NotYourAverageBear

Introduction

In almost all of my articles, I combine either a macro case or a theoretical background (when covering dividends) with an actionable idea. After all, I believe that discussing macro developments is just as important as knowing which stocks to trade and invest in.

In this article, we are going to dive into global supply chain reconfiguration, a trend that was accelerated by the pandemic, which came with new geopolitical and macroeconomic challenges and the need to move production out of China. Moreover, we’re now dealing with severe deindustrialization risks in Europe due to high energy prices and environmentalist policies making it unattractive to keep production onshore.

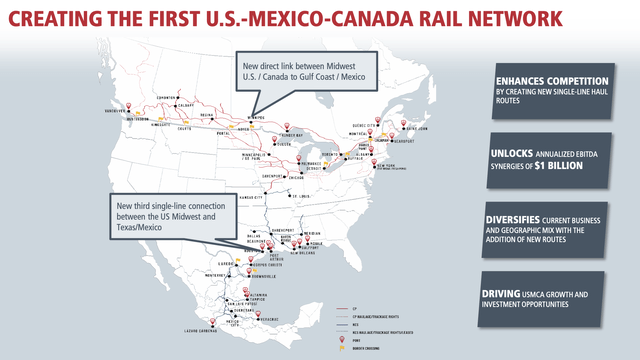

I believe that North America will be the single-biggest winner of the supply chain “re-shoring” trend, which means new investment opportunities are opening up. While there are many (and we will discuss most of them in the future), my favorite play is Canadian Pacific (NYSE:CP). This railroad has been a core holding of my portfolio since 2021. This railroad isn’t just a great dividend growth stock, it is also a major beneficiary of supply chain re-shoring as the merger with Kansas City Southern will allow the company to service Canada, the United States, and Mexico. This means benefiting from higher industrial production and the ability to connect major grain, automotive, chemical, energy, and other supply chains.

In this article, I will walk you through my thoughts and cover the supply chain story as well as my favorite investment: Canadian Pacific.

So, let’s dive into it!

The Great Supply Chain Reconfiguration

Supply chains are complex and hard to move. Hence, regardless of what happens to supply chains, we’re dealing with long-term developments, not an investment catalyst that develops overnight.

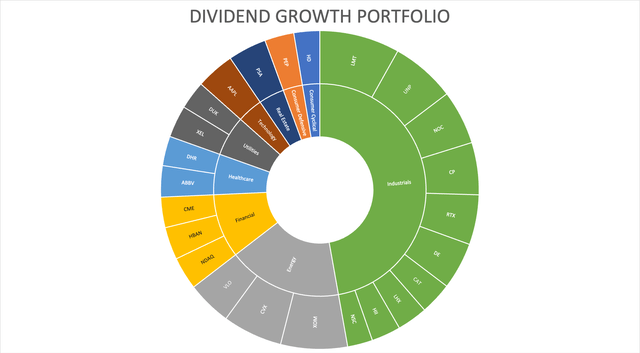

In 2020, I started building my long-term dividend portfolio, which now consists of almost my entire net worth (minus some emergency savings). I have 100% of my money invested in the United States and Canada (because of the Canadian Pacific Railway).

As the chart above shows, I own a lot of industrial companies. That is not based on the decision to be overweight industrials, but because a lot of stocks I like are industrials.

A lot of investments are related to transportation and logistics without too much China exposure. Most of my companies have only minor (often indirect) exposure in China and Asia in general.

I’m not saying that because I dislike Asia (I do not), but because I believe that North America will play a bigger role in global manufacturing and related in the decades ahead.

This has a number of reasons. The biggest one is the pandemic. As almost everyone knows, the pandemic caused a global shutdown in economic activity. The worst lockdowns were witnessed in China thanks to its zero-COVID strategy. These developments showed the world how dependent we are on China. It all started when China became the cheap manufacturing hub of the world. Now, this is changing as China is slowly becoming more expensive and tricky to operate in because of its laws and because companies cannot take these supply chain risks anymore.

