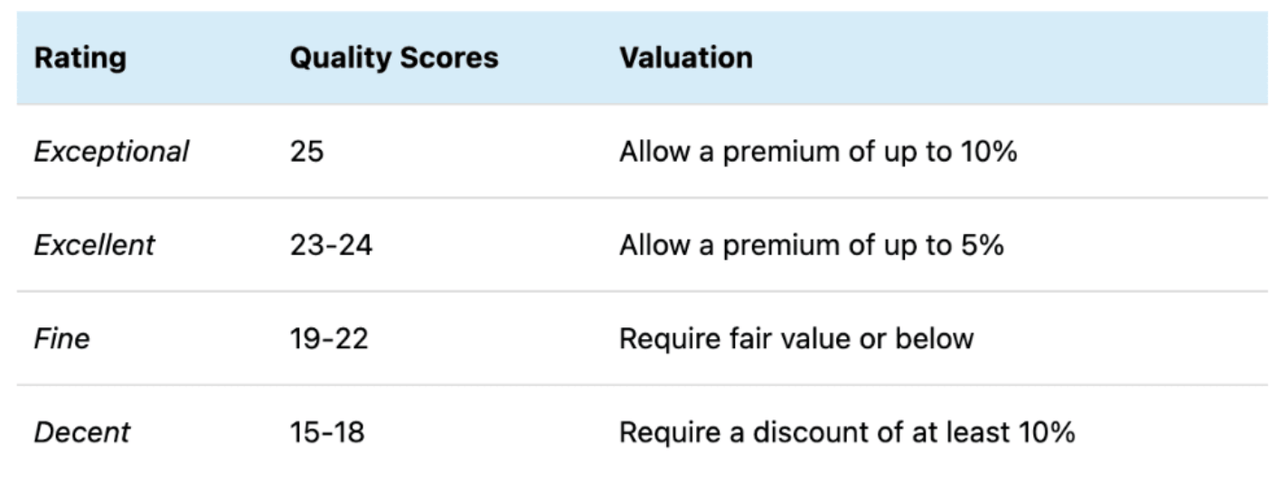

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

Created by the author

My Buy Below prices recognize that the highest-quality stocks rarely trade at discounted valuations. As a dividend growth investor with a long-term investment horizon, I’m more interested in owning quality stocks than getting a bargain on lower-quality stocks.

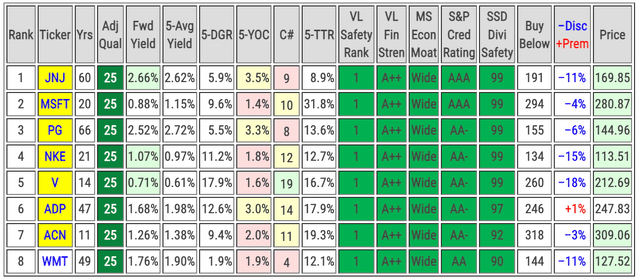

Stocks Scoring 25 Points

This elite group of stocks earned the top scores for every quality indicator, scoring a perfect 25 out of 25 points. I rate these stocks Exceptional.

Created by the author from a personal spreadsheet

| Rank | Company (Ticker) | Sector | Supersector |

| 1 | Johnson & Johnson (JNJ) | Health Care | Defensive |

| 2 | Microsoft (MSFT) | Information Technology | Sensitive |

| 3 | Procter & Gamble (PG) | Consumer Staples | Defensive |

| 4 | NIKE (NKE) | Consumer Discretionary | Cyclical |

| 5 | Visa (V) | Information Technology | Sensitive |

| 6 | Automatic Data Processing (ADP) | Information Technology | Sensitive |

| 7 | Accenture plc (ACN) | Information Technology | Sensitive |

| 8 | Walmart (WMT) | Consumer Staples | Defensive |

WMT is new to this group after an upgrade to its SSD Dividend Safety Score.

