alfexe

Introduction

We need to talk about gold and gold miners, as I believe that gold miners are the best way to trade the price of gold – besides physical gold. The reason I’m writing this article is that we see some highly interesting developments that make a rebound and relative strength in gold prices highly likely after this year has been very hard on the world’s most famous shiny metal. As stocks continue to get clubbed, gold and longer-duration bonds start to outperform. It appears that the first cracks in the narrative appear as the market believes that we’re close(r) to a point where the Fed cannot continue its extremely hawkish path, leading to market participants betting on a rebound in gold as the risk/reward is starting to look extremely attractive. After all, it seems that the Fed will have to make a choice soon: to get inflation down or to protect financial stability. If the Fed picks the latter, gold and its miners are a huge buy!

The Federal Reserve Is Creating Havoc

“Do not fight the Fed” are five words I’ve been told countless times over the past 12 years. The interesting is that it usually meant something like “just go long, the Fed isn’t going to let this market tank”.

And that made sense. After all, when I began trading in 2011, I started almost at the very beginning of what would be one of the longest periods of accommodative policies in the central bank’s history. It was a period of subdued inflation, which made it easier for the Fed to refrain from doing anything that would upset the market.

CME Group

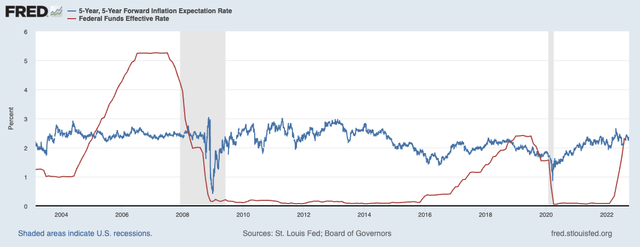

The chart above shows whether the Fed’s policies are restrictive, neutral, or accommodative.

While definitions vary, CME Group (CME) (where I got this chart from) used the following definition:

The “neutral” rate is thought to reside at a level that equals or slightly exceeds longer-term inflation expectations. With long-term inflation expectation probably in the 3% territory, the Fed would not get to “neutral” until short-term rates were raised to more like 3.5% or so.

At the end of last month, I wrote a detailed market outlook article, where I used the graph above to make an important point: the Fed isn’t as aggressive as it may need to be. After all, and using the definition above, the Fed’s policies have barely made it into neutral territory. Historically speaking, it is likely needed to hike rates further to get inflation (expectations) down to acceptable levels.

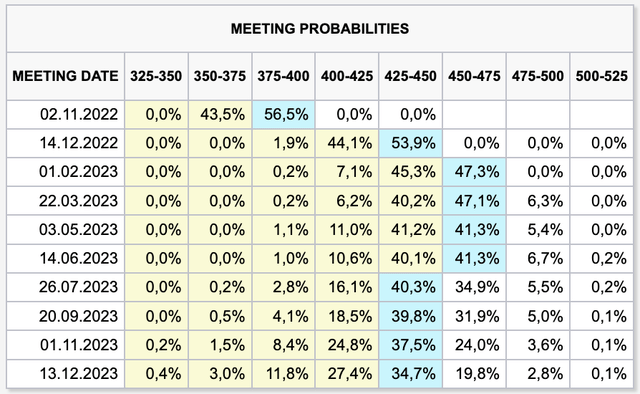

The good news is that it looks like the Fed will soon enter restrictive territory as the market is now expecting the terminal rate to be in the 450 to 500 basis points rate with a rate cut in the summer of 2023.

While these estimates change constantly, depending on the news, the market does not expect the Fed to be supportive in a time of economic weakness. And that’s exactly why this market environment is so tricky. On the one hand, we have high and lasting inflation, mainly caused by supply issues, which the Fed cannot directly impact. On the other hand, we have slowing economic growth, which the Fed will need to make worse in order to “harm” demand to fight inflation.

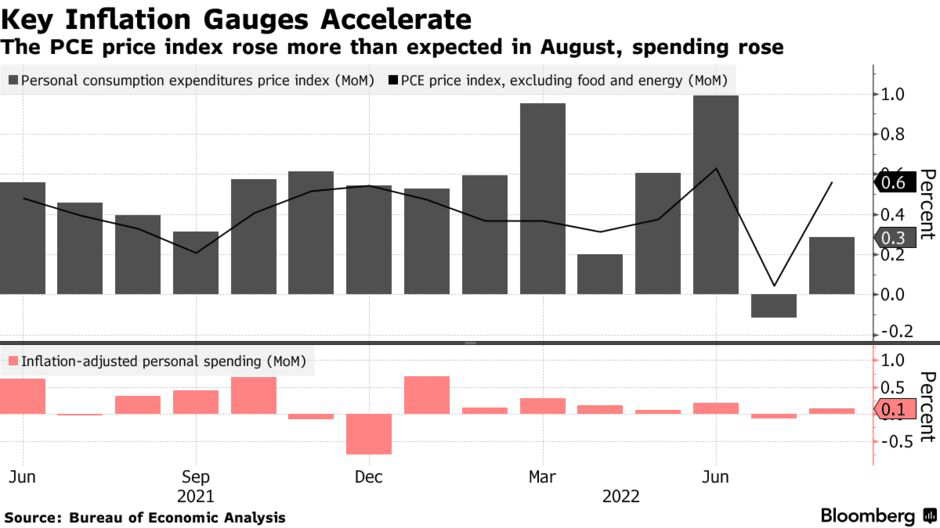

It also didn’t help that personal consumption expenditure prices rose more than expected in August. The fact that the Fed’s favorite inflation indicator remained strong might be a sign that it hasn’t done too much harm to the economy. After all, the Fed knows it needs to hurt economic growth to get inflation down. However, it also knows that it cannot go too far as severe stagflation risks would be a worst-case scenario for lower- and middle-income families.

Bloomberg

At this point, believe it or not, the biggest bull case is that economic growth and inflation come down hard. That would force the Fed to become less aggressive.

In other words, “do not fight the Fed” started to mean something else this year.

Now, we aren’t done discussing the Fed. However, in the next segment, we involve Gold as well.

Why I’m Turning Bullish On Gold

While gold in British pounds or euros is close to its all-time high, COMEX-listed gold futures are not. Gold is currently trading roughly 18% below its all-time high as a result of dollar strength. Yes, inflation is sky-high, yet gold isn’t the hedge some people believe it to be. The problem is that in a scenario where the Fed is draining liquidity from the system, the dollar becomes stronger. That’s bad for gold. The best situation for gold is a dollar downtrend as a weaker dollar is usually what gets gold going (instability and inflation fears).

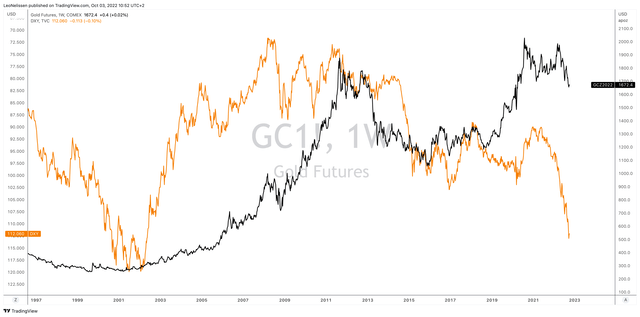

Note that the massive gold rally in the early 2000s was supported by a significant decline in the dollar as the chart below shows.

TradingView (Black = COMEX Gold, Orange = Inverted Dollar Index)

While people believe that gold is an inflationary hedge (it is in some way), the opposite is currently the case. Last month, Bloomberg ran a headline saying “Gold slides as hotter US inflation keeps hawkish Fed on track”. That perfectly sums up the situation.

It also means that we know where to look for clues when it comes to finding a bull case, right?

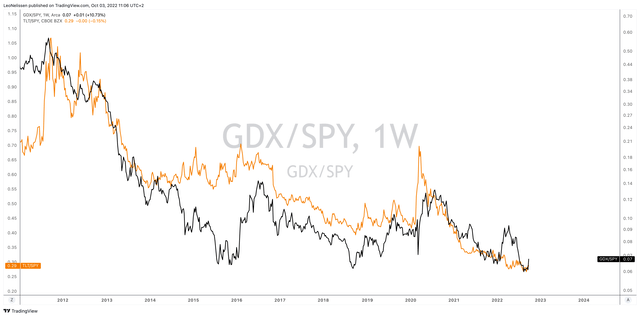

The chart below got my attention last week. What we’re looking at below is the ratio between gold mining stocks (VanEck Gold Miners (NYSEARCA:NYSEARCA:GDX)) and the S&P 500 – that’s the black line (log scale). The orange line displays the ratio between long-term government bonds (TLT) and the S&P 500. Bond yields have been under tremendous pressure as a result of exploding long-term inflation expectations and an aggressive Fed. However, during the last few weeks, “long” bonds have started to gain a relative advantage. The same goes for mining stocks.

