Sundry Photography/iStock Editorial via Getty Images

Thesis

I have been a long-term bull on Tesla (NASDAQ:TSLA) as you can see from my previous writings. I have published a series of articles arguing for its nonlinear growth potential. In this article, I will switch perspective and address the bears’ counterargument. The point is not to prove them to be wrong. Quite the opposite, their concerns are 100% valid to me. I am analyzing these concerns not to dismiss their concerns, but to provide a full view, so we can all make an informed decision.

An open mind that can work with conflicting views is the starting point for investing, especially for nonlinear stocks like TSLA. And this has been a cornerstone of my own investing philosophy. And it is also a philosophy that my writing and market service always promote. We always value disconfirming information more than confirming information.

Charlie Munger was once asked for tips for investors who have to work with two opposing views. And his response quoted below, as usual, is so quotable:

Charlie Munger: Well, I do have a tip. At times in my life, I have put myself to a standard that I think has helped me: I think I’m not really equipped to comment on this subject until I can state the arguments against my conclusion better than the people on the other side. If you do that all the time; if you’re looking for disconfirming evidence and putting yourself on a grill, that’s a good way to help remove ignorance.

Following this wisdom, let’s play the game of arguing against ourselves. Many of you probably are familiar with the common bears’ view already such as high valuation, competition, carbon credit, et al. So, this article will limit the scope to two concerns (scale of government subsidies and tax incentives) not often discussed, concerns that have to be gleaned mostly from the footnotes or independent disclosures.

Government Subsidies

First, TSLA’s current financials are dressed up by a multitude of government aids, both from local state, federal, and also overseas. Musk is very vocal against government aid and if you follow his Twitter, you may form the wrong view that TSLA does not benefit from such aid.

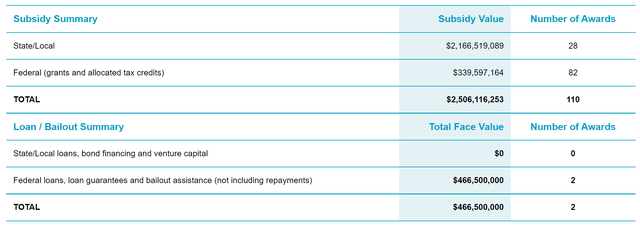

On the contrary, TSLA benefits extensively from these aids. And given how fickly government policies can change, such aids form a considerable uncertainty for TSLA’s long-term prospects. Take U.S. aid as an example. These aids include federal loans, tax breaks, loan guarantees, bailout assistance, State/Local loans, bond financing, and venture capital. You can see a detailed list of these aids at this link. As of this writing, TSLA receives a total of 110 subsidies with a total face value of more than $2.5B. To put things into perspective, TSLA’s 2021 total net income was only $5.6B.

These subsidies are not limited to the US alone. They come from overseas markets like Europe and China too, adding a further layer of uncertainties, as elaborated below.

Source: Subsidytracker.goodjobsfirst.org

Tax Incentives

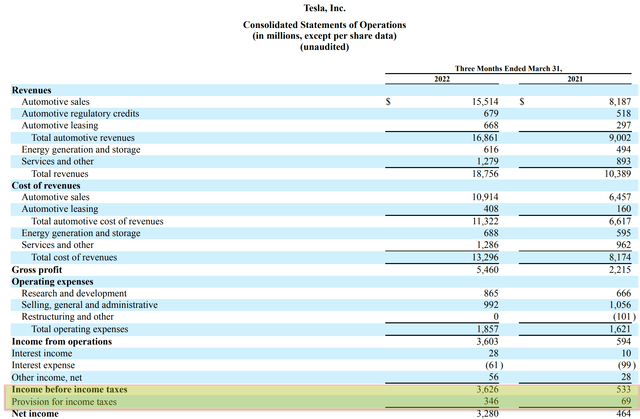

The following chart shows TSLA’s most recent income statement. The taxes are highlighted. And as you can see, it earned $3.6B of pretax income in the quarter ended on March 31, 2022, and reported a provision for income tax of $346M. So this leads to an effective rate of less than 10% (9.6% to be precise). The picture of last year was very similar: $69M of tax provision on a $533M pretax earnings.

The reasons for such low tax rates, as indicated in its Form 10-K, are several temporary tax incentives. For example, China has approved a tax reduction for TSLA from the normal rate of 25% to 15%. The reason for singling out China here is twofold.

First, China has become an important market for TSLA. As of 2021, its China sales are nearly half of its U.S. sales, and the China sales contribute about half of its total pretax income. Second, the tax break is scheduled to expire in 2023. Given the large size of its China sales, if the tax rates do invert to 25% by 2023, the additional taxes in China alone will create a non-negligible impact on its earnings.

To further compound the uncertainty, TSLA cars are also exempted from the 10% purchase tax in China (as detailed in the following Reuters report). This exemption is also scheduled to expire in 2023 and whether it can be extended or not is uncertain.

BEIJING (Reuters) – China will exempt Tesla Inc’s TSLA.O electric vehicles from its purchase tax, the Ministry of Industry and Information Technology (MIIT) said on Friday, a concession made amidst trade tensions with the United States. Tesla sees China as one of its most important, growing markets, and the exemption from a 10% purchase tax could reduce the cost of buying a Tesla by up to 99,000 yuan ($13,957.82), according to a post on Tesla’s social media WeChat account.

Tesla form 10-Q

Final thoughts

To summarize, the common bearish concerns such as high valuation, competition, carbon credit, et al., are 100% valid. Moreover, TSLA also faces other uncertainties such as extensive government subsidies and tax incentives from the local government, federal government, and overseas markets. These factors help to dress up TSLA’s financials to a substantial extent but are not sustainable in the long term. Again, the goal here is not to dismiss the bears’ concerns, but to provide a full view so we can all make a better investment decision.

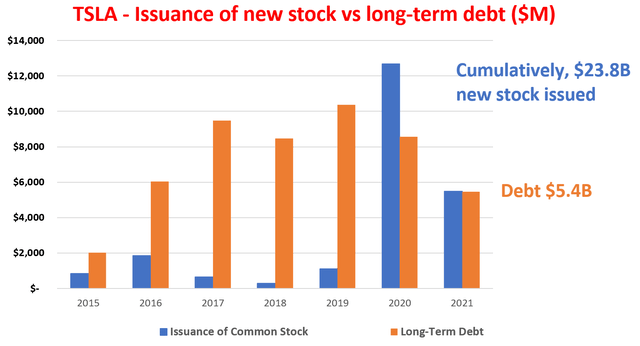

Finally, let me conclude with a brief of my bullish thesis to caution bears with some upside risks too. As a nonlinear growth stock, TSLA enjoys higher-order benefits as it scales up its production and delivery as argued in my earlier article. For such nonlinear stock, market psychology plays a large role and it is usually a bad idea to short just based on valuation considerations. The price and value of such companies are often disconnected – and for extended periods of time. And Musk seems to be a master to work with this disconnection, as you can see from the chart below. The company has issued a total of $23.8B of new stocks between 2015 and 2021 cumulatively, while the debt was reduced to a mere $5.4B.

Author based on Seeking Alpha data

Be the first to comment