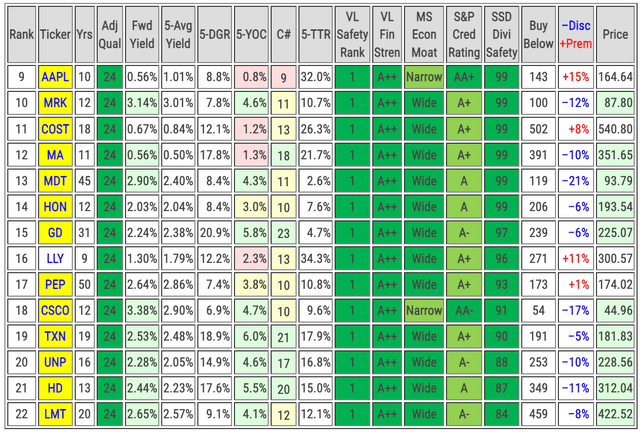

Stocks Scoring 24 Points

The stocks in the second group missed a perfect score by missing out on just one of the quality indicators. This is evident in the table, where a lighter green replaces the darker green. I rate stocks with quality scores of 22-23, Excellent.

Created by the author from a personal spreadsheet

| Rank | Company (Ticker) | Sector | Supersector |

| 9 | Apple (AAPL) | Information Technology | Sensitive |

| 10 | Merck (MRK) | Health Care | Defensive |

| 11 | Costco Wholesale (COST) | Consumer Staples | Defensive |

| 12 | Mastercard (MA) | Information Technology | Sensitive |

| 13 | Medtronic plc (MDT) | Health Care | Defensive |

| 14 | Honeywell International (HON) | Industrials | Sensitive |

| 15 | General Dynamics (GD) | Industrials | Sensitive |

| 16 | Eli Lilly (LLY) | Health Care | Defensive |

| 17 | PepsiCo (PEP) | Consumer Staples | Defensive |

| 18 | Cisco Systems (CSCO) | Information Technology | Sensitive |

| 19 | Texas Instruments (TXN) | Information Technology | Sensitive |

| 20 | Union Pacific (UNP) | Industrials | Sensitive |

| 21 | Home Depot (HD) | Consumer Discretionary | Cyclical |

| 22 | Lockheed Martin (LMT) | Industrials | Sensitive |

WMT was promoted, and Intel (INTC) was demoted (see below).

Two stocks dropped out altogether:

- CME Group (CME), with its lower VL Financial Strength rating of A

- Stryker (SYK), with its lower S&P Credit Rating of BBB+

Stocks Scoring 23 Points

These stocks missed the highest rating level on two quality indicators. As mentioned above, I rate stocks with quality scores of 22-23, Excellent.

Created by the author from a personal spreadsheet

| Rank | Company (Ticker) | Sector | Supersector |

| 23 | UnitedHealth (UNH) | Health Care | Defensive |

| 24 | BlackRock (BLK) | Financials | Cyclical |

| 25 | Ecolab (ECL) | Materials | Cyclical |

| 26 | Air Products and Chemicals (APD) | Materials | Cyclical |

| 27 | Hershey (HSY) | Consumer Staples | Defensive |

| 28 | Comcast (CMCSA) | Communication Services | Sensitive |

| 29 | Illinois Tool Works (ITW) | Industrials | Sensitive |

| 30 | Intel (INTC) | Information Technology | Sensitive |

| 31 | Coca-Cola (KO) | Consumer Staples | Defensive |

| 32 | Bristol-Myers Squibb (BMY) | Health Care | Defensive |

| 33 | Emerson Electric (EMR) | Industrials | Sensitive |

| 34 | 3M (MMM) | Industrials | Sensitive |

| 35 | Pfizer (PFE) | Health Care | Defensive |

| 36 | Amgen (AMGN) | Health Care | Defensive |

| 37 | Abbott Laboratories (ABT) | Health Care | Defensive |

| 38 | Raytheon Technologies (RTX) | Industrials | Sensitive |

There are two additions to this group. INTC got demoted into this group after its SSD Dividend Safety Score changed from Very Safe to Safe. ABT got promoted into this group after it earned a higher S&P Credit Rating.

