Sky_Blue/iStock Unreleased via Getty Images

Over the weekend, we received the first quarter production and delivery report for electric vehicle maker Tesla (NASDAQ:TSLA). The company was expected to see record numbers as it continued to expand in both of its current factories and start deliveries from the new Berlin facility. Due to some major headwinds, the numbers were a little soft, but the major items to watch will come in a couple weeks at the April 20th earnings report.

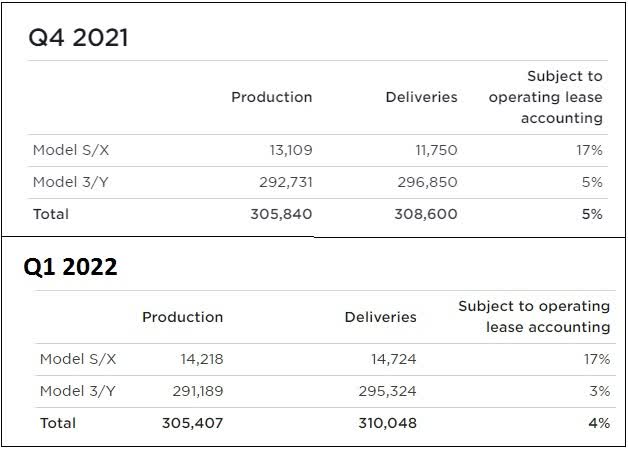

Investors were expecting big things in the first quarter of 2022. Tesla continues to ramp production of its refreshed Model S and X vehicles, and the Shanghai factory has continued to increase its vehicle build rates over time. Back in January, key Tesla watchers like Troy Teslike were expecting a sequential jump of around 25,000 units from Q4’s quarterly record. Unfortunately, supply chain issues and some COVID shutdowns in China impacted things a bit, so Tesla didn’t achieve that much growth as seen below.

Tesla Quarterly Production & Deliveries (Tesla Investor Relations)

I’m not going to make a big deal about whether Tesla beat or missed expectations. Some websites were reporting a street average of 317k, while others were reporting an analyst average down to 309k based on the Shanghai shutdowns. The main point here is that coming in around 310k vs. 330k brings down some of the bull cases for the year a little, and Q2 will really depend on how much longer Shanghai is closed.

My main focus here is on what the reported numbers mean. The big takeaway is that we should see some nice tailwinds to average selling prices. First, Tesla has been raising prices across the board over the past year, which should flow through more as this year evolves. There will be a slight headwind from a stronger dollar, but that shouldn’t impact things too much. Second, the mix shifted a bit toward Model S/X vehicles, which is definitely good for selling prices. Finally, a lower leasing percentage means more cash deliveries, which should also benefit overall vehicle revenues.

What I’m most curious to see is how the street reacts to this Q1 report. Going into Saturday’s release, the average revenue estimate was $17.66 billion, as compared to Q4’s total of $17.72 billion. There might be some reduced revenues from solar and energy products due to seasonality, but as I mentioned you have a slight increase in deliveries and some tailwinds for selling prices. As I’ve covered previously, analysts like to keep the bar low for Tesla, and that’s clearly evident with an example below.

Wedbush Tesla Note (JC Oviedo Twitter)

Wedbush’s Dan Ives, with just a week to go in Q1, was calling for just $15.79 billion in revenue and reportedly had a delivery estimate of 278k despite saying Tesla was trending well above expectations. There also was had Piper Sandler expecting just 294k deliveries for Q1, helping hold down that analyst average a little as well. These two figures alone dragged the overall average down enough for the Tesla bulls to claim a Q1. Again, it doesn’t really make a difference to me whether this quarter was claimed to be a beat or miss. However, I just wanted to show again that the street loves to keep a really low bar for Tesla that does make it a lot easier for the company here.

Calling for $2 billion less in revenue when Tesla was expected to show at least flat deliveries seems a bit curious. However, that isn’t even the lowest number on the street, as one analyst who is either really bearish or just outdated has a $14.33 billion figure currently. If we were to take out some of these seemingly nonsensical numbers, the street average would likely be around $18 billion. I’ll probably be close to that number when I do my full earnings preview article and quarterly model, once we get the March Tesla China numbers and some other data points in.

More importantly than revenues for Q1 will be the rest of the quarter’s income statement. We know that operating expenses should drop a bit from Q4 levels as Tesla had some extra costs related to Elon Musk’s various pay packages. However, will this be enough to offset potential margin losses from rising materials costs as well as the initial ramps of the Berlin and Austin factories? At the moment, the street is looking for about 30 cents less a share than was seen in Q4, or even more if you back out the Q4 one-time items. There’s also a wild card if Tesla were to have sold any of its Bitcoin holdings, but anything on that front would likely be discounted as it is a non-core item.

Currently, I’m not as much concerned with the short-term delivery numbers as the longer term production picture. Shanghai will be down for at least a few days, which may or may not impact Q2 depending on when the closure finally stops. The bigger item for this quarter is the ramp of the two new factories, as these will provide the bulk of Tesla’s capacity growth for the next 12-18 months. I’m interested to see if the company brings back a shorter range Model Y for the US market, along with the introduction of that variant for Europe. I don’t think Tesla has enough demand for the current lineup to fill all of the Austin and Berlin capacity, so we’ll need to see prices come down at some point.

As for Tesla shares, they have rallied lately thanks to the announcement of another potential stock split. Shares closed Friday around $1,085, which is now more than $130 above the average price target on the street, and they rallied a bit further on Monday morning. I’ll also point out that Cathie Wood has started selling again in her Ark Invest ETFs, completely reversing her January / February purchases and then some.

In the end, Tesla’s Q1 delivery announcement was mostly as expected. The company’s numbers were pressured a little by supply chain and COVID issues, so there wasn’t as much sequential growth as was hoped earlier this year. Now, the focus shifts to getting the Shanghai plant back open, as well as getting the two new factories’ production ramps going. In a little more than two weeks we’ll get the Q1 earnings report, at which point we’ll see how the margin story has been impacted by all these items. This weekend’s news doesn’t do much to change the long-term narrative, but the recent rally has investor expectations inflated a little.

Be the first to comment