skynesher/E+ via Getty Images

Merger arbitrage

I always have my price. As long as it’s completely legal, more or less ethical, and analyzable, problems can be solved with enough money. Apollo (APO) as a buyer is a problem. They’re willing to act aggressively, including walking away from deals when it serves their interests. And yet if you offer a juicy enough yield, I can be enticed. This is one such yield.

Who?

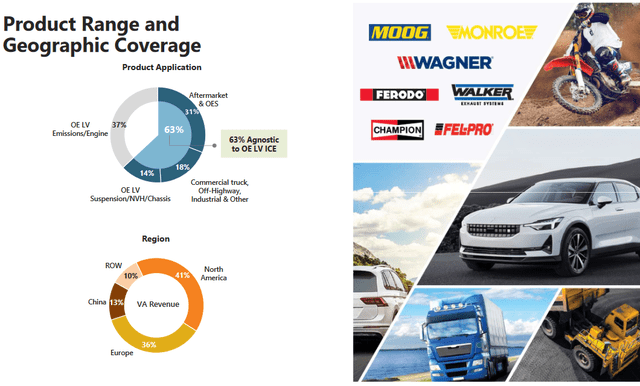

Tenneco (NYSE:TEN) is a motor parts, performance solutions, clean air, and powertrain provider for vehicles including commercial trucks and motorsports.

What?

Apollo is buying them for $20 per share. They have US, Canadian, Chinese, and the target shareholder approval. They await clearances from the EU, Mexico, Japan, and Turkey. In theory, they need Ukrainian and Russian approval, but the Ukrainians and Russians are away from their phones at the moment; those clearances are subject to waivers from Apollo. They also need foreign investment clearances from both Spain and Australia.

When?

The deal should close by November, assuming that Apollo tries.

Where?

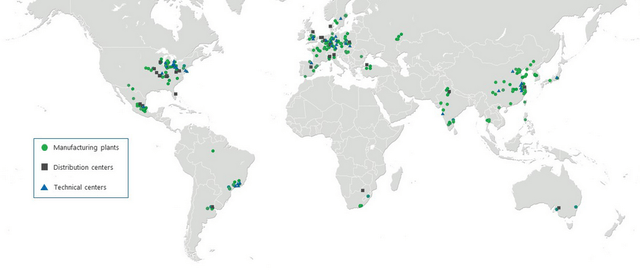

Their headquarters is in Illinois. They have 196 manufacturing sites around the world.

Why?

I like big spreads, and this spread is big.

|

Target |

Ticker |

Parity |

Spread |

IRR |

|

Tenneco |

(TEN) |

$20.00 |

$2.58 |

41% |

Caveat

In this weak equity and credit environment, shares would probably trade beneath $8 as a standalone company, and the target’s board and management could come under a lot of pressure to accept a re-cut deal to around $17 per share.

Conclusion

Despite a tricky environment (and tricky buyer), the definitive merger agreement probably holds up.

TL; DR

Buy TEN.

Be the first to comment