Mihaela Rosu

I like the Oracle (NYSE:ORCL) valuation setup, but am leery of missing growth drivers over the last decade. I like the Intuit (NASDAQ:INTU) strong-growth profile, but the valuation is still a little expensive. That’s the dilemma for investors researching these two leaders in the business software industry, both with increasing focus on cloud-based artificial intelligence [AI].

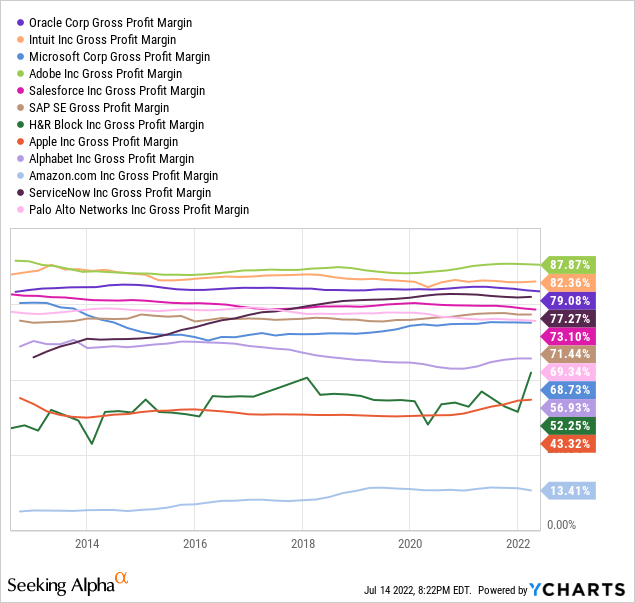

The two companies work at different ends of the marketplace (exclusively business-to-business sales for Oracle vs. more of a retail model for Intuit), but operate with remarkable, similarly high gross profit margins. Gross margins for the two are nearly the best of any Big Tech peer or competing enterprise.

YCharts

Management decisions and focus seem to be conservative and deliberate at Oracle, while Intuit is a leader in reviewing customer surveys and ratings to reinvent its software over time. Both have engaged in major merger deals in recent years to fill in gaps for offerings and add new levels of data for future AI endeavors.

Oracle is in the process of digesting its $28 billion acquisition of Cerner, one of the world’s top medical recordkeeping enterprises. The merger idea is medical care information can be more effectively managed through Oracle’s cloud networks and operating systems, with the combined effort able to expand faster outside the U.S. For sure, co-founder and Executive Chairman Larry Ellison has been searching for ways to increase Oracle growth rates.

Intuit bought Credit Karma (a free to use financial information website) for $8 billion in 2020 and Mailchimp (email marketing for small business) for $12 billion in 2021. Management has been busy entering new markets to provide small business with useful products, and opening avenues to cross-sell existing software.

Operating Highlights

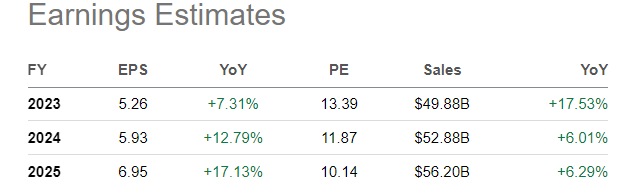

Oracle’s growth rate estimates for sales and earnings are in the neighborhood of 9%-12% annually. The Cerner deal was small in comparison to ORCL’s $190 billion stock market capitalization, and may not move the needle much for accelerating investor interest.

