PierreDesrosiers/iStock via Getty Images

By Sam Korus

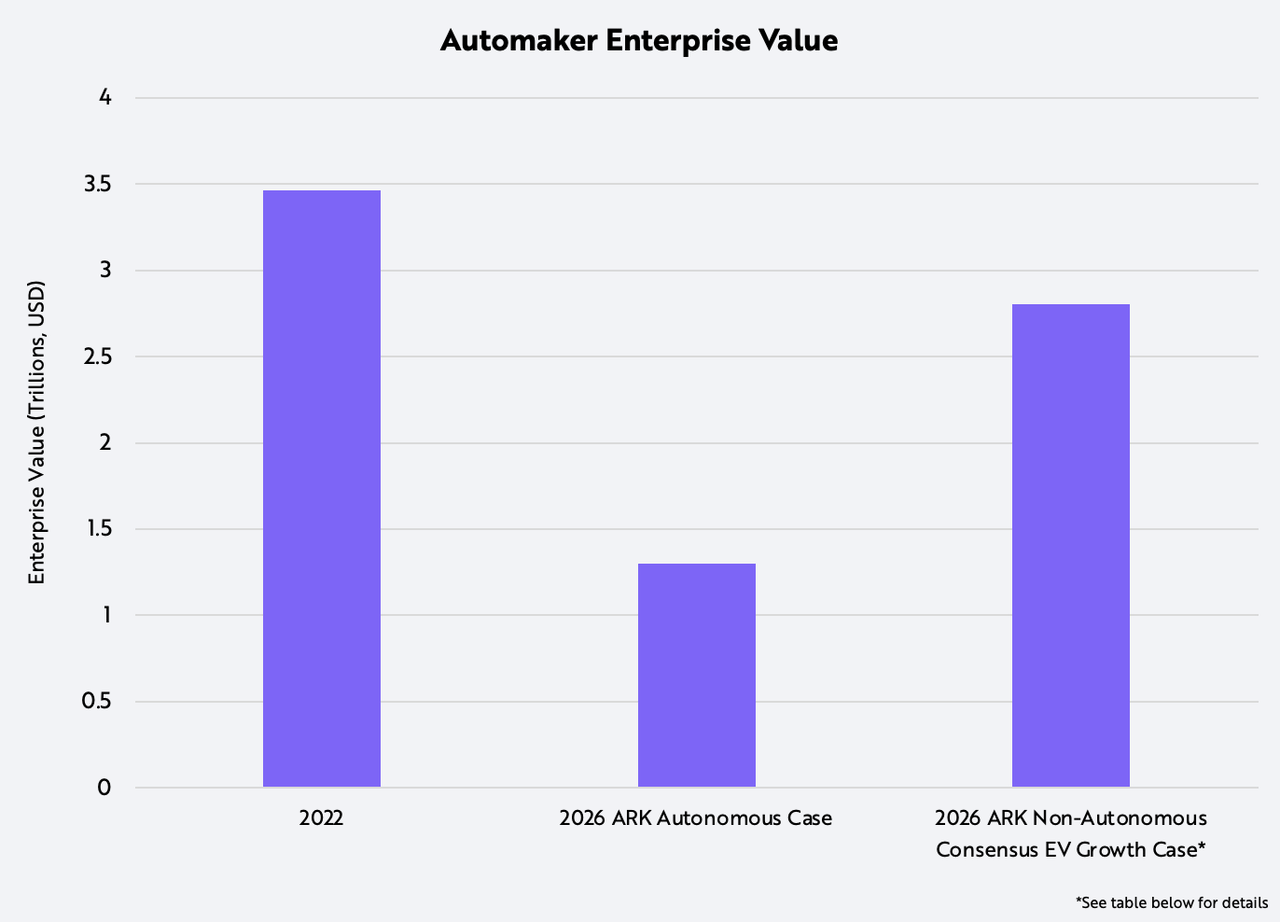

According to ARK’s research, during the next five years the auto industry as measured in units will grow, but as measured by enterprise value, it will shrink. In 2021, the number of light vehicles sold globally was 78 million and the enterprise value of automakers, roughly $3.5 trillion. According to IHS Markit, during the next five years unit auto sales will increase at a 4.7% compound annual growth rate and hit a new high at 98 million units in 2026. ARK’s Non-Autonomous EV Base Case agrees with the consensus view that unit sales will increase by 20 million during the next five years but that the enterprise value of global automakers is likely to drop roughly 20% to ~$2.8 trillion. If autonomous taxi services were to emerge, as ARK’s research suggests will be the case, then vehicle unit sales are likely to drop 8% to 72 million, cutting the enterprise value of traditional automakers by more than 60% to $1.3 trillion, as shown below.

