Parradee Kietsirikul/iStock via Getty Images

Here are the facts.

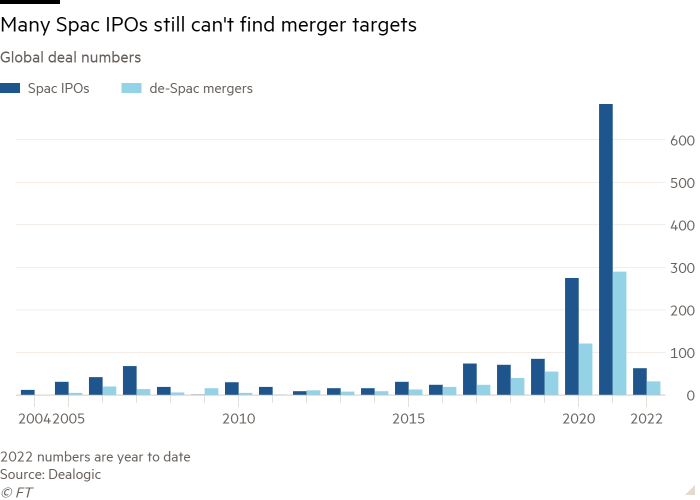

More than 1,000 special acquisition companies have been floated on global stock markets.

Two years on, more than 600 SPACs are still searching for a partner.

This is a picture that many “advanced” assets show for the past four years, including the cryptocurrency pasture.

SPACs can’t find acquisitions (Dealogic)

The label, “de-SPAC” mergers are those deals that actually did find a partner.

The “glow” seems to be off.

In the first quarter of 2022, only 63 blank check companies were floated. This is down by more than 80 percent from a year earlier.

De-Spac mergers also fell, with only 32 coming in the first quarter as more and more investors exercise their right to ask for their money back.

The Ipox SPAC index that covers how the sector’s prices are doing is down by 30 percent over the past year.

And, the regulators are coming down, hard, on the loosely functioning market.

Background

As can be seen in the chart above, SPACs came to market in the early part of the new century. Volume rose up until the time that the Great Recession began and then dropped off for the next decade.

The use of the blank check company really took off in 2020 as Jerome Powell and the Federal Reserve began to pump money into the economy at a faster rate than had ever been experienced before.

The Fed, early on, began buying $120.0 billion in securities every month, and the stock market and debt markets took off.

The picture captured in the above chart is little different from most debt markets. It shows how money flowed into these markets in huge amounts as the Fed pumped massive amounts of funds into the economy. They spread into more and more areas as investors sought more outlets to invest the monies that were now available to them.

Note, the capital value of Bitcoin follows a very similar track.

Around 2017, the capital value was around $200.0 billion. In early November 2021, the value had risen to over $3.0 trillion. Since November 2021, the value has fallen below $2.0 trillion.

And, the experience can be traced to many other areas…private equity, venture capital, angel finance, and so on.

The securities portfolio of the Federal Reserve increased from $3.8 trillion on December 25, 2019, to $8.3 trillion on December 30, 2021.

One could say that the American financial system was flooded with liquidity.

And, the SPAC market, as well as many other markets, swam in the Fed’s generosity.

The SPAC market particularly benefited as it had very loose requirements, celebrity sponsors, and other benefits of the time.

“Investors fell over themselves to jump in, ignoring warnings about high fees, share dilution, and a regulatory loophole that appeared to allow SPACs to make impossibly rosy financial promises.” (FT article).

Problems Ahead

As mentioned above, the regulators are coming down on SPAC offerings.

The Securities and Exchange Commission, under the leadership of Gary Gensler, is promising to be particularly aggressive in this particular vehicle.

Professionals in the blank check space argue that the current structure has “genuine benefits” when the channel is “used appropriately.”

Such cases occur if the sponsors have great management expertise to bring to the acquired company or when they can bring the financial resources to the transaction that might not otherwise be forthcoming.

Also, the structure can give “retail investors” an opportunity to invest that they would not otherwise be able to participate in.

But, most all admit that, right now, the regulation is too loose and something needs to be done about it.

The problem is that in a situation like the present one where there are a lot of issues to be resolved and there are a lot of investor cases to deal with, the regulator, especially one like Gensler, will tend to err on the side of “too much” regulation, rather than err on the side of “too little.”

Furthermore, the Federal Reserve is facing the “other side of the picture” where it needs to really tighten up on its monetary policy in order to combat the high and rising inflation that exists and to “correct” from its excessive largess from the past.

Although the Fed has not started to reduce the size of its securities portfolio, it has raised its policy rate of interest.

For the future, though, it looks like there are members of the FOMC that, one, want the Fed’s policy rate of interest to be raised by 50 basis points in the future and not just be 25 basis points, and, two, want the Fed to begin to reduce the Fed’s securities portfolio.

So far, investors seem to believe that the Fed has not really tightened up to any degree. That is one reason why some Fed members are calling for 50 basis point increases in the policy rate of interest rather than 25 basis point increases.

So, what happens if the Fed actually does move to a more restrictive position?

What if the Fed raises its policy rate by 50 basis points four or five times this year and, at the same time, actually begins to reduce the size of its securities portfolio?

If they did this, investors would probably sell shares in the stock market and the stock market would seriously decline.

And, if they did this, investors would probably move more aggressively out of SPACs and would move aggressively out of other forms of assets, assets whose prices rose during the time that the Fed was increasing the monthly purchase of securities over the past couple of years.

If this does happen, one might fear that there could be a significant market correction in several financial areas that have experienced produce bubbles over the past two years or so.

The Disequilibrium

The Federal Reserve has created quite a few areas of market disequilibrium over the past two years or so, as it seemed to go overboard in its efforts “to save” the economy.

Now, it seems as if we might be moving into payback time.

This is always the problem when policymakers err on the side of too much monetary ease.

Now is the time to look out for signs that the disequilibrium situations are going to revere themselves.

Markets, like the one for SPACs, that overexpand, often come back to haunt the investors.

Consider yourself warned.

Be the first to comment