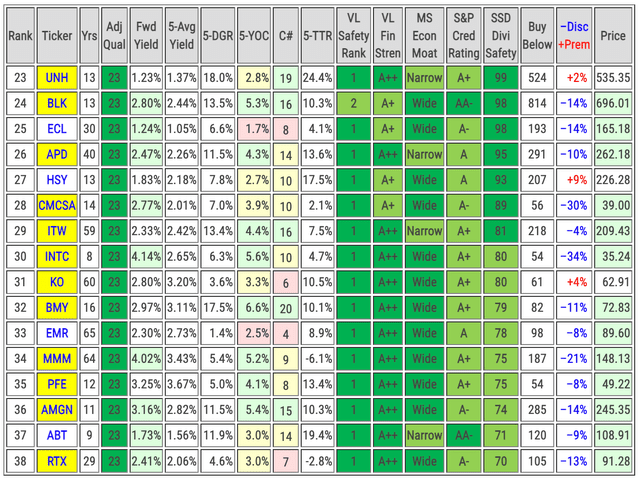

Stocks Scoring 22 Points

The stocks in this group missed the highest rating level on three quality indicators. I rate stocks with quality scores of 19-22, Fine.

Created by the author from a personal spreadsheet

| Rank | Company (Ticker) | Sector | Supersector |

| 39 | Hormel Foods (HRL) | Consumer Staples | Defensive |

| 40 | Chubb (CB) | Financials | Cyclical |

| 41 | NextEra Energy (NEE) | Utilities | Defensive |

| 42 | Intuit (INTU) | Information Technology | Sensitive |

| 43 | Atmos Energy (ATO) | Utilities | Defensive |

| 44 | Caterpillar (CAT) | Industrials | Sensitive |

| 45 | Globe Life (GL) | Financials | Cyclical |

| 46 | WEC Energy (WEC) | Utilities | Defensive |

| 47 | American Electric Power (AEP) | Utilities | Defensive |

| 48 | Travelers (TRV) | Financials | Cyclical |

| 49 | United Parcel Service (UPS) | Industrials | Sensitive |

| 50 | Analog Devices (ADI) | Information Technology | Sensitive |

The following stocks are new additions to this group:

- GL got added after it M* Economic Moat improved to Narrow

- ADI got added after its S&P Credit Rating improved to A-

ABT got promoted out of this group, while Cummins (CMI) and W.W. Grainger (GWW) got demoted (see below).

Three stocks dropped out altogether:

- Baxter International (BAX), with a lower S&P Credit Rating of BBB

- Kimberly-Clark (KMB), with a lower VL Financial Strength of A

- Pinnacle West Capital (PNW), after reductions in its VL Financial Strength and S&P Credit Rating.

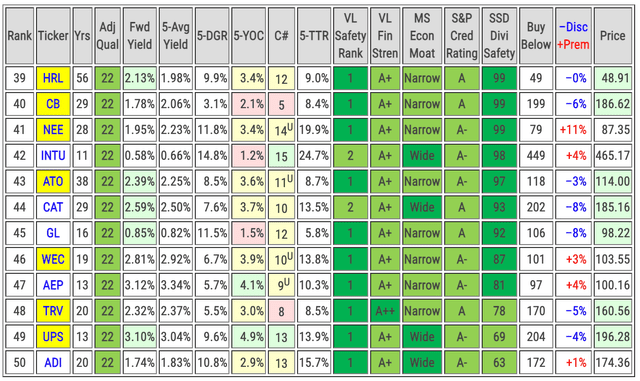

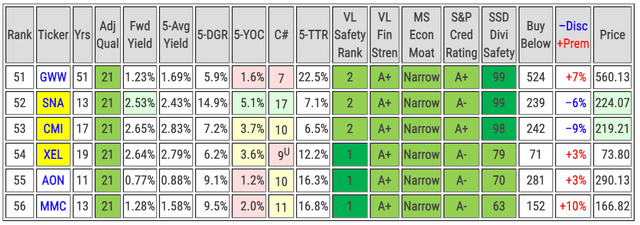

Stocks Scoring 21 Points

These stocks earned the highest rating on just one of the five quality indicators.