Oracle Website

Oracle Website

Oracle Website, 2022 Milestones

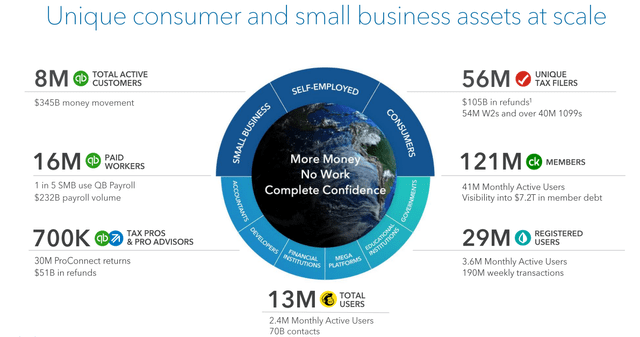

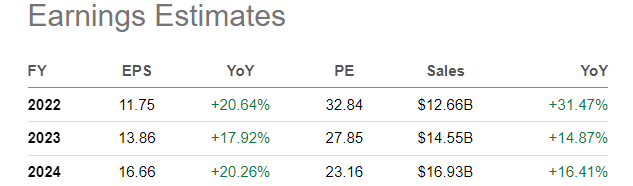

While Oracle is a leader in cloud and networking infrastructure, analytics, software and solutions for big business, Intuit is the top cloud software and online provider for small businesses in America, running QuickBooks, TurboTax, Mint (budget tracking and financial management), Credit Karma, and Mailchimp, among other popular names. Intuit has projected underlying growth rates of 15%-20% annually the next five years vs. an equity capitalization of $105 billion today.

2022 Annual Shareholders Meeting Presentation

2022 Annual Shareholders Meeting Presentation

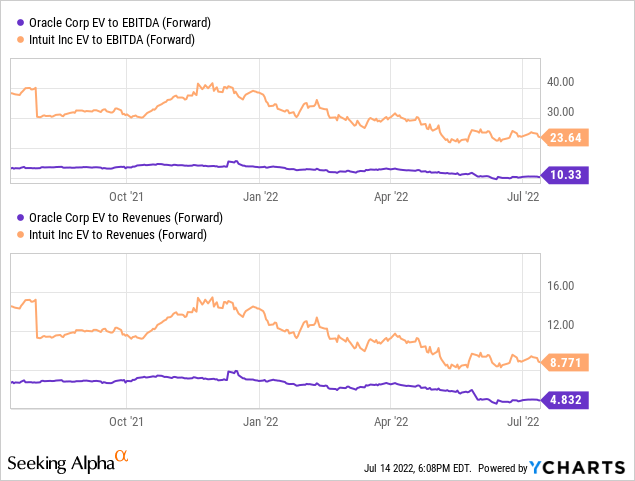

Valuations

Let’s quickly run through some investing data points for comparison. If your goal is low upfront valuations of the operating business, Oracle looks like the clear winner. Assuming a zero-growth future for both organizations, Oracle would be the better choice, hands down. Enterprise value, including equity and debt capitalizations, to forward projected EBITDA or Revenues favors Oracle as the bargain choice.

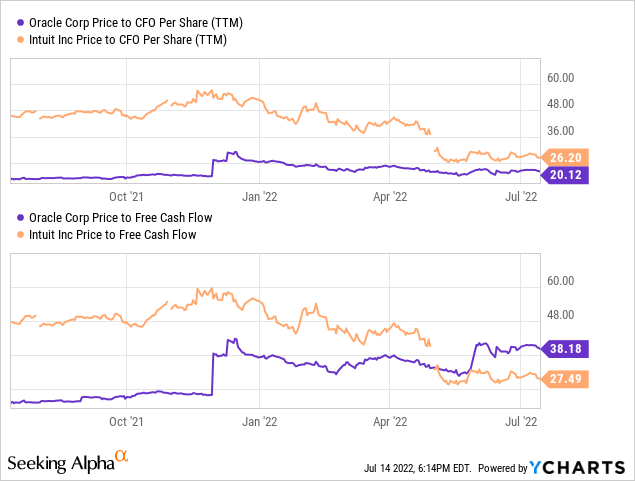

YCharts

However, cash flow valuations are considerably closer to each other. In fact, price to “trailing” free cash flow generation favors Intuit (good for a nearly 4% free cash flow yield at $385 per share).

YCharts

Business Growth and Investment Returns

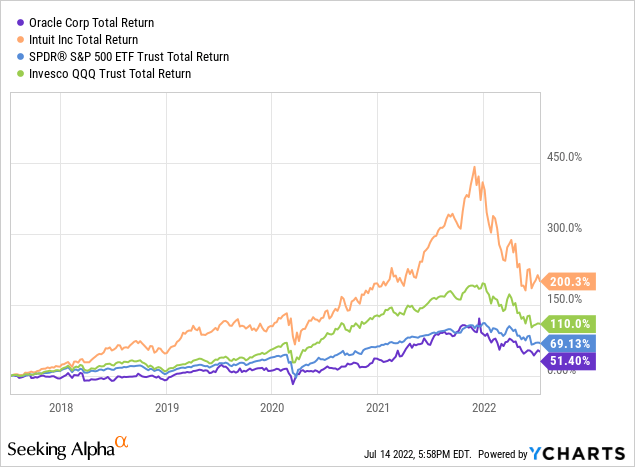

If your investment goal is maximized gains for your brokerage account, Intuit’s excellent level of growth has driven a material price advance. Trailing total returns have more closely followed growth rates in the underlying businesses since 2020, with Intuit as the top choice.

YCharts

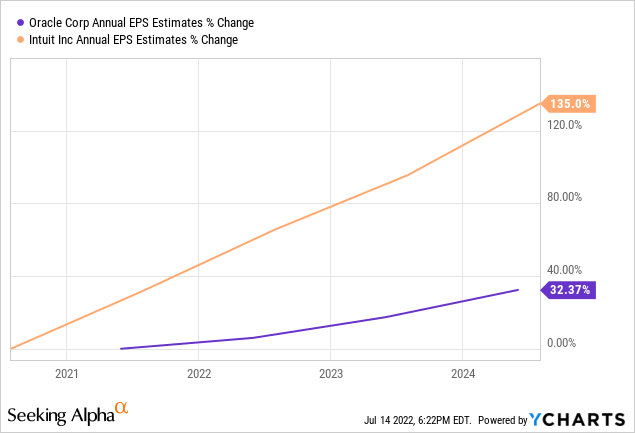

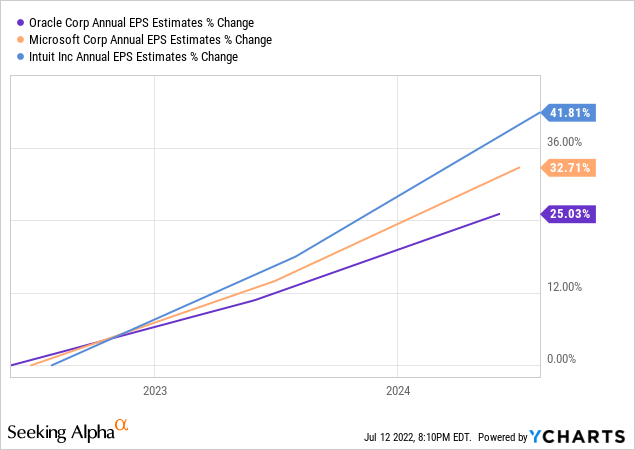

And, Intuit is projected to grow much faster than Oracle for years to come, highlighted on the consensus estimate tables below.

ORCL, Seeking Alpha – Analyst Estimates – July 13th, 2022

INTU, Seeking Alpha – Analyst Estimates – July 13th, 2022

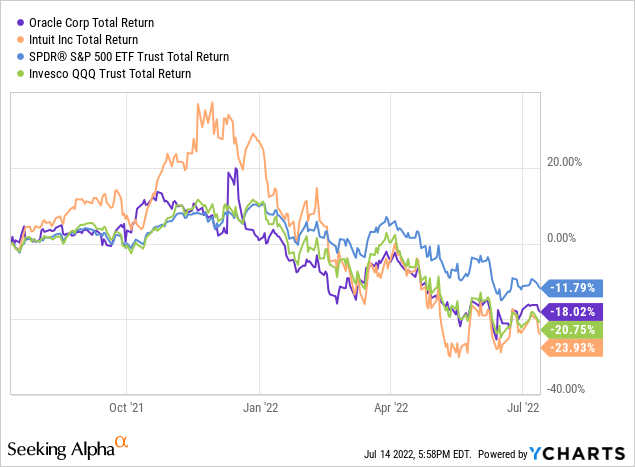

Since late 2021, both have suffered from the rise in interest rates and a looming economic slowdown, just like Wall Street equities generally or other Big Tech selections. Investment losses over the past year are hovering around -20% for both Oracle and Intuit.

