alicat

Texas Capital Bancshares, Inc. (NASDAQ: TCBI) has been sluggish in the last two years. It can be attributed to the pandemic disruptions that hampered its growth. As such, its strategic transformation and initiatives are timely and relevant. Its performance remains slow-moving, but it is still in line with its current changes. Also, it has a good liquidity position, allowing it to sustain itself and its potential growth. Likewise, the stock price appears boring, which is adherent to its fundamentals. Nevertheless, this restructuring may lead to an upside in the following years. Growth prospects may not materialize soon, so patience is a must-have for its investors.

Company Performance

The pandemic has not been good for Texas Capital Bancshares, Inc. Despite its size, it has become one of the unsuccessful banks to take advantage of the situation. The last two years have been challenging, given its sluggish performance. But, this contraction led to a transformative restructuring that continues today. Although it may take more time to materialize, better results are seen compared to the tedious 3Q 2021.

It aims to expand its coverage and specialization through increased investments in technology. It is also shifting to a bank-client relationship-based model. We can see that it continues to work on deepening customer relationships and reinforcing a quality client experience. Today, it increases its client-facing professionals and offers more banking products and services.

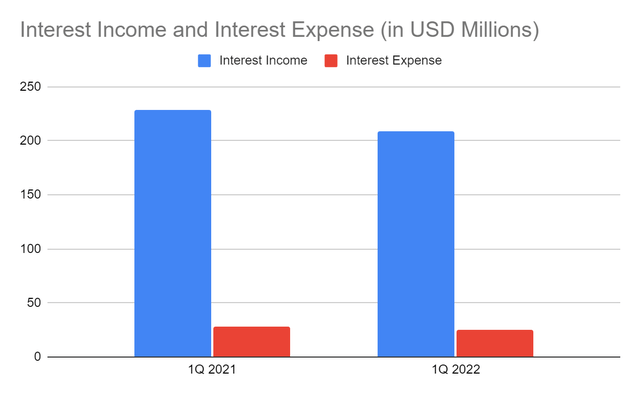

This plan not only focuses on shifting its attention to more sustainable business lines but repositioning its interest-sensitive assets. Deleveraging and contracting its operations also help sustain its growth and profitability. It is visible in the income statement. For instance, interest income is now $208 million, a 10% year-over-year decrease. Likewise, the interest expense is $24 million vs $28 million in 1Q 2022. As such, the net interest margin without provisions is now higher at 88% vs 87% in 1Q 2021. It shows how the transformation improves the stability of its revenue and profitability. If we check the balance sheet, there is a change in the composition of its earning and interest-sensitive assets and liabilities.

Interest Income and Interest Expense (MarketWatch)

Indeed, the operational switch appears to help improve the quality of its assets and stabilize growth. Profitability with a maintained liquidity position remains the focus. For instance, liquid assets like interest-bearing cash and AFS investments are now lower. But, there is also a notable increase in cash due from banks and debt securities. Also, it now focuses more on secure and high-yielding loans, such as commercial and industrial loans. I will discuss more of its balance sheet later.

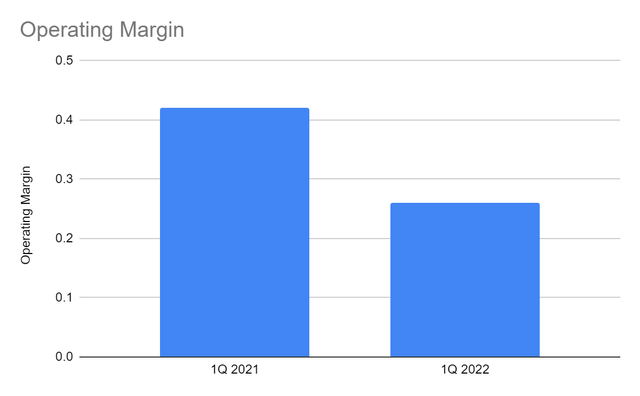

Meanwhile, non-interest expenses are in a strong upsurge as expected. Amidst inflationary pressures and company transformation, short-term expenses are often geared upward. The same applies to TCBI. But, the increase is more in line with the transformation. Note that the company aims to double the current number of its client-facing professionals by 2025. The operating margin of 26% is way lower than 41% in 1Q 2021. Despite this, it is nice to see that it remains profitable amidst inflation and massive changes in its operations. It may take a few years to finalize, but the payoff appears to be worth the wait.