Source: ARK Investment Management LLC, 2022; S&P Capital IQ; IHS Markit

Forecasts are inherently limited and cannot be relied upon.

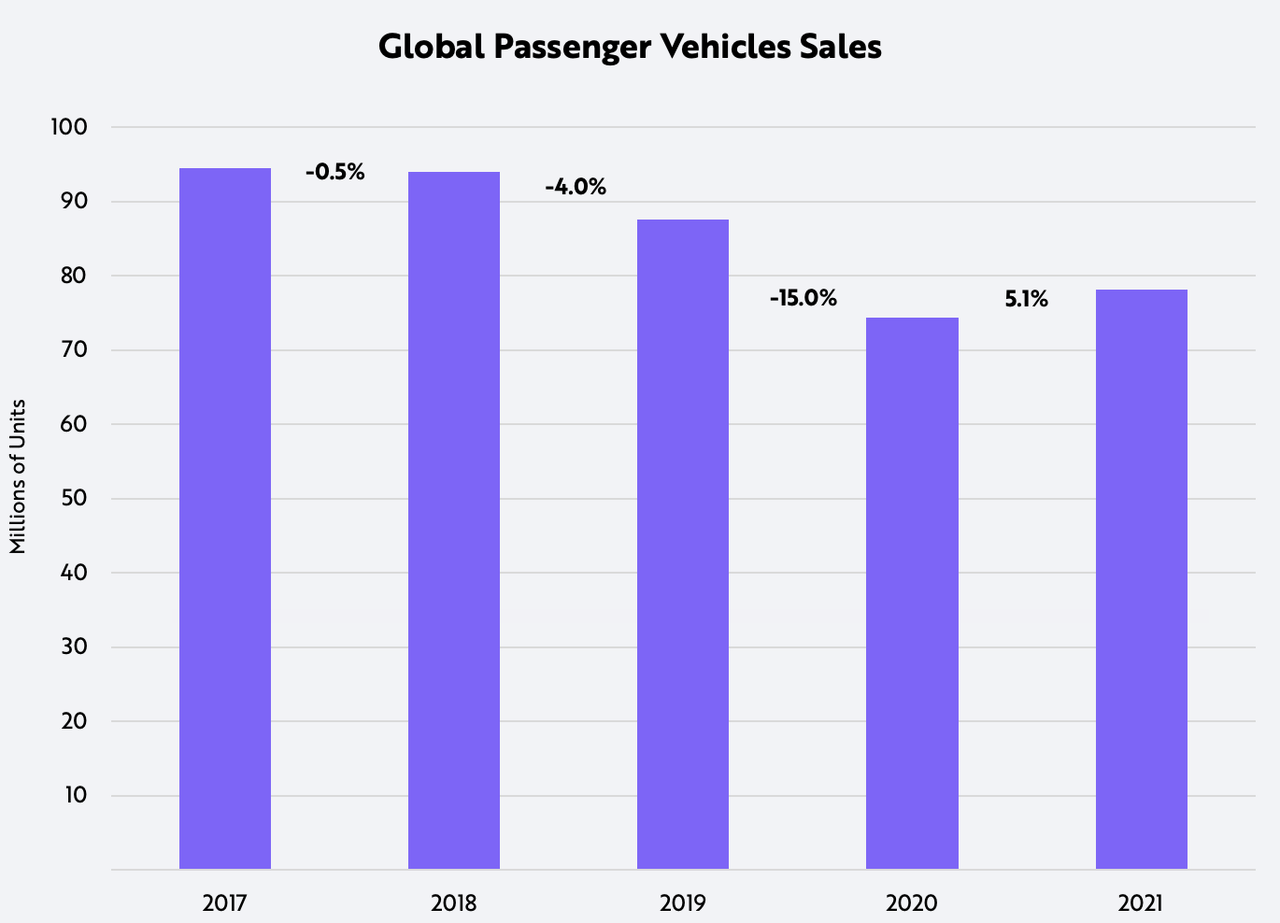

Historically, unit sales have been a good proxy for growth in the enterprise value of the global auto industry. After declining from 2017 to 2020, auto sales increased roughly 5% in 2021, as shown below, leading to optimism that the enterprise value of the global auto industry would revive and move back toward historical highs.

