piola666/E+ via Getty Images

When it comes to the small wine producers in North America, one company that should not be overlooked is The Duckhorn Portfolio (NYSE:NAPA). Fundamentally, management has done well with the business. They have successfully grown the company’s topline over the past few years, and that growth looks set to continue in the long run. Profits have also generally improved as well, though recent performance has been a bit mixed. Having said that, shares of the company are not particularly cheap. In fact, the way shares are priced today indicates that the company might still be a rather pricey prospect for investors to consider, and certainly not an ideal opportunity for value investors.

Mixed performance

The last time I wrote about The Duckhorn Portfolio was in an article published in November of last year. At that time, I felt rather conflicted about the business. I found its fundamental performance to tractive, with revenue and profit growth consistent and strong over a time frame of about three years. I ultimately viewed the company as a good growth play for at least the foreseeable future. At the same time, I acknowledged that shares of the company were rather expensive. Overall, I felt like the high price of the stock more or less was balanced by the company’s growth. Because of that, I ultimately rated the company a ‘hold’, which means that I feel like it should generate a return that is virtually flat or should, at best, trail the market over time. Fast forward to today and a change in the firm’s bottom line has resulted in the picture evolving. While revenue growth has continued at a nice clip, profit growth needs some work. And it seems that, because of that, the market has punished the stock, sending it down by 11.6% compared to the 0.6% decline experienced by the S&P 500.

When you see such a return disparity, your initial thought might be that the fundamental condition of the company has materially worsened. But that’s not the case. When a company is priced for growth and fails to achieve all that analysts anticipate, even attractive performance can push the stock down materially. By attractive, I need to only point to revenue growth for the company. After seeing sales increase from $241.2 million in 2019 to $336.6 million in 2021, sales continued to expand into the first half of the 2022 fiscal year. According to management, revenue for this time frame came in at $202.9 million. That represents an increase of 15.7% over the $175.3 million the company generated the same time one year earlier.

According to management, this increase in revenue was driven by multiple factors. For starters, the company did see an increase in the volume of products sold. In addition to this, contribution to revenue from a pricing perspective was neutral. But the company did see product mix improvements in the wholesale channel, plus experienced growth in its DTC (or direct to consumer) operations as a result of higher tasting room sales. As a note, revenue growth was particularly strong in the second quarter of the year, coming in 18% higher than it was one year earlier. This was despite a negative price and mixed contribution year over year. As a leading indicator for the company, it boasted significant improvements in its wholesale to distributor channel.

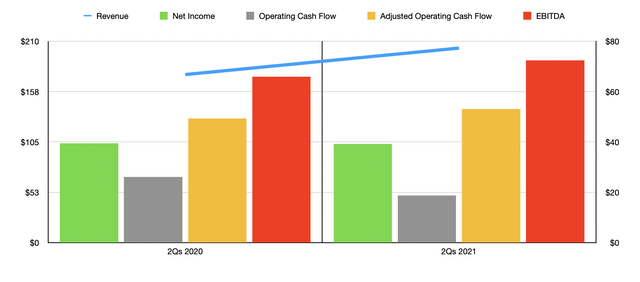

When it comes to profitability, the picture for the company, however, was rather mixed. Net income for the first half of the year was $39.2 million. That compares to the $39.5 million generated in the first half of the 2021 fiscal year. Digging into the numbers, we actually find that the company’s gross margin improved slightly. However, it did experience some pain associated with increased selling, general, and administrative costs. As the company focused on growth, it incurred higher costs associated with compensation that, in turn, was chalked up to an expanded workforce and higher equity-based compensation. The company also saw some higher expenses as a result of being a public company while a year earlier it was still private and did not have many of the regulatory expenses involved with being so.

This increase in costs also impacted other profitability metrics for the company. Operating cash flow, for instance, came in during the first half of the 2022 fiscal year at just $18.8 million. That compares to the $26.1 million generated one year earlier. Having said that, if we adjust for changes in working capital, cash flow would have actually risen modestly, climbing from $49.3 million to $53.1 million. Another profitability metric that mirrored that was EBITDA. According to management, EBITDA grew from $65.9 million to $72.4 million.

When it comes to the 2022 fiscal year, management has provided some guidance. They believe, for instance, that revenue will range from between $364 million and $369 million. At the midpoint, this would imply a year-over-year improvement of 8.9%. The downside to this is that it implies a weakening in the second half of this year. Meanwhile, EBITDA should be between $121 million and $125 million while earnings per share should be between $0.55 and $0.58. At the midpoint, this earnings guidance implies net profits of $65.3 million. That would, at least, represent an improvement over the 2021 results of $55.98 million or 16.7%.

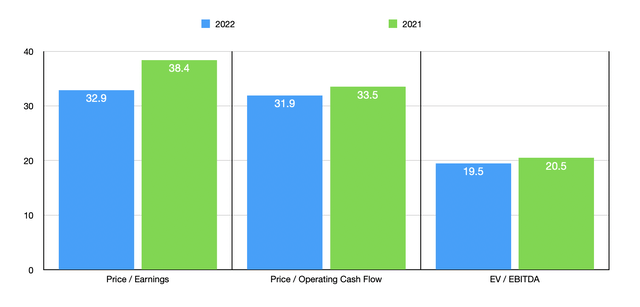

Taking all of this data, we can effectively price the company. Using the 2021 results, the company is trading at a price-to-earnings multiple of 38.4. The price to adjusted operating cash flow multiple is a bit lower at 33.5. And the EV to EBITDA multiple of the company should be 20.5. If, instead, we were to rely on 2022 estimates, the company should be trading at multiples of 32.9, 31.9, and 19.5, respectively. To put the pricing of the company into perspective, I decided to compare it against a couple of similar firms. Unfortunately, there aren’t very many wine companies that I could find that are of similar size. The best I found were two similar companies as illustrated in the table below. On a price-to-earnings basis, these companies had multiples of 20 and 40, respectively. On a price to operating cash flow basis, they were at 20.4 and 34.8, respectively. And using the EV to EBITDA approach, the multiples were 14.6 and 28.1, respectively. In all three cases, whether we are using our 2021 results or 2022 estimates, The Duckhorn Portfolio was cheaper than one firm but more expensive than the other.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| The Duckhorn Portfolio | 38.4 | 33.5 | 20.5 |

| MGP Ingredients (MGPI) | 20.0 | 20.4 | 14.6 |

| Brown-Forman (BF.A) (BF.B) | 40.0 | 34.8 | 28.1 |

Takeaway

Based on the data provided, it seems to me as though The Duckhorn Portfolio is still doing well fundamentally. Yes, the company has had some pain on the bottom line. But much of this is likely temporary in nature. Long term, I fully suspect the company will do well for itself and will create value for shareholders. Having said that, I still believe that shares, while perhaps not significantly overpriced, are certainly not attractive from a price perspective today. In all, I feel like my ‘hold’ designation is more or less still appropriate. Though for value investors, it might be wise to look elsewhere for opportunities.

Be the first to comment