Operating Margin (MarketWatch)

External Factors

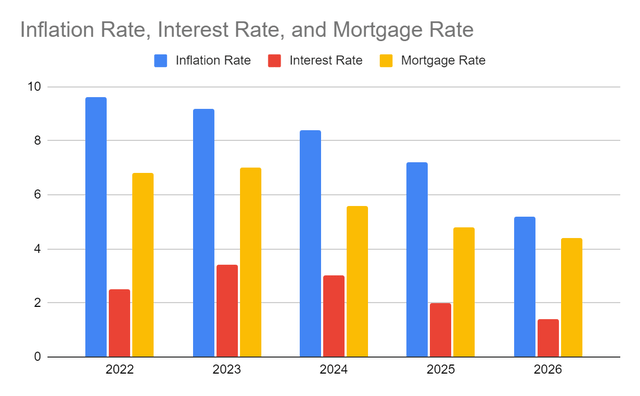

Texas Capital Bancshares, Inc. is not done with its strategic restructuring yet. But now, it faces more external pressures as the economy continues to reopen. The continued increase in the inflation rate has become more evident in the second quarter. In May, it reached its all-time high in four decades at 8.6%. With the current changes in prices, analysts estimate that the inflation rate in June could have been even higher at 8.7%.The geopolitical tension in Eastern Europe is another driving force since Russia is a primary energy provider. The supply chain disruptions, which may only start to improve in 2023 also affect prices. But, it is the pent-up demand across industries that drives the upsurge in prices. It is most evident in the real estate sector as house prices skyrocket. Given all these factors, I’m raising my estimation of inflation. It is such a shame to think that inflation may slow down in the second half of my previous articles. This year, I expect it to reach 9.6%. But for the following years, I expect a more stable economy. The inflation rate may have a gradual decrease to 5.2%.

In response, interest and mortgage rate hikes are expected. Last month, the Fed raised the Federal Funds rate by 75 basis points. Today, the expected interest rates may reach 3.4% this year. It is another increase from the 3-3.25% estimation a few months ago. Either way, these estimations are far higher than the estimation in 1Q 2022. Likewise, the current mortgage rate is surging at 5.7%. It has already surpassed the initial estimation of 5.1-5.3% at the end of the year. With that, it may even go as high as 7%. But from 2024-2026, I expect them to decrease again as inflation may stabilize. They may still be higher than the pre-pandemic levels, but the rates may become more manageable.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, Barron’s, and Forbes)

Thankfully, the restructuring of TCBI appears to be in line with the current macroeconomic changes. It also continues to invest over the balance to improve risk tolerance, capital preservation, and returns. It can be confirmed in the Balance Sheet, given the changes in its debt and equity securities. It also becomes more proactive in driving further growth although results are yet to materialize. Currently, its business banking leadership is now present across its primary markets in Texas. Its treasury solutions are generating more clients and revenues.

It capitalizes on the high inflation environment with its recent launching of a high-yield interest savings account. Accounts are purely digital, allowing it to capture more customers from far areas. Its APY of 0.70% interest is higher than the national average. But of course, potential risks are higher, given the drastic surge in macroeconomic indicators. Even so, the company is well-positioned and well-capitalized to sustain its transformation and initiatives.

It also expands its capital market products and loan platforms. Another wise move is the launching of Texas Capital Securities in 1Q 2022. It caters to its clients to provide investment banking products, offerings, and solutions. It matches its initial goal to improve robust banking and treasury capabilities. It is also in line with its goal to deepen its client relationships, especially in the C&I segment.

