Justin Sullivan/Getty Images News

Intro

I periodically come across the opinion that the market, by its nature, is very often irrational. Moreover, I myself have expressed this point of view more than once in the past. But perhaps this is an overly simplistic view of the nature of things…

If we consider the market as a one-dimensional system, then indeed, many things may seem irrational. But if we assume that we are dealing with a multidimensional system, then much that previously seemed irrational becomes completely rational. And it is in this context that I propose to look at the current price of Tesla (NASDAQ:TSLA).

Clearly overvalued company

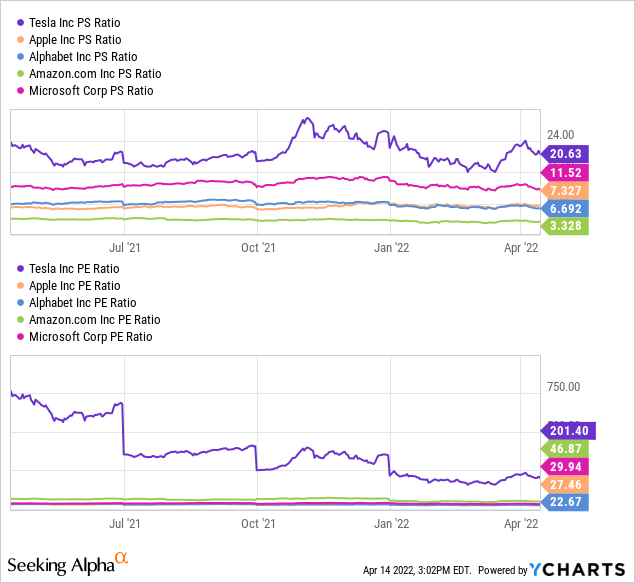

Agree, that it is very difficult to find such a basic multiple that would not indicate a critical overvaluation of Tesla:

But it would be a mistake to draw any conclusions from such a comparison. Simply because the current phase of Tesla’s life cycle is significantly different from the companies with which we tried to compare it.

Just like no two snowflakes are the same, no two companies are in the same phase of their life cycle. And this is a significant problem for investment analysis. But it can be partially solved.

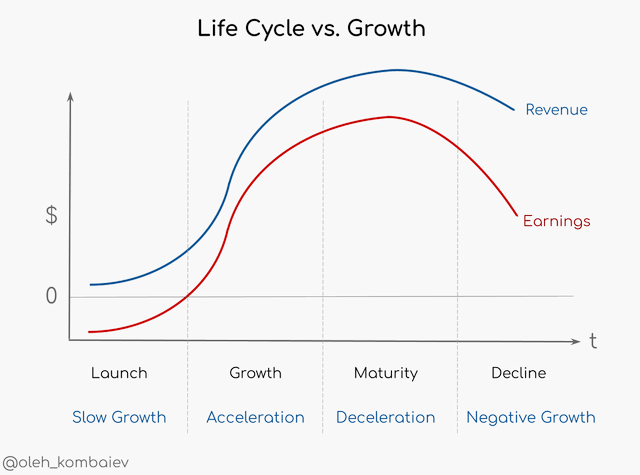

The main indicator of the company’s life cycle phase is the growth rate of its financials. Simplified, it looks like this:

So, it turns out that if you evaluate a company taking into account its life cycle, which is expressed in the company’s growth rate, then this result may already make sense.

Clearly overvalued company?

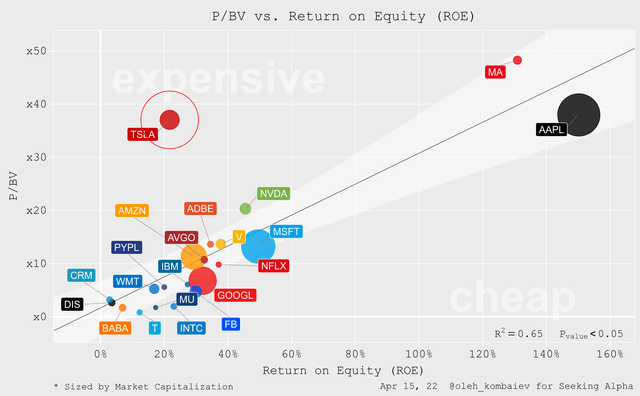

As further evidence that if you do not take into account the phase of the company’s life cycle, then Tesla is critically overvalued, I will give the following two-dimensional model.

The return on equity is inextricably tied to the P/BV multiple that investors are willing to pay. This is expressed in a direct relationship between the first and second:

Please note that there are 21 companies in my sample and 20 follow the general trend. And the only company that stands apart is Tesla. Tesla’s return on equity barely exceeds 20%, but the company’s P/BV multiple is almost equal to Apple’s (AAPL). What is this if not proof of overvaluation?

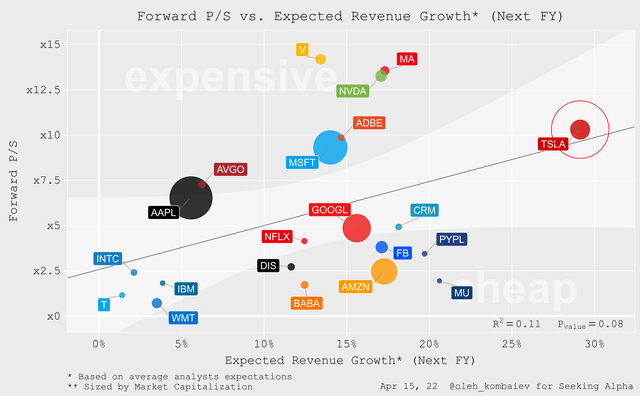

Now let’s look at the situation through the prism of the company’s life cycle. As I already noted, the company’s growth rate is a key indicator of the life cycle phase. So, let’s consider the relationship between the expected revenue growth rate and the forward P/S multiple:

Now the situation has changed dramatically. According to average analyst expectations, Tesla’s revenue growth in the next fiscal year will be almost 30%. At the same time, Tesla’s P/S forward multiple barely exceeds 10, which is generally in line with the trend.

