Xiaolu Chu/Getty Images News

Despite worsening supply chain constraints worldwide, Tesla’s (NASDAQ:TSLA) first quarter deliveries managed to beat the average consensus estimate by 900 vehicles. The electric vehicle (“EV”) pioneer and leader set a new record at 310,048 vehicles delivered during the first three months of the year, up 68% from the prior year. The achievement has accordingly paved way for another blockbuster sales beat, with first quarter revenues coming in at $18.8 billion (+%81 y/y; +6 q/q; vs. consensus estimate $17.9 billion). The EV maker’s earnings beat has also assuaged investors’ monthslong concerns about potential bottom-line erosion, as costs of raw material crucial to EV productions like nickel and lithium continued on a reckless uptrend.

Looking ahead, Tesla remains on a positive track towards delivering impressive free cash flow needed to fund its longer-term growth initiatives and targets. The company’s first quarter results underscore the continued advantage and strength of its market leadership in procuring sufficient raw materials to ensure swift navigation through unprecedented supply chain constraints. Despite the three-week shutdown of its Giga Shanghai facility due to protracted COVID restrictions in the Chinese financial hub and other cities across China, lost productions estimated at approximately 40,000 vehicles and the related sales drag are not expected to materially deviate Tesla from its multi-year volume growth target. Tesla CEO Elon Musk cited that the company could potentially achieve 60% year-on-year volume growth for full year 2022 despite acute production challenges at the Shanghai plant in the current quarter, which could result in similar production levels observed during the first quarter with nominal growth. This compares to the EV maker’s previous guidance for productions and deliveries at a minimum growth rate of 50% year-on-year from just its Fremont and Shanghai production facilities.

Based on the number of vehicles sold last year, targeted 2022 volume growth at 50% would imply delivery of more than 1.4 million vehicles this year. Considering the Fremont facility’s annual production capacity capped at 600,000 vehicles, the targeted volume growth implies Giga Shanghai could deliver more than 800,000 vehicles at full capacity. And now with the new Giga Berlin and Giga Austin production facilities that have recently come online, Tesla likely has more than sufficient production capacity to cushion the lost volumes from the three-week production halt at Giga Shanghai earlier in the current quarter. Meanwhile, automotive demand continues to outstrip supply – a trend that resonates with Tesla – despite dampening consumer sentiment ahead of a cloudy economic growth outlook. Tesla recorded a much higher vehicle average selling price (“ASP”) during the first quarter, yet demand has not been dented one bit, which underscores its brand and pricing power. Paired with the transportation sector’s structural transition to electric, especially across Tesla’s major markets – the U.S., China and Europe – the company remains EV’s “poster child”.

Considering the stock’s elevated valuation, even under the current risk-off environment for equities, market participants are expecting nothing short of high growth and strong execution ahead from Tesla. Investors will likely zero in and focus on Tesla’s continued ability to execute and deliver on its industry-leading growth potential. This includes further development to services offered by its brand, such as materialization of Full Self-Driving (“FSD”) / Autopilot and Tesla’s robotaxi aspirations, especially as expansion beyond the brand’s core vehicle sales business becomes increasingly critical to sustaining its current valuation levels. The ability to overcome current industry and company-specific challenges like protracted supply shortages, restore capacity production in Shanghai with continued ramp-up in Berlin and Austin, favourable regulatory rulings and progress on FSD / Autopilot rollout, as well as new product and feature announcements also remain welcomed catalysts for the stock.