Created by the author from a personal spreadsheet

| Rank | Company (Ticker) | Sector | Supersector |

| 51 | W.W. Grainger (GWW) | Industrials | Sensitive |

| 52 | Snap-on (SNA) | Industrials | Sensitive |

| 53 | Cummins (CMI) | Industrials | Sensitive |

| 54 | Xcel Energy (XEL) | Utilities | Defensive |

| 55 | Aon plc (AON) | Financials | Cyclical |

| 56 | Marsh & McLennan (MMC) | Financials | Cyclical |

There are two additions to this group. GWW got demoted into this group after its VL Financial Strength rating dropped from A++ to A. Likewise, CMI got demoted into this group after its M* Economic Moat changed from Wide to Narrow.

Stocks Scoring 20 Points

Stocks in this group would have scored four points for each of the five quality indicators. However, there are no stocks that qualified in this way this year.

Last year, Franklin Resources (BEN) qualified in this group, but the stock’s VL Safety Rank and VL Financial Strength rating deteriorated, so BEN dropped out of the list of highest-quality DG stocks this year.

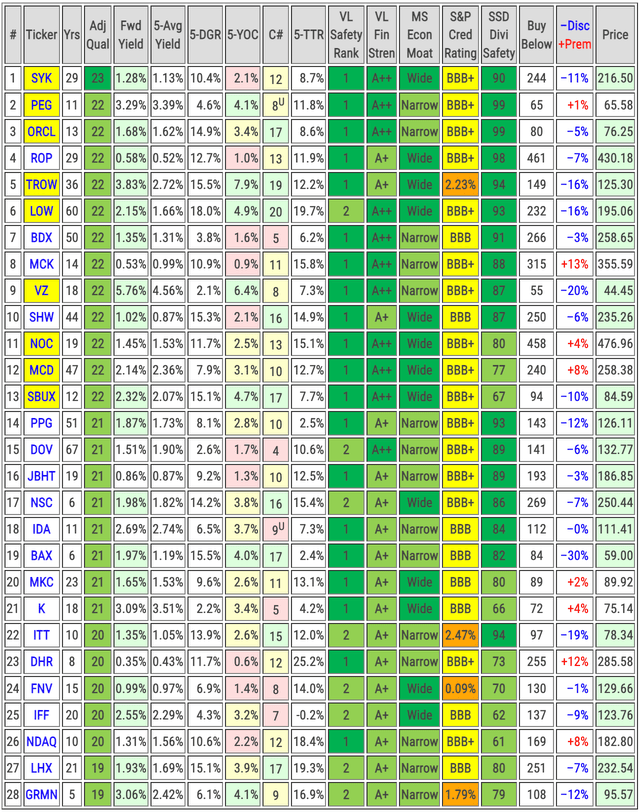

Bonus: Stocks that Failed the S&P Credit Rating

In his June 2020 article, David Van Knapp included a bonus section containing stocks that failed the S&P Credit Rating screen but passed the stringent screens for this article. Stocks with a low investment-grade S&P Credit Rating (in the BBB range) or lacking an S&P Credit Rating but with a long-term debt/capital ratio less than 10% qualify here.