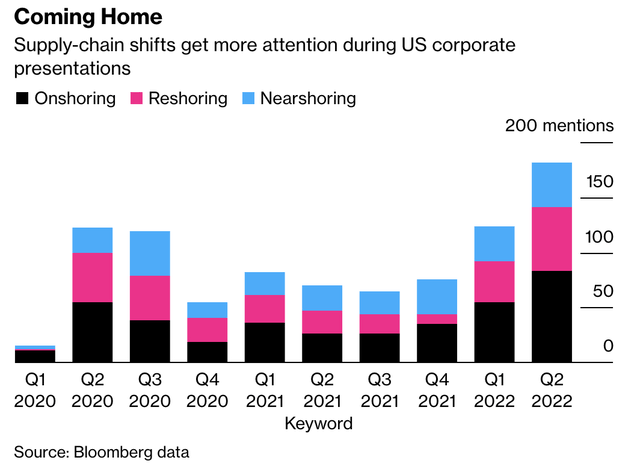

What’s interesting is that we’re now seeing a “measurable” shift in supply chains. This year, the number of supply-chain-related mentions during US corporate presentations has taken off (beyond pandemic levels).

Moreover, the construction of new manufacturing facilities in the US has soared by 116% over the past year (as of June 2022), outperforming a 10% gain on all building projects combined, according to the Dodge Construction Network (via Bloomberg).

Intel (INTC) and Taiwan Semiconductor Manufacturing (TSM) are building chip factories in the South and new aluminum and steel plants are being erected by major companies like US Steel (X) in Arkansas and Nucor (NUE) in Kentucky – to name a few.

Moreover:

Scores of smaller companies are making similar moves, according to Richard Branch, the chief economist at Dodge. Not all are examples of reshoring. Some are designed to expand capacity.

But they all point to the same thing – a major re-assessment of supply chains in the wake of port bottlenecks, parts shortages and skyrocketing shipping costs that have wreaked havoc on corporate budgets in the US and across the globe.

With that said, it gets better for North America. Even China is now figuring out that these trends are not in its favor. Hence, and in order to avoid US tariffs, Chinese companies are moving to Mexico.

Mexico has relatively cheap labor and two other major factors:

- It is bordering to the largest consumer market in the world – the USA.

- It has a free trade deal with that country.

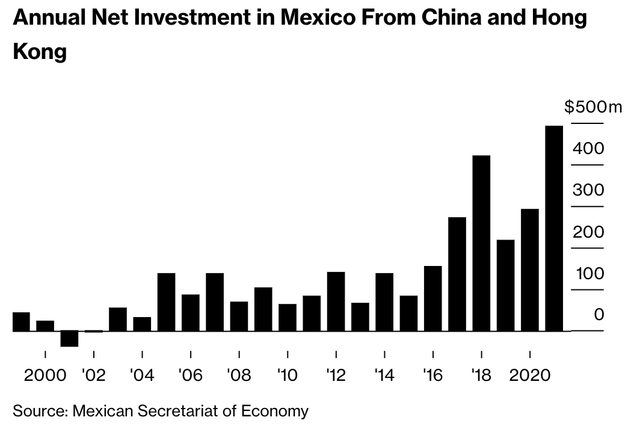

Annual net investments in Mexico from China and Hong Kong rose to roughly $500 million in 2021, beating anything we have seen so far.

According to Bloomberg:

This isn’t a top-down initiative like Xi’s “Belt and Road,” which has financed power plants, bridges, and ports across scores of countries. Yet for the most part, Chinese policymakers have blessed the drive by low-margin businesses to offshore production as Beijing’s focus shifts to fostering advanced manufacturing industries such as semiconductors and new-energy vehicles. In 2015, China’s cabinet issued a document encouraging “international cooperation on production capacity.”

It also helps that the wage gap between China and Mexico is narrowing as China’s fast growth (including its middle-class) and the enormous levels of pollution have made it harder to increase production at will. This is bullish for North America, in general, as it makes shifting away from China much easier.