TradingView (Black = GDX/SPY (Log), Orange = TLT/SPY)

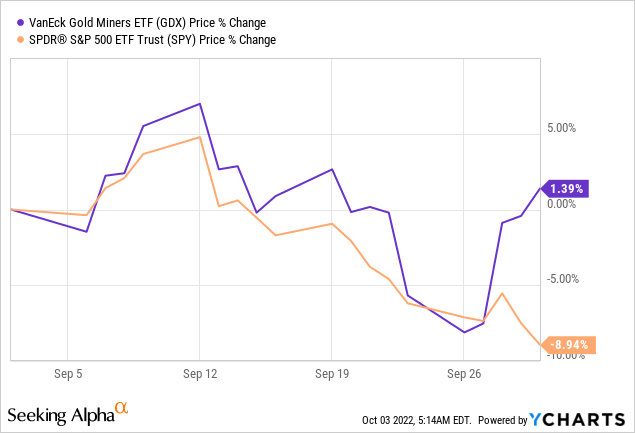

Not only did gold miners outperform, they even went up outright as the chart below shows. Gold miners are up 1.4% over the past month. The market is down 9% during the same period.

This divergence makes sense as we’re at a crucial point. Last week, I got a report on my desk from the Bear Traps Report, which said the following (I don’t have a link for this, unfortunately):

Global Financial Stability risks starting to trump inflation risks, those that nail this inflection point and the timing, we will crush market alpha adjusted returns in 2H 2022 into 1H 2023.

Bloomberg (via Bear Traps Report)

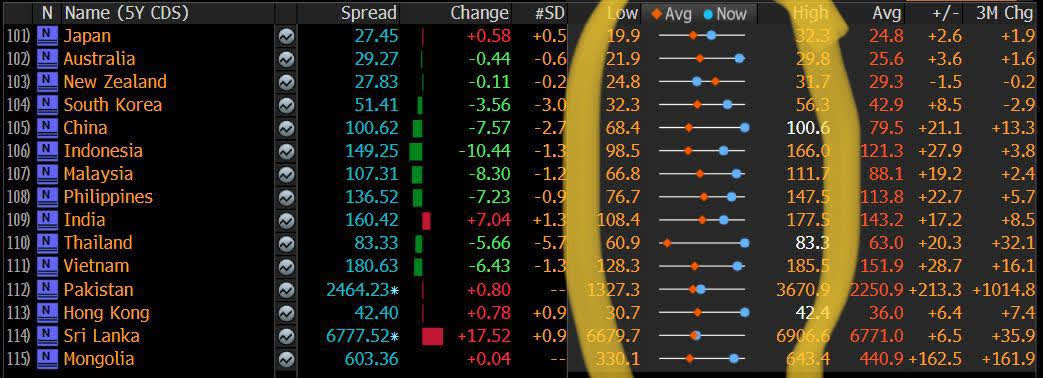

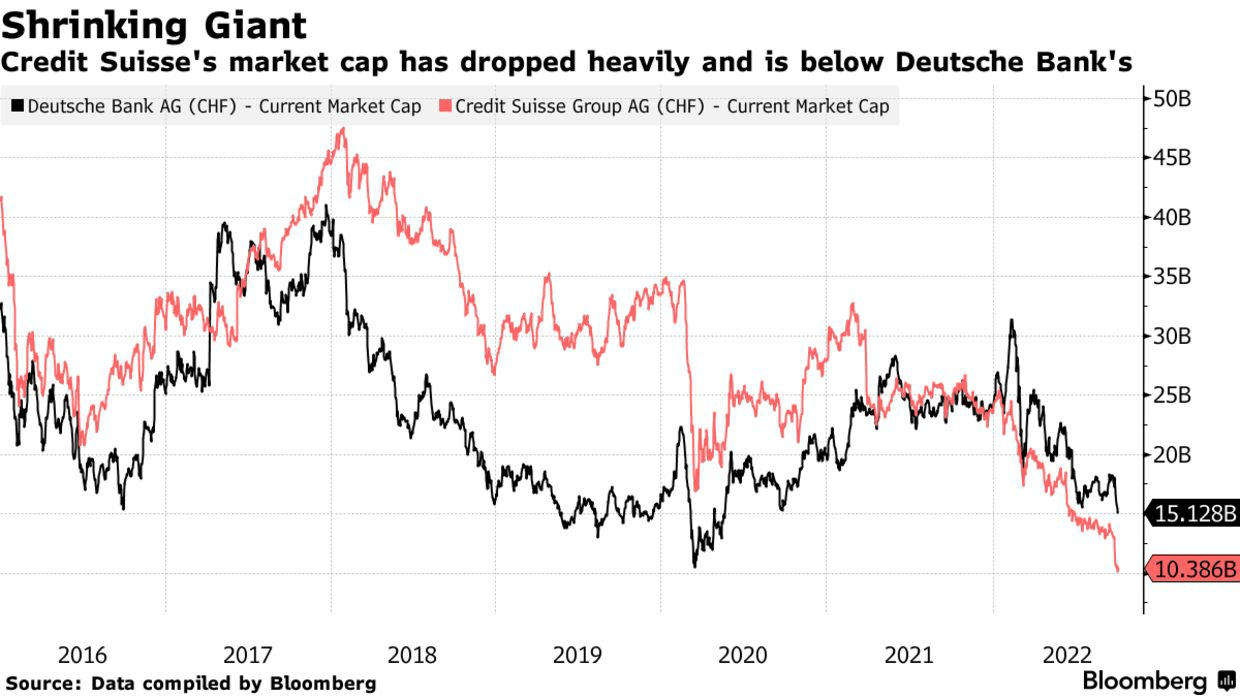

As I said in the introduction, the Fed may soon prioritize financial stability over its fight against inflation. As the overview above shows, credit default swaps (“CDS”) have risen to high levels across the board. Especially emerging markets are suffering from the strong dollar, which means investors start to buy insurance to be protected against rising default risks. That’s basically what CDS’ are. The same goes for financial institutions, which are now showing serious cracks. The chart below shows two major banks, whose CDS levels have been rising: Deutsche Bank and Credit Suisse. By the time you’re reading this article, I’m sure you have heard that the stock prices of the two banks aren’t doing “that well” to put it very mildly.

Bloomberg

Hence, voices are getting louder that the Fed may have to change something.

It does make sense as bonds and stocks lost more than $35 trillion ($35,000 billion) this year. Once people start losing a lot of money, they do look for the easiest solution, which is an early Fed pivot.

Bloomberg

Earlier this month, Bloomberg run an article highlighting this shift.

Hawks like Cleveland Fed chief Loretta Mester say they must keep raising rates aggressively to win the battle against inflation even if that causes a recession. Vice Chair Lael Brainard has offered a slightly softer assessment while continuing to stress the need to tighten policy.

Brainard’s speech Friday — the first from Fed board leadership since officials met last week — said policy will need be restrictive for some time and avoid the risk of prematurely pulling back.

But she injected a note of caution about how fast they need to go, while discussing a number of ways in which the global rate-hiking cycle could spill over on the US economy.

While none of this is dovish in any way, the comments are starting to show a bit of variation after a nonstop stream of hawkish comments from Fed members. Even the ones who were very dovish until the very last moment (prior to the hiking cycle), like Lael Brainard.

Essentially, she is making the case to become more data dependent, looking at the steady flow of new economic data, which I believe means something like “if economic growth keeps imploding, we may take our foot off the brake”:

“Uncertainty is currently high, and there are a range of estimates around the appropriate destination of the target range for the cycle,” she told a conference hosted at the New York Fed on financial stability. “Proceeding deliberately and in a data-dependent manner will enable us to learn how economic activity and inflation are adjusting to the cumulative tightening.”

If the Fed were indeed to take the foot off the brake, it could weaken the dollar a bit. The problem is that the dollar isn’t just strong because of the Fed, but also because the euro area and the United Kingdom are in a big mess. These two currencies (euro and pound) account for roughly 70% of the dollar index.

Yet, if the Fed were to slowly hint that it may pivot, I have little doubt that gold will fly. Hence, I’m looking at miners.

Why GDX?

There are many roads that lead to Rome. People can buy physical gold, physical gold ETFs, mining ETFs, single mines, or other ways.

As this article isn’t aimed to explain the long-term bull case for gold, I have decided to go with miners. When trading gold, I believe it’s important to find a way to get as much alpha as possible. In the case of gold miners, we’re dealing with companies that are highly correlated to the price of gold – after all, it drives their income – that have a history of outperformance during bull markets.

The GDX ETF is the largest gold mining ETF in the world with net assets of roughly $600 million. The expense ratio is 0.53%, which is much higher compared to index fund ETFs. Yet, I believe it’s acceptable.

One of the things that make GDX great is that it means we don’t have to find single mining stocks. Researching these can be tricky as investors need to understand how mining operations work, how many reserves a mine has, where it produces (geopolitical risks), how its balance sheet is doing, and much more.

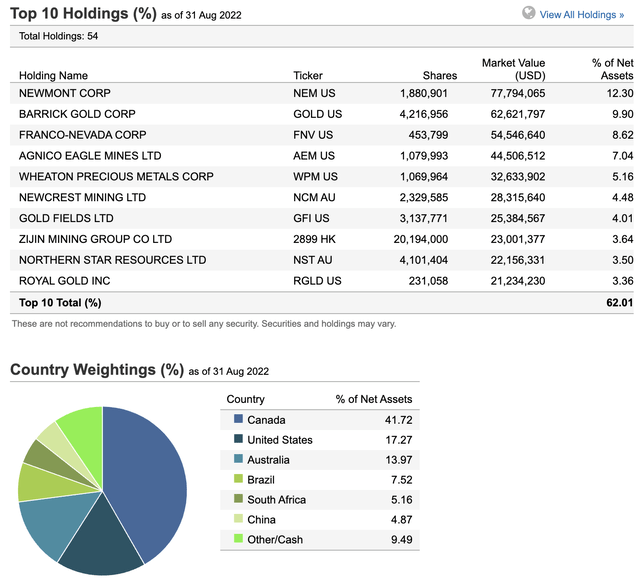

This ETF holds 49 mining companies and it reinvests all dividends. The ETF’s largest holding, Newmont (NEM) accounts for 12.3% of its assets, and the top 10 account for 62%. Moreover, Canada has a 42% weighting, which makes sense given the density of high-quality gold mining companies in that country. The United States and Australia account for 17.3% and 14.0% of total assets, respectively.

With that said, GDX is currently 45% below the highs set in 2020. The last time the market started to price in a more dovish Fed (2018-2020), GDX advanced roughly 150%. Gold soared from $1,200 per ounce to roughly $2,100.

CME Group

While it’s hard to guess how far GDX can run, I think if the Fed hints at a pivot, we can easily see a similar performance. Hence, I believe the current risk/reward is quite good.

Takeaway

Just like the market, in general, gold and gold miners are in a tough spot. Despite high inflation, gold investors have not enjoyed capital gains. The problem is that the dollar has become too strong. It caused gold to fall quite significantly from its recent highs. As gold miners trade at a higher beta, mining stocks have lost close to half of their value.

The biggest bull case for gold and its miners is a pivoting Federal Reserve. While the consensus is that the Fed won’t start to ease until at least the second half of 2023, voices calling for an earlier pivot are slowly but steadily getting louder.

The problem is that the Fed needs to tame inflation at a time when growth expectations are plummeting. In addition to structural supply issues, this is making it impossible to achieve a “soft landing”. Hence, financial stability is at risk, which could now trigger the Fed to prioritize financial stability over fighting inflation.

That’s not the consensus yet, which is why GDX is trading almost 50% below its peak.

At this point, I believe that momentum is shifting. Gold and miners have started to outperform the market. I expect this to continue. The reason I’m discussing GDX is that I expect mining stocks to deliver more alpha.

GDX looks like it could soon start to move upwards.

However, please be aware that GDX is very volatile. Only trade mining stocks if you are aware of the volatility. So far, my thesis is far from consensus, which is often the case at turning points. If I’m right, the GDX trade will pay off handsomely. If I’m wrong and the Fed is indeed going to crush inflation regardless of the state of the economy, GDX could fall another 10-20%.

Yet, looking at the bigger picture, I think that still makes the risk/reward rather attractive.

(Dis)agree? Let me know in the comments!

Be the first to comment