Created by the author from a personal spreadsheet

| # | Company (Ticker) | Sector | Supersector |

| 1 | Stryker (SYK) | Health Care | Defensive |

| 2 | Public Service Enterprise (PEG) | Utilities | Defensive |

| 3 | Oracle (ORCL) | Information Technology | Sensitive |

| 4 | Roper Technologies (ROP) | Information Technology | Sensitive |

| 5 | T. Rowe Price (TROW) | Financials | Cyclical |

| 6 | Lowe’s (LOW) | Consumer Discretionary | Cyclical |

| 7 | Becton, Dickinson (BDX) | Health Care | Defensive |

| 8 | McKesson (MCK) | Health Care | Defensive |

| 9 | Verizon Communications (VZ) | Communication Services | Sensitive |

| 10 | Sherwin-Williams (SHW) | Materials | Cyclical |

| 11 | Northrop Grumman (NOC) | Industrials | Sensitive |

| 12 | McDonald’s (MCD) | Consumer Discretionary | Cyclical |

| 13 | Starbucks (SBUX) | Consumer Discretionary | Cyclical |

| 14 | PPG Industries (PPG) | Materials | Cyclical |

| 15 | Dover (DOV) | Industrials | Sensitive |

| 16 | J.B. Hunt Transport Services (JBHT) | Industrials | Sensitive |

| 17 | Norfolk Southern (NSC) | Industrials | Sensitive |

| 18 | Idacorp (IDA) | Utilities | Defensive |

| 19 | Baxter International (BAX) | Health Care | Defensive |

| 20 | McCormick (MKC) | Consumer Staples | Defensive |

| 21 | Kellogg (K) | Consumer Staples | Defensive |

| 22 | ITT (ITT) | Industrials | Sensitive |

| 23 | Danaher (DHR) | Health Care | Defensive |

| 24 | Franco-Nevada (FNV) | Materials | Cyclical |

| 25 | International Flavors & Fragrances (IFF) | Materials | Cyclical |

| 26 | Nasdaq (NDAQ) | Financials | Cyclical |

| 27 | L3Harris Technologies (LHX) | Industrials | Sensitive |

| 28 | Garmin (GRMN) | Consumer Discretionary | Cyclical |

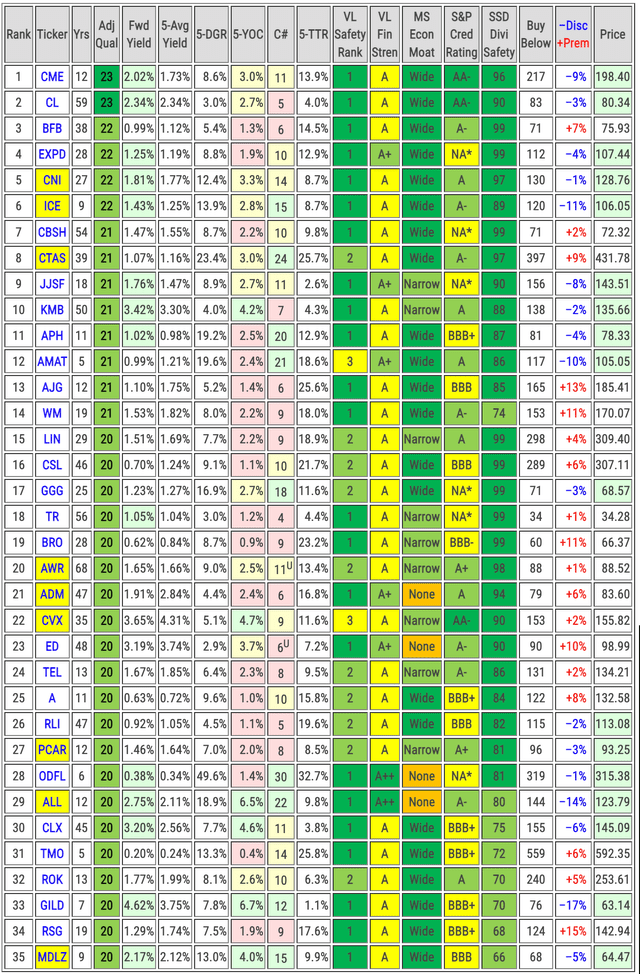

Bonus: Other Stocks that Scored at least 20 Points

Here is another bonus section, this time listing stocks that scored at least 20 total points but otherwise failed our stringent quality screens. I’m excluding stocks presented in the previous bonus section.