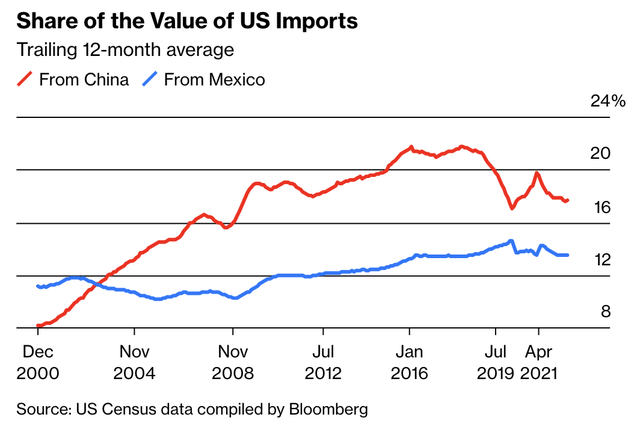

Another gap that is closing is the one showing US imports from China and Mexico. Please note that this trend started to turn in 2016, not as a result of the pandemic. Back then, it was former President Trump who initiated the trend to bring back manufacturing from China – and Mexico. On a side note, his successor President Biden is doing the same under his “Made-In-America” program.

The President believes that when we spend American taxpayers’ dollars, it should support American workers and businesses. In his first week in office, President Biden signed Executive Order 14005, Ensuring the Future is Made in America by All of America’s Workers, launching a whole-of-government initiative to strengthen the use of federal procurement to support American manufacturing.

However, the problem is that Mexico doesn’t have extensive networks of suppliers across a large number of industries. This is one of the reasons why I am making the case that we’re discussing a long-term trend here. This doesn’t happen overnight. If there’s one thing I have gotten from my studies in the field of supply chain management, it’s that these things take time. Mexico will have to adapt to the new situation. This means adjusting regulations and accommodating the establishment of stable supply chains.

However, given what I’ve seen so far, I’m positive this will get done. The same goes for new operations in the US, which have far more experience building supply chains.

With that said, there are more developments that are important to mention. The most important one is deindustrialization risks in Europe. Even before the current energy crisis, I made the case that Europe was facing risks of hurting its industries because of environmental policies that made production more expensive.

Don’t get me wrong, I’m not in favor of letting polluting companies do whatever they want. After all, that caused severe environmental issues less than 50 years ago. No, my point is that net-zero policies are hurting companies in ways that are completely unnecessary.

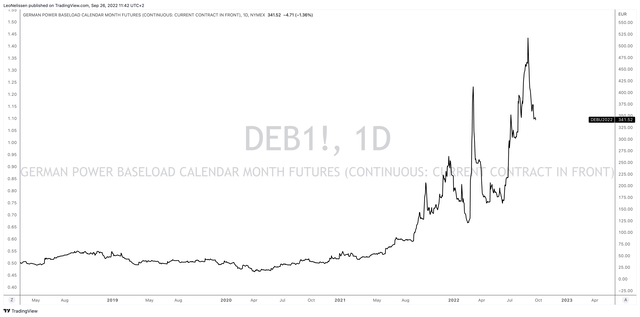

Right now, German baseload power futures are almost 10x higher compared to pre-pandemic levels. This is the result of the energy crisis as Russia has reduced natural gas exports to almost zero. However, it is also a sign of Europe’s inability to be prepared. The continent became dependent on Russia while shutting down both coal and nuclear energy. Now, it remains to be seen how bad the winter gets as hundreds of millions face an implosion of spendable income given the surge in the cost of living.

TradingView (German Baseload Power Futures)