Source: ARK Investment Management LLC, 2022; IHS Markit

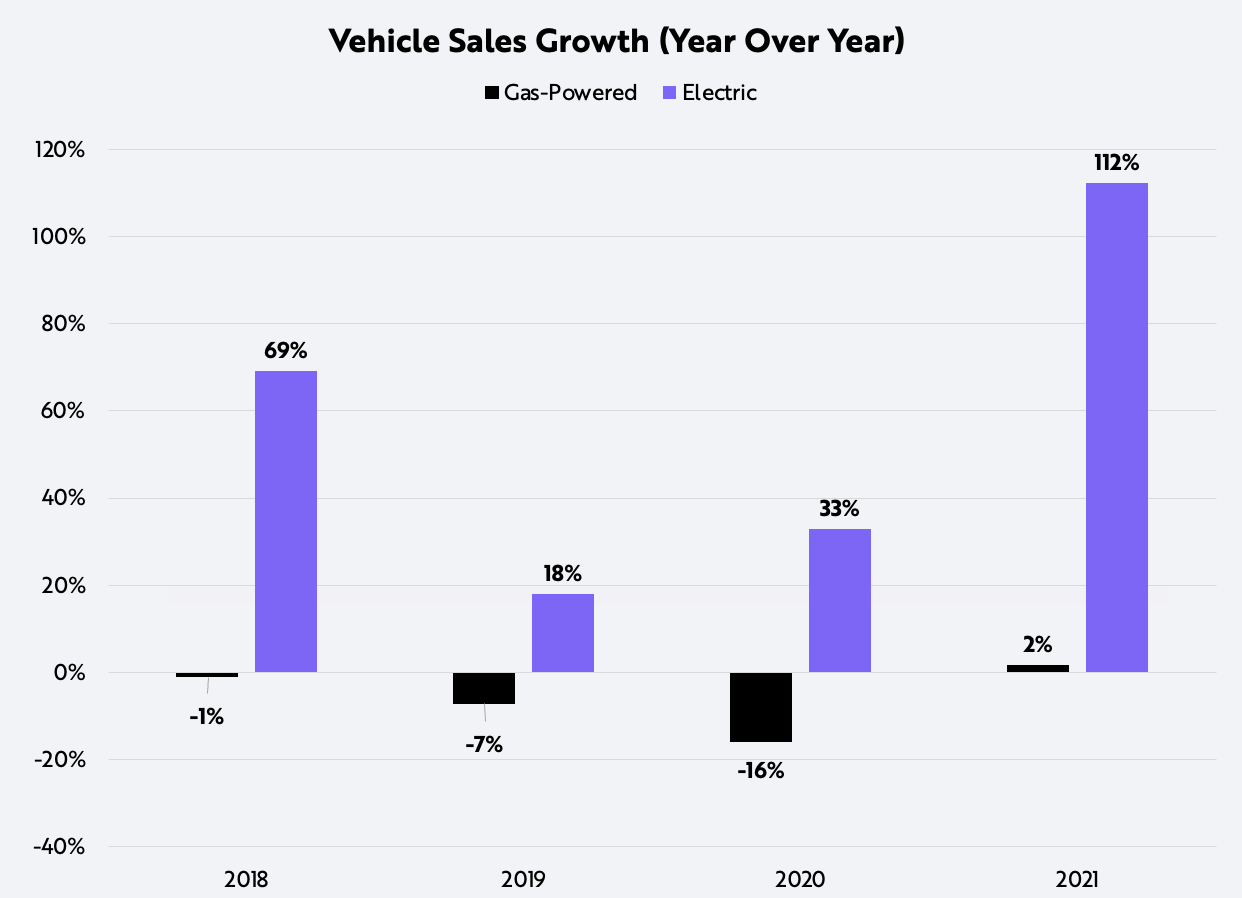

Now, we believe the auto industry is undergoing two profound shifts that are breaking the link between unit sales and enterprise value: a shift from the internal combustion engine to electric vehicles and, albeit early, a shift from human driven to autonomous vehicles. In 2021, the breakdown in auto sales by powertrain highlighted the challenges awaiting non-Chinese automakers with 85-95% of revenues in gas-powered vehicles. In 2021, while global vehicle sales did increase 5.1%, the 1.7% attributed to gas-powered vehicles accounted for only one-third of total growth, and the 112% attributed to electric vehicles for two-thirds, as shown below. In other words, the consumer preference shift toward electric vehicles has gathered momentum.

Source: ARK Investment Management LLC, 2022

Forecasts are inherently limited and cannot be relied upon.

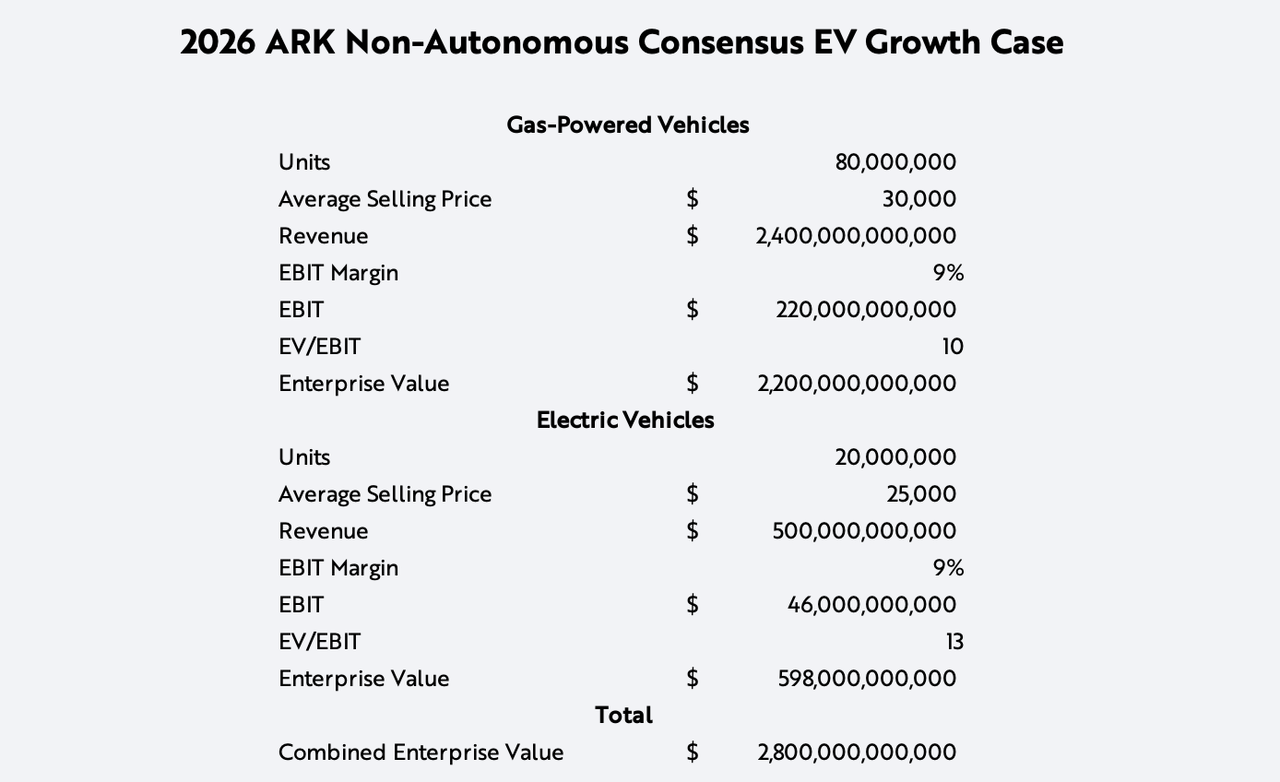

The consensus forecast for global unit sales in 2026 is ~100-million-unit sales, ~80 million gas-powered and ~20 million electric. Translated into growth rates, gas-powered cars will continue to grow at a ~1.7% compound annual rate and electric vehicles, 33%, through 2026. If these consensus forecasts prove correct, then the enterprise value of global automakers is likely to decline 20%, from $3.5 trillion today to $2.8 trillion in 2026, as shown below.[1]

Source: ARK Investment Management LLC, 2022; IHS Markit

Forecasts are inherently limited and cannot be relied upon.

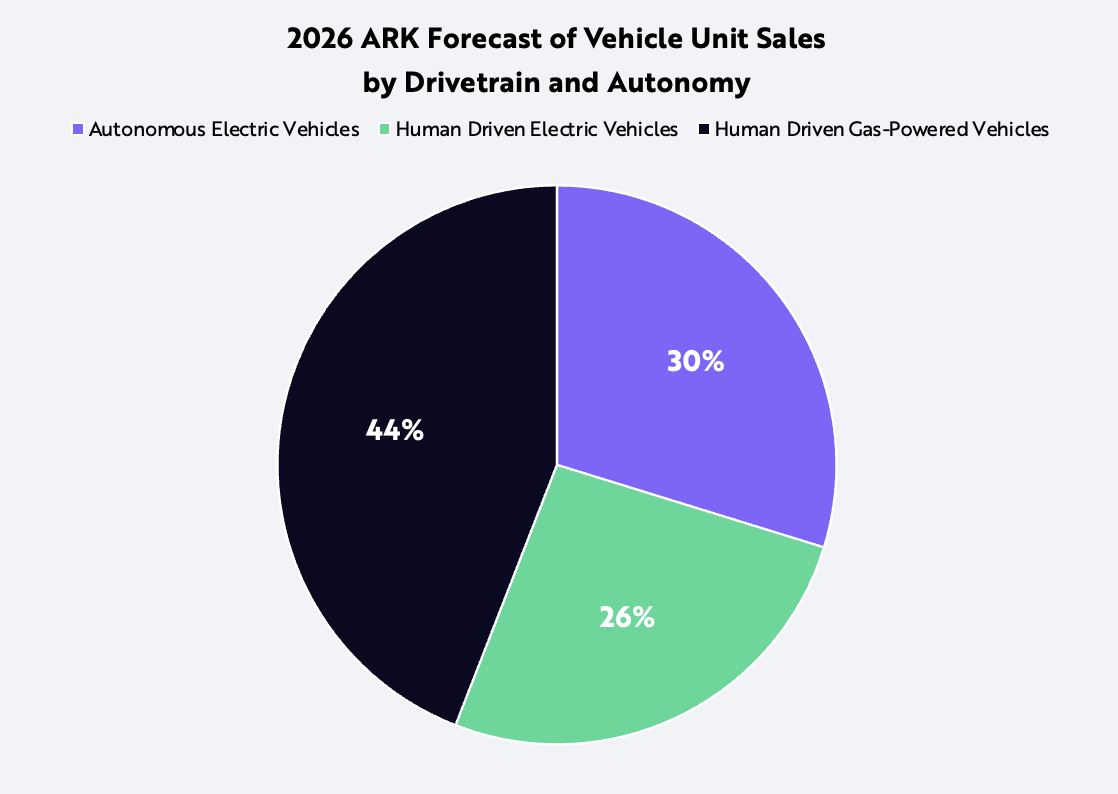

If ARK’s autonomous forecast proves correct, then total vehicles sales are likely to drop roughly 8% during the next five years, from ~78 million units in 2021 to ~72 million in 2026. Moreover, 44% of the 72 million are likely to be gas-powered, 26% electric, and 30% autonomous electric, as shown below.

Source: ARK Investment Management LLC, 2022; IHS Markit

Forecasts are inherently limited and cannot be relied upon.

