fstop123/E+ via Getty Images

The idea of buying a rental property is very compelling.

You essentially use the bank’s money to buy a property and then use your tenant to repay your mortgage, while you patiently wait for appreciation.

If you get a good deal, your property should even generate some extra cash flow, and after 20-30 years, you’ll own the property free and clear.

There are also some important tax advantages that allow you to depreciate your property to defer taxes.

Sounds wonderful, right?

It’s the ultimate way to leverage other people’s money to build wealth and many have successfully used this strategy to build fortunes.

This whole idea was so compelling to me that I decided to specialize in real estate investing during my studies and eventually made it my career. I made some personal investments and also participated in some very large deals during my time in private equity real estate.

Even then, I eventually decided to stop investing in rental properties, and today, I do nearly all of my real estate investing through publicly listed REITs. I have explained why in several articles that I have posted over the years, and the more I learn about this topic, the more convinced I become that I made the right choice.

That’s because there is a hidden dark side to rental properties…

I am sure that you have read the ugly 3 Ts (tenants, toilets, and trash), but it actually goes far beyond that, and once you consider the whole picture, you quickly realize that the profits of rental properties are nothing more than just a mirage in most cases.

In what follows, I will highlight the hidden truth of rental investing, and explain why REITs are superior in most cases:

Rental Properties Are Very Time Consuming And Your Time Has Value

I start with the topic of time and opportunity costs because it is the biggest issue that’s also the most commonly ignored by investors.

A lot of people falsely imagine that owning rental properties is mostly passive. This is in large part because there are plenty of YouTubers / bloggers who sell the dream of earning passive income in order to sell you their expensive courses on rental investing.

In reality, buying and managing rental properties is much closer to operating a business than earning passive income, and since it takes so much time, you need to deduct the value of that time when calculating your returns.

Let’s take a look at an example:

You buy a rental property for $250k.

You finance 80% of it with a 4% mortgage.

You rent it out for $2,000 per month and earn $1,200 net of expenses.

In theory, that equates to a 12.8% cash-on-cash return, which sounds great. Add to that a few percentage points of early appreciation and you are getting close to 20% total returns.

But in reality, the economics are not nearly as good once you properly account for the value of your time.

If you are someone who is actively managing your rental business, I would expect it to take at least 5 hours per week on average. Some weeks, you will put in 0 hours, but in some others, you will work 20 hours. 5 hours is an average and it covers everything from looking for deals to negotiating, renovating, marketing, etc.

Then if you assume that the value of your time is $30 per hour, it essentially means that your opportunity cost is $150 per week or $600 per month. After all, if you had invested your money in REITs, you could have used this time to work your job so it is really just the cost of your labor and not the passive return of your rental property investment.

Now if you deduct the $600 from your previous returns, then your returns actually turn negative because you only had $6,400 of annual cash flow.

At this point, your investment is really just another job and not a particularly well-paid one given the risks that you are taking. Then you may or may not earn additional upside from appreciation, but that’s always a big question mark and depends heavily on where and when you are investing.

The point here is that the management of rental properties is extremely inefficient and costly, and you cannot simply ignore the costs simply because you are doing all of it. You could have used this time to earn a salary working a job and therefore, it has value.

Things get somewhat better as you gain scale, but you will never enjoy the same economies of scale that REITs enjoy. As such, you are at a big economic disadvantage from the get-go.

Property Managers Are Hugely Conflicted And Expensive

Perhaps a better solution would be to hire a property manager. It is certainly cheaper if your time is even modestly valuable.

But the issue is that even property managers remain expensive, and most importantly, they are hugely conflicted.

The aim of the property manager is to take on as many properties as possible because they earn a percentage of revenue. The time that they are able to spend on your property is then very limited. It is in their best interest to make very quick decisions and waste as little time as possible on your property, which then leads to neglectful, poorly-informed decisions, and increased risks.

These indirect costs can be so substantial that many property owners still think that self-managing is superior, despite the issues that we highlighted previously.

REITs are different because the managers are internally hired by the REIT in most cases and they then only work for the REIT. Their compensation is not a percentage of the revenue, but a fixed salary + a bonus that’s typically tied to the performance of the REIT. The managers will often also have a lot of skin in the game, which motivates them to work in the shareholder’s best interest. To give you an example, the CEO of Farmland Partners (FPI) owns about 5% of the equity, representing $34 million, a very large chunk of his net worth.

Similarly, Sam Landy, CEO of UMH Properties (UMH) has about 50% of his retirement savings invested in the shares of the company.

As a result, the management is far better than if you give your rental property to a random property manager who has completely different interests from yours.

Your Personal Liability is On The Line, Putting You At Great Risk

I rarely hear rental investors talking about liability risk and yet it is so important.

You are making a highly leveraged investment and you are personally signing on to all of the loans.

Moreover, you are making a highly concentrated investment in a single asset in which you are putting the lives of other people.

What could go wrong?

All it takes is one bad surprise and you could lose it all.

A tenant who develops asthma due to the mold in your property and sues you for damages…

A tenant who gets electrocuted and sues you for damages because you didn’t properly maintain your property up to the latest codes that change all the time…

The dog of your tenant falls sick because of “XYZ” and sues you for damages…

You can put an LLC between you and your property but that only goes so far. The tenant will still sue you personally and you could be easily personally liable for a lot of things.

Since you are also personally liable for all the debts, you are taking enormous risk and that’s why so many rental investors end up filing for bankruptcy protection each year. In comparison, REIT bankruptcies are extremely rare, and not a single REIT shareholder has ever lost all of their money as long as they held a well-diversified portfolio.

The Tax Advantages Are Actually a Disadvantage If You Think Long Term

The supposed tax advantages of rental properties are well-publicized.

Since you can depreciate your property, you can artificially reduce the income that it generates and lower your taxation.

That sounds great, but there is a huge catch that people seem to forget about.

Once you have depreciated your property, you can never sell it. Otherwise, you will be hit with a huge tax bill since your cost basis will now be much lower and your tax bracket may have also (hopefully) increased over time.

As such, you are now stuck with your property forever, and that comes with huge indirect costs. It means that you won’t be able to move in and out of the real estate market, even if the market conditions become unfavorable and you identify better opportunities elsewhere. That’s a big cost and most people ignore it completely.

With REITs, you can completely defer all taxes by holding them in a tax-deferred account, and you still retain all flexibility. You can move in and out of the market in an instant. Beyond that, even if you hold REITs in a taxable account, they remain very tax-efficient as we explain in a recent article.

Leverage is a Double Edge Sword

The whole appeal of investing in rental properties is the cheap and abundant leverage that it can afford people.

If you don’t have much capital, it allows you to really turbo-charge your path to wealth by taking on huge debt that’s secured by an asset that’s hopefully going to appreciate over time.

That’s all great if things go well.

But things never go well 100% of the time. All it takes is one black swan-like the great financial crisis or the pandemic – and you could lose it all overnight.

When you are 80% leveraged, you essentially lose 100% of your equity if property prices drop by 20%.

Even if the market is performing well, you could easily suffer a 20% loss if you just get the wrong tenant who trashes your place, or you suffer an unexpected physical break in your property. As an example, your roof starts leaking, but it goes unnoticed for a while, and it causes significant water damage to the entire property.

The point here is that leverage can be good, but it can also ruin you.

That’s why REITs only use 40-50% leverage these days. They learned from the great financial crisis that it is better to consistently earn a 12-15% annual return with more safety than to earn a 15-20% annual return, but then risk going broke when you are hit with a crisis.

Increasingly Often, Tenants Are in Power

The last point that’s often ignored by a lot of rental investors.

In a lot of states, tenants are already king, and this is true in increasingly many places in the US and also abroad.

Because housing is unaffordable in many places, there are more and more people who remain tenants, and politicians naturally want to appeal to them.

The laws are becoming more tenant-friendly and this makes the management of rental properties even more complicated.

As a result, the importance of scale is also becoming more significant. REITs like Mid-America (MAA) and Essex (ESS) own thousands of units and can afford to have the best managers working for them, as well as in-house lawyers when needed.

If you own just a few rental properties, you won’t have the scale that’s needed to cover these costs, and you are exposing yourself to significant risks. All it takes is one tenant dispute and it could cost you years of returns.

Bottom Line

We always hear about all the benefits of owning rental properties. Leverage, cash flow, appreciation, and tax benefits.

But what we rarely hear about are all the hidden drawbacks that actually far outweigh the benefits when you look at the bigger picture and properly account for the opportunity costs and risks.

That explains why so many successful investors favor REITs over rental properties. They have historically been more rewarding in most cases, and importantly, they are a lot safer and require a lot less time from you.

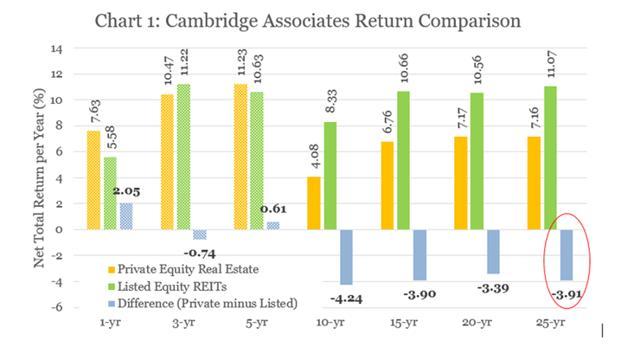

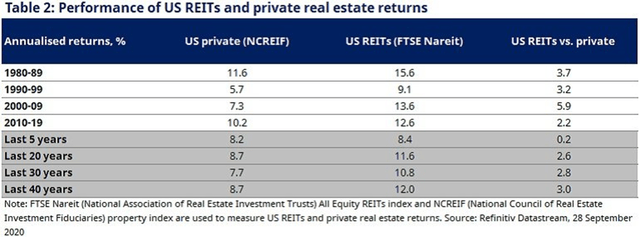

Here are 3 different independent studies that conclude that REITs are more rewarding once you account for all the fees and opportunity costs:

REITs outperform private real estate (EPRA) REITs outperform private real estate (Cambridge Associates) REITs outperform private real estate (Refinitiv Datastream)

Best of all, since the REIT market is notoriously inefficient, you can often find bargains, and earn even better returns by being selective. As an example, my REIT portfolio has compounded at 18% per year on average since its inception, compared to 10% for the most popular REIT ETF (VNQ) over this time period.

Be the first to comment