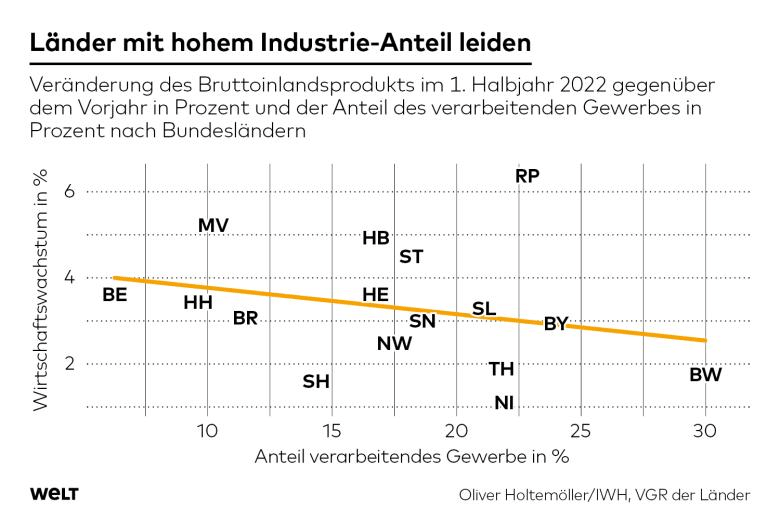

The chart below is a good example of deindustrialization risks. As it’s in German, let me translate. What you’re looking at below is an overview of the German states. The x-axis shows the manufacturing intensity. For example, Bade-Württemberg (“BW”), the home of Mercedes Benz, has almost 30% manufacturing exposure. The y-axis shows economic growth.

WELT

The higher the manufacturing exposure, the lower the economic growth in the first half of 2022.

Now, major companies are considering moving production. As Germany is an export nation, it is starting to make sense to move production to the countries where it is selling to. One of these countries is the United States where Germany sells a lot of machinery, related supplies, and its cars.

Earlier this month, Volkswagen came out saying if it sees gas shortages, it is going to move production.

Volkswagen, Europe’s biggest carmaker, said Thursday that reallocating some of its production was one of the options available in the medium term if gas shortages last much beyond this winter. The company has major factories in Germany, the Czech Republic and Slovakia, which are among European countries most reliant on Russian gas, as well as facilities in southern Europe that source energy from elsewhere.

In Germany alone, the automotive giant has close to 300,000 employees. That’s direct employment. Think of all the jobs that are tied to these jobs.

This news came a few months after VW company announced new investments in the United States (supply chain relocation).

According to the Wall Street Journal:

VW CEO Herbert Diess told reporters during an earnings call on Wednesday that the company wants to boost electric-vehicle investment in North America in particular as the fallout from the war and the pandemic continue to weigh on growth in other regions.

“We see that America will be untouched by what’s happening in Europe, so it should be geostrategically a region in which we should invest more,” Mr. Diess said.

Summarizing this part, I believe this is one of the most important articles I’m writing this year as supply chain configurations will have a lasting impact on geopolitical relations and almost every supply chain. This comes with opportunities and risks.

One opportunity is to invest in North American infrastructure.

That’s where Canadian Pacific comes in.

Why I Love Canadian Pacific

**Please note that all financial numbers below are in Canadian dollars unless noted otherwise.**

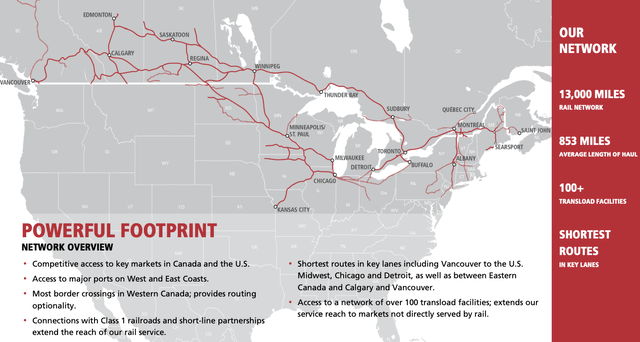

Canadian Pacific is one of North America’s largest railroads with a US$65.7 billion market cap.

The railroad is the biggest competitor of its peer Canadian National (CNI) and a major player in agriculture, which was important to me when I bought the stock a while ago. Ignoring the pending merger with Kansas City Southern, the company covers all major Canadian economic hubs and large parts of the American Midwest and Northeast.

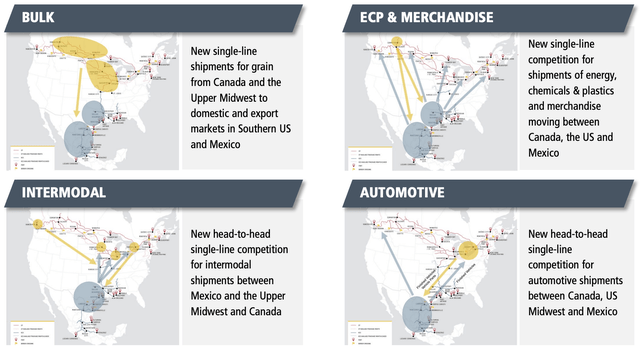

The company transports a lot of bulk. Roughly 40% of its 2021 revenues came from grains, coal, potash, and fertilizers. Intermodal accounted for just 22%. Moreover, domestic transportation was just 34% of total revenues. Global (exports to Asia and Europe) accounted for 34% of revenues as well. The remaining part was cross-border trade.

