Jamie McCarthy

Thesis

Tesla, Inc. (NASDAQ:TSLA) bears have continued their winning streak in 2022. After forcing TSLA from its August highs, TSLA buyers could not retake its bullish bias. Hence, it became clear that the market was not convinced of Tesla’s execution at its August highs, as we highlighted in a previous update.

Then, more bad news followed after Tesla’s FQ3 earnings call in October. Tesla CEO Elon Musk became overly engrossed and arguably distracted with his Twitter 2.0 project. China’s recent zero COVID refinement was thrown into disarray as cases spiked, leading to lockdowns sprouting in major cities once more.

Rumors emerged that its previous price cuts in China did not achieve its expectations, corroborated by the significant decline in lead time for its vehicles (from 22 weeks in early 2022 to one week recently).

Tesla bulls have continued to argue that the fall in lead time is predicated on Giga Shanghai’s expanded capacity (to about 1M annualized run rate), which Tesla completed in early H2’22. However, even Tesla bull Gary Black, the portfolio manager of The Future Fund Active ETF (FFND), suggested that Tesla is facing a “competition problem in a slowing Chinese economy.”

As such, the worries of intense competition from China’s leading EV makers, such as BYD Company (OTCPK:BYDDF) and NIO (NIO), have likely led to buyers cutting further exposure. Moreover, even BYD couldn’t escape the China headwinds, as it remains nearly 50% below its June 2022 highs.

Our analysis indicates that the market is potentially reflecting a much weaker Q4 than what Wall Street suggests. With TSLA’s embedded growth premium, there’s a need to digest its execution risks, as its Q4 growth cadence seems to be at risk. Coupled with a highly distracted CEO, it has also worsened its focus to deliver a robust Q4 card amid the Twitter chaos.

However, we need to remind investors that stocks have shown a tendency to bottom when we least expect it, including high-growth speculative stocks like TSLA. We gleaned that TSLA is close to re-testing its 200-week moving average or 200-week MA, a critical long-term support level for long-term buyers to return.

Furthermore, TSLA’s valuation has been inching closer to its March 2020 COVID lows. Hence, unless Tesla’s growth algorithm is expected to change dramatically moving forward, we believe the selloff has likely reached a climax and is close to finding robust support for a mean-reversion bear market rally.

We maintain it as a Speculative Buy, with a reduced medium-term price target (PT) of $250 (implying a potential upside of 47%).

TSLA: Forced Selling Happening Now

Tesla bulls should struggle to find positive media headlines recently, which is constructive for buyers. Buyers need the media to fan more pessimism to force more holders to give up rapidly (keyword: rapidly) to help TSLA form a sustained bottom for a speculative opportunity to pan out accordingly.

For instance, Bloomberg reported that Elon Musk had lost more than $100B in his net worth in 2022, given the underperformance of TSLA. It also followed up with a report suggesting the gap between TSLA’s consensus PT and its stock price has surged to the second-widest in the NASDAQ (NDX) (QQQ).

And then, we read an analyst who raised concerns about Tesla’s competitive headwinds, as Shanghai-based 86Research highlighted:

We can tell from the shortened lead time that the order intake for Tesla in China is insufficient. The company is facing great competition from local competitors as well as lower consumer confidence. The promotions, including insurance subsidies, may also extend into next year. – Bloomberg

Essentially, we have the pre-condition for a potentially sustained bottom: lots of bad news and headlines in the media. More doom and gloom, the better it is.

But does TSLA price action show that the market is forcing a capitulation move?

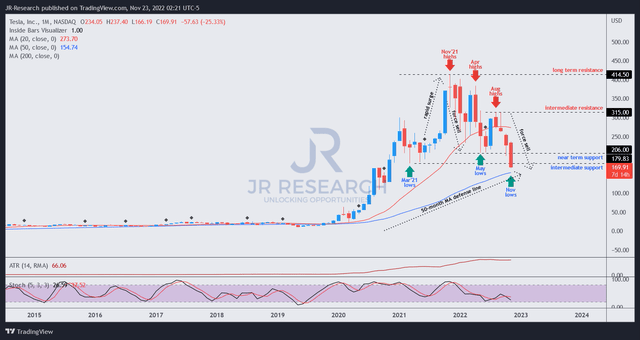

TSLA price chart (monthly) (TradingView)

We gleaned that the market seems to have forced a steep selloff from its August highs that has extended into November.

The move is similar to its previous move from April 2022 to May 2022. It also led to a mean-reversion rally that formed its August highs subsequently.

Hence, we believe the current move seems to be a forced selling attempt by the market, which should find support along TSLA’s critical 50-month moving average.

As such, the potential for a robust bottoming process is even more constructive than its May lows, as it could attract long-term buyers waiting in the wings to participate more aggressively.

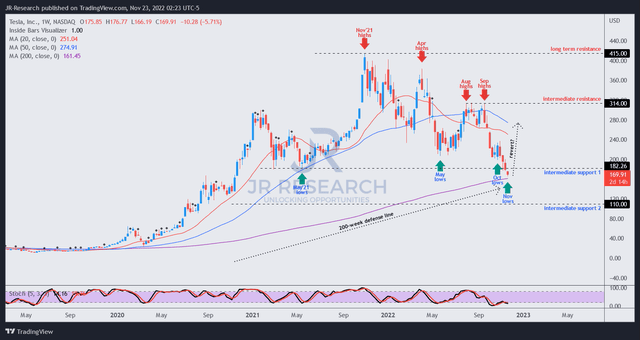

TSLA price chart (weekly) (TradingView)

The market invalidated our previous thesis of a sustained bullish reversal at its October lows. However, as explained, the market seems keen to force a further capitulation that has taken out TSLA’s May 2021 lows.

That’s a highly critical level to defend, and we don’t think TSLA bulls would give up this level so easily to the bears without an intense battle.

Furthermore, TSLA’s 200-week MA (purple line) is close enough to provide much-needed support to bolster the defense of TSLA bulls, suggesting some respite should be close.

Hence, we postulate that a meaningful mean-reversion rally against TSLA’s medium-term downtrend is looking increasingly likely.

Maintain Speculative Buy with a PT of $250.

Be the first to comment