Adrian Vidal/iStock via Getty Images

Inflation has surged to a 40-year high this year due to the immense fiscal stimulus packages offered by governments in response to the pandemic and the ongoing war between Russia and Ukraine, which has led some commodity prices to skyrocket. As a result, income-oriented investors are wondering what they should do to protect the real value of their portfolios from eroding. Lazard (NYSE:LAZ) is a great candidate for income-oriented investors. The stock is offering a 5.3% dividend with a wide margin of safety while it is trading at a markedly cheap valuation level. In this article, I will analyze why its dividend is safe.

Business overview

Lazard is a financial advisory company, with presence in 41 cities worldwide and a history of 173 years. It operates in two divisions, namely Financial Advisory and Asset Management. The former includes mergers and acquisitions, debt restructuring and capital raises while the latter is focused primarily on institutional clients.

Lazard is one of the most respected companies in the financial world. When a company or a country needs to restructure or refinance its debt, it often resorts to Lazard for financial advice in order to evaluate its options and handle its debt in the most efficient way. Lazard greatly profits from every debt restructuring but its customers benefit as well and hence they do not try to avoid the high fees of Lazard.

Lazard currently enjoys strong business momentum thanks to the impact of the coronavirus crisis on the global economy. Most countries have offered unprecedented fiscal stimulus packages to support their economies in response to the pandemic. In addition, numerous companies have issued appreciable amounts of debt to endure the coronavirus crisis. As a result, global debt has skyrocketed, to a new all-time high. This is a strong tailwind for the business of Lazard.

In the fourth quarter of 2021, Lazard grew its revenue 14% over the prior year’s quarter, from $849 million to $968 million, thus exceeding the analysts’ consensus by $111 million (by 13%). Growth was driven by the financial advisory segment, which grew its revenue 20%, to a record level, thanks to the involvement of Lazard in several major financial transactions, such as the $52.5 billion spin-off of VMware from Dell and the acquisition of Hunter Douglas by 3G Capital for $7.1 billion.

In the quarter, Lazard grew its adjusted earnings per share 16%, from $1.66 to $1.92, and thus exceeded the analysts’ estimates by an impressive $0.49. The company has beaten the analysts’ earnings-per-share estimates in 6 of the last 7 quarters. This is a testament to its sustained business momentum. In the full year, Lazard grew its earnings per share 40%, from $3.60 to a new all-time high of $5.04.

Growth prospects

Lazard has grown its adjusted earnings per share at a 14.9% average annual rate over the last decade. This is undoubtedly an enviable growth rate.

Even better, the financial advisory company has many growth drivers to continue growing its earnings for years. As mentioned above, global debt has skyrocketed in the last two years due to the pandemic. As a result, many companies and countries will have to restructure or refinance their debt in the upcoming years. That will be a strong tailwind for the business of Lazard.

It is also important to note that Lazard does not rest on its laurels. Instead, it continuously comes up with new investing strategies in order to attract more customers and enhance its global reach.

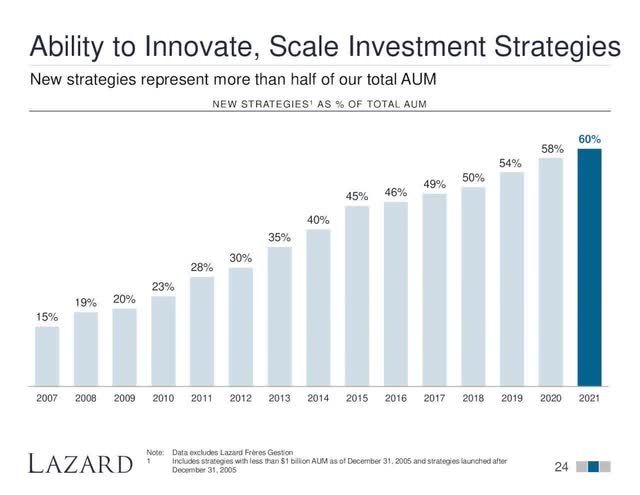

Lazard new strategies (Lazard Investor Presentation)

Source: Investor Presentation

Notably the new strategies currently represent 60% of the total assets under management. This is an impressive figure for a well-established company like Lazard and is a testament to the continuous efforts of the company to remain highly competitive.