Created by the author from a personal spreadsheet

| # | Company (Ticker) | Sector | Supersector |

| 1 | CME (CME) | Financials | Cyclical |

| 2 | Colgate-Palmolive (CL) | Consumer Staples | Defensive |

| 3 | Brown-Forman (BF.B) | Consumer Staples | Defensive |

| 4 | Expeditors International of Washington (EXPD) | Industrials | Sensitive |

| 5 | Canadian National Railway (CNI) | Industrials | Sensitive |

| 6 | Intercontinental Exchange (ICE) | Financials | Cyclical |

| 7 | Commerce Bancshares (CBSH) | Financials | Cyclical |

| 8 | Cintas (CTAS) | Industrials | Sensitive |

| 9 | J&J Snack Foods (JJSF) | Consumer Staples | Defensive |

| 10 | Kimberly-Clark (KMB) | Consumer Staples | Defensive |

| 11 | Amphenol (APH) | Information Technology | Sensitive |

| 12 | Applied Materials (AMAT) | Information Technology | Sensitive |

| 13 | Arthur J. Gallagher (AJG) | Financials | Cyclical |

| 14 | Waste Management (WM) | Industrials | Sensitive |

| 15 | Linde plc (LIN) | Materials | Cyclical |

| 16 | Carlisle (CSL) | Industrials | Sensitive |

| 17 | Graco (GGG) | Industrials | Sensitive |

| 18 | Tootsie Roll Industries (TR) | Consumer Staples | Defensive |

| 19 | Brown & Brown (BRO) | Financials | Cyclical |

| 20 | American States Water (AWR) | Utilities | Defensive |

| 21 | Archer-Daniels-Midland (ADM) | Consumer Staples | Defensive |

| 22 | Chevron (CVX) | Energy | Sensitive |

| 23 | Consolidated Edison (ED) | Utilities | Defensive |

| 24 | TE Connectivity (TEL) | Information Technology | Sensitive |

| 25 | Agilent Technologies (A) | Health Care | Defensive |

| 26 | RLI (RLI) | Financials | Cyclical |

| 27 | Paccar Inc (PCAR) | Industrials | Sensitive |

| 28 | Old Dominion Freight Line (ODFL) | Industrials | Sensitive |

| 29 | Allstate (ALL) | Financials | Cyclical |

| 30 | Clorox (CLX) | Consumer Staples | Defensive |

| 31 | Thermo Fisher Scientific (TMO) | Health Care | Defensive |

| 32 | Rockwell Automation (ROK) | Industrials | Sensitive |

| 33 | Gilead Sciences (GILD) | Health Care | Defensive |

| 34 | Republic Services (RSG) | Industrials | Sensitive |

| 35 | Mondelez International (MDLZ) | Consumer Staples | Defensive |

Concluding Remarks

The DVK Quality Snapshots scoring system provides an elegant and effective way to assess the quality of DG stocks. 119 /76

This article updates my August 2021 article in which 59 DG stocks passed the stringent quality screens, and seven DG stocks earned perfect scores. This update identifies 56 DG stocks and eight DG stocks earning perfect scores.

The stocks identified in this article are high-quality DG stocks, at least based on DVK Quality Snapshots. The universe is 730 DG stocks in the latest Dividend Radar (Published: August 5, 2022), whereas I presented 56 + 28 + 35 = 119 DG stocks today (or 16.3% of all Dividend Radar stocks).

Quality is not the only factor to consider when selecting candidates for investment. The stock’s valuation is important, too. To assist readers, the tables in this article provide my risk-adjusted Buy Below prices and a column indicating by how much the stock’s price is trading at a discount or premium to my Buy Below price.

No fewer than 76 of the DG stocks covered are trading below my Buy Below price!

Other factors to consider include dividend yield and growth rate, total return performance, and income and growth prospects. The tables provide some key metrics that should give readers a good start.

As always, I recommend doing your due diligence before investing in any stock covered in this article.

Thanks for reading, and happy investing!

Be the first to comment