Mark Wilson/Getty Images News

Introduction

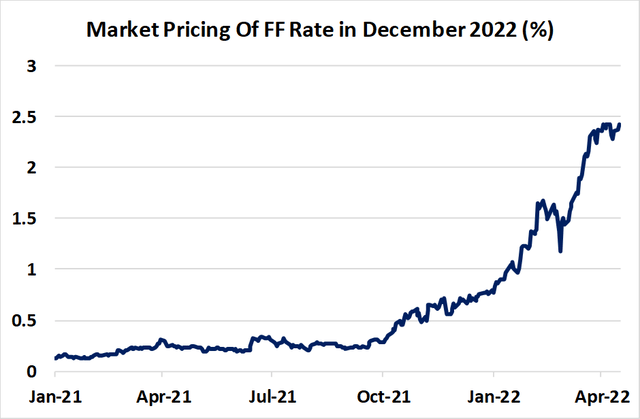

With inflation rate reaching a four-decade high at 8.5% in March, investors remain confident that the Fed could surprise the market by hiking more aggressively than previously expected to combat the elevated inflationary pressures. With the FFZ2 currently trading at 97.560 (source: Bloomberg), figure 1 shows that the STIR market is expecting the Fed Funds rate to stand between 2.25% and 2.5% at the end of the year, which stands at the high of the dot plot projections from the latest FOMC meeting (March 16).

Hence, an important question that market participants have been asking in recent weeks is the following: Can the Fed match the market’s expectations, and at what costs?

Figure 1

Political Pressure To Strengthen Through 2022

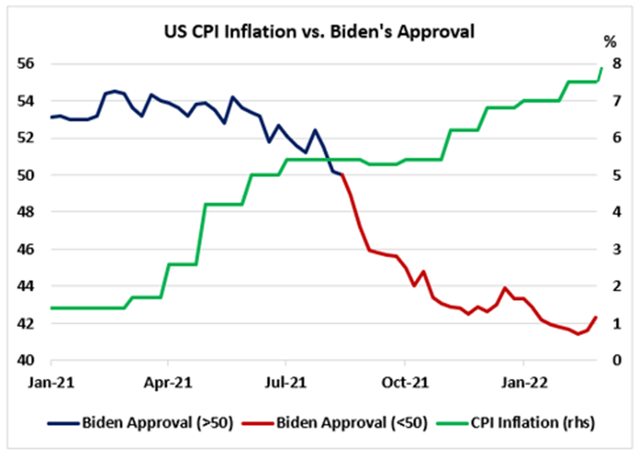

Historically, a surge in inflation has generally been associated with a fall in the President’s rating approval. Even though we could argue that the US President’s approval could be affected by a range of factors, the drop in Biden’s popularity in the past year has mainly been attributed to the rise in inflationary pressures, which are now expected to remain elevated longer than previously expected. Figure 2 shows that Biden’s approval rate fell from over 54% in early 2021 to 42% in latest polls while CPI inflation rose from 1.4% to 8.5%.

It is clear that the Fed will be unable to delay its tightening cycle this year as the global economy starts to decelerate sharply as Biden has mentioned earlier this year that taming inflation is the Fed’s ‘critical job’.

Figure 2

Inflationary pressures to remain elevated for longer

Even though some investors are starting to speculate that inflation probably peaked in March (at 8.5%), global supply chain disruptions and the Ukraine war shock could significantly slow down the decline towards target. The strict lockdown policies imposed by Chinese officials are a greater risk for global inflation as the world has been more reliant on Chinese goods since the start of the pandemic. In addition, new sanctions imposed on Russia (including energy) could support oil prices in the medium term, therefore maintaining the inflation rate elevated through 2022.

Hence, a prolonged period of elevated inflation could ‘pressure’ policymakers to hike more aggressively in the coming meetings, proceeding with 50bps to 75bps steps.

Fed Bullard Is Not Ruling Out 75bps Hike

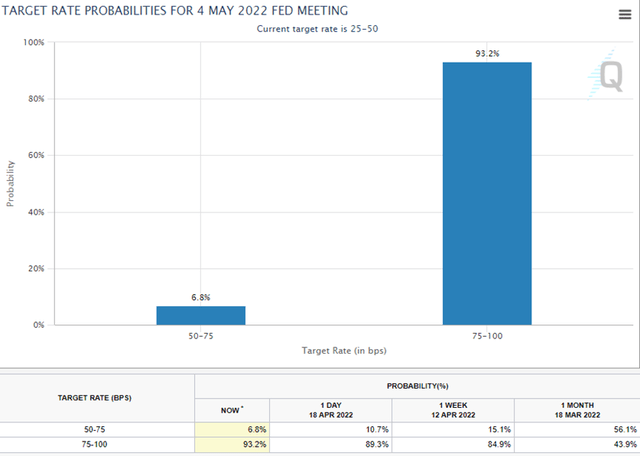

We heard earlier this week that St. Louis Fed President James Bullard mentioned that a potential 75bps increase could not be ruled out given that inflation is currently standing at a forty-year high (a greater than 50bps hike is not Bullard‘s ‘base case’ though). As a reminder, the Fed started its tightening cycle last month, proceeding with a 25bps hike on March 16. The next meeting is on May 4th and the implied probability of a 50bps hike is currently at 93.2% according to CME Fed Watch Tool. Figure 3 shows that the probability has increased significantly since last month (was at 44% on March 18).

Figure 3

Hawkish Fed and Market Uncertainty Driving USD Higher

Since the start of the year, the surge in geopolitical uncertainty has been strongly supporting the US dollar against major crosses, with the DXY index trading at its highest level since March 2020. Even though we have heard a lot of ‘bearish USD‘ investors talking about the negative impact of the ‘De-dollarization‘ on the greenback in the long run, the dollar has once again confirmed its status of ‘safe-haven‘, with the DXY index appreciating by nearly 6% since the start of the year.

It is interesting to see that unlike US Treasuries, the US Dollar has shown more independence to inflation over time. Even though US Treasuries have been considered as a long term ‘safe-haven‘ asset, their performance is conditioned on the current level of inflation. US Treasuries have performed extremely poorly since the start of the year due to elevated inflation, registering their biggest drawdowns in decades.

DXY index broke above its 100 psychological level last week and has been testing the 101 level since the start of this week. Next key resistance to watch on the topside stands at 102.98, which was the high reached in March 2020 following the COVID-19 shock. Even though some investors have been constantly trying to call for a peak on the US dollar, momentum could continue in the short term as recession risks keep increasing in the Euro area, leaving the euro vulnerable.

At this stage, the Fed has much more capacity to tighten than the ECB as new Russian sanctions and inflation put Europe at greater recession risk. Therefore, monetary policy ‘divergence‘ should continue to support the US dollar against the euro in the medium term, with EURUSD likely to reach its ST key support at 1.0640 (low reached during COVID).

We have already seen how the monetary policy divergence between the Fed and the BoJ has been weighing against the Yen lately. Momentum traders have been desperately chasing the trend on USDJPY following BoJ‘s dovish comments on monetary policy last month.

Figure 4

Challenging Year for US Equities

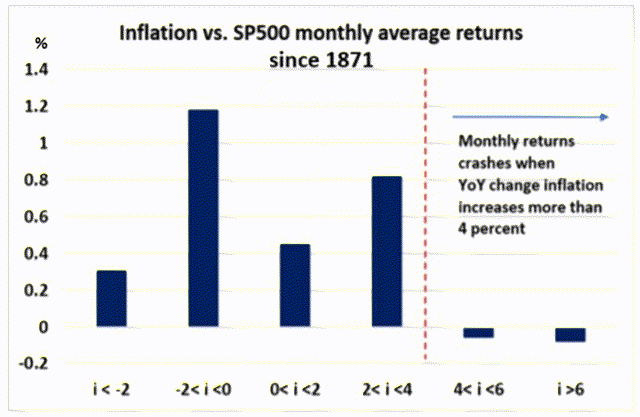

Historically, rising market uncertainty, falling economic activity and elevated inflationary pressures have been the worst regime for stocks. Figure 5 shows that US equity returns collapse when inflation remains above the 4% level. In this chart, we compute the average monthly returns of US equities for different buckets of inflation using Robert Shiller monthly data since 1871.

Figure 5

The IMF recently revised growth forecasts for this year to the downside to 3.6% (1.3ppt lower than 6 months ago). Future quarterly expectations are likely to be revised to the downside again as uncertainty remains elevated in addition to the result of the aggressive tightening cycle run by the Fed.

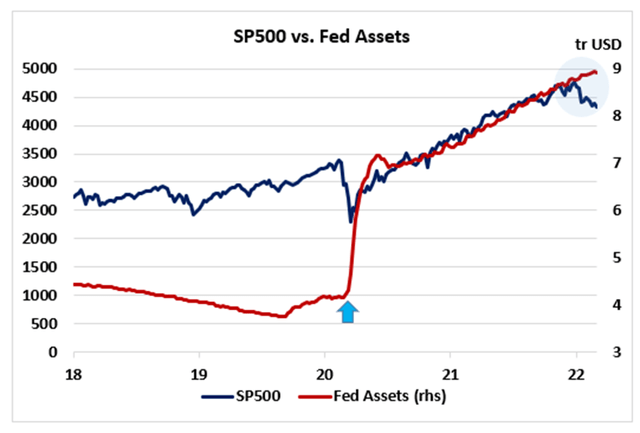

With elevated market uncertainty, Fed hiking aggressively and liquidity drying up, equities will be certainly challenged this year following nearly two years of spectacular momentum. Figure 6 shows that surging ‘liquidity‘ (Fed total assets) has certainly been among the major drivers of equities post COVID. With Fed’s assets expected to pause at around 9tr USD, momentum on the SP500 may also halt in the medium term, with risky assets becoming more sensitive to ST macro news.

Figure 6

To conclude, even though inflation may have peaked or be close to its peak, the geopolitical and economic uncertainty will certainly lead to a higher volatility regime in the near to medium term, with demand for ‘safe-assets‘ such as the US dollar or gold remaining strong.

Be the first to comment