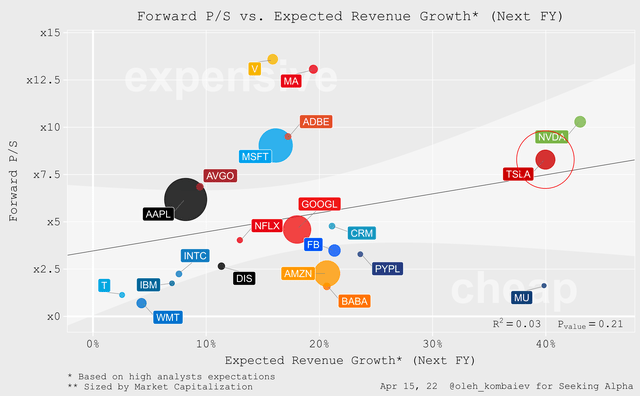

The previous model was built on average analyst expectations, which tend to be too conservative. Let’s look at the result, if based on the high expectations of analysts:

So, the result has not changed much – Tesla is quite adequately assessed in terms of this approach. But let’s not stop there…

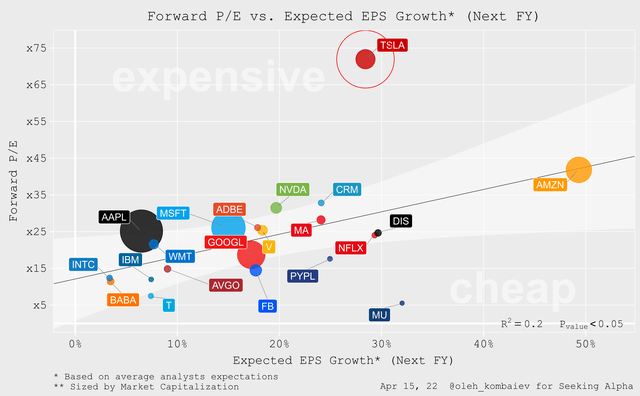

Now let’s look at the relationship between the expected earnings growth rate and the P/E forward multiple. The rate of EPS growth also characterizes the life cycle of the company.

But in this case, it turns out that the expected growth rate of Tesla’s EPS does not correspond to the current level of the P/E forward multiple. So, we have received a proof that Tesla is overvalued. But can it be trusted? In my opinion, the answer again lies in the area of the phase of the company’s life cycle.

Life Cycle vs. Price drivers

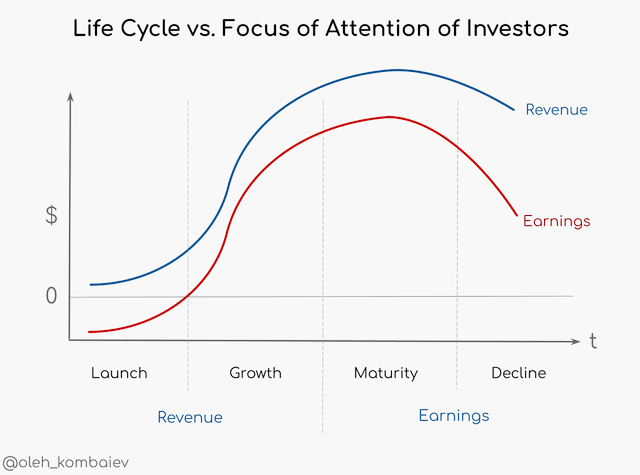

The growth of the company always takes place in quantitative and qualitative aspects. If we simplify it a lot, then at the stage of launch and growth, the company captures the market share and grows mainly in the quantitative aspect (revenue). Starting from the stage of maturity, the company continues to grow mainly in the qualitative (earnings) aspect.

Accordingly, the focus of investors also does not remain static. In the early stages of a company’s development, they are more interested in the quantitative growth of the company. And then the focus of investors’ attention shifts towards qualitative growth:

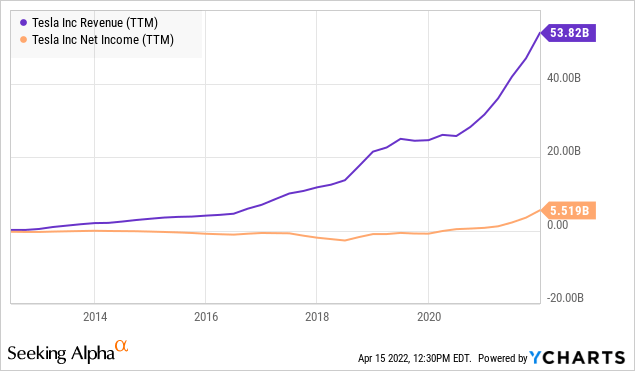

Tesla has only relatively recently begun generating positive net income. At the same time, revenue growth is accelerating. Thus, Tesla has clearly not yet reached the maturity phase. Therefore, I believe that models based on revenue indicators more adequately reflect the rational price of Tesla.

Bottom line

So, Tesla is a company that is in the growth phase and at the moment, the limits of its quantitative growth are not fully understood. Therefore, this company should be evaluated primarily in terms of revenue and only through the prism of growth. As I have already shown, such an analysis confidently shows that Tesla’s current price is quite justified.

Be the first to comment