PashaIgnatov/iStock via Getty Images

In March 2022, gold and palladium rose to new all-time highs, and platinum and silver posted gains before all four metals corrected lower. Precious metals tend to do well in inflationary environments, but they also have industrial applications. Gold is the leader of the precious pack, while silver is a speculative metal that tends to follow the yellow metal higher or lower. Platinum and palladium are rare metals. While gold and silver production come from many regions worldwide, the platinum group metals come primarily from South Africa and Russia.

Markets across all asset classes have been volatile in 2022. Russia’s invasion of Ukraine came after two years of dealing with the global pandemic. Tensions on the geopolitical landscape have increased, with a worldwide bifurcation along ideological lines. China, Russia, Iran, North Korea, and their allies are on one side of the dividing line. The United States, the European Union, the UK, Japan, Australia, Canada, and their allies are on the other.

For nearly eight decades, the US dollar has been the world’s reserve currency. Commodities, including precious metals, have used the US currency as a pricing benchmark. The bifurcation of global powers threatens the dollar’s position in the worldwide economy. Precious metals transcend borders. Aside from their industrial applications, they have long been stores of value and hard currency or a global means of exchange. While bull markets rarely move in straight lines, the trend in most of the four leading precious metals remains higher in early April 2022. The Aberdeen Physical Precious Metals Basket Shares ETF (NYSEARCA:GLTR) holds physical gold, silver, platinum, and palladium.

Inflation is rising, pushing all prices higher

Friday’s employment data for March showed the US economy added 431,000 jobs compared to expectations for 490,000. While the number was slightly lower, the February data was revised up to 750,000 new jobs in February. The unemployment rate fell to 3.6%.

On a month-on-month basis, average hourly wages moved 0.4% higher in March and were revised up 0.1% in February. They rose 5.6% in March and were revised 5.6% higher in February on a year-on-year basis.

Meanwhile, the ISM gauge of factory activity declined to 57.1 in March from 58.6 in February. The ISM’s index of prices paid by producers increased by 11.5% as input costs continue to skyrocket.

The bottom line is that rising wages and increasing input prices are signs that inflation continues to grip the economy. The US administration blamed the sky-high February consumer price index data on Russia’s invasion of Ukraine. Meanwhile, the war began on February 24, so the real impact will come in the March CPI data, which could be shocking.

Commodity prices have been rising since the first half of 2020, when they reached lower as the global pandemic gripped markets across all asset classes. Bull markets rarely move in straight lines, but the trends remain higher as of April 1, 2022.

The US central bank will remain far behind the inflationary curve

The latest jobs and ISM reports are more fuel for the US central bank that only recently awakened from a delusional slumber. Throughout most of 2021, the Fed blamed inflationary pressures on pandemic-inspired supply chain bottlenecks. The central bank called inflation “transitory.” The Fed and US administration has used the pandemic as an excuse, never acknowledging that liquidity and stimulus lit the inflationary fuse. The administration recently pivoted from blaming the pandemic to blaming Russian President Putin in the energy markets. Aside from liquidity and stimulus, the shift in the US energy policy in early 2021 caused production to decline, handing the pricing power to OPEC and Russia. Europe has relied on Russia for energy, and sanctions threaten supplies, putting even more upside pressure on prices.

Inflation is a harsh economic condition that feeds on itself like cancer. The short-term US Fed Funds rate stands at 25-50 basis points on April 1. Even if the Fed boosts rates by 50 basis points at the April FOMC meeting, the short-term rate will stand at 75-100 basis points. The February CPI at a forty-year high of 7.9% means that real interest rates will remain in negative territory. The Fed is way behind the inflationary curve based on the February data, and the March data will be worse. Negative interest rates continue to feed the inflationary fire.

Meanwhile, with the US debt at the $30 trillion level, each 25-basis point increase in the Fed Funds rate increases debt servicing by $75 billion each year. If the Fed Funds rate equaled the February CPI, the debt servicing would amount to a frightening $2.37 trillion each year, and that is without the compounding effect. The Fed is in a catch-22 position as it took too long to react to inflation, and the necessary monetary policy medicine would thrust the economy into a tailspin. Moreover, with the US mid-term elections later this year, the administration does not want to see the economy and stock market tank. The US economy has not been in this position since the late 1970s. The Fed will remain far behind the inflationary curve as higher interest rates would cause economic instability.

The bond market has sent a message

The US bond market woke up long before the Fed’s economists.

US 30-Year Treasury Bond Futures (CQG)

The weekly chart shows the US 30-Year Treasury bond futures market turned lower in August 2020 from the 183-06 level. Since then, the long bond futures have made lower highs and lower lows, falling to the latest low last week at 146-10. The Treasury fell to the lowest level since April 2019. Support for the long bond stands at the October 2018 136-16 low. Below there, the next technical support level is at the late 2013 127-23 bottom.

The Fed controls short-term interest rates, but the bond market establishes rates further out along the yield curve. The bond market had been reacting to inflation long before the central bank realized that the economic condition was structural. While blame is useless, and action is what matters, politicians and central bankers use blame to cover their tracks with the public. Taking responsibility is the first step in establishing a path to getting the economy back on the correct course. The pandemic and Russia have fanned the flames of the inflationary fire, but the arsonists have been liquidity, stimulus, and energy policy.

Precious metals are inflation barometers- The PGMs have clean energy applications

Precious metals are commodities and are economic indicators that reflect inflationary pressures. Rising interest rates are historically bearish for precious metals because they increase the cost of holding gold, silver, and platinum group metals. Higher US rates also push the dollar higher against other world currencies, adding to the metal’s bearish pressure.

Meanwhile, the sector faces bullish and bearish factors as real interest rates remain negative and inflation has been a vicious cycle that continues to rise. Gold and silver are financial assets. Gold is a reserve currency held by central banks worldwide. Silver follows gold and is a speculator’s dream, as it tends to outperform gold on the upside and underperform on the downside, providing leverage compared to the yellow precious metal.

Platinum and palladium are industrial and precious metals. PGM’s density and heat resistance allow them to clean toxins from the environment. Russia is the world’s second-leading platinum producer and the leading palladium producer.

In March, gold and palladium prices moved to new all-time highs before correcting.

Weekly COMEX Gold Futures Chart (CQG)

The weekly chart shows that gold rose to $2,078.80 per ounce, marginally eclipsing the August 2020 $2063 peak.

Weekly NYMEX Palladium Futures Chart (CQG)

Palladium rose to $3,380.50 per ounce, not so marginally eclipsing the May 2021 $3019 high last month.

Weekly COMEX Silver Futures Chart (CQG)

Silver, gold’s turbocharged partner, rose to a new high for 2022 of $27.31 per ounce in March.

Weekly NYMEX Platinum Futures Chart (CQG)

In March, platinum futures also reached a new 2022 high at $1197 per ounce.

Buying precious metals on rallies tends to be a dangerous and low-odds strategy and buying them on price corrections improves the potential for success. Gold, silver, platinum, and palladium prices have declined from the March highs.

The GLTR holds a basket of the four leading precious metals

The recent price correction in the four leading precious metals is an opportunity with a handcuffed Fed that cannot go far enough to extinguish the inflationary fire.

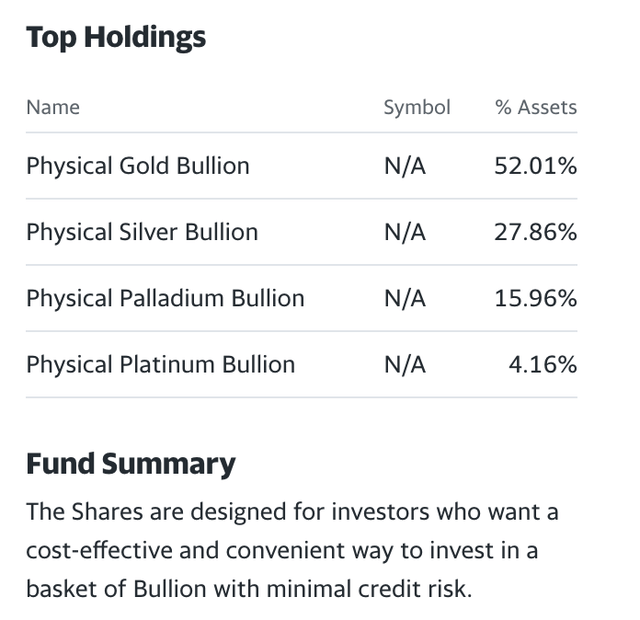

The most direct route for investment in precious metals is via the physical market for coins and bars. The Aberdeen Physical Precious Metals Basket Shares ETF holds the metals for investors. The fund summary and most recent top holdings include:

Top Holdings of the GLTR ETF Product (Yahoo Finance)

At $95.72 per share on April 1, GLTR has over $1.16 billion in assets under management. The ETF trades an average of 111,565 shares each day and charges a 0.60% management fee.

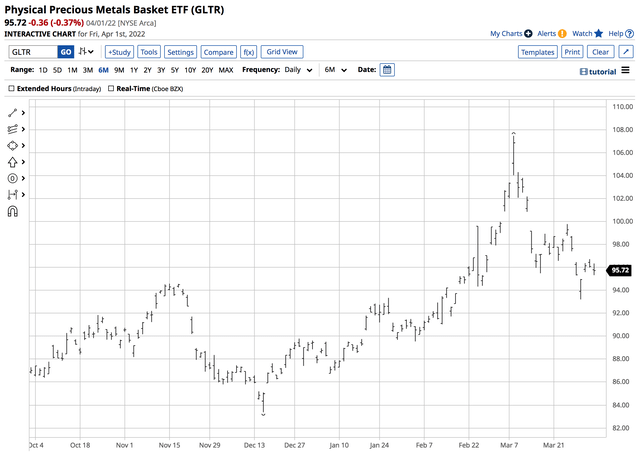

Chart of the GLTR ETF Product (Bartchart)

GLTR rose from $89.45 on December 31, 2021, to $95.72 on April 1 or 7%. The ETF reached a high of $107.47 on March 8, when the precious metals reached their most recent highs.

Inflation is not going away anytime soon, with US real rates in negative territory. Buying GLTR below the $100 level could deliver substantial rewards in an inflationary environment.

Be the first to comment