In other words, CP was and still is, an investment in the commodities it ships, Canada’s economy, and its ability to connect North American economies. Especially in current times, the company benefits from high global grain, fertilizer, and coal demand, to name three commodities that benefit from the war in Ukraine and global shortages.

Now, we can add Mexico to this list. Since 2021 Canadian Pacific is trying to buy Kansas City Southern. KCS shares are now in a voting trust, waiting for the final approval of the STB. This is expected to happen in the first months of 2023.

This merger connects all North American countries, allowing the company to offer attractive services to shippers who can now rely on a single shipper between certain destinations.

While the company doesn’t service large parts of the US, it will operate the perfect network allowing it to ship agricultural goods to major ports outside of Canada, connecting automotive suppliers to producers, energy producers to major export ports, and consumers from all nations – to name a few things.

The screenshot below shows four examples of network benefits.

In other words, these benefits are fantastic. Not just in general, but especially based on the first part of this article where I explained how supply chains are shifting.

It’s also good for the environment as it reduces the need for trucking on certain routes.

According to CP CEO Keith Creel:

“CPKC will become the backbone connecting our customers to new markets, enhancing competition in the U.S. rail network, and driving economic growth while delivering significant environmental benefits. We are excited to reach this milestone on the path toward creating this unique truly North American railroad.”

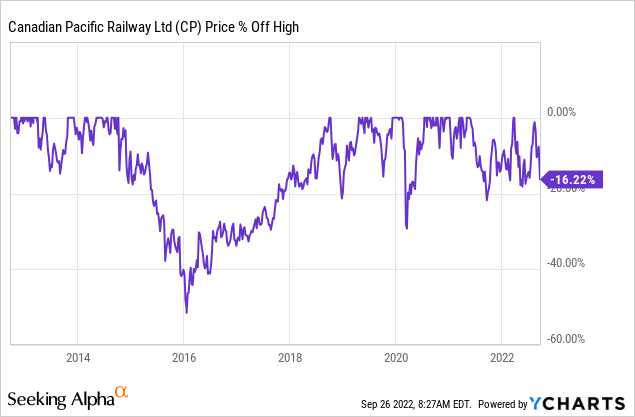

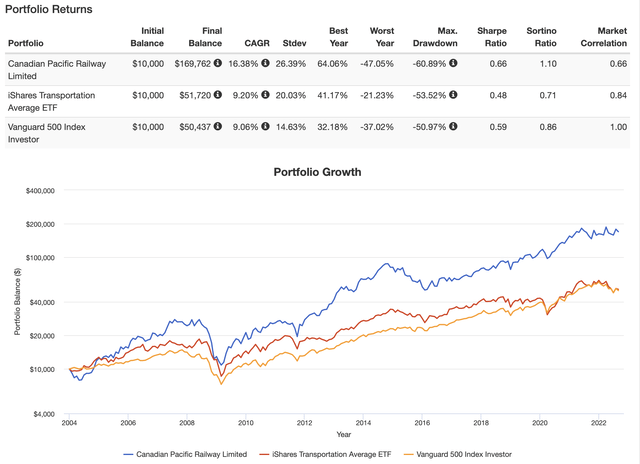

The most important thing is that CP isn’t a long-shot investment. Even before the merger news, CP shares were a great source of wealth.

Since 2004 (and prior to that), the company has outperformed its transportation peers and the market. In this case, I’m using New York-listed CP shares that have returned 16.4% per year since 2004. This beats the market and the iShares Transportation ETF (IYT) by a wide margin. The standard deviation is (obviously) higher as we’re dealing with a cyclical company and a comparison with two baskets of stocks. Yet, even on a volatility-adjusted basis, CP shares have outperformed (Sharpe/Sortino ratios).