Update On Giga Shanghai Productions

Tesla’s Shanghai factory is a crucial artery that bridges the U.S.-based EV maker to its vast opportunities in Chinese and European market. The critical role of Giga Shanghai is corroborated by strong domestic demand from the Chinese market, despite a slowing economy exacerbated by the recent COVID lockdowns. During the final month of the first quarter, Tesla sold almost all of the 65,754 vehicles produced at its Shanghai facility to the Chinese market, leaving only 60 vehicles exported to Europe. Despite the early- and late-March plant suspension, output and delivery volumes for the month from Tesla’s Shanghai factory still managed to reach an all-time high, underscoring its strength in ramping up productions as well as the strength of EV demand across China. Although new passenger vehicle registrations in China declined by 11% year-on-year in March to 1.6 million units due to an ongoing industry-wide semiconductor shortage, local EV sales still accelerated with year-on-year increase of 137.6% to more than 445,000 units, despite the country’s latest COVID resurgence and slowing economy. China currently accounts for close to half of the world’s EV sales, underscoring a strong uptake rate that makes favourable tailwinds for Tesla’s continued expansion in the country.

However, Giga Shanghai’s current quarter performance may be muted compared to its first quarter achievements. The plant, which is responsible for producing Tesla’s best-selling Model 3 and Model Y for the local Chinese market as well as for export to Europe, is estimated to have lost “about a month of build volume” during the three-week lockdown that began on March 28th due to the biggest COVID outbreak in Shanghai and other major cities across China since the onset of the pandemic two years ago.

Yet, Tesla is expecting “record output per week from Giga Shanghai” in the current quarter despite the April setback, as the plant re-ramps through May and June, barring any new supply chain challenges that may arise. The plant has since reopened the week of April 17th under a closed-loop system where workers are required to live within the facility and adhere to strict COVID prevention measures such as regular testing. At Tesla specifically, the some 400 staff that have been invited to return to the Shanghai plant were allocated a sleeping bag and mattress for resting within a designated area, and they are required to “take a nucleic acid test daily for the first three days and have their temperature checked twice a day while maintaining a stringent hand-washing mandate”. The limited manpower has Tesla’s Shanghai plant requiring all returning workers to take rotating 12-hour shifts for six consecutive days with one day off. This compares to the previous work schedule under regular conditions of two days off for every four consecutive workdays. Under the new arrangement, Musk is hopeful that Giga Shanghai’s production levels could potentially net out to similar volumes observed in the first quarter.

However, some of Tesla’s Chinese EV peers like Xpeng (XPEV), alongside Chinese tech giant Huawei, are less optimistic and now warning of an industry-wide production shutdown if the COVID restrictions extend into May. Despite Tesla’s makeshift closed-loop arrangement, China’s continued commitment to its COVID Zero approach could still bring about extended limitations to ramping up productions at the Shanghai plant again. Although “some 276 auto component suppliers have gotten back to work” since the latest wave of China’s COVID outbreak, the country’s COVID Zero strategy remains a large overhang on the supply chain. Logistical challenges remain intense due to strict quarantine controls levied on the country’s trucking fleet, which is responsible for transporting about 75% of total freight in China – key industrial hubs like Jiangsu, Guangdong, Shanxi and Shanghai saw road freight volumes decline by close to a fifth in March compared to the prior year.

The curbs remain a serious threat to even production facilities, like Tesla’s Giga Shanghai, which have reopened for operations under a closed-loop system. Tesla’s Shanghai plant is estimated to “only have [sufficient] inventory for two weeks based on its new closed-loop schedule”. Paired with the ongoing logistical challenges across China, which could “make moving people and goods around the country near impossible”, Giga Shanghai will likely continue to experience acute production limitations through the current quarter.

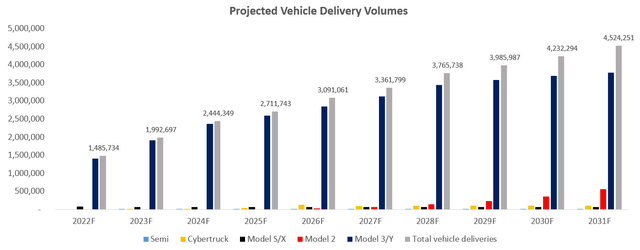

As a result, we have lowered our second quarter delivery forecast to about 278,300 vehicles (previous forecast: 342,450) to reflect impacts of the extended pandemic lockdowns in Shanghai and other major production hubs across China. We have also accordingly adjusted our full year 2022 delivery estimate to 1.48 million vehicles (previous guidance: 1.56 million vehicles) with expectation for a “stronger production and delivery cadence” in the latter half of the year coupled with progress from the new production plants that have recently come online in Austin and Berlin.