1-Year Total Returns, YCharts

Yet, the difference in growth rates has made a huge impact on investor returns over longer periods of time. On a 5-year performance chart, total returns including price appreciation and dividends have favored Intuit’s rapid growth. INTU has widely outperformed Oracle, the SPDR S&P 500 ETF (SPY) and Invesco NASDAQ 100 ETF (QQQ).

5-Year Total Returns, YCharts.com

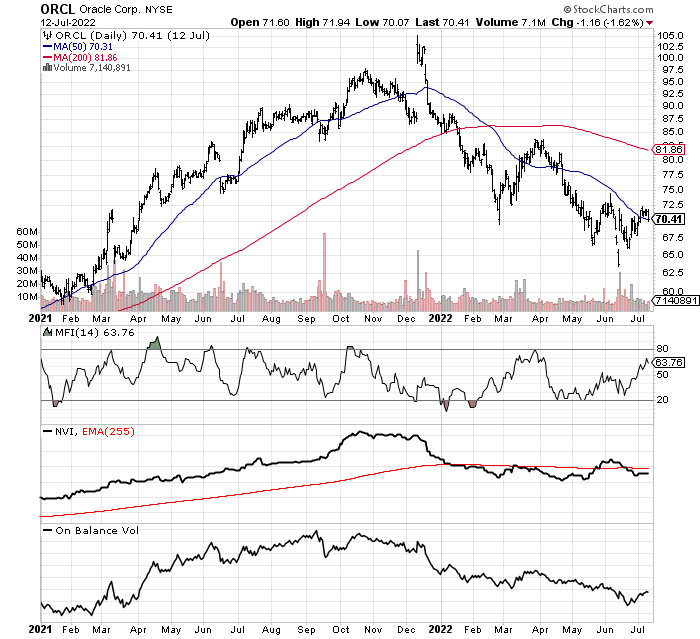

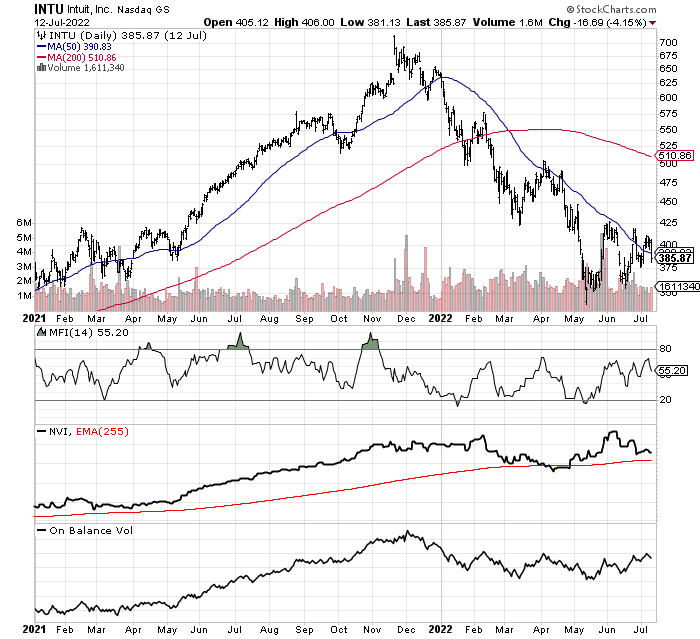

Momentum Tiebreaker

When you get down to a few picks with just as many pros and cons to weigh vs. the other, I defer to the trading momentum picture to make my final judgment. Overall, I do find Intuit’s underlying long-term technical indicators are holding up better, some of them drawn underneath the price/volume stats on the 18-month chart below. Specifically, the stronger Negative Volume Index and On Balance Volume stats are noteworthy for Intuit, despite a steeper percentage price decline. So, in my final comparative analysis, I believe Intuit is the more intelligent long-term buy, regardless of its higher upfront valuation today.

StockCharts.com

StockCharts.com

What If They Merged Operations?

When researching this article, I had a crazy thought. Putting the two together would create one of the world’s top cloud and business software/solutions sellers for everyone in the working world, with cross-selling possibilities and future artificial intelligence [AI] data gathering/parsing/learning to help productivity across the board. An example of merger synergies, Oracle could extend its accounting software reach with the QuickBooks name as a starter package for more advanced company-specific applications.

