Group4 Studio

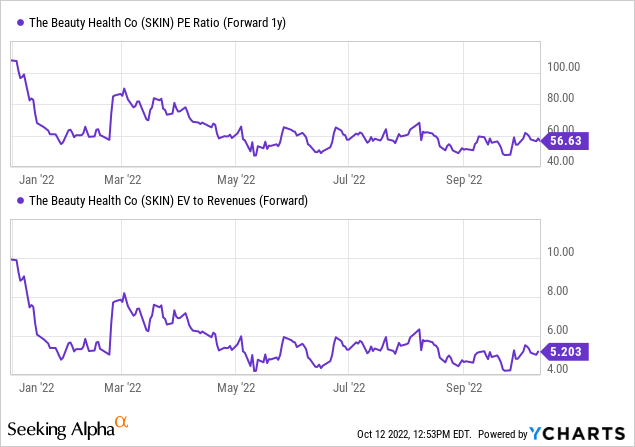

In conjunction with its 2022 investor day (webcast here), the Beauty Health Company (NASDAQ:SKIN), a provider of skin treatment solutions, outlined a new mid-term financial plan through 2025 that screened favorably even relative to the optimistic Street outlook pre-event. Still, there were signs of conservatism in the numbers, as management opted for a fairly wide range to account for potential headwinds ahead. Given the mid-term guide also does not incorporate any benefits from potential M&A accretion or product launches (e.g., the at-home Glow ‘n Go launch), there remains ample room for upside down the line. The current valuation multiple may seem lofty at first glance, but the double-digit % revenue and profit growth potential, supported by significant addressable market opportunities and operating leverage benefits, should see SKIN grow into its valuation.

Mid-Term P&L Guidance Reinforces Underlying Growth Potential

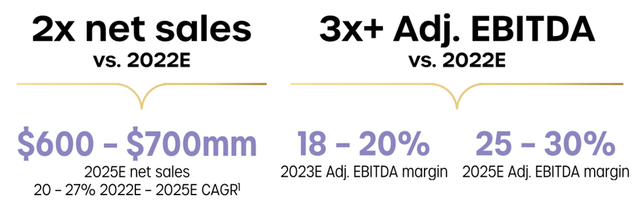

Through the next three years, SKIN has guided to doubling its revenues to $600m-$700m (a 20–27% CAGR), supported by a >$250bn addressable market opportunity in skin and hair. Geographically, Europe, the Middle East, Africa (EMEA) and the Asia Pacific are the key growth regions over the US – relative to the low-teens % penetration in the Americas, the company has a much lower presence at low-double digits in EMEA and ~1% in Asia. As these targets are on an organic basis as well, there are no potential benefits from M&A or new product launches in the numbers, leaving ample opportunity for upside here.

The revenue growth target supports a similarly strong adj EBITDA guidance through 2025. On the back of front-end loaded margin expansion, SKIN is set to hit 18-20% margins by 2023 (well above today’s <15% guidance) before ramping up to the 25-30% range by 2025. To unlock the projected margin gains, management will rely on its multiple investments to drive operating leverage to the earnings growth trajectory. These include optimizing manufacturing by moving the sites closer to expansion locations, as well as gradually shifting to higher-margin consumables. Coupled with the upside potential from the Syndeo skincare delivery system (currently gross-margin-neutral), meaningful margin expansion seems well within reach. The key here lies in unlocking operating leverage benefits, which should come through in the coming quarters as P&L benefits from the 2021/2022 investment cycle (across infrastructure, logistics, and the workforce) shine through.

International Expansion as a Key Growth Driver

Underlying the growth plan for the next three years is the planned expansion of the international business segment, which is set to contribute >50% of total revenues by 2025. Having allocated investment dollars toward building out sales infrastructure and new international HydraFacial Experience Centers, as well as a 2023 Syndeo international launch, SKIN is well-positioned to further accelerate its expansion in EMEA and the Asia Pacific.

Partnerships will be a key lever in its planned expansion as well – the company recently expanded its Sephora partnership, with plans to launch in Singapore (a twelve-door opportunity) in the coming month or so. If successful, SKIN will launch throughout the Asia Pacific region in September 2023, presenting a > 200-door opportunity. Over the mid to long-term, Sephora alone offers a ~2.7k store opportunity worldwide (note SKIN is currently in nearly all North American stores), while opportunities to also leverage its lower-cost ‘Perk’ treatment present incremental upside.

In addition, the recently announced partnership with Organicell will see the company gain a new revenue stream from its anti-aging/anti-inflammatory booster. Given the short development timeline (around six months) and the opportunity to expand its treatment areas, successful execution of this ‘land-and-expand’ strategy should yield a significant expansion of the customer base and greater customer spending over time.

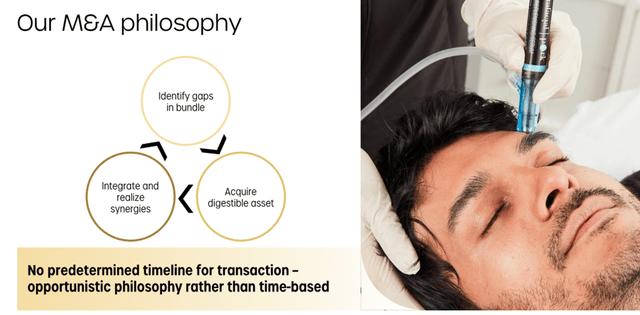

Incremental M&A Upside

SKIN also remains disciplined on the M&A front, with its criteria spanning financial accretion to strategic considerations such as differentiated products/services with high customer satisfaction (as measured by the net promoter score). This is largely consistent with management’s prior views, but in light of commentary on the webcast holding off on an acquisition timeline (“opportunistic philosophy rather than time-based”), I suspect any M&A catalyst will take time to play out. That said, SKIN has a healthy cash balance to deploy, and given the current assumption for no M&A in the mid-term guidance, any acquisitions through 2025 would present incremental upside to the financial targets. Despite the company’s balance sheet capacity, smaller tech-enabling tuck-ins will likely be the key focus at this point, particularly with the company looking to enhance the core Hydrafacial platform.

A Compelling Mid to Long-Term Growth Story

With investors becoming increasingly discerning of growth companies’ bottom line potential, SKIN’s new mid-term plan to drive a tripling of its adj EBITDA by 2025 (implying 25-30% margins) will be well-received by investors. Thus far, execution has been strong, with key partnerships established with the likes of Sephora and Organicell, while the transition to localized manufacturing in the Asia Pacific is already well underway. Assuming management keeps on this path, the 20-27% net sales CAGR and 10-15%pts EBITDA margin expansion should be well within reach over the coming years. Net, SKIN seems well positioned given its differentiated product offering, addressable market opportunities, and operating leverage potential, justifying the current valuation.

Be the first to comment