Tesla Vehicle Delivery Volume Projections (Author)

Industry-Leading Brand And Pricing Power

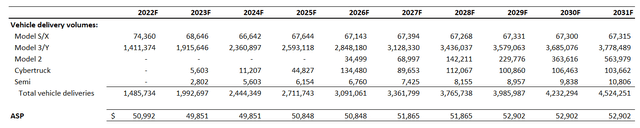

In addition to record-setting first quarter delivery volumes, a higher ASP coupled with relentless demand for Tesla vehicles were also key drivers of the EV titan’s latest sales beat. As discussed in our previous analysis, Tesla has been strategically increasing prices across the board in recent months. The consecutive price hikes observed across Tesla’s Chinese and American markets have averaged 3% to 5% in March alone, taking the cheapest Model 3’s sticker price to $46,990. The EV maker’s consolidated vehicle ASP (i.e., total automotive sales, excluding automotive leasing revenues, divided by total delivered vehicles in the period) increased from $49,705 in Q4 2021 to $52,227 in Q1 2022, reflecting a more than 5% increase sequentially. Tesla’s ability to pass on increasing input costs to consumers without chipping away demand – as opposed to the recent pricing mishap observed at Rivian (RIVN) – underscores its industry-leading brand and pricing power, which are crucial to its success under the currently clouded economic outlook where consumer spending could slow amidst rising inflation.

The impact of a higher ASP on revenues is expected to be more prominent in the second half of the year, as recent orders get delivered over the next six to 12 months based on current wait times observed across all Tesla markets. And considering expectations for continued cost growth in lithium – the key raw material used in EV batteries – Tesla’s pricing power could potentially allow for additional adjustments to its sticker prices over the longer-term. Due to a popular decision by lithium miners to “slow or halt expansions and new projects during a two-year lithium price slump through the middle of 2020”, compounded by extended COVID disruptions, supply of the raw material has struggled to keep up with re-accelerated demand in recent years arising from the global transition to electric. Lithium demand is expected to “jump fivefold by the end of the decade”. The EV maker has repeatedly called out the procurement of lithium supply its “biggest challenge” over the past year. This has accordingly encouraged ramped up efforts by Tesla in securing long-term contracts with raw material suppliers to hedge against rising costs of commodities used in batteries, as well as its plans to switch to the cheaper lithium-iron-phosphate (“LFP”) batteries for standard range models. To date, about half of Tesla’s first quarter production volumes were powered by LFP batteries. But again, strong demand and pricing power remain huge contributors to Tesla’s industry-leading price-cost balance.

As a result of recent changes to Tesla’s pricing strategy, we have also accordingly adjusted our forecasted vehicle ASP for full year 2022 to $51,000 (previous forecast: $50,600). The adjustment reflects Tesla’s continued ability to adjust its pricing strategy in accordance with fluctuating raw material costs, as well as resilient overall demand, especially with increasing sales mix contribution from the lower-priced Model 3/Ys.

Tesla ASP Projections (Author)

Tesla’s Strong Cash Flow Generation To Fund Growth Investments

Looking ahead, Tesla’s ability to maintain robust free cash flow generation from its day-to-day operations will remain a critical advantage against competing industry peers. The company ended the first quarter with $17.5 billion in cash and cash equivalents on its balance sheet, and generated $2.2 billion (TTM: $7.0 billion; +39% from Q4 2021 TTM FCF $5.0 billion) in free cash flows after accounting for debt repayment totalling $2.1 billion and capital expenditures of $1.8 billion. Much of the boost to Tesla’s liquidity in the current quarter were attributable to its impressive consolidated gross margin improvements to 29.1% (+779 basis points y/y), and automotive gross margins 32.9% (consensus estimate: 29%). The margin improvements were primarily driven by the increasing sales mix of higher-margin Model 3/Y vehicles produced in Giga Shanghai and other cost improvements enabled by “manufacturing efficiencies in Fremont”, as well as Tesla’s pricing power as discussed in the earlier section. The results have largely assuaged previous investors’ concerns on increasing input cost impacts to the industry.