Here’s my theoretical proposal: Oracle could use help with outside-of-the-box thinking on enabling business customer efficiency. Intuit could benefit from larger data scale and a smarter introduction to international markets with the right partner. Oracle would have better direct access selling its cloud products to tens of millions of existing Intuit customers. The Intuit ecosystem is a much larger pond and could eventually funnel successful business customers to Oracle products, a function of existing goodwill built over the years.

Together, the AI possibilities in the future are quite mindboggling, with an active client/user footprint as high as 200 million in five years (Intuit’s goal number vs. 430,000 current customers for Oracle). Why not use Intuit’s high ratings by customers to your advantage?

A “New” Microsoft?

If you will, Oracle/Intuit could become the “new” Microsoft (MSFT), with a full complement of offerings for every part of the business community. For a theoretical purchase price, I am assuming an all-stock Oracle bid with a slight 20% price premium paid for Intuit (more of a merger of equals).

You would think adding a somewhat different business software firm with a retail focus vs. Oracle’s networking application background might alter management decision-making in a negative way. Perhaps, but Microsoft’s strength is offering everything from consumer software and operating systems at the retail level all the way up to cloud and networking services for big business. The expansion of brand name awareness and cross-selling of services is the beauty of Microsoft’s business model. Apple (AAPL), Alphabet/Google (GOOG) (GOOGL), and Amazon (AMZN) are running the same approach to much higher business growth rates and investor returns than Oracle. To a degree, Oracle’s legacy business is stuck in a slower growth position, as it competes with a short list of well-heeled multinationals for the same big business pie of cloud and networking spend.

Looking forward, a marriage of estimated growth rates the next two years would get the combined company closer to Microsoft’s top-tier forecast in the cloud and software services area of Big Tech.

YCharts

On a 20% premium offer for Intuit, combined enterprise value on forward revenues would be an estimated 6.9x multiple. For this higher margin business, the relative valuation would be a solid 20% discount to the analyst estimated 8.5x multiple for Microsoft. (Remember: both Oracle and Intuit generate far higher gross profit margins on sales in the 80% range vs. Microsoft’s current 69%.)

EV to forward EBITDA for the merged company would be about the same as Microsoft’s estimate. However, my proposed combined price to forward 1-year earnings multiple of 17.5x would roughly stand at a 15% discount to Microsoft’s 20.5x ratio.

The point of this exercise is a combination of Oracle and Intuit assets would initially be priced at a discount to Microsoft’s valuation, with an outlook just as bright. More than likely, institutions and mutual/hedge funds would be very excited to own an equivalent growth rate, higher margin blue-chip business than Microsoft in the U.S. high tech space.

Final Thoughts

Intuit is good for a starter position at $385, but I am still looking for lower quotes in the weeks/months ahead. I rate INTU between a Buy and Hold presently. My view is further outsized weakness in Intuit should absolutely be bought by long-term investors. Prices closer to $300 a share would be strong buy territory. I rate Oracle more of a market-performer or Hold in a weakening economic environment, as currently positioned. Of course, lower pricing would bring a more compelling bullish argument.

Nevertheless, a fully integrated cloud solutions/software company able to sell to every and any business outfit in America (through both back-office and retail sales) could be truly interesting to own. While Intuit is not the obvious choice for a takeover play by Oracle, I believe it offers a unique chance to kick-start operating growth rates and Wall Street interest. A combination of innovative services/platforms for small business with Oracle’s focus on big tech, big business, big data could open all kinds of cross-selling opportunities and enhance the Oracle brand name with consumers/customers.

As AI problem-solving becomes more common in our data-driven world, the merged organizations would have unique offerings and scale to help businesses grow throughout their lifecycle. Access to huge amounts of Intuit data on small business activities would be the AI icing on the cake to target greater efficiencies and new products for American business success. The combined effort would rival International Business Machines (IBM), Meta Platforms (META), Microsoft, Apple, Amazon and Alphabet for potential AI revenue success.

What are the odds of my mental exercise happening in the real world? I would guess the odds are low, but the idea is worthwhile to contemplate. I am confident an Oracle/Intuit marriage would greatly improve and diversify the prospects for either set of shareholders vs. a standalone setup.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment