Million-Mile Batteries Enable Virtual Power Plants

If I assume the entire auto industry is headed toward becoming ~100% electric powered by 2030 as I proposed in November 2018, then by 2025 new electric vehicle sales could reach 30.8 million. I used a 50% annual growth rate to estimate future production. Over the previous six years, the growth had ranged between 46% and 69%, making a 50% growth rate reasonable.

However, new factory construction is very lumpy, taking one or two years to build and bring a new EV factory up to speed. 2019 plug-in EV production was only up 9% over 2018. Last year the Tesla Shanghai Model 3 factory and the Fremont Model Y production line were both under construction. So new model arrivals were delayed until 2020. Legacy auto companies were also delayed in releasing competitive models. It seems like the industry fell one year behind my growth projections.

- This means plug in EV production should reach approximately 20 million vehicles by 2025, my previous estimate for 2024.

GM (NYSE:GM) recently held an “EV Day” where the company revealed its plans to convert its internal combustion engine, ICE, vehicles into electric vehicles. GM projects that by 2025, it will be building about 1 million EVs per year. This would be 5% of global production if realized.

Tesla in contrast has guided for 500,000 vehicles in 2020. I expect this guidance will be reaffirmed at the upcoming shareholder meeting April 29th, next week. Going forward with the industry average growth rate, Tesla will be building 3.8 million BEVs in 2025.

The point is GM’s aspirations for 2025 are 25% as large as Tesla’s. GM has plans to build 16 new plug in models. Tesla, in contrast, will build the majority of the volume using just five models for which the production factories are already operational for four, the S, X, 3, and Y. The Cyber Truck is in development.

While the race to build more BEVs is heating up, Tesla may be about to introduce a completely new and unexpected revenue source: Virtual Power Plants.

Tesla is expected to reveal that it has a path to building more than 1,000 gigawatts of batteries, and that the batteries built will be able to power a vehicle for 1 million miles. 1,000 gigawatts is sufficient to build around 13 million BEVs like the Model 3.

This is 33 times more than the capacity of the current Nevada Gigafactory and also 33 times more than the stated GM plans for 2025. It will be interesting to learn how many years into the future Tesla expects it to take to reach that goal. But what about the million-mile batteries, what are those for?

Most people think of long-life batteries as enabling robo-taxis and commercial vans. But million-mile batteries also enable the creation of Virtual Power Plants, a technology few have bothered to learn about.

Analysts are upgrading their Tesla stock ratings

Last week, Goldman Sachs analyst Mark Delaney upgraded Tesla stock with a BUY rating and an $864 price target. Other firms have upgraded their ratings, even if only from “Sell” to “Hold”. And Tesla short interest has fallen from 43.7 million shares sold short as of May 31, 2019, to 16 million as of March 13, 2020.

Generally speaking, analysts appear to be trending away from a bearish position toward a bullish position on Tesla. Some have changed from really bad to bad, others from hold to buy, but the general trend for price targets is upward. The rising stock price is increasing Tesla’s access to capital.

The reason this is important is because it gives Tesla access to more cash with which it can build more factories for cars and especially for batteries. Today, Tesla’s market cap is two thirds of the US auto market. GM, Ford (NYSE:F), and Fiat Chrysler (NYSE:FCAU) share the remaining one third.

(Source: Tesla Daily Podcast)

This enables Tesla to more easily raise cash with equity to build more facilities and further increase its lead compared to other auto makers. Currently, Tesla is building Model Y production lines in Shanghai and near Berlin. Tesla is also preparing to build another Gigafactory for the Cyber Truck in the middle of the US, possibly Texas. Personally, I also expect the company will announce plans to build a second Model Y Gigafactory in the middle US region, because raising cash from equity is today fairly easy and painless.

The increased market cap also will make it easier to begin building Virtual Power Plants, a new technology thrust.

EVs and the Future of Cleaner Air

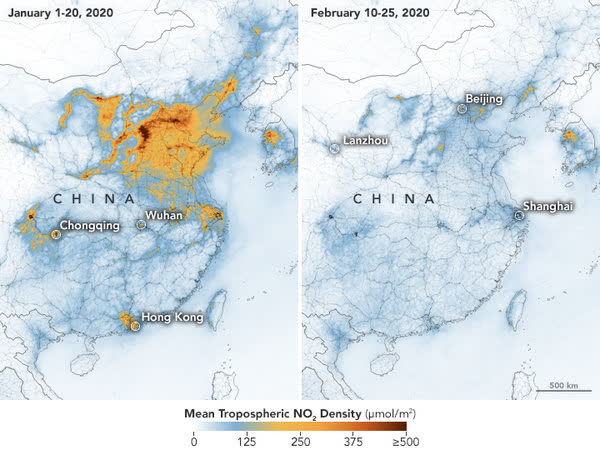

While the world is shut down due to health concerns you know all too well, scientists have used the opportunity to carry out some measurements of how much the air quality has changed as a result of the reduced economic activity. In particular, the reduction in fossil fuel burning in cars and factories has resulted in dramatically cleaner air.