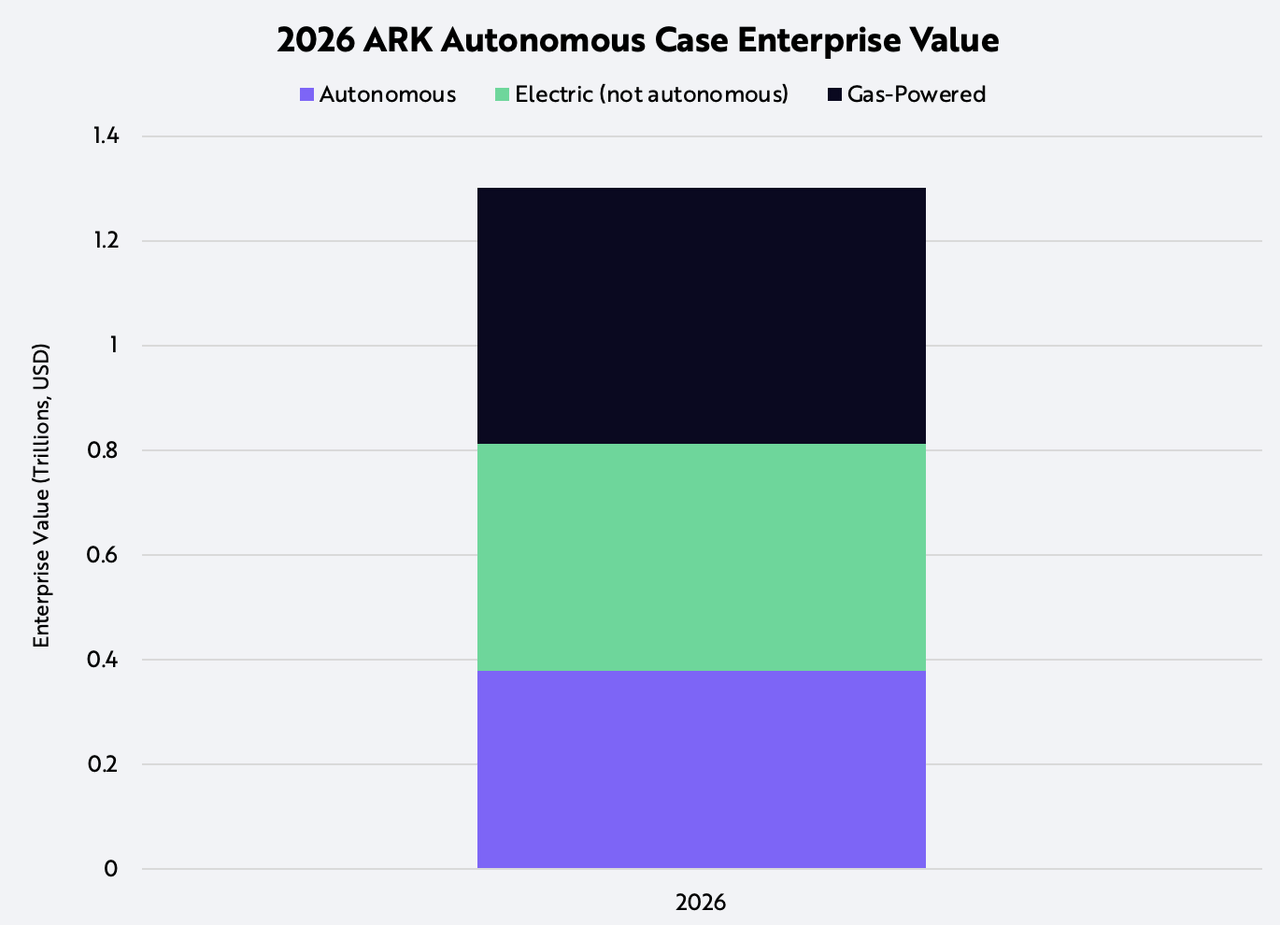

As a result, the enterprise value attributable to automakers in 2026 would be $1.3 trillion, with autonomous electric automakers and electric vehicle automakers each accounting for ~$0.4 trillion and gas-powered automakers ~$0.5 trillion, as shown below.

Source: ARK Investment Management LLC, 2022; IHS Markit

Forecasts are inherently limited and cannot be relied upon.

If our assumptions for electric and autonomous electric vehicles are correct, then today’s $3.5 trillion in global automaker enterprise value seems to be discounting a much higher margin profile for the industry than it has achieved in years. In our view, the shifts to electric and autonomous are unlikely to create a rising tide that lifts all boats. Instead, the industry seems to be at risk as autonomous platform providers extract value at the expense of hardware manufacturers’ margins. If we are wrong and autonomous does not scale, the industry still seems overvalued based on the accelerated consumer preference shift toward electric vehicles at the expense of gas-powered vehicles.

The auto market illustrates why active portfolio management will be critical as innovation disrupts the traditional world order. Disruptors can camouflage the underperformance of traditional players and create value traps––stocks that are “cheap” for a reason.

Disclosure: ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For a list of all purchases and sales made by ARK for client accounts during the past year that could be considered by the SEC as recommendations, click here. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. For full disclosures, click here.

©2021-2026, ARK Investment Management LLC (“ARK” ® ”ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment