jetcityimage/iStock Editorial via Getty Images

After the bell on Wednesday, we received first quarter results from electric vehicle maker Tesla (NASDAQ:TSLA) in this shareholder letter. Investors were curious to see how the Shanghai shutdown in Q1 impacted results, along with the start of production in two new factories. In the end, the headline numbers looked tremendous, but they did contain one major asterisk that could limit the enthusiasm a bit.

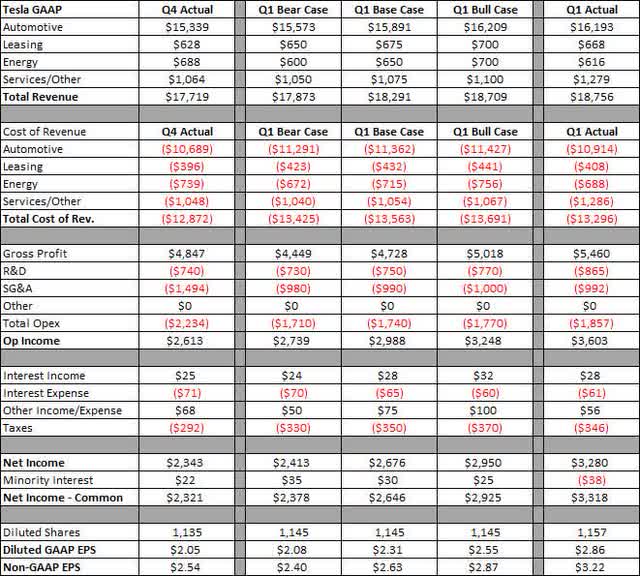

As I discussed in my earnings preview article, I expected Tesla would once again beat street estimates that were again ridiculously low. The company did just that, coming in just above $18.75 billion in total revenue and at $3.22 in non-GAAP EPS. That’s nearly a billion ahead on the top line and a dollar on the bottom line. In the graphic below, you can see the overall results against my three cases and what was reported in Q4 2021.

Tesla Quarterly Results (Author Estimates, Tesla Q1 Letter)

So what was the big surprise here? Well, it was one of the big points that the bears have trumpeted over time, and that was regulatory credits. Tesla reported revenue from these credits of $679 million, more than double the $314 million reported in Q4, and about $400 million above what I was expecting. On the call, it was stated that a change in CAFE rules resulted in a $288 million one time credit benefit. Take that one major item out, and I was just $65 million off on my base case total revenue projection.

On the margin side, Tesla reported GAAP gross margins of 32.9%, up about 230 basis points over Q4 levels. However, a good chunk of that, 150 basis points, was due to the credit sales, but overall auto margins still rose. As I discussed previously, price raises were likely to flow through, which they did with average selling prices per delivery rising a few percent, and Tesla was able to overcome some inflationary headwinds out there. Both energy and service margins weakened, coming in below what I was expecting. Research and development expenses were a bit higher than I expected, but I was basically dead on for SG&A expenses. The rest of the income statement was mostly as I figured, except for minority interests that swung to a loss and thus boosted profitability by $68 million over my base case.

With Tesla now producing solid GAAP profits, cash flow again came in strong. Free cash flow was more than $2.2 billion, although that was down more than half a billion sequentially. Tesla’s accounts payable and accrued liabilities again rose, this time by more than $1.3 billion over Q4 levels, and days payable outstanding jumped 7 days sequentially. The company reported a net cash increase of nearly $2 billion to $12.7 billion.

As expected, management’s guidance in the shareholder letter was extremely limited. The company reiterated its 50% long term unit growth forecast, while stating that supply chain challenges have kept factories running below capacity. There were no current production run rates given in the letter for either the Shanghai factory in the near term, which has reopened on a limited basis, or the two new facilities in Berlin and Austin. However, on the conference call, Elon Musk said he thought a 60% increase in deliveries this year was possible. For Q2, he said that production could be lower than Q1, about the same, or maybe even higher, so it’s all a guess at this point.

In the end, Tesla impressed with its headline results, although the large amount of regulatory credit sales takes a bit of shine off the results. Those sales, along with price raises, helped boost margins over Q4 levels, so Tesla’s results handily beat the usually low street estimates. Tesla shares are up about 5% on the news, which I think is a fair reaction for now, as I don’t really believe that these Q1 results do much either way to change the long-term narrative.

Be the first to comment