(Source: NPR)

(Source: NPR)

This knowledge, thanks to Coronavirus, will impose a persistent subliminal pressure to end the use of fossil fuels going forward. In particular this will add pressure causing many people to switch from ICE to BEVs. People feel good when they drive an EV, and increasingly, many people feel bad driving ICE (internal combustion engine) vehicles.

In addition to reducing emissions from ICE vehicles, fossil fuel burning to power the industries must also be reduced if we are to achieve a cleaner world. To realize that, we need to increase the power produced by renewable energy sources such as wind and solar. The problem with renewable energy is that it can’t be turned on or off. The sun for example does not shine at night.

One path to smoothing the production of renewable energy is to install large battery banks such as in South Australia at the Hornsdale wind farm facility where Tesla installed the world’s largest utility class battery. That facility initially had a power storage capacity of 129MWh. It has worked so well that it is being upgraded to 185MWh.

The point of this article is that while 185MWh is the world’s largest utility class battery, the same storage capacity can be had by combining just 2,500 Model 3 cars. Said otherwise, the now 1 million BEV Tesla fleet is equivalent to 400 Hornsdale batteries worth around $36 Billion. But no one has reaped that value because car batteries don’t have a long enough cycle life.

The catch is, to enable this, we would need million-mile batteries and a smart charger/inverter for the car connection. The new inverter would need to be in communication with the local utility and take directions for charging and discharging the car.

If Tesla can install million-mile batteries into all of its cars, then a $45,000 Model Y will be worth $45,000 to the car buyer, plus $36,000 to the local utility for a total value around $81,000. But to realize this additional $36,000 will require some effort.

Tesla’s Battery Day

Many Tesla enthusiasts are drooling over the upcoming Tesla Battery Day.

Enthusiasts are hoping to learn that Tesla has procured materials and has a path to build an annual production of >1 terawatt hour of batteries for EVs and utility power storage. That will be enough for about 13 million electric cars per year.

They are hoping to hear about robo-taxis and delivery vans that can drive for 100,000 miles a year without replacing the battery for 10 years, or 1 million miles.

However, these dreams don’t come close to matching what I expect Tesla has up the sleeve. Million-mile batteries enable the use of BEVs for vehicle to grid energy transfers.

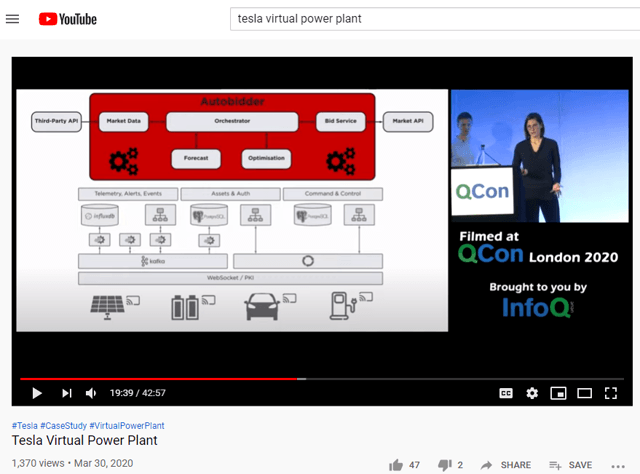

You can watch a technical discussion of the Virtual Power Plant Tesla is developing at this link. Tesla is developing the software and hardware to power a system of 10kWh Power Wall batteries distributed around a town. The batteries are located at homes and businesses in South Australia, and this virtual power plant is already in operation today. Here is a more “lay” presentation of the same concept.

(Source: YouTube Tesla Virtual Power Plant, InfoQ)

(Source: YouTube Tesla Virtual Power Plant, InfoQ)

The reason no EV has been used as an energy buffer for grid power is simply because the life of batteries has been too low. Charging and discharging a car battery to modulate the grid would be great for the grid, but bad for the EV owner due to battery life degradation.

With a million mile battery things are completely different. Such a battery can be charged and discharged so many times that its function as a car will not be diminished for the typical car owner who lets the car sit 90% of the time. Tesla would only need to introduce a new battery charger / inverter that can take instructions from the local utility to create this function.

As discussed in the above videos, the charger already exists. It is being used for the Tesla Power Wall batteries (not BEV batteries). But there really isn’t any difference from the inverter’s perspective. So building a charger inverter that would do the same thing using a vehicle battery should be straightforward.

How Large A Market Might Virtual Power Plants Be?

To date, the battery has tacitly been understood to be one or more Tesla Power Wall 10kWh batteries. A Tesla car already comes with a much larger 75kWh to 100kWh battery. As soon as Tesla figures out how to manufacture a battery capable of one million miles’ worth of charge discharge cycles, then this new function makes sense to vehicle owners.

To date Tesla has put 1 million vehicles on the road. If we guess the average battery size is 75kWh, then the total energy storage potential is 75 gigawatt hours of energy. This is the capacity of around 580 Hornsdale Wind Farm battery banks.

The Hornsdale battery was sold for $90 million so that the equivalent value of the Tesla fleet is $52 Billion. The per car value is around $36,000 value for a Model 3 battery if it were used by a utility to balance the grid power and help eliminate the high costs associated with peaker power plants. This value is entirely separate from the function of the car as a car. While at home or work and plugged into the grid, the car provides a completely new $36,000 value as a grid electrical energy storage device.

But none of the existing Tesla cars have million-mile batteries so they cannot provide this additional function. Once Tesla begins installing million-mile batteries into Model 3s and Model Ys, each car will be worth about 75kWh * $90Million / 129MWh = $36,000 to a utility. So cars that are sold as Model 3 cars are worth perhaps $45,000 for that function we know as “car”. But they are also worth around $36,000 to utilities if they can be used as utility energy storage batteries.

Therefore, if Tesla can enable the use of the cars for both functions, car AND utility energy storage, they are together worth around $86,000. Tesla could logically collect $45,000 from the vehicle purchaser for the “car” function and another $36,000 over time from the local utility for the “utility energy storage” function. Likely this $36,000 would be shared between the utility (savings in peaker plant charges), car purchaser (savings in electricity charges), and Tesla (pure additional profit) so that each benefits from the new functionality created by Tesla.

(Source: Fred Lambert at Electrek)

(Source: Fred Lambert at Electrek)

Adding this functionality would provide a boost to the value of Tesla BEVs. Taking a car with a value of say $45,000 and adding $36,000 value to it is crazy.

Elon Musk stated “Battery Day people. Wait until Battery Day. It’s gonna blow your mind. It blows my mind, and I know it!“.

I don’t know about you, but a million-mile battery doesn’t blow my mind. Finding a path to a terawatt of battery production would be huge, but my mind can understand it. My mind is not blown by either of those functions that most people are drooling over.

My mind is, however, blown by the possibility that a $45,000 car has $81,000 worth of value by simply plugging it into a new charger that happens to help balance the local utility power grid. No vehicle today interfaces its charging behavior with the local utility grid. Adding this functionality would blow my mind, and I know it.

As for estimating the value of this feature, in 2019 Tesla sold 367,500 cars and had a revenue of $24.6B. Using the above figure as the highest possible income boost (Tesla likely won’t get all of the increased value), the boost in revenue would have been $13.2 Billion.

This boost is about 50% of Tesla gross sales. Is this why Elon Musk has said 50% of future income would come from Tesla Energy? All it needs to do is to sell cars, and with the cars sell charger inverters to couple the cars to the grid and the increased income arrives through Tesla energy from utilities for allowing the utilities to use the car batteries to balance the grid power.

Everyone is thinking Tesla needs to sell a ton of batteries to utilities for the Energy business to earn that much. Perhaps it’s less complicated. Tesla plans to just double the functionality of the cars it is already selling!

Therefore, going forward where the number of cars is larger, so too will be the net profit. The only caveat to the above figures is that the revenue will likely be over a period of time. Still, such a huge additional income even if realized over a 10-year period of time boosts the entire enterprise value. And who knows, Tesla could sell the function to utilities as an upfront charge using a Present Value for the future battery usage.

It remains to be learned how the details will play out financially. But it seems obvious this function is on its way given the Virtual Power Plant experiment underway in South Australia. That system will be exactly the same except that a Tesla car will take the place of the current Tesla Power Wall battery.

Conclusion

If Tesla develops a million-mile battery for its EVs, then that new technology will enable it to begin sales of “Virtual Power Plants” to utilities around the world. Each Tesla Model 3 would be worth say $45,000 for the car plus another $36,000 (over perhaps a 10-year period) for the car’s functionality to store and deliver electrical energy. This functionality will help utilities eliminate peaker plants and save money, thus creating the value for Tesla to earn.

This potential new revenue stream seems audacious enough to fit Elon Musk’s comment that it blows his mind and he knows what it is. Nothing else seems to fit that statement from Musk. If Tesla announces this functionality on Battery Day, I expect the share price to increase significantly.

Tesla’s net income should increase immediately upon this technology being deployed.

It would effectively mean that Tesla will have increased the net profit margin of all of its cars, though the income would likely flow into the company through Tesla Energy as a separate source of income and over a period of several years. This sort of income is more typically found as recurring license fees and the like.

Disclosure: I am/we are long TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I expect many or most legacy auto companies will fail to navigate the collapsing market for gas vehicles. Tesla EVs are no more “cars” than the Apple iPhone is a “flip phone”. They have different capabilities than the old technology. For Tesla, much of the new technology is still under development. But it includes electric utility power grid energy storage, something no other auto company is even considering getting into. Tesla is already refining the software to do it in South Australia and simply needs to introduce the million mile battery into cars, and then enable the chargers to perform the functions of inverters and voila, a completely new market space for Tesla to fill that no other EV can.

Be the first to comment