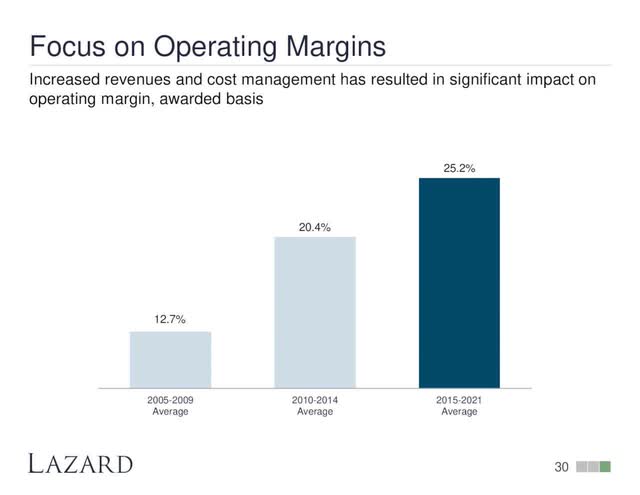

Moreover, thanks to its consistent revenue growth and some cost-cutting initiatives, Lazard has essentially doubled its operating margins, from 12.7% in 2005-2009 to 25.2% in 2015-2021.

Lazard Margin Growth (Lazard Investor Presentation)

Source: Investor Presentation

Thanks to its lean business model, which requires minimum capital expenses, and its constant focus on improving its margins, Lazard is likely to enhance its margins even further in the future. Higher revenues will play a major role in this, as they will enhance the economies of scale of the company.

On the other hand, it is prudent to keep somewhat conservative growth expectations, given the high comparison base formed by the record earnings in 2021. This helps explain why analysts expect Lazard to incur a 12% decrease in its earnings per share this year. Nevertheless, they also expect the company to grow its earnings per share by 6% in 2023.

To cut a long story short, given the consistent growth record of Lazard and the tailwind from the sustained increase in the amount of global debt, Lazard is likely to keep thriving for many more years.

Dividend

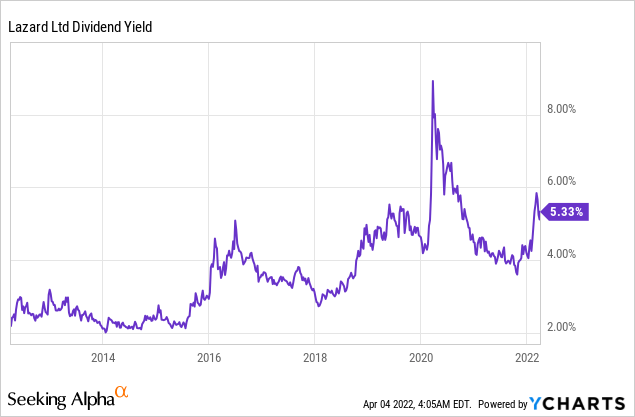

Lazard is currently offering a nearly 10-year high dividend yield of 5.3%.

The high yield has partly resulted from the 21% correction of the stock this year, which in turn has been caused by the surge of inflation. High inflation exerts pressure on the valuation of stocks, as it renders them less attractive. This is the reason behind the exceptionally low forward price-to-earnings ratio of 8.0 of Lazard.

As soon as inflation begins to revert towards healthier levels, probably next year, the stock of Lazard will be rewarded with a richer valuation level and its dividend yield will fall towards historical levels.

It is also worth noting that Lazard has paid the same dividend for 12 consecutive quarters and hence some investors may fear that the dividend is not entirely safe. However, Lazard has a solid payout ratio of 41%. In addition, the company has a healthy balance sheet, with a BBB+ credit rating. Given also the reliable growth trajectory of the company, the dividend has a wide margin of safety, though it is prudent not to expect meaningful dividend growth anytime soon. Instead Lazard has shown a preference to keep a low payout ratio for its regular dividend and offer special dividends in some years (e.g. in 2016-2018) in order to keep a wide margin of safety for its regular dividend.

Final thoughts

Lazard passes under the radar of most investors due to its mundane business model. However, this high-quality financial company has a reliable growth trajectory and it is currently offering a nearly 10-year high dividend yield of 5.3%, with a wide margin of safety. Those who lock in its attractive yield are likely to be highly rewarded as soon as inflation begins to subside.

Be the first to comment