OlekStock/iStock via Getty Images

Investment Thesis

Upstart Holdings, Inc (NASDAQ:UPST) is starting to show some signs of failure, with the economic downturn putting unprecedented pressure on its ability to secure willing funding partners in FQ2’22. We are already seeing UPST back-pedaling its previous management promise by re-using its balance sheet in sustaining its existing operations, since it reported a massive decline of -43.77% QoQ in Institutional Buyers and -20.6% in bank & credit unions loan funding then. UPST CEO Dave Girouard said:

We’ve concluded that we need to upgrade and improve the funding side of our marketplace, bringing a significant amount of committed capital on board from partners who will invest consistently through cycles… Furthermore, while we continue to believe that it doesn’t make sense for Upstart to become a bank, we’ve decided it may make sense to at times, leverage our own balance sheet as a transitional bridge to this committed funding. ( Seeking Alpha )

Assuming further underperformance against FICO-based loans over the next few quarters, we may see a catastrophic collapse in UPST’s operations and, consequently, stock performance by H1’23. That would be tragic, since the management has always touted the immense benefits of its “superior” AI-based approach in outperforming conventional lending practices. That drastic correction has already been reflected in the eye-watering losses of $29.48B of Enterprise Value over the past year to $1.91B at the time of writing.

Unfortunately, the time of maximum pain is not even here yet, since the Feds are set to aggressively hike interest rates through 2023 in its ongoing battle against rising inflation. Though we have to applaud the management’s quick turnabout in saving the business temporarily, it remains to be seen if the platform is able to survive the stormy economic weather over the next few quarters. Since these are significantly worsened by its lending partners’ tightened belts through H1’23.

In the meantime, UPST bulls may potentially hold on and, maybe, nibble at the $10s, given the speculative success it would enjoy once the macroeconomics improves. Combined with its recently launched small business loan in June 2022 and mortgage product by 2023, we may also see moderate successes ahead in its auto loans, given the Inflation Reduction Act’s attractive $7.5K tax credit for EV purchases from 2023 to 2032. We shall see.

UPST’s Growth-At-All-Costs Strategy May Pay Off By H2’23

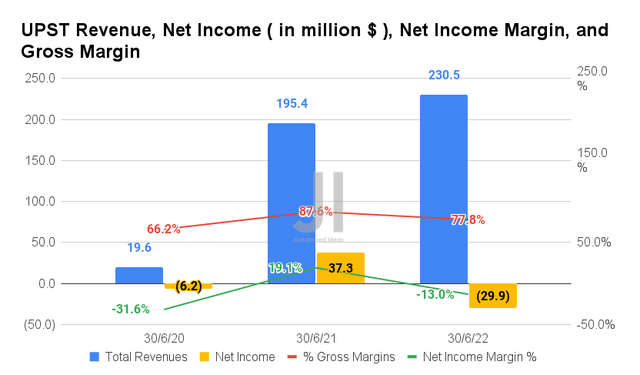

In FQ2’22, UPST reported revenues of $230.5M and gross margins of 77.8%, indicating a notable increase of 17.96% though a moderation of -9.8 percentage points YoY, respectively. Given its elevated operating expenses of $, the company reported deepening net losses of -$29.9M and a net income margin of -13% in the latest quarter, representing a decline of -80.16% and -32.1 percentage points YoY, respectively.

It is apparent that UPST is feeling the pain of the economic downturn, with lower loan originations of 321.13K and loans of $3.3B in FQ2’22, indicating a decline of -31% and 26.66% QoQ. This naturally reduced its contribution profit by -18.2% QoQ to $120.9M, though still at a decent margin of 47% with an increase of 25.02% YoY.

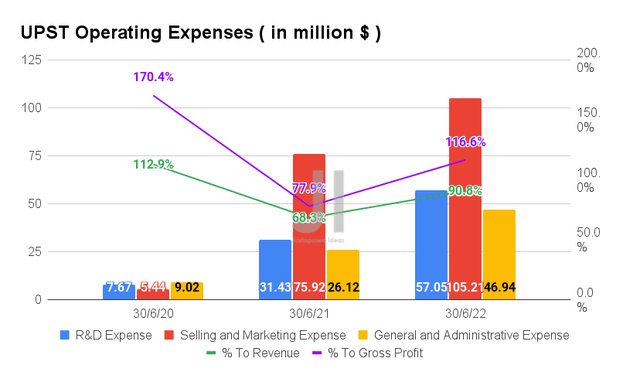

In FQ2’22, UPST continues to report elevated operating expenses of $209.2M, representing a massive increase of 56.73% YoY, with $30.33M attributed to its Stock-Based Compensation. Naturally, the ratio of its expenses to revenues rose to 90.8% and to gross profits to 116.6% for the latest quarter, indicating an increase of 22.5 and 38.7 percentage points YoY, respectively. Thereby, explaining its lack of profitability at the moment.

However, we are also encouraged by UPST’s growth-at-all-costs strategy, since an increasing portion of its revenue is centered around its growing R&D efforts, from 16.08% in FQ2’21 to 24.7% in FQ’22. Therefore, we are cautiously optimistic that UPST’s investments would eventually prove to be top and bottom lines accretive once the macroeconomics improves and the loan fundings return by H2’23.

Patience for now, since UPST has also returned much value to its long-term investors through $125.04M of share repurchases in the latest quarter, bringing their share count down by -12.18% QoQ to 83.83M. Impressive indeed, despite the tragic correction thus far.

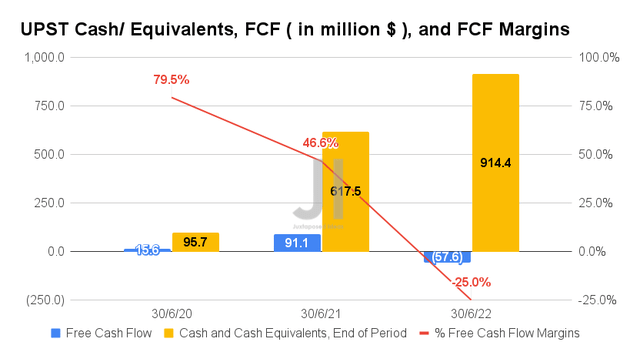

In FQ2’22, UPST reported a negative Free Cash Flow ((or FCF)) generation of -$57.6M and an FCF margin of -25%, representing a massive YoY decline of -63.22% and -71.6 percentage points, respectively. Nonetheless, the company appears well poised for the worsening macroeconomics over the next few quarters, given its massive war chest of $914M in cash and equivalents. Though we must also highlight the $856.56M of long-term debts and $3.51M in interest expenses in the latest quarter, with $624M of auto/ personal loans on its balance sheet.

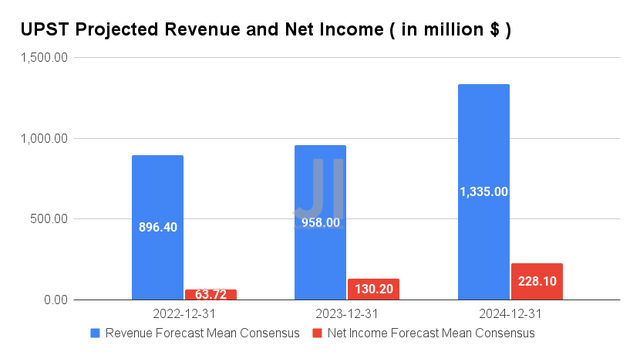

Over the next two years of elevated interest rates, UPST is expected to report minimal revenue growth at a CAGR of 6.05%, with in-line net income profitability. However, given Mr. Market’s prediction of improved macroeconomics, the company is expected to report a massive YoY jump in revenue growth by 39.35% and net incomes by 75.19% by FY2024.

In the meantime, consensus estimates that UPST will report revenues of $896.4M and net incomes of $63.72M, representing an increase of 5.22% though a decline of -52.95% YoY, respectively. With the company expected to report its FQ3’22 earnings in November, analysts will be looking closely at its financial performance then, with revenues of $169.47M and EPS of -$0.09. These projections would indicate a massive YoY decline of -25.82% and -86.95%, respectively. We shall see, since these were a far cry from previous consensus estimates of $246.6M in revenue, with another earnings miss potentially triggering a plunge in its stock prices then.

Meanwhile, we encourage you to read our previous article on UPST, which would help you better understand its position and market opportunities.

- Upstart: The Disruptor Has Been Disrupted – Now Nearing IPO Levels

- Upstart: Auto Lending Will Juice Its Business – Buy Now At 70% Down

So, Is UPST Stock A Buy, Sell, Or Hold?

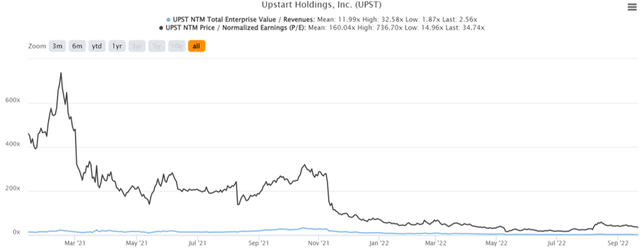

UPST 2Y EV/Revenue and P/E Valuations

UPST is currently trading at an EV/NTM Revenue of 2.56x and NTM P/E of 34.74x, lower than its 2Y mean of 11.99x and 160.04x, respectively. The stock is also trading at $21.31, down -94.69% from its 52 weeks high of $401.49, nearing its 52 weeks low of $21.16.

UPST 2Y Stock Price

Consensus estimates remain bullish about UPST’s prospects, given their price target of $26.40 and a 15.44% upside from current prices. However, given the Fed’s 75 basis point interest hike in September and likely another similarly in November 2022, we expect to see continued headwinds for the stock performance ahead. Recovery is improbable in these uncertain conditions, as seen in the S&P 500 Index’s massive -21.65% plunge YTD.

On the other hand, investors with a higher risk tolerance may speculatively nibble at the mid $10s during this time of maximum pain for long-term portfolio growth and investing. Naturally, one needs to size their portfolio accordingly, due to the potential volatility through 2023. May the odds ever be in your favor.

Be the first to comment