Tesla’s ability to maintain strong profits and cash flow generation will be crucial to its growth roadmap, which includes new product and feature roll-outs. The cost controls realized from manufacturing efficiencies implemented in the first quarter will also be “key to unlocking $25,000 EVs needed to continue driving volume growth” over the longer-term.

The improvements made to Tesla’s cost structure and economic model will also allow appropriate funding towards investments into its ongoing robotaxi endeavours, a potentially major growth driver for latter parts of the decade and beyond. Global autonomous ride-hailing demand is expected to grow into a $12 trillion market, underscoring a tremendous new opportunity for Tesla upon materialization of its self-driving technology developments. In Tesla’s latest earnings call, Musk had alluded to the production of a new vehicle dedicated to the company’s future robotaxi fleet. The new model, slated for start of volume productions in 2024 (possibly later considering Musk’s long-time reputation for production delays), will be “highly optimized for autonomy”, free from steering wheels or pedals to enable “the lowest fully considered cost per mile”.

In addition to futuristic projects, Tesla’s balance sheet will also bolster the impending start of productions for the long-awaited Cybertruck and Semis, as well as the speculated $25,000 “Model 2”, in addition to the accompany 4680 battery cells. The successful buildout of Tesla’s product portfolio will be crucial for its growth trajectory ahead, especially as investors price in expectations for Tesla’s ability to execute and deliver in the stock’s elevated valuation.

TSLA Stock – Fundamental Estimate And Valuation Update

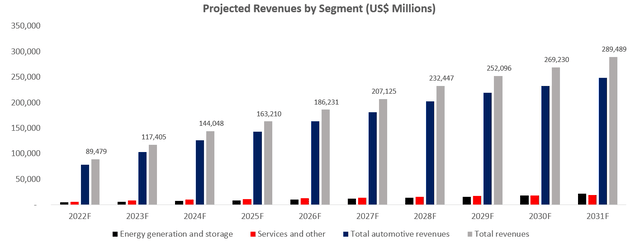

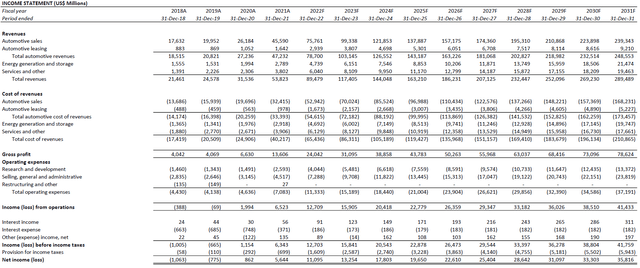

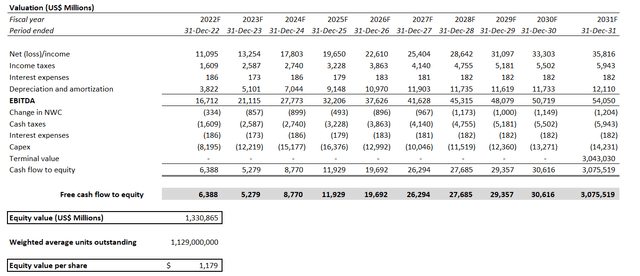

Adjusting our previous forecast for Tesla’s actual first quarter deliveries, as well as recent developments to its pricing strategy and progress on production ramp-up amid protracted supply chain disruptions, we are projecting total revenues of $89.5 billion (+66% y/y) for 2022. The topline is expected to further advance at a compounded annual growth rate (“CAGR”) of 12.5% towards $289.5 billion by 2031, which is consistent with Tesla’s industry outperformance as well as the accelerated transition to electric worldwide in coming years.

Tesla Revenue Projections (Author)

Much of Tesla’s success will continue to rest on its core vehicle sales. Considering the projected vehicle delivery volumes, as well as Tesla’s pricing strategy discussed in earlier sections, automotive revenues are expected to total $78.7 billion (+67% y/y) for full year 2022. The segment is expected to further expand at a CAGR of 12.2% towards annual revenues of $248.6 billion by 2031, reflecting the expectation for Tesla’s continued market dominance as global EV adoption nears an imminent inflection point.

Paired with Tesla’s projected cost structure, which considers its recent margin expansion enabled by cost controls, offset by the expectation for continued pricing pressures from raw material inputs as well as impacts from early-stage ramp up at the new Austin and Berlin facilities, the company is expected to generate profits of $11.1 billion (+97% y/y) by the end of the year.

Tesla Financial Projections (Author)

Tesla_-_Forecasted_Financial_Information.pdf

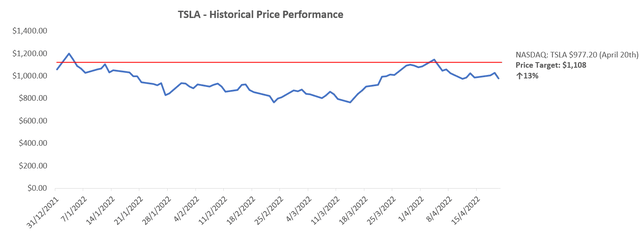

Our price target for Tesla remains in the $1,100 level despite some near-term production headwinds in the current quarter reflected in our fundamental adjustments. This represents upside potential of 13% based on the stock’s last traded share price of $977.20 on April 20th.

Tesla Valuation Analysis (Author)

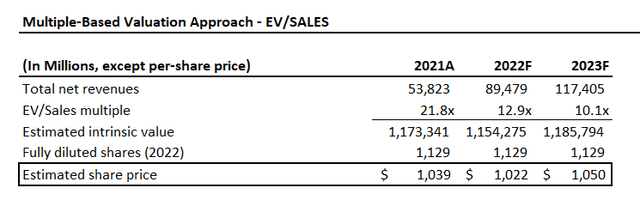

The price target is derived by equally weighing an EV/sales-based and discounted cash flow (“DCF”) valuation approach. The forward EV/sales and terminal valuation multiple assumptions applied remain in line with our most recent analysis from a few weeks back, considering there have not been any material contractions/expansions observed in the industry since. We have slightly adjusted the WACC used to discount projected cash flows from 10.4% to 10.7% to better reflect Tesla’s capital structure and risk profile ahead.

Tesla Valuation Analysis – DCF (Author) Tesla Valuation Analysis – EV/Sales (Author) Tesla Valuation Summary (Author)

Conclusion

Tesla’s blockbuster first quarter performance has defied all market concerns stemming from ongoing supply chain constraints and impacts from runaway inflation. The results also underpin Tesla’s almost certain outperformance against all automotive peers that have repeatedly warned about their respective dampening production outlooks amidst protracted supply shortages that show no signs of abating anytime soon. The EV titan’s demonstration of pricing power with a series of consecutive price hikes that has done near-zero damage to demand is also worthy of praise and encouraging of its leading growth prospects over the course of continued EV adoption. Looking ahead, Tesla’s continued ability to execute and deliver according to plan, in addition to maintaining its unmatched growth story, will be crucial to sustaining the stock’s elevated valuation.

Author’s Note: Thank you for reading my analysis. Please note that we will be launching a Livy Investment Research Marketplace service on March 31st. The service will allow you to follow my coverage portfolio, interact with me directly, and participate in chat rooms with other subscribers. Early subscribers will receive a legacy discount at $249 per year. Stay tuned for more details as we ramp up to launch in the coming months.

Be the first to comment