viper-zero

With the Boeing (NYSE:BA) 737 MAX and Boeing 787 back in the delivery stream, these are interesting times for Boeing. The US jet maker is still not having access to one key market, Defense is underperforming, and debt remains high, but positives are there nonetheless. We have recently seen some analysts, also on Seeking Alpha, become more bullish on Boeing, even talking about a turnaround of the decade. While this might be a rewarding entry point, I believe it is a good time to also realize that the turnaround at Boeing is a work in progress that started the day after the second crash with the Boeing 737 MAX and many changes, especially in the leadership ranks, have yet to be made. If you want a real turnaround, have a look at Bombardier (OTCQX:BDRAF). The company, as well as its stock prices, are emerging from a very thorough reorientation of the company and that has paid off for shareholders with the stock being up 157% versus 4% for the broader markets.

Also important to realize is that, while Boeing shares are now marked as a buying opportunity, I changed my rating from Hold to Buy on Boeing in May 2022 based on signs of pricing strength in the market. Since then, shares have gained 46% compared to a 4% gain for the broader markets. So, by covering Boeing in detail we have identified entry points that have already been rewarding. Seeking Alpha analysts tend to outperform the global markets and, by precisely mapping companies such as Boeing, I have been able to identify entry points that are even more rewarding than the Seeking Alpha consensus. It shows the value of precise mapping and coverage and it is one of the reasons why picks from The Aerospace Forum, my marketplace service, have picks that significantly outperformed the market. We stick to our area of expertise and that is translating into value for readers.

It is a complex puzzle that, when put together, identifies entry points way earlier than other parties. The next piece of that puzzle might be a purchase of Dreamliners by United Airlines (UAL). In this report, I explain why a choice for Boeing 787 would not be surprising even though other options are available and on order as well.

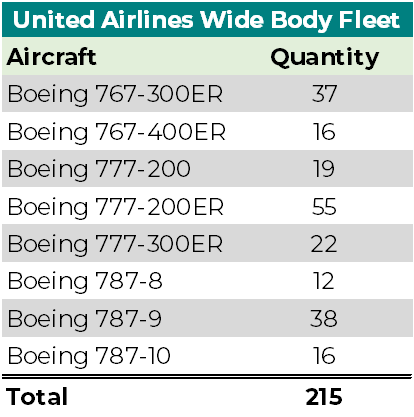

A Peak At The United Airlines Wide Body Fleet

United Airlines wide body fleet (The Aerospace Forum)

The current wide body fleet of United Airlines consists of 215 aircraft. Around 30% of the fleet consists of next generation wide body aircraft. The Boeing 777-300ER fleet is relatively new and United Airlines acquired those aircraft with significant discounts from Boeing years ago, when the US jet maker was looking to bridge the gap between Boeing 777 and Boeing 777X production without having to significantly reduce the production rate. The US jet maker eventually did have to significantly dial back the production rate, but United Airlines got a good deal on the aircraft it did buy.

The Boeing 767-300ER fleet is aging with an average age of 23.8 years. The youngest aircraft is almost 20 years old and the oldest aircraft is 31.7 years old. Earlier this year, the airline removed one aircraft that was over 30 years old from service due to corrosion and repair was financially not attractive for the airline. Typically, wide body aircraft are removed from the fleet when the aircraft approaches the age of 25 years, but there are airlines pushing this to 30 years. United Airlines has 20 Boeing 767-300ERs aircraft that are older than 25 years and, out of these 20 aircraft, 13 are older than 30 years. You could say a replacement is long overdue. The Boeing 767-400ER fleet has an average age of 21 years, so also for these aircraft it is time to consider a replacement.

United Airlines has marked its Boeing 777-200ER as a CASM winner. That might be the case, but its CASM advantage is likely largely derived from the aircraft being fully depreciated. The longer trips on which these aircraft are utilized on, pushing the CASM (costs per available seat-mile) down, is something that I will just consider efficient use of the machines and not so much a reason for the aircraft to be a true CASM winner. The Boeing 777-200/200ER fleet has an average age of 23.5 years, so also for this part of the fleet United Airlines should seriously consider a replacement.

Unite Airlines has recently started bringing back its Boeing 777-200ERs to the fleet after an engine failure in 2021, and back then I had expected this would result in an acceleration of the Boeing 777-200/200ER phase out.

The number of aircraft that should eventually be replaced is 127. Those are 127 aircraft that Boeing and Airbus (OTCPK:EADSF) will be competing for.

