wellesenterprises/iStock Editorial via Getty Images

Investment Thesis

Tesla (NASDAQ:TSLA) is the world’s leading electric vehicle manufacturer, with an inspiring mission to “accelerate the world’s transition to sustainable energy”. It has been at the forefront of this industry since its inception almost 20 years ago, but it is in the last five years where Tesla has truly transformed itself from a challenger into an industry behemoth.

I analysed and outlined my investment case for Tesla in a previous article, but I will summarise my investment thesis in short.

The company has already shown an ability to achieve operational efficiencies and margins that are far greater than its incumbent ICE (internal combustion engine) competitors, but this is only the beginning. The transition from ICE vehicles to EVs is still in its very early innings, with Facts and Factors forecasting the Global Electric Vehicle Market to grow at a CAGR of 24.5% from 2022 to 2028, eventually reaching a size of $980B. Tesla also has plenty of optionality within the business, meaning there are a number of different routes to success. The most talked about one is autonomous driving, and rightly so, as this could open up a whole new, extremely lucrative industry.

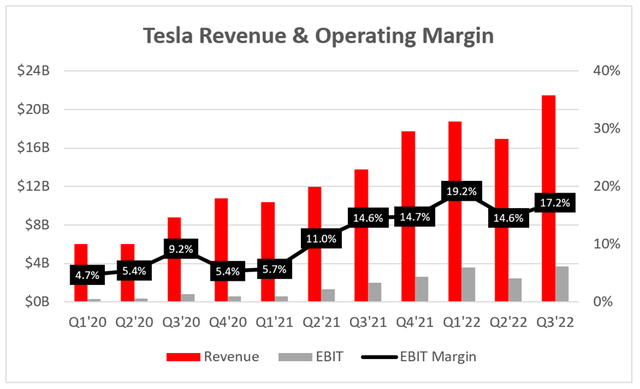

Tesla Q3’22 Earnings Presentation

Yet Tesla produces relatively high-end vehicles, and in a difficult economic climate with a weakening consumer and raging inflation, some investors are predicting difficult times ahead for Tesla. Not only is there a fear of lower demand, but supply chain issues, factory closures, inflation, and CEO Elon Musk’s ongoing Twitter (TWTR) acquisition saga have all weighed down on the company in 2022.

Investors were hoping that Tesla’s Q3 earnings would provide some of the answers to these uncertainties surrounding this company. I wrote an article recently on what exactly what I’d be watching out for when the results were released – so, how did Tesla fare? Let’s take a look.

Earnings Overview

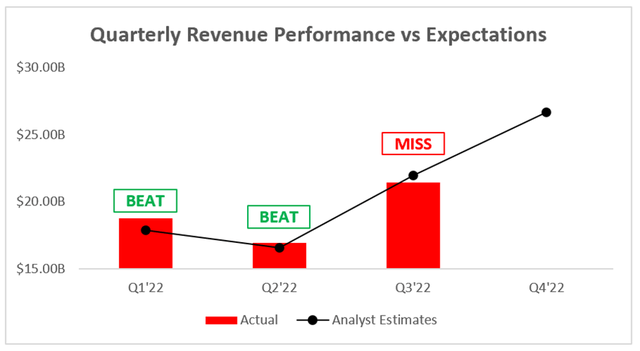

Starting from the top, and Tesla grew its revenue by 56% YoY to $21.45B; however, this fell short of analysts’ $21.96B estimates.

Perhaps investors shouldn’t be surprised, given that a few weeks earlier Tesla reported vehicle delivery figures for September that also fell below analysts’ estimates. Putting the miss vs. analysts aside, Tesla still delivered incredible YoY growth and a record-breaking quarter with regards to revenue; even if it came in below expectations, it was by no means a bad figure given the macroeconomic turmoil that should’ve had a much greater negative impact on the company.

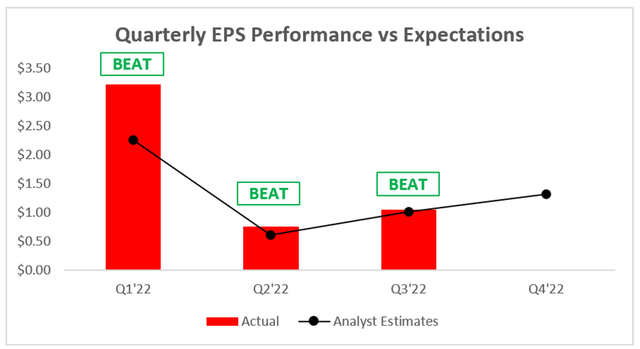

Moving down to earnings, and Tesla beat expectations on the bottom line, posting EPS of $1.05 compared to analysts’ estimates of $1.01.

A miss on the top line but a beat on the bottom line implies that Tesla had a particularly strong quarter when it came to its margins and operational efficiency – yet, I have some reasons to be concerned…

Margins: A Strong Quarter Or Some Yellow Flags?

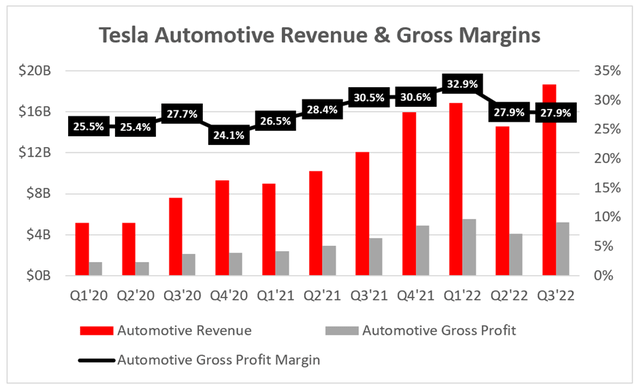

In my results preview article, I spent a lot of time focusing on Tesla’s automotive gross margins. This is primarily because the margins dropped off in Q2’22, with management (fairly, in my view) blaming this on the prolonged shutdown of its Shanghai factory, driven by Covid lockdowns. I stated that, since all factories should be more efficient than they were back in Q2, I would expect Q3 gross margins to exceed 30% – well, that didn’t happen.

Automotive gross margins stayed flat QoQ, remaining at just 27.9%; this time, management could not pin the blame on factory shutdowns.

For me, the gross margin demonstrates two things: Telsa’s operating efficiency (i.e. the costs) and Tesla’s pricing power (i.e. the revenue). The fact that gross margins stayed flat QoQ, and operating efficiency should’ve improved due to higher production in Shanghai, leads me to conclude that Tesla did in fact reduce the price of some vehicles QoQ, which calls into question just how strong both demand is for Tesla and also how strong its pricing power is.

CEO Musk spoke to the demand once again in the Q3 earnings call, and remained optimistic (shock):

Let’s see, with respect to demand. We’ve got a lot of questions about demand in recent weeks. I can’t emphasize enough, we have excellent demand for Q4, and we expect to sell every car that we make for as far into future as we can see.

I do have some sympathy with the company, since it’s currently in an extremely difficult macroeconomic environment. Unfortunately, shares are priced for perfection, and these margins did not demonstrate the perfection that investors have been used to over the past couple of years.

On the flip side, Tesla once again produced industry-leading operating margins of 17.2%, which was a substantial improvement on the 14.6% EBIT margins achieved in Q2.

How can it be that Tesla’s automotive gross profit margins remained flat QoQ, yet EBIT margins improved so substantially? The answer is quite simple: Tesla’s total gross profit increased by 27% QoQ due to an increase in vehicle sales, and its operating expenses actually decreased by 4% QoQ due to one-off restructuring costs of $142m that the company incurred in Q2.

Whilst gross profit margins didn’t impress me much, the improved EBIT margins clearly demonstrate that Tesla is still in the process of scaling up – and as it continues to scale up, even if gross profit margins don’t improve (which I’m sure they will over time), it will continue to improve operating margins and rake in the cash.

Full Self Driving – Is It Actually Happening?!

Undoubtedly, one of the most exciting aspects of being a Tesla investor is the progress in its autonomous driving technology. This may have been a sequence of overpromising and underdelivering over the past few years, but apparently I like being hurt, because I think it may finally be coming together!

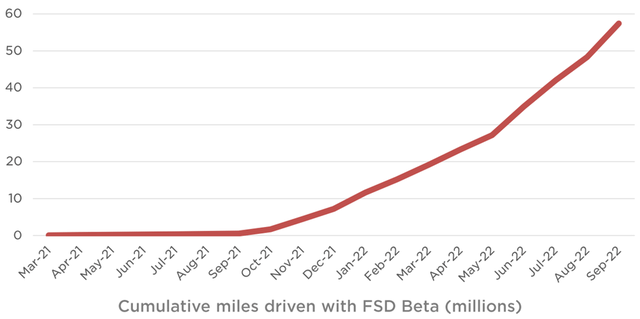

The number of miles driven with Tesla’s FSD Beta continues to grow exponentially, as the company harvests more and more data to help improve its technology. CEO Musk remains optimistic about finally solving FSD in 2022, as he stated on the Q3 earnings call:

This quarter, we expect to go to a wide release of full self-driving Beta in North America. So, anyone who has ordered a full self-driving Beta — full self-driving, will have access to the FSD Beta program this year, probably about a month from now. So — and then obviously, any new — anyone who buys a car and purchases a full self-driving option, will immediately have that available to them.

So, the safety that we’re seeing when the car is in FSD mode is actually significantly greater than the safety we’re seeing when it is not, which is a key threshold for going to a wide Beta.

… we’re expecting to release the full self-driving software to anyone who orders the package by the end of this year. So, a separate matter as to will it have regulatory approval. It won’t have regulatory approval at that time. But the car will be able to take you from your home to your work, your friend’s house, to the grocery store without you touching wheel. So, it’s looking very good.

This feels too close to a deadline for it to be another overly optimistic promise from Musk, but that could certainly still be the case. Regulatory approval remains another huge hurdle to clear, but it’s hard to see another company that has made as much progress on autonomous driving as Tesla – and, if the company is in fact close to cracking it, then this opens up a whole new world of possibilities (that investors should benefit from).

Valuation Appears Reasonable Enough

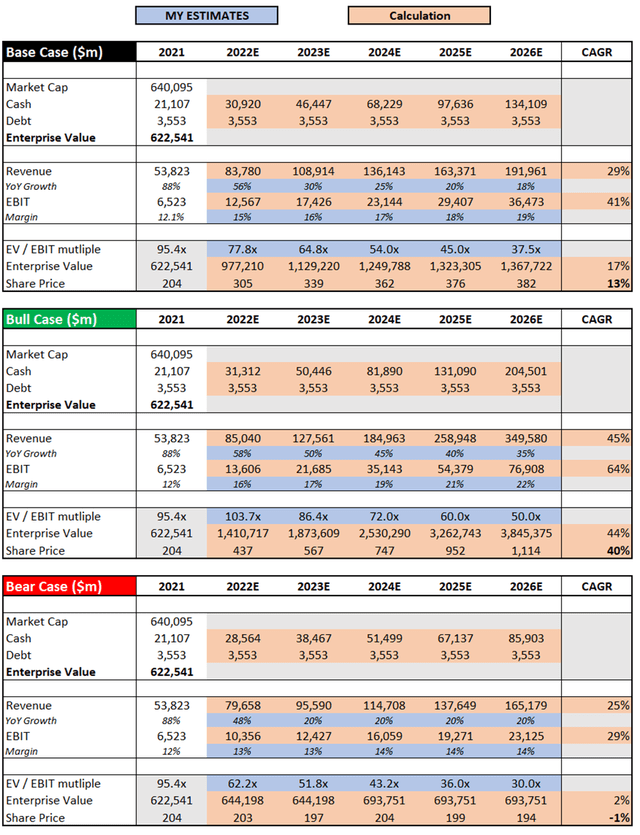

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Tesla is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have kept virtually everything in this model identical to my previous article since not much can change in a matter of weeks. The only difference I’ve made was to slightly reduce the overall revenue figure in 2022 due to Tesla falling short in this earnings report; it is not too material, and I have kept everything else the same – including EBIT margins, which have clearly shown strength when Tesla operates at scale, and Q4 should be even more impressive. In fact, I wouldn’t be surprised to see Tesla exceed the 15% EBIT margins for 2022 offered up in my base case.

Put all that together, and I can see Tesla shares achieving a CAGR through to 2026 of (1%), 13%, and 40% in my respective bear, base, and bull case scenarios.

It would appear that CEO Elon Musk also has high expectations for Tesla’s future share price performance, as he produced some classic Elon lines during the Q3 earnings call:

And several years ago, I said, I think on an earnings call, and I thought it was possible for Tesla to be worth more than Apple, which was then the highest market cap company, I think, in the market. And Apple at that time, I think it was around $700 billion. And I said it required incredible execution, at least some luck, and we did indeed achieve that. Tesla went, in fact, or passed Apple’s market cap at the time. And now, I’m of the opinion that we can far exceed Apple’s current market cap. In fact, I see a potential path for Tesla to be worth more than Apple and Saudi Aramco combined.

Ever the optimist, Musk has set out a path for Tesla to achieve new heights; the only question now is whether or not he’ll be proved right yet again.

Bottom Line

There are certainly some yellow flags for investors in this quarter; the flat gross margins QoQ indicate to me that demand or pricing power is not as strong as management would have investors believe. As mentioned, this isn’t exactly a surprise given the rapidly weakening economy, but investors should be aware that this is an issue that could both persist and worsen.

On the plus side, Tesla is showing clear signs that it is still able to expand operating margins as it continues to scale up, with Q4 set to be a record quarter in terms of deliveries. As long as gross margins don’t decline further (they might), then Tesla is on course to rake in the cash in Q4 with even stronger EBIT margins.

It also feels to me like FSD is reaching new heights; maybe I’m wrong, maybe I’m a fool, but this is how I view Tesla – it is a brilliant business even without FSD, and the FSD potential only acts as a catalyst to send this company to new heights. Does it need FSD? I don’t think so… but if it works, then I believe shareholders will be duly rewarded.

Despite my concerns on gross margins, I will reiterate my ‘Buy’ rating on Tesla.

For transparency, I expect this to be a volatile stock, and I am fully aware that a weak Q4 could drag the share price down. Yet I truly believe that in 5+ years, this company will be a world-beater, so I plan to gradually acquire shares over a long period of time – by no means do I think this current share price will be the lowest Tesla will ever go, but it’s a price I’m currently willing to pay.

Be the first to comment