Dr_Microbe TG

People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences – Peter Lynch.

Author’s Note: This is an abbreviated version of an article originally published in advance inside Integrated BioSci Investing for our members.

In biotech investing, whenever a company’s lead franchise (i.e., the crown jewel) is heading to the FDA for approval, you can bet that something big is brewing. That is to say, the so-called binary event will move the needle of your stock. Hence, you should pay extra attention to this development. More importantly, you should forecast the potential outcomes to adjust your position accordingly.

That being said, TG Therapeutics, Inc. (NASDAQ:TGTX) (“TG”) is poised to receive an FDA decision for its multiple sclerosis drug (ublituximab) this month. If positive, this event can be a turning point for the said stock. In this research, I’ll feature a fundamental analysis of TG while focusing on this binary development. Moreover, I’ll share with you my expectation of this intriguing company.

Figure 1: TG chart.

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in my previous article,

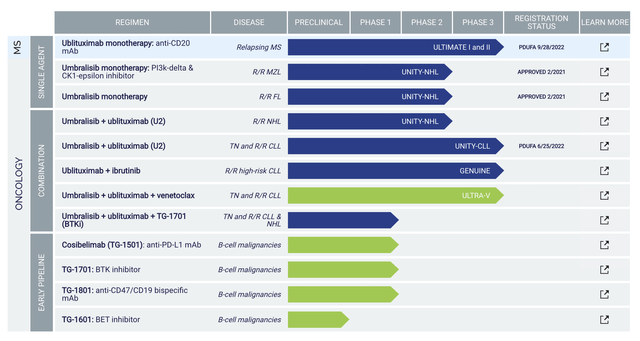

Operating out of New York, TG Therapeutics is focused on the innovation and commercialization of stellar medicines to serve the unmet needs in blood cancers and autoimmune diseases. As shown below, the pipeline has two intriguing medicines ublituximab (i.e., Ubli) and umbralisib (Umbra). Due to safety and efficacy concerns, TG pulled Umbra off the market for its approved indications: marginal zone lymphoma (MZL) and follicular lymphoma (i.e., FL). The company also canceled their application of the U2 (Ubli plus Umbra) combo for chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL). As such, you now only have Ubli’s upcoming potential approval for multiple sclerosis (i.e., MS). There are also other early-stage molecules such as TG1501 (cosibellimab), TG1601 (i.e., a BET inhibitor), TG-1701 (BTK inhibitor), and TG1801 (CD47/CD19 bispecific antibody).

Figure 2: Therapeutic pipeline.

Disease Context of Multiple Sclerosis

Shifting gears, let’s discuss the Disease Context (i.e., DC). That way, it can help you better appreciate Ubli’s clinical advancement and thereby gain more insight into its upcoming approval decision. Accordingly, MS is caused by the body’s natural defense (i.e., immune) system becoming overactive and thereby attacking the central nervous system (i.e., brain and spinal cord). The onslaught doesn’t occur constantly. Instead, it comes and goes which manifests dreaded neurological symptoms. Some of them include a loss of bladder control or blindness.

Ublituximab Mechanism of Action

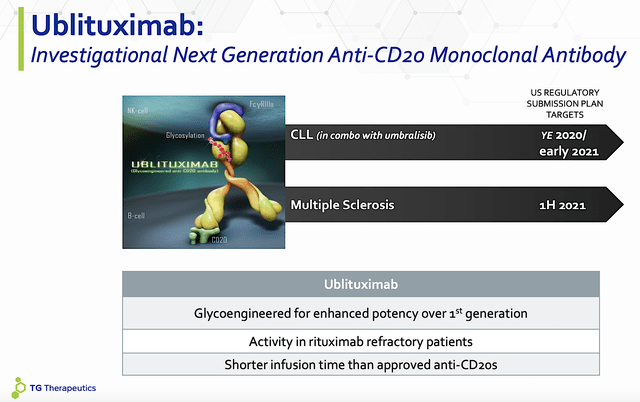

As you can appreciate, Ubli has an interesting Mechanism of Action (i.e., MOA). In other words, it’s a monoclonal antibody for the CD20 target on a special cell coined B-cell. As the “commanding officer” of the immune system, B-cell plays a crucial role in attacking invaders.

For patients afflicted by MS, these misguided B-cells hit the central nervous system itself. By suppressing these B-cells, Ubli calms down the immune system. As you can appreciate, the DC and MOA fit nicely like matching puzzle pieces which explicates the strong clinical data.

Figure 3: Ublituximab’s mechanism of action.

Robust Advanced Data

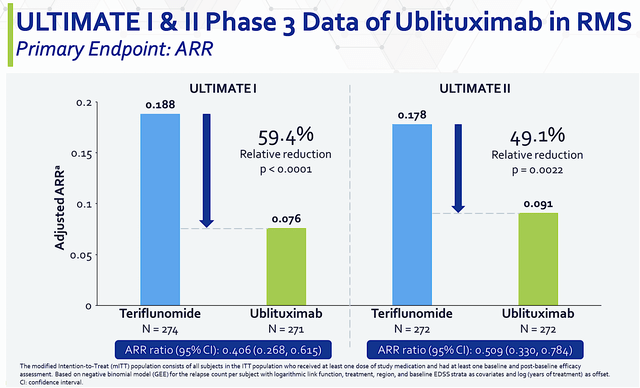

Of the clinical outcomes, Ubli posted excellent Phase 2 data. Similarly, the Phase 3 (ULTIMATE) trials also generated stellar results. I elucidated from the previous research:

From the figure below, you can see that Ubli trumped teriflunomide by 49.1% to 59.4% as it has superior reduction in annualized relapse rate (i.e., ARR). With both p-values all less than 0.05, you’d know the results are real rather than random occurrences. In the statistical and clinical sense, those results are statistically significant and clinically meaningful.

Figure 4: ULTIMATE primary endpoint in ARR.

Ublituximab Approval Decision

On December 28, TG’s fate will be decided by the FDA’s decision on Ubli as a treatment for MS. That is to say, the drug has a Prescription Drug User Fee Act (PDUFA) set for the aforementioned date. Though the FDA has until December 28 to issue its decision, the agency can deliver an early notice. I’ve seen many early approvals, especially near the Christmas (or Hanukah) holiday. A prime example is Caplyta of Intra-Cellular Therapies (ITCI).

Sizing Up The Management

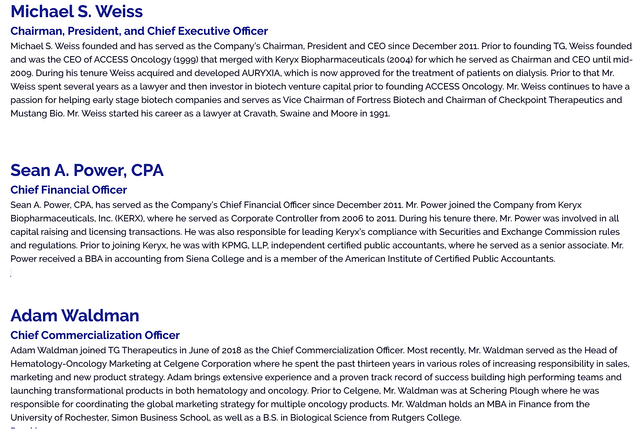

As you can imagine, biotech management is crucial to the success of the company. For instance, prudent management is adept at taking a drug from bench research to commercialization. In case of failure, the esteemed management would in-license novel therapeutics to right the ship. Moreover, they can acquire another company to generate more growth.

Now, analyzing management is both an art and a science. As you know, nearly all biotech management has superb pedigrees. As such, it’s more meaningful to you to focus on whether the management delivers as they promised. More importantly, you should see if they are transparent in difficult times.

On both aforesaid metrics, TG’s management performance is unclear. Precisely speaking, the CEO (Michael Weiss) doesn’t have a scientific background which can limit his clinical acumen. Nevertheless, that does not preclude him from being an excellent Chief. Moreover, the management pulled their launched drug off the shelf. Hence, investors questioned whether they knew something undisclosed. Furthermore, the latest corporate presentation failed to update pertinent changes.

Figure 5: TG’s management.

That aside, it is interesting to note that CEO Weiss sounded a bit “skittish” in the latest earnings conference call. Per Mr. Weiss,

On the regulatory front, as in the past, we will not provide color on any interactions with the FDA but we would like to provide an update on where we are in the process, with less than 2 months of the target PDUFA action date of December 28, 2022. We can confirm that we have completed the late cycle meeting and labeling discussions have recently commenced. We remain hopeful that ublituximab will be approved.

As you know from companies like Axsome Therapeutics (AXSM), whenever there is a labeling discussion, the drug is usually approved. Nevertheless, Mr. Weiss’ seemingly soft confidence led to investors’ confusion, which likely caused the stock to tumble in the ensuing days. While that is a plausible scenario, perhaps Mr. Weiss is simply being cautious with his words. After all, he was a lawyer.

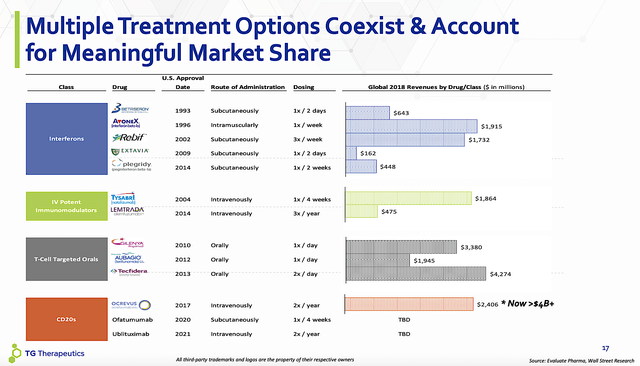

Multiple Sclerosis Market

Notably, the market for MS is quite significant. The data showed that there are 2-3 million patients suffering from MS worldwide. By 2025, this global market is expected to grow to $30B. Notably, the CD20 monoclonal antibody dubbed ocrelizumab (Ocrevus) garnered $4B in 2019. If Ubli can gain roughly $1B in annual sales (i.e., one-quarter of Ocrevus), the underlying value of TG would substantially increase far beyond its current market valuation.

Figure 6: Multiple sclerosis market shares.

Financial Assessment

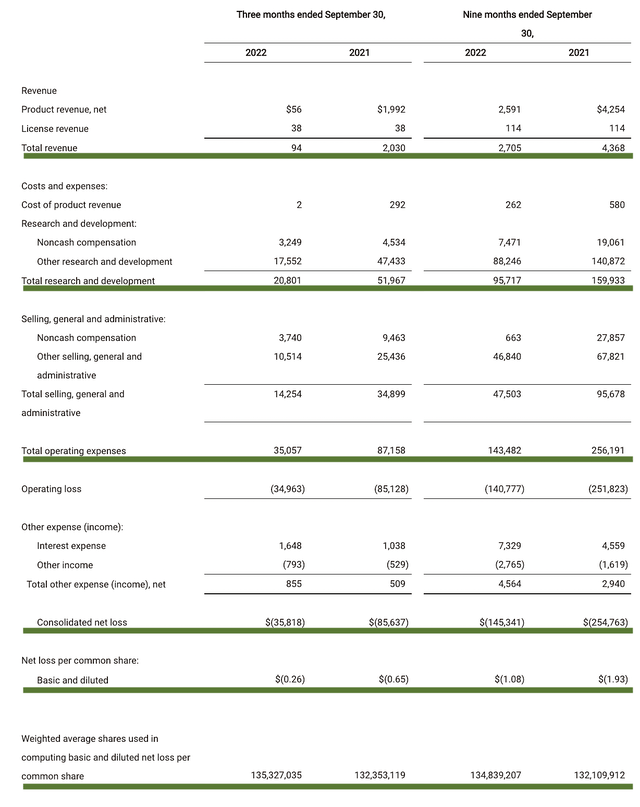

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 3Q2022 earnings report for the period that ended on September 30.

As follows, TG procured $94K compared to $2.0M for the same period a year prior. The substantial revenue decline was due to TG pulling its approved product off the shelf. Given that TG is now without a commercialized asset, it’s much more meaningful for you to focus on other metrics.

That being said, the research and development (i.e., R&D) registered at $20.8M compared to $51.9M for the same period a year prior. I generally like to see an increasing R&D trend. After all, the money invested today can turn into blockbuster profits tomorrow.

Additionally, there were $35.0M ($0.26 per share) net losses compared to $85.6M ($0.65 per share) net declines for the same comparison. On a per-share basis, the bottom line is improved by 60%. And that made sense, as the company reduced its R&D spending.

Figure 7: Key financial metrics.

About the balance sheet, there were $197.7M in cash, equivalents, and investments. Against the $35.0M quarterly OpEx, there should be adequate capital to fund operations into 1Q2024. Simply put, the cash position is adequate relative to the burn rate. However, TG is likely to raise additional capital sometimes next year, probably in 2H.

While on the balance sheet, you should check to see if TG is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 132.3M to 135.3M, my math reveals a 2.2% annual dilution. At this rate, TG easily cleared my dilution cut-off for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with an investment regardless of its underlying strength. At this point in its growth cycle, the most important concern for TG is whether Ubli can gain approval for MS by December 28. Given that the MS franchise is the savior for TG, a failed data report means the share price would tumble over 70% and vice versa. There is also a potential management concern. Moreover, there is a risk that TG won’t be able to reduce its spending fast enough and thereby runs into the potential cash flow constraint.

Conclusion

In all, I maintain my buy recommendations on TG Therapeutics with a 4.2/5 stars rating. As a stock that tested investors’ patience and loyalty to the extreme, TG Therapeutics fumbled big time after initial success. In late 2020, the shares traded as high as $54. A series of unfortunate events (like the Umbra/U2 withdrawal due to safety concerns) nearly decimated all of TG’s market capitalization. Investors also started to question the management’s transparency and capability. Nevertheless, December 28 would determine the fate and reputation of this management. If Ubli can gain approval for MS, you can anticipate a huge turnaround for this stock. In that situation, your patience and loyalty will be handsomely rewarded. Else, TG will fade into history as a failed biotech.

Be the first to comment