The Options For A Thorough Fleet Renewal

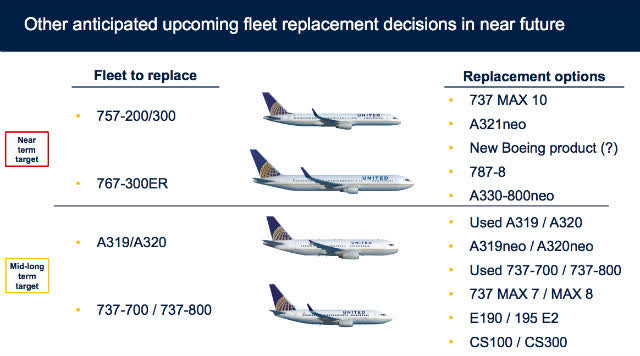

United Airlines fleet plan 2018 (United Airlines)

Looking at the fleet ages, one could wonder why United Airlines has not decided to update its fleet earlier. The reason is that United Airlines had been looking to replace its Boeing 757 and Boeing 767 fleet with a new Boeing aircraft addressing the middle of the market. During the 2022 Investor Day at Boeing’s delivery center at Renton which I attended online and covered, CEO David Calhoun mentioned that for the coming years no new aircraft developments are on the planning table. I do not view that as a major positive, not even a small positive. But for United Airlines, it narrowed down the options it envisioned to have back in 2018. Airbus previously pitched the Airbus A330-800neo to the airline, but with limited market adoption of the smallest member of the Airbus A330neo family, it is not the preferred option. The Airbus A330neo works, it is not a bad product, but for airlines that are not operating an Airbus wide body fleet, it makes less sense.

Airbus

Airbus has been able to sell Airbus A350 to United Airlines, but that is an order that has not been consummated and neither party has had a lot of pleasure from this order. For that order, and to understand why it has not been consummated to this date, we have to go back 13 years. In 2009, United Airlines ordered 25 Airbus A350-900 aircraft and 25 Boeing 787-8 aircraft. It was a typical hedge order as we typically see. It helps airlines gain advantageous pricing schemes and reduces risk of aircraft development and delivery delays affecting the airline’s planning. However, a year later, United Airlines combined with Continental Airlines as part of a round of consolidation in the airline industry. Continental Airlines also had a total of 25 Boeing 787 aircraft on order. The resulting overall order book was leaning more towards Boeing than towards Airbus.

This, however, did not necessarily role out any future role for the Airbus A350. The fact, however, is that the Boeing 787 would better integrate with the existing fleet that United-Continental would have. The newly formed airline recognized this, and by 2013, the order was sized up to 35 aircraft and converted to orders for the bigger -1000 variant as an envisioned replacement to the Boeing 747-400 of which United operated 23 aircraft with first deliveries expected in 2018. However, in 2015, Boeing stepped up and started selling Boeing 777-300ERs to United Airlines and the Airbus A350-1000 order effectively became redundant as a replacement to the jumbo jet. By September 2017, Airbus and United Airlines reached an agreement to convert the Airbus A350-1000 orders to orders for the Airbus A350-900 and increasing the order quantity by 10 units to 45, effectively positioning the aircraft as a replacement for the Boeing 777-200ER with deliveries to start by 2022 (this year). However, by 2019 the order was deferred until 2027 and deliveries are now scheduled for “after 2027”. So, what we are seeing is that deliveries are now scheduled no earlier than 18 years after the initial order was placed.

By 2017, United Airlines had aligned the order as a replacement to the Boeing 777-200ER but favoring CapEx relief it elected to defer Airbus A350 deliveries. In a report published last month I noted the following:

These aircraft could be used to replace the Boeing 777-200/200ER fleet, but it means that United Airlines is looking at CapEx of $8 billion to $9 billion to renew the fleet. Usually this is financed with debt and with interests rates higher, that could become costly for United Airlines while the competition is progressing better in keeping the fleet age down.

So, what was provided as CapEx relief over the past few years as United Airlines kept deferring the A350 order is now going to add to the debt pile and that will be the case whether the airline opts for a Boeing solution or an Airbus solution. In some way, we are also seeing that while in 2018 a Boeing 777-200/200ER replacement was not highlighted as the Airbus A350 was given this role, the deferral to post-2027 opens up that replacement opportunity for Boeing.

