NicolasMcComber

Texas Capital Bancshares’ (NASDAQ:TCBI) recent divestiture of its BankDirect Capital Finance holding marks continued progress on its strategic shift toward building out a core Texas commercial lending base. Strategically, it’s hard to argue against the move – it creates a better-capitalized and more liquid balance sheet, allowing for capital reallocation to accelerate the turnaround progress. The transaction makes sense financially as well, with current guidance calling for the addition of ~199bps to TCBI’s CET1 ratio and a compelling 6.5% accretion to tangible book value.

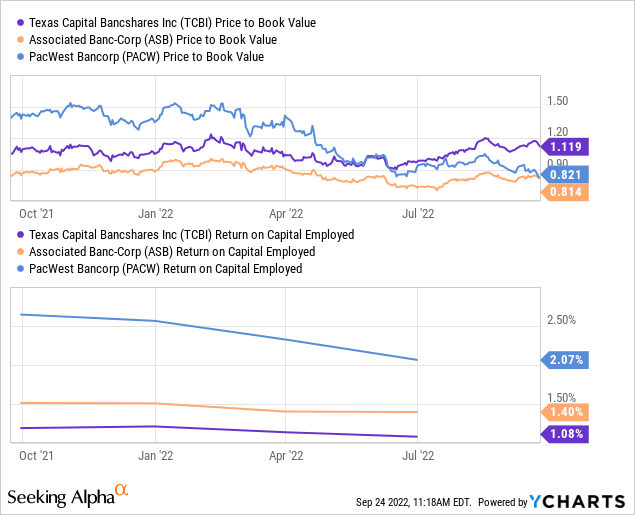

That said, the near-term exposure to normalizing credit quality trends is an issue, particularly with FY23 return projections below par and an improved revenue growth profile still yet to materialize at TCBI. Given the premium P/E valuation of TCBI stock compared with regional bank peers like Associated Banc-Corp (ASB) and PacWest Bancorp (PACW), I would wait for a better entry point.

BankDirect Divestment Aligns with Long-Term Strategic Goals

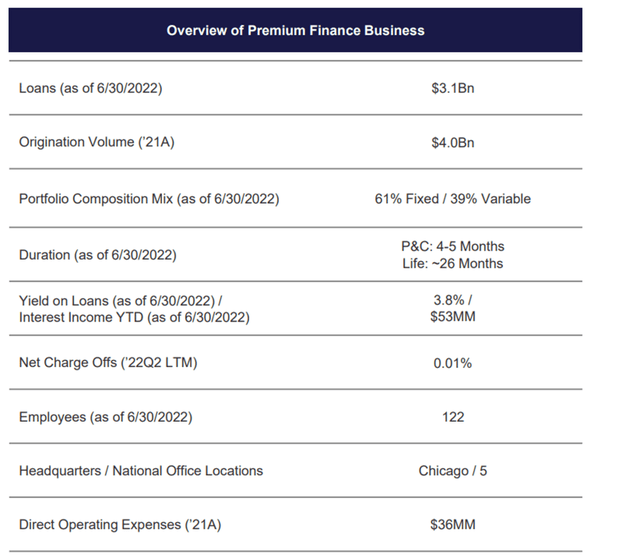

TCBI has disclosed the sale of BankDirect Capital Finance to AFCO Credit Corporation (an indirect wholly-owned subsidiary of Truist Financial Corp (TFC)) in a ~$3.4bn all-cash deal. The transaction proceeds imply a reasonable 8.5% asset premium to BankDirect’s ~$3.1bn loan book.

For context, BankDirect is a quality lender that has grown through the cycles while maintaining low credit losses – on a trailing twelve-month basis, net charge-offs were an impressive 0.01%. As of Q2 2022, the loan portfolio yield stood at ~3.8%, comprising 61% fixed rate and 39% variable rate loans, and generated YTD interest income of ~$53m. The sale should face limited regulatory hurdles and is expected to close in Q4 2022.

On balance, the deal fits nicely within TCBI’s strategic roadmap to build out a Texas-focused, commercial relationship banking model. While BankDirect is a quality asset in its own right, management has long viewed this business as a non-core asset, given the limited synergies within the broader portfolio. Thus, this sale gets the company further along the path to rightsizing its business lines.

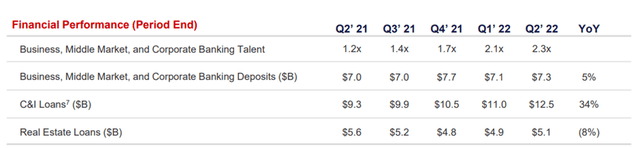

Post-sale, loan demand will not be slowing down – the YoY quarterly operating leverage guidance remains intact for the year, signaling a resilient core loan growth outlook for the back half of the year. Within the loan book, momentum in commercial and industrial (C&I) will be worth keeping an eye out for following the +34% YoY growth in Q2 as management reallocates more resources into building out coverage (in line with its mid-term plan).

Net Accretive Financial Impact and a Timely Boost to the Capital Position

Financially, the BankDirect sale increases capital levels and tangible book value post-closing. Per the latest guidance, TCBI’s CET1 ratio will gain ~199bps (vs. the 10.5% base as of the June quarter), while the ~$160m addition to the common equity base equates to a 6.5% accretion to tangible book value.

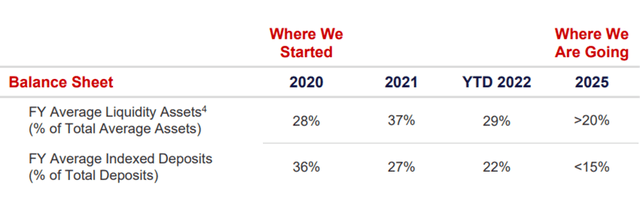

As TCBI will see no deposit balances being sold with this transaction (vs. the ~$3.1bn loan book), the deal should also result in a positive decline in the loan-to-deposit ratio. Similarly, the liquidity position (liquid assets to total assets ratio) is set to improve post-deal as well.

Perhaps more importantly, the deal will equip TCBI with a significant pool of excess capital to deploy. Most of it will likely be used to accelerate the strategic turnaround or support organic growth, though, with any upsizing to the buyback program only likely if the stock trades cheaply (e.g., below tangible book).

On the P&L side, the key change will be the deduction of ~$36m of expenses, which adds to the reinvestment capacity going forward. Management has not indicated any planned reinvestments into other areas for now, but given the lost interest income, reinvestment of the transaction proceeds will likely be necessary sooner rather than later.

The opportunity is clear – having come in at +30% annualized in H1 2022, the organic loan growth momentum should allow TCBI to accretively deploy excess capital and liquidity. Assuming the ~3.8% premium finance loan yield and a further cash yield boost from upcoming Fed Funds rate hikes, for instance, TCBI should have little trouble generating sufficient interest income to cover the loan interest shortfall from the divestiture. Combined with a ~$36m cut in the opex run-rate, I suspect management is being conservative here, leaving ample upside to future earnings.

BankDirect Divestiture Not Enough to Justify Steep Valuation Premium

Overall, TCBI will be pleased with this deal. Yes, BankDirect was a profitable business, but it had long been viewed as non-core, given it carried no deposit balances and no customer relationship. Plus, the divestiture offers a nice lift to the pro-forma financials, with a projected 6.5% accretion to the tangible book value and a neutral to modestly accretive EPS impact in 2023.

While this planned transaction also looks set to boost capital levels and improve the loan-to-deposit ratio, it does not adequately compensate for the near-term challenges at hand. In particular, the credit risks and asset quality implications from an accelerated rate hike cycle are a concern. The lack of a meaningfully improved growth profile (TCBI’s turnaround is still in progress) also stands out relative to the steep premium P/B valuation multiple. Pending visibility into improvements across key P&L and return metrics relative to regional bank peers, I would remain neutral on the stock.

Be the first to comment