Why Texas Capital Bancshares, Inc. May Stay Afloat

The performance of TCBI remains lackluster, and for me, it is reasonable. Its expansion plan is adherent to the improvement and diversification of its asset-sensitive portfolio. I also expect lower income in 2022-2023. But in 2024, its prudence and effort may pay off.

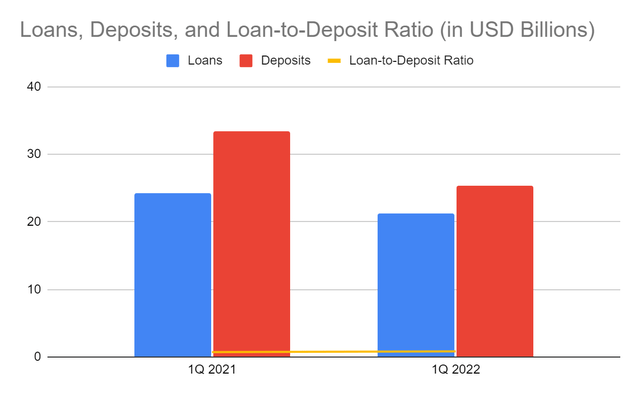

It is nice to see it focus on enhancing the quality of its earning assets. Some of these are its debt and equity securities and high-yielding loans. There is also a massive decrease in deposits, which is a wise move given the high-flying interest rates. It is more challenging to manage than the fixed high-yielding digital savings account of Bask Bank. It is no surprise that the changes in loans and deposits are leading to improved profitability as shown by the net interest margin.

It maintains an impressive liquidity position. Its loan-to-deposit ratio of 83% is within the ideal range of 80-90%. It is well-positioned to sustain its expansion plan. The increased demand in the C&I segment offsets the contraction in the mortgage market. Also, its expanded products and solutions may help it capture more clients and increase its viability. Provisions comprise 0.98% of the total loans vs 0.92% in the previous quarter. Meanwhile, cash and investments comprise 29% of the total assets, so it is very liquid. Deleveraging is another factor that enhances its liquidity. The total borrowings today are 25% lower than in 1Q 2022. Cash and investments are almost four times higher than borrowings.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

As mentioned, it has more interest-sensitive assets. Loans and securities are high yieldings. which may drive the revenue rebound in 3Q. Yet, we must not expect much increase in income this year. I expect the management to focus more on front-loading in line with the expansion. It may lead to higher expenses. We can already see it in the increased non-interest expenses due to more professionals hired. That is why investors may have to be more patient before reaping their potential rewards.

Stock Price Assessment

The stock price of Texas Capital Bancshares, Inc. is slightly elevated from its dip in June. But, the downtrend is visible. We can attribute it to the macroeconomic pressures and its still slow-moving returns. At $54, it has already been cut by 12% from its starting price. It may be a good entry point to make a position.

The PE Ratio of 13 and Price-to-Operating Cash Flow of 5.2 indicates potential undervaluation. Meanwhile, the PB Ratio is 0.88, but if we focus on the tangible book value the ratio will be 0.99. It suggests that the stock price is fairly valued. It is also not a dividend investor cup of tea since it has never paid dividends. It is not possible anytime soon as TCBI prioritizes reinvestment in growth and sustainability. To assess the price better, we may use the DCF Model.

FCFF $179,250,000

Cash $235,000,000

Outstanding Borrowings $1,503,000,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 50,710,000

Stock Price $54

Derived Value $59.15

The derived value confirms the potential undervaluation of the stock price. It may also be attractive at the current value. There may be a potential upside of 10% in the next 12-24 months.

Bottomline

Texas Capital Bancshares, Inc may not be as robust as its pre-pandemic performance. But, its growth prospects are attractive, given the strategic transformation. It is profitable and liquid, allowing it to sustain its potential expansion. Also, the stock price appears undervalued.

I believe that investing in TCBI requires much patience. A massive upside in the stock price is not possible soon. Yet, I am optimistic about its performance, given its priorities and financial position. For those who can wait, the recommendation is that Texas Capital Bancshares, Inc. is a buy.

Be the first to comment