Choice For Boeing 787 Is Not Surprising

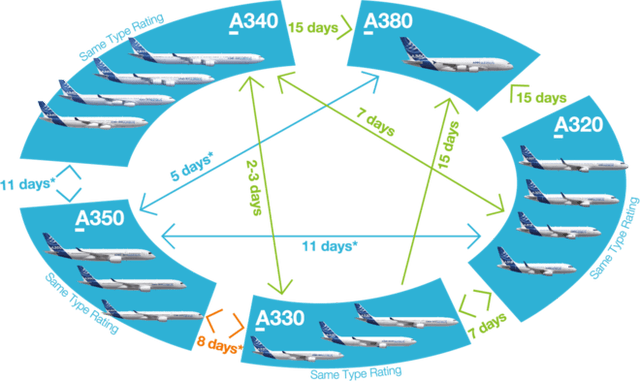

Airbus training paths flight deck (Airbus)

While no selection has been announced, the Boeing 787 should come out as the winner here. We see limited appetite from United Airlines to add the Airbus A350 to the fleet and that has been the case for years now. On paper, an Airbus A330neo/A350 solution could work, requiring a 11 day training from the Airbus A320 family that United Airlines has in its fleet to the Airbus A350 and an eight day training to also be able to fly the Airbus A330neo, which shares a cockpit layout with the Airbus A350 rather than the Airbus A330ceo.

This is where Boeing has a big advantage, because the differences training from the Boeing 777 to the Boeing 787 takes just five days.

Size And Importance Of The Order For Boeing

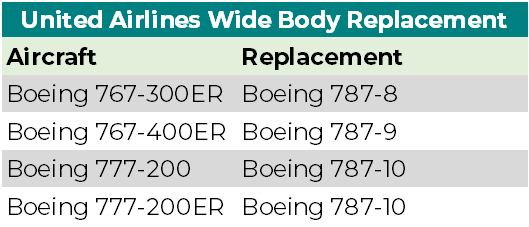

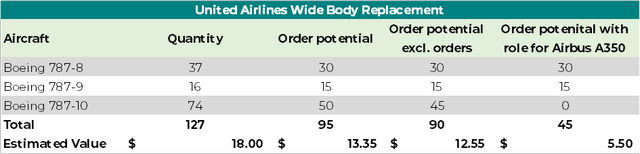

The Aerospace Forum

To determine the value of the order, we need to make some assumptions on which Dreamliner will be replacing each type. Generally, the Boeing 767-300ER could be replaced by the Boeing 787-8 while the -400ER can be replaced by the Boeing 787-9 and the Boeing 777-200 aircraft find their replacement in the Boeing 787-10. The Boeing 787-9 is the more popular member of the aircraft, so I could also see United leaning somewhat towards that variant instead of the -8.

Just swapping the aircraft on a one-on-one basis would provide us with an order of 127 aircraft valued $18 billion. Keeping in mind the aircraft that are already on order, namely 5 Boeing 787-10s, and the capacity of the aircraft the order potential would be closer to 90 Boeing 787-10 and if United Airlines still sees a future for the Airbus A350, the order potential for Boeing would be $5.5 billion for 45 aircraft. However, I do believe that the order if placed with a complete replacement in mind would be 90 to 125 aircraft valued $12.55 billion to $18 billion.

Boeing

For Boeing, the order would be extremely good news as the airline is envisioning bringing its production rate on the Boeing 787 from the current level of two aircraft per month to 10 aircraft per month by mid-decade. A big order from United Airlines would definitely help Boeing achieve that, realizing higher overall revenues and lower unit costs.

Conclusion: United Airlines Order Could Be A Big Boost To Boeing and Boeing Stock

Important to realize is that the United Airlines order has a long history, especially with Boeing’s European competitor. The way it is looking now, Boeing will ultimately be winning, as it managed to keep the Airbus A350 out of the United fleet as a replacement to the Boeing 747-400, after which increasing the order quantity for the Boeing 787 as a replacement to the Boeing 767-300ER/400ER and Boeing 777-200/200ER seems to be more appealing. We have yet to hear confirmation on an order and the quantities, but I believe that Boeing will be booking this order, and it could be a big order valued between $12.5 billion and $18 billion for 90 to 125 aircraft, giving the jet maker 3.75 to 5.2 years of production in backlog or, said differently, a sizeable order from United Airlines supports a rate hike for the Dreamliner program as envisioned. At rates envisioned for mid-decade, the order could fill 9 to 13 months of production.

So, I do see continued upside for Boeing based on inventory unwind, continued order inflow, and year-over-year improvement in delivery volumes, and United Airlines could be another piece of the puzzle helping Boeing in improving its performance.

Be the first to comment