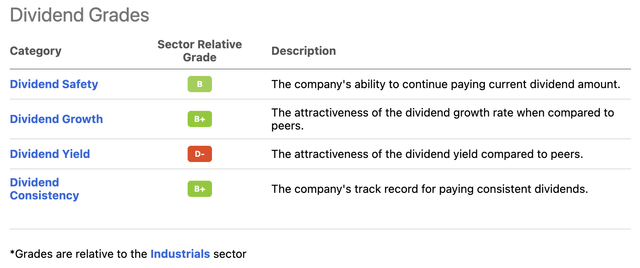

Moreover, the company is a dividend growth stock, although with a low yield.

Its current yield is 0.8%, which is not something that will get a lot of income-seeking investors interested. Yet it’s backed by an impressive dividend scorecard (provided by Seeking Alpha).

The 10-year average annual dividend growth rate is 9.3%.

Now, with that said, the valuation has come down a lot as the market is hit by economic turmoil.

We’re in an environment of slowing economic growth, ongoing supply chain issues, and an aggressive Federal Reserve, eager to use demand weakness to pressure inflation. I explained this in great detail in a recent article, which I recommend readers take a look at.

Generally speaking, I try to buy more CP shares whenever the stock is 20% below its all-time high.

As it’s very hard to estimate how far stocks can/will fall, I like the risk/reward when CP is down 20% for long-term investments.

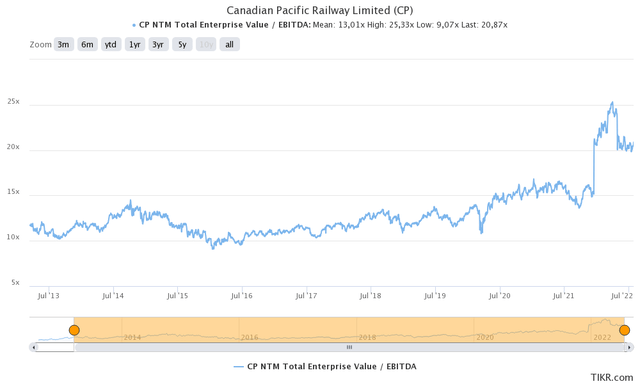

With that said, the company is trading at 15.0x 2023E EBITDA of $7.2 billion and 12.6x 2024E EBITDA of $8.4 billion. The big EBITDA difference is caused by merger synergies and organic growth.

Moreover, the enterprise values incorporate the company’s $88.5 billion market cap (this time in Canadian dollars), $18.4 billion, and $16.9 billion in expected 2023 and 2024 net debt, respectively, as well as $730 million in pension-related obligations.

That doesn’t look like deep value – and it isn’t. However, it’s a fair valuation, which incorporates post-merger synergies and a steep increase in expected growth if economic growth rebounds on top of the (expected) weather-related recovery in Canadian grains, which we will discuss as we get 3Q22 earnings results in the weeks ahead.

Takeaway

This article had two purposes. First, to discuss what I believe to be one of the most important secular trends in the world right now. And second, to give you an actionable idea.

What we’re seeing is a major supply chain shift, accelerated by the pandemic. North America is expected to benefit from supply chains coming back. The pandemic showed that supply chains concentrated in China were too risky. When adding political risks, it makes sense to bring back supply chains. In the US, companies are currently expanding, fueled by new demand from foreign nations. European companies are looking to produce closer to their end-markets. These decisions are made easier by the energy crisis in Europe, making domestic production unattractive.

Moreover, Mexico is benefiting from Chinese companies that move production closer to the US to avoid trade tariffs and the impact of supply chain relocations.

Hence, I believe that Canadian Pacific is one of the best ways to benefit from these long-term developments. The company’s merger with Kansas City Southern will allow it to combine Canada, the United States, and Mexico, moving major freight across ports, industrial hubs, and metropolitan areas.

It also helps that market turmoil is making the valuation more attractive, which is why I have consistently expanded my position this year.

Going forward, I expect Canadian Pacific to beat major transportation ETFs as well as the market, in general. It also helps that the company is a dividend growth stock, although its yield is low.

So, long story short, if you’re looking for quality industrial exposure, I think CP is the way to go.

And even if you don’t care for CP, be aware of changing supply chains, as this comes with new challenges and opportunities.

(Dis)agree? Let me know in the comments!

Be the first to comment