sefa ozel

In 2008, the world’s financial system was rocked by the subprime mortgage crisis, which lead to one of the deepest recessions since the depression. But through the chaos and closures, there were firms who survived, and firms who thrived.

With the US Fed hiking rates and likely to put the US back into another recession amid wars and COVID, I thought it would be timely to review the academic research, the stories and the advice from business leaders whose companies survived or thrived through the 2008 Great Recession. Then, apply those learnings and see how today’s largest businesses stack up in terms of readiness to deal with a recession.

Ranking Recession Readiness is a series of articles I’m authoring based on academic research along with advice from business leaders who took their firms through the Great Recession of 2008, to help investors identify which top 100 US firms are positioned to strive through a downturn, and which firms will stumble.

Today’s company under the spotlight is probably one of the most controversial firms in the market today, Tesla (NASDAQ:TSLA). You only have to go into the comments section of any Seeking Alpha article covering Tesla and see just how polarizing the company, its valuation and its CEO (Elon Musk) are to the investment community, and the world at large.

So in writing about Tesla’s preparedness to face a recession, I’m bracing myself for some very robust debate of my piece, which will probably be more intense than any other I’ll write (including the time I wrote that Tesla had lost favour with the Wall Street Bets community…!).

I suggest however that before commenting on my work, you thoroughly review the methodology that has been used to come to my conclusions. There you will see that I’m not setting out to say that Tesla will or won’t survive a recession, nor am I trying to evaluate the firm on its products or viability. I’m not even trying to put a price on the firm! I am focused on trying to determine how prepared Tesla is to face a recession, compared to the Top 100 US Firms, by analysing the balance sheet and its qualitative traits.

So, let’s get started!

A full breakdown of the methodology and explanation behind the calculations is available in my introductory article, Ranking Recession Readiness: Is Google Prepared For The Recession?

(Data & prices correct as of pre-market 13th July, 2022)

(The Top 100 US Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 US Firms compare on Recession Preparedness

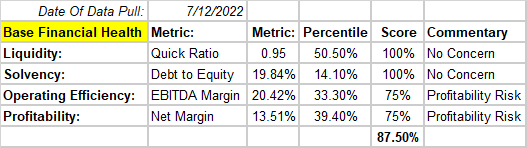

Tesla’s Base Financial Health

First and foremost, let’s review Tesla’s overall financial health as it stands today in the current operating environment. Again, we’re comparing Tesla to the Top 100 US Firms list, so we’re using comparative scores, not creating absolute scores.

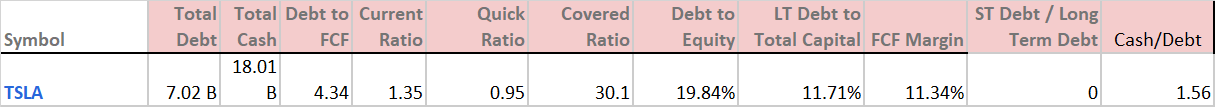

Author

From a baseline view, Tesla’s metrics are largely healthy, with a quick ratio metric of 0.95 considered to be average against its peers, which I’ve decided to be lenient toward and award it a “No Concern” score, given a quick ratio is an unlikely worst-case scenario. Its debt to equity ratio is exceptional at just shy of 20%, and considered well below the average for its peer group.

When we get to efficiency and profitability, however, for a car manufacturer these numbers might be exceptional figures for the auto manufacturing industry, compared to the Top 100 US Firms however, these are relatively meagre, so Tesla is penalised slightly.

Overall, Tesla’s base financial health is a solid 87.5%.

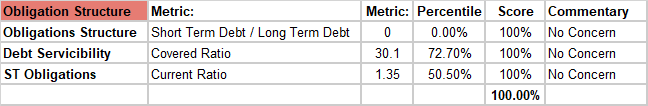

Next, we take a closer look at Tesla’s debt structure.

Author

Across the board here there are no concerns, with no short-term debt, a very safe covered ratio of 30, and an average current ratio of 1.35, which given the above, I’ll assign a No Concern score to.

Tesla pays no dividends so we can skip that part of our review, and move right on to the Firm’s Future Outlook.

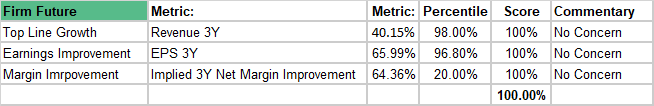

Author

Here, Tesla outshines the Top 100 peer group with exceptional financial outlooks. Despite having a lower net margin improvement than the peer group, I don’t think there will be much debate if I say a 60% profitability improvement gives me “no concerns”.

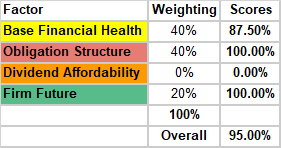

Finally, we put it all together, and assign a weighting to each of the scores.

Author

A 95% overall financial health score is excellent, though I note Tesla’s main weakness is its profitability when we compare it to the Top 100 US Firms peer group, but I feel this shouldn’t cause us too much concern.

Now it’s time to really stir up some emotions with Tesla fans, as we critically review Tesla’s balance sheet preparedness for an economic downturn.

Assessing Tesla’s Recession Preparedness

Are you ready? Let’s get stuck in and take a peek at the main balance sheet metrics.

Author

These figures are not too bad, with low debt, plenty of cash to cover said debts, and a pretty decent free cash flow margin. We’ve already looked at current, quick and covered ratios which are decent, and we’re pleased to see no short-term debts as previously mentioned.

Let’s now apply scores to each of these metrics relative to Tesla’s peer group, assign weights to those scores to see how recession-ready Tesla is.

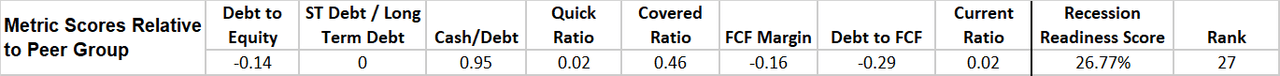

Author

Unfortunately for Tesla, despite some solid metrics, the biggest drawbacks for the firm are its current ratio being 0.95 versus a Top 100 Firms median of 1.35, and its current ratio falls very much within the normal level for its peer group, making Tesla only marginally more prepared for a recession than the bulk of the Top 100 US Firms.

A 26.77% Recession Readiness Score is still above average, and more prepared than the vast majority of firms, however, a rank of 27 is a bit of a “middle-of-the-pack” ranking. Not a leader, not a lagger, just one in the crowd.

With that being said, quantitative analysis does not tell the whole story, so let’s go through a more qualitative assessment of Tesla’s readiness.

A Deeper Dive Into Tesla’s Recession Readiness

I’m sure you recall from reading, in great detail, the methodology behind this analysis, and so you would be able to recall the 6 main themes of advice from the 2008 Great Recession.

We’ve well and truly covered the debt and cash aspects of advice, so now we move on to the more nuanced components.

Firstly, we look at how Tesla’s receivables look, noting that the ideal scenario is minimising exposure to customers’ financials by reducing our accounts receivables.

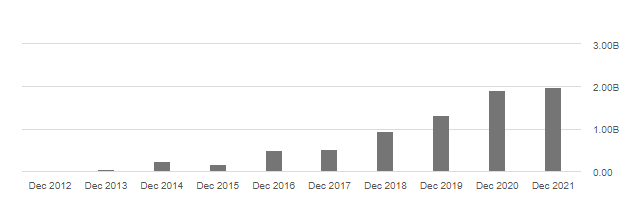

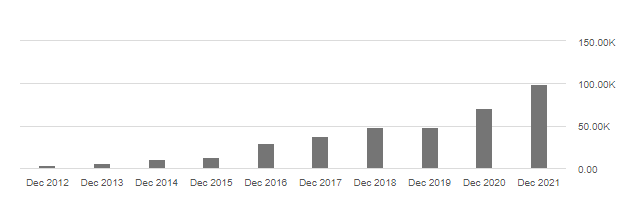

Tesla as a business is growing at a very solid pace, as too are its receivables. We can see in the 2021 reporting period that the growth of total receivables had slowed and now sit at $2.42B (MRQ), representing 8.3% of total current assets, and 3.67% of total assets.

I’m not here to debate if this is a sign Tesla’s growth is slowing, I’ll leave that for the comments section, but from a viewpoint of making preparations for a recession, this is actually considered a good move.

TSLA Total Receivables (Seeking Alpha)

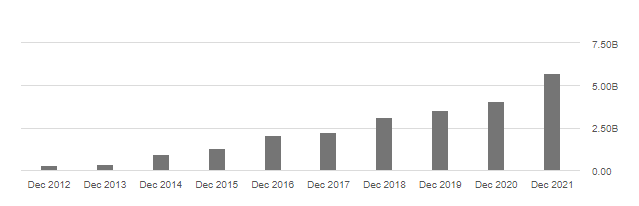

The next advice theme is centered around minimising total inventory given the costs associated with warehousing and holding stock.

Here we see inventory jumped upward $934m between the FY 2021 reporting period and the MRQ. In a potential slowdown of consumer spending, especially on Consumer Discretionary items like expensive vehicles, surplus inventory could incur huge costs the business would prefer not to carry, while experiencing a downturn.

Total inventory came to $6.691B in the MRQ, representing 23% of total current assets and 10.13% of total assets.

TSLA Inventory (Seeking Alpha)

Combining total receivables and inventory shows us Tesla is holding nearly a third of its entire total current assets, and 13.8% of its total assets in stock and accounts that we would much prefer to see minimised.

The next piece of advice to consider was cutting expenses, but avoiding layoffs.

Here we can look at Tesla’s total employee count, and assess revenue per employee and profit per employee as a gauge of whether Tesla might consider layoffs to reduce its costs.

Manufacturing companies typically turn to layoffs in factories as a way to quickly cut costs for the business, and so there is a very good likelihood that Tesla will consider doing the same.

With 99,290 employees, Tesla generates $626,347 in revenue per employee, but only $84,640 in profit. Depending on the scale of the downturn, I would say there is a moderate chance Tesla might look at reducing its headcount in order to maintain profitability.

This is something to be avoided, however, given that once the recession ends, hiring and training staff is a relatively expensive process, and could make it difficult for Tesla to bounce-back quickly and recover any lost output capacity.

TSLA Total Employees (Seeking Alpha)

The final piece of advice we will cover is the recommendation to invest in capital-intensive projects during a recession while the opportunity cost of capital is much lower. This is probably the most difficult to assess given there’s no data you can use to predict a firm’s decision-making, however when it comes to Tesla, we have some pretty good history to use as our guide.

Firstly, Elon Musk is brilliant at quickly developing new projects in order to raise funds, i.e., the “Not-A-Flamethrower” he created to fund The Boring Company. Tesla also sells mugs, belt buckles and other assorted apparel items.

I think it is fairly safe to say that Tesla’s management is not afraid of a pivot, or to try new ideas to solve problems, so when it comes to considering investing in CAPEX, I reckon we can say with a great deal of safety that any and all projects will be on the table for consideration during a recession.

Closing Remarks

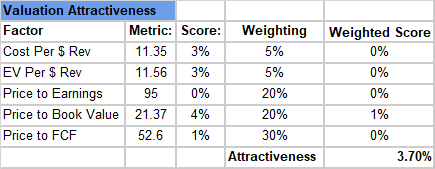

I want to close by saying that I don’t provide any specific pricing targets around my recession readiness scores and analysis, other than a broad buy, hold or sell. But I will point out that my assessment of Tesla’s current valuation attractiveness relative to the Top 100 US Firms peer group is a dismal 3.7%. It’s therefore impossible and irresponsible of me to recommend Tesla as a Buy for investors looking to place capital into the Top 100 US Firms looking for relative safety from the recession.

Author

Therefore, I will give Tesla a HOLD recommendation, given it has a solid balance sheet, good financial health, and while there are some qualitative concerns (receivables, inventory and potential layoffs), Elon Musk is Elon Musk; I would not at all be surprised if he somehow managed to find a way to turn the recession into a brilliant opportunity for Tesla.

I hope you enjoyed this piece, I thoroughly look forward to reading your comments and welcome respectful and well-meaning disagreement and discussion. (Praise and compliments are also accepted.)

If you have any questions or would like to see any particular Top 100 US Firms assessed for their recession readiness, please leave a comment and let me know (I always do my best to monitor and respond to